The document summarizes a group project analyzing the theoretical understanding of financial statements and their key components. It includes:

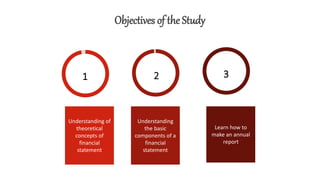

1) An introduction outlining the objectives of understanding financial statement concepts and components.

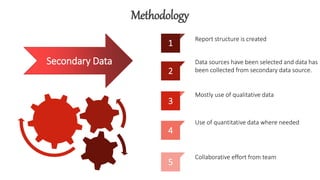

2) A methodology section describing how secondary data was used to create a report structure and collect both qualitative and quantitative data with collaborative input from group members.

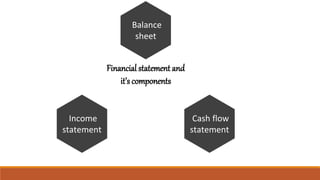

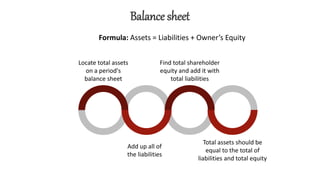

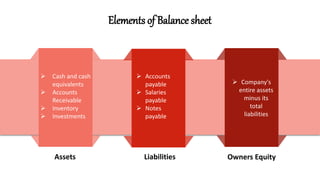

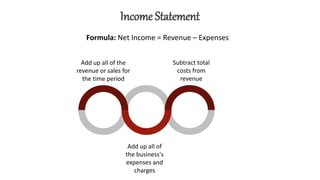

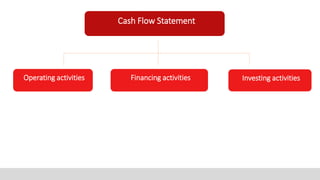

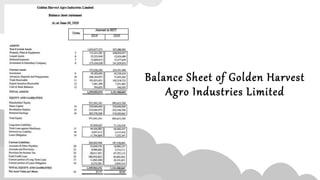

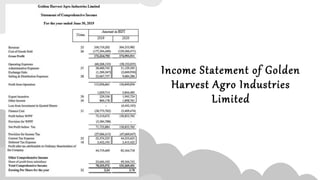

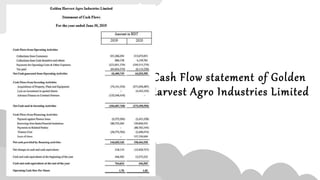

3) Descriptions of the main financial statements - balance sheet, income statement, and cash flow statement - and their basic formulas and elements.

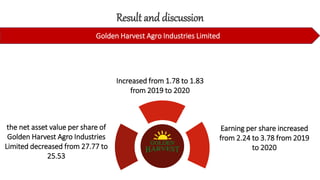

4) An example analysis of the financial statements of Golden Harvest Agro Industries Limited.

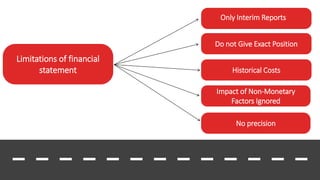

5) A conclusion reinforcing that financial statements accurately portray a company's performance and assist stakeholders in decision making.