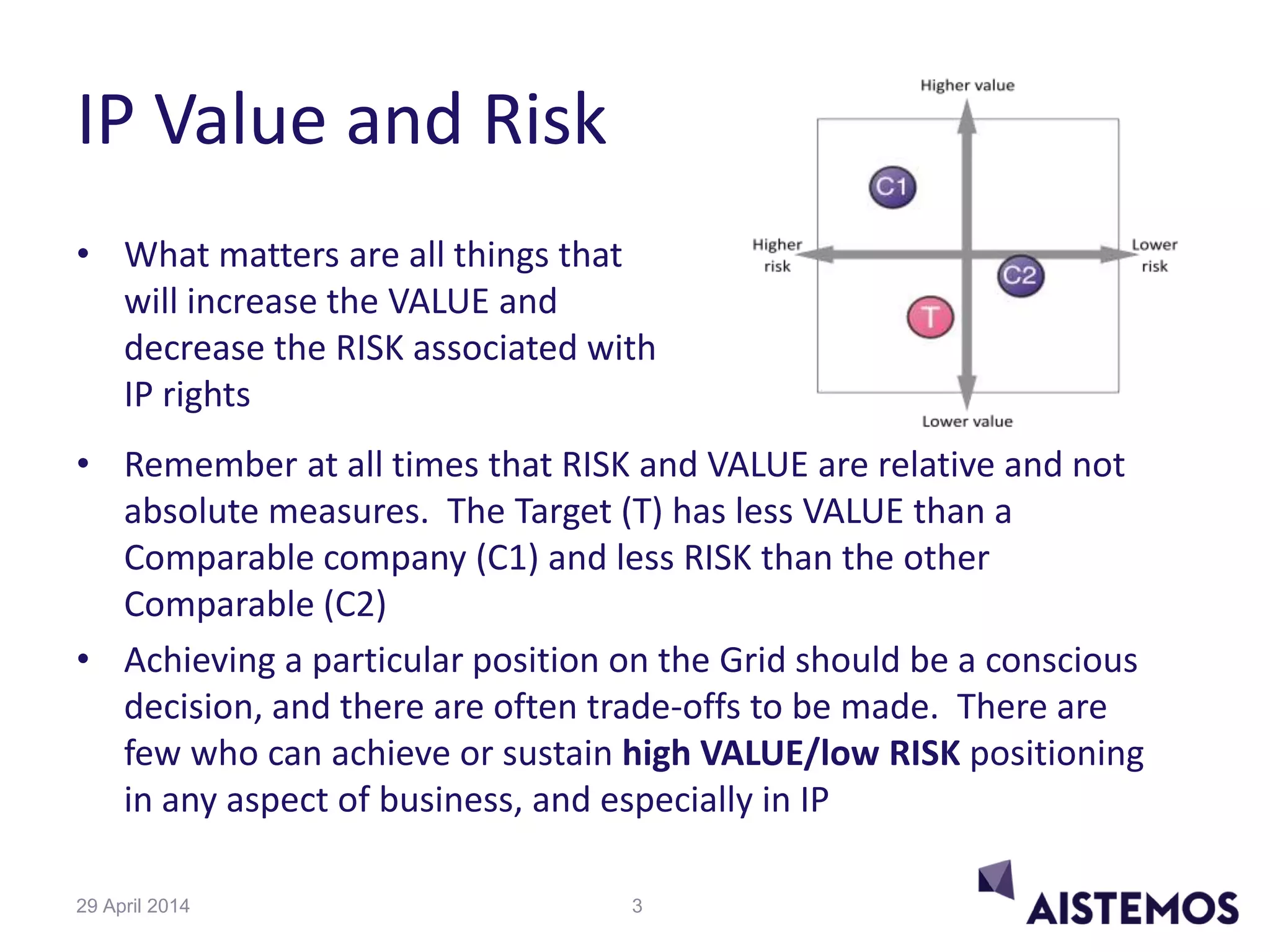

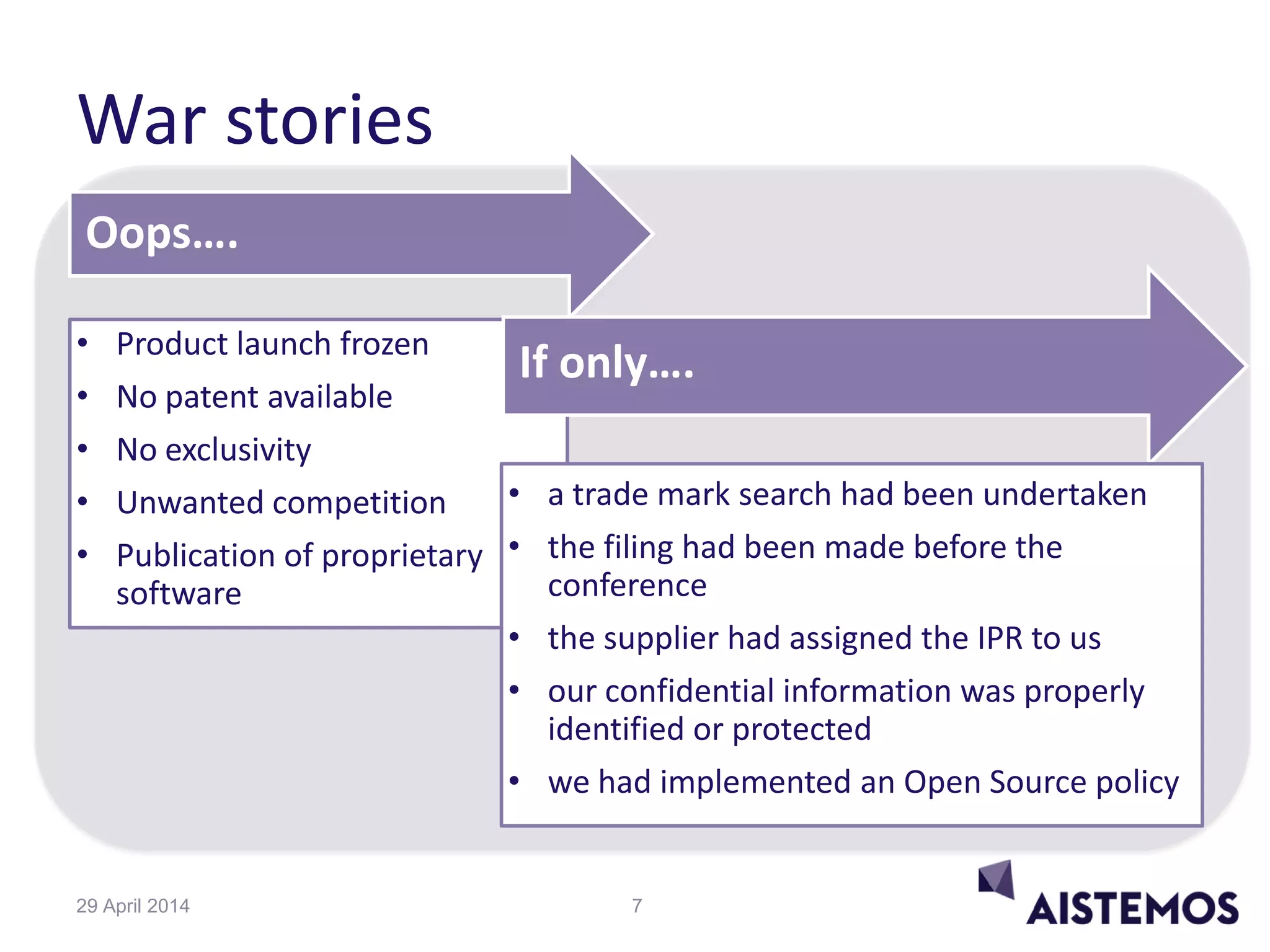

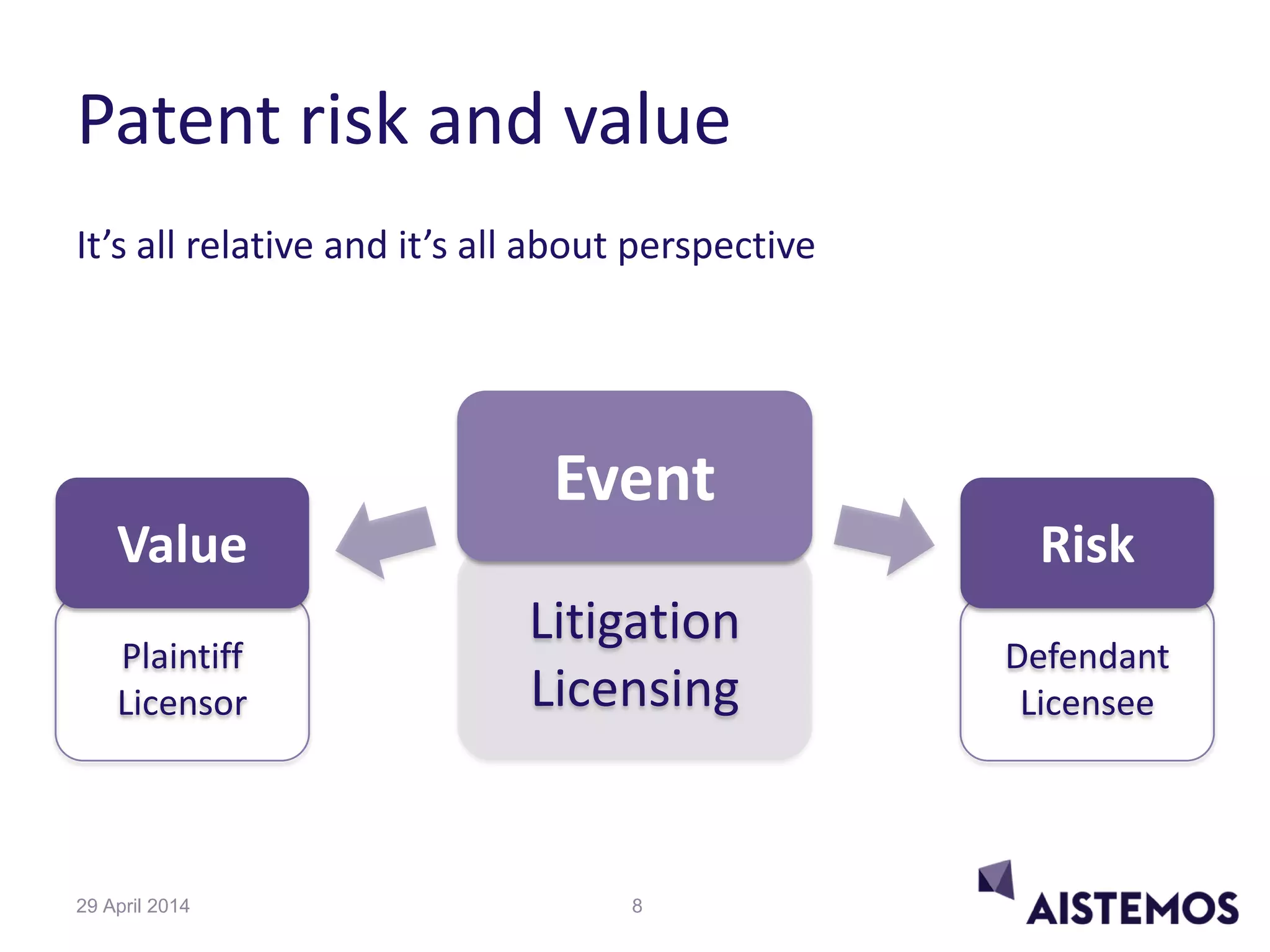

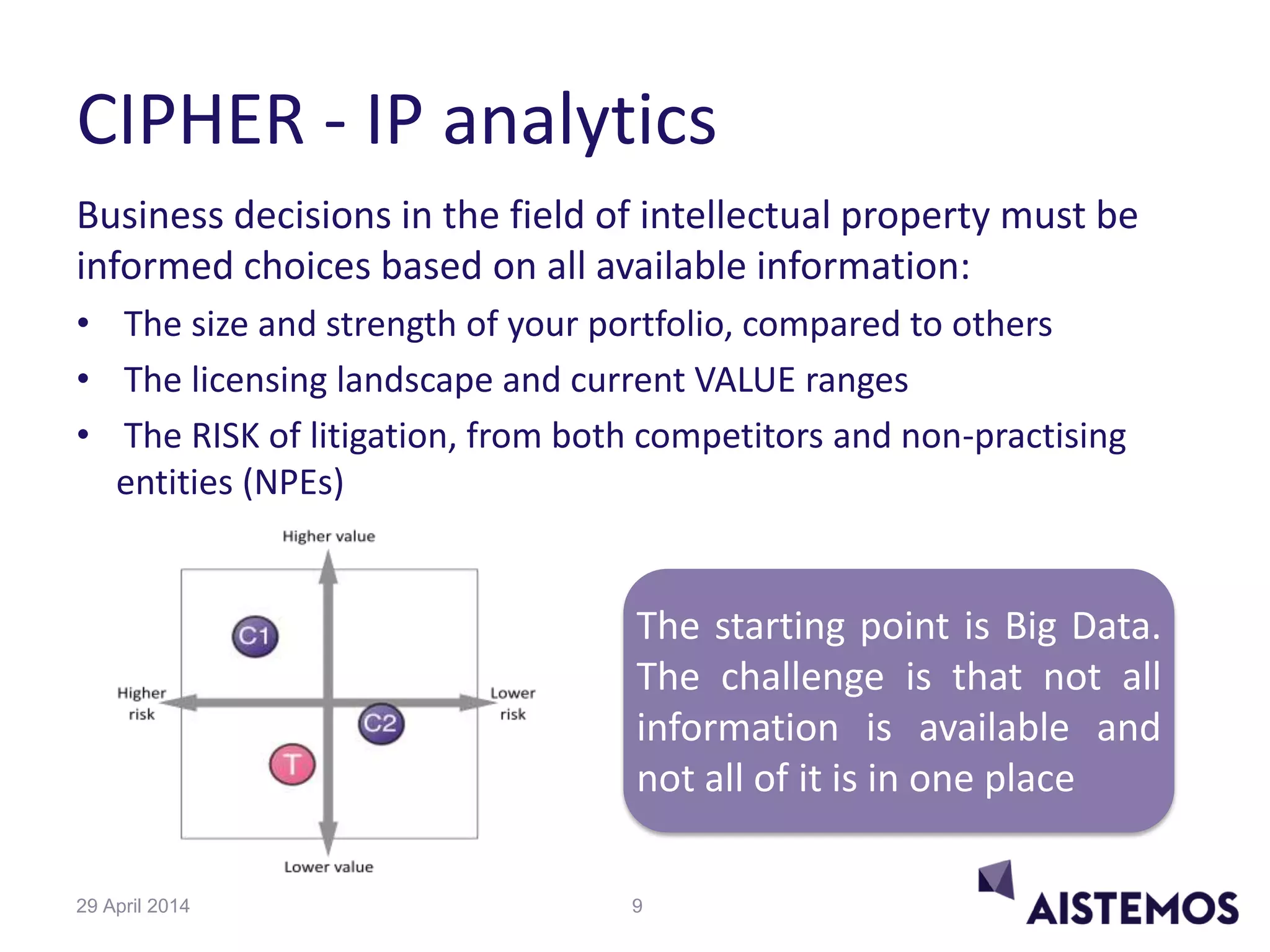

This document discusses IP value and risk. It describes AISTEMOS, a company that analyzes IP data to help organizations understand the value and risk of their patent portfolios. Understanding drivers of value and risk like litigation, licensing, and portfolio management can help companies make informed business decisions. The document also notes that IP is an evolving asset class, and tools to analyze IP data and mitigate risk will help financial institutions further recognize and engage with IP.