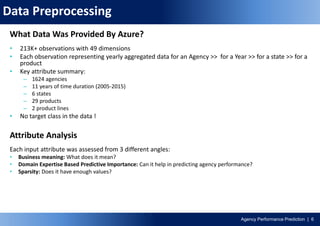

- The document discusses building a predictive model for classifying insurance agencies into one of three performance categories (GROW, STABLE, LOSS) based on past performance data from over 1,600 agencies.

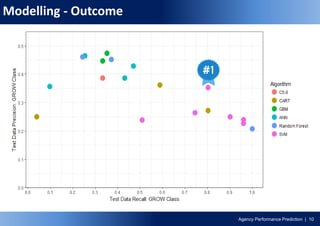

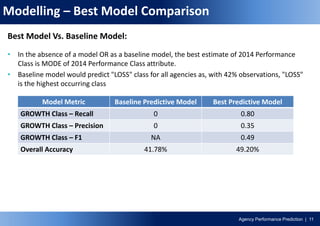

- Several machine learning algorithms were tested on preprocessed agency data, with the best model achieving a recall of 80% for the GROW class and overall accuracy of 49.2%, outperforming the baseline model.

- Key challenges included class imbalance in the target variable and variance in the historical agency data.

![Agency Performance Prediction | 4

Insights Required & Business Benefits

What Insights Are Required?

Classify each agency into one of the following categories

– GROW: Business from the agency is likely to grow > 5% in 2014

– STABLE: Business from the agency is likely to stay flat with growth in the range [-5%,5%] in 2014

– LOSS: Business form the agency is likely to shrink > 5% (< -5% growth) in 2014

Note: Business growth is measured in terms of %growth in Average Monthly Written Premium Amount achieved by the Agency for a given year

Potential Business Benefits

• Improved understanding of Agency Performance - at a micro level & macro level

– How is an individual agency is likely to perform?

– How are all agencies in a state are likely to perform?

• Optimized utilization of Agency Development Funds](https://image.slidesharecdn.com/aigperformanceclassification-170112063410/85/AIG-Performance-Classification-4-320.jpg)

![Agency Performance Prediction | 7

Data Preprocessing (Cont…)

Key Preprocessing Challenges:

SR# Challenge Category Challenge Resolution

1 Missing Values 1. Identified and dropped highly sparse attributes

2. Missing values encoded as "99999", "Unknown" were converted to NA during file read in R

2 Unwanted Data 1. Agencies, appointed as late as 2014 & for which 2014 growth rate can not be calculated - were

removed

2. Scope of analysis is "Personal Line (PL)" data, hence, Commercial Line (CL) data was filtered out

3 Unavailable Data New attributes created for all Quantity and Revenue attributes to average them over the # of months

data is available

4 Incomplete Data 2005 and 2015 data removed as data were available only for 8 & 5 months respectively

5 Repeating Data Agency specific attributes were detached from raw data, processed separately and later merge with

main data

6 Format Of Data For

Modelling

1. All Quantity attributes & revenue attributes were aggregated based on AGENCY_ID and YEAR

2. Each important attribute was expanded with AGENCY_ID in row and Year identifier in column

E.g. WrittenPremAmount column was converted to 2006_WrittenPremAmount,

2007_WrittenPremAmount....

7 No Target Class

Present

1. Lag variable was created for Written Premium Amount

2. Growth Rate for each agency for all years (2006-20014) was calculated

3. Each agency was assigned a class label based on 2014 growth rate:

• GROW class := 2014 growth rate > 5%

• STABLE class := 2014 growth rate in the range [-5%, 5%]

• LOSS class := 2014 growth rate < -5%](https://image.slidesharecdn.com/aigperformanceclassification-170112063410/85/AIG-Performance-Classification-7-320.jpg)