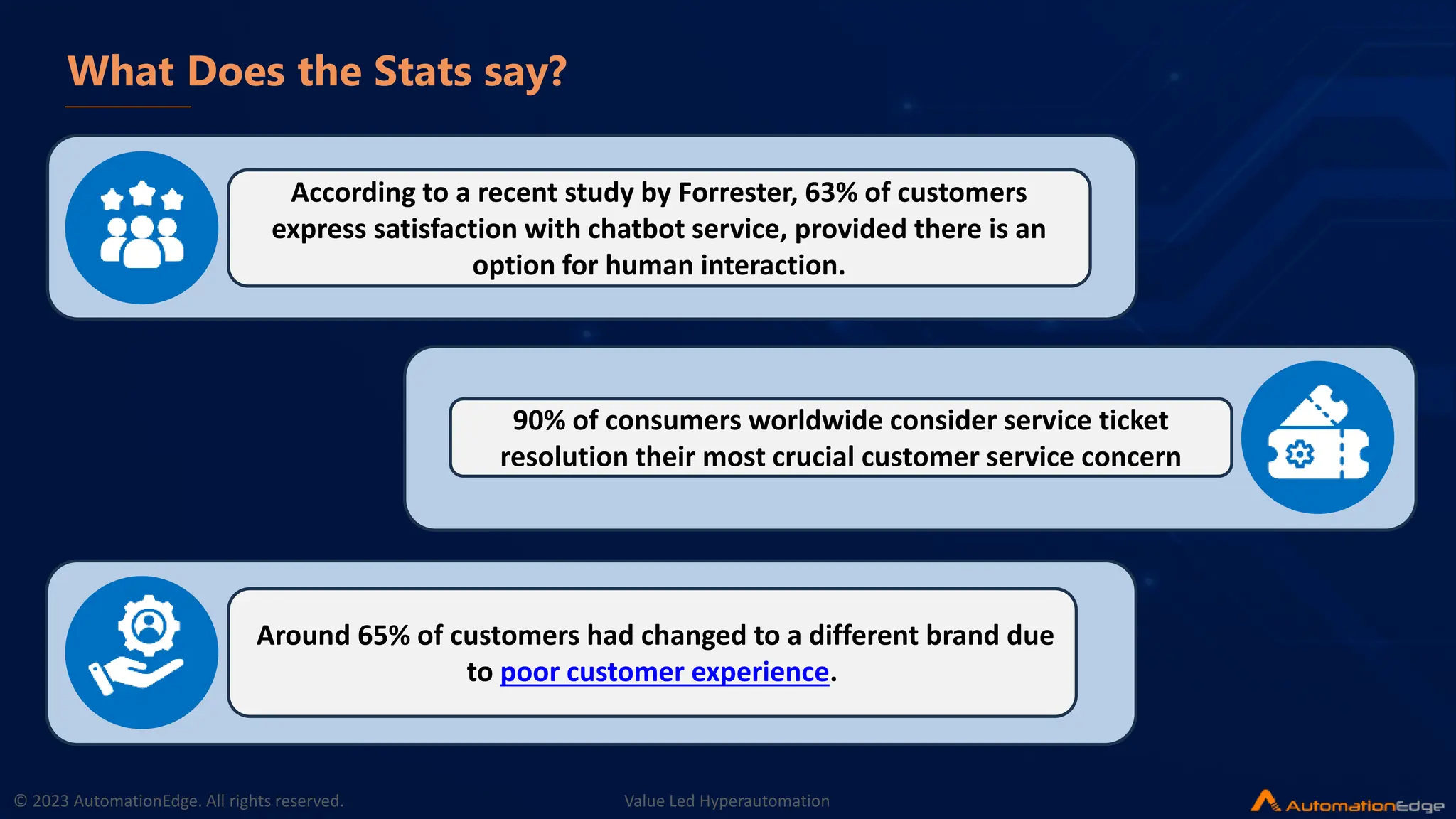

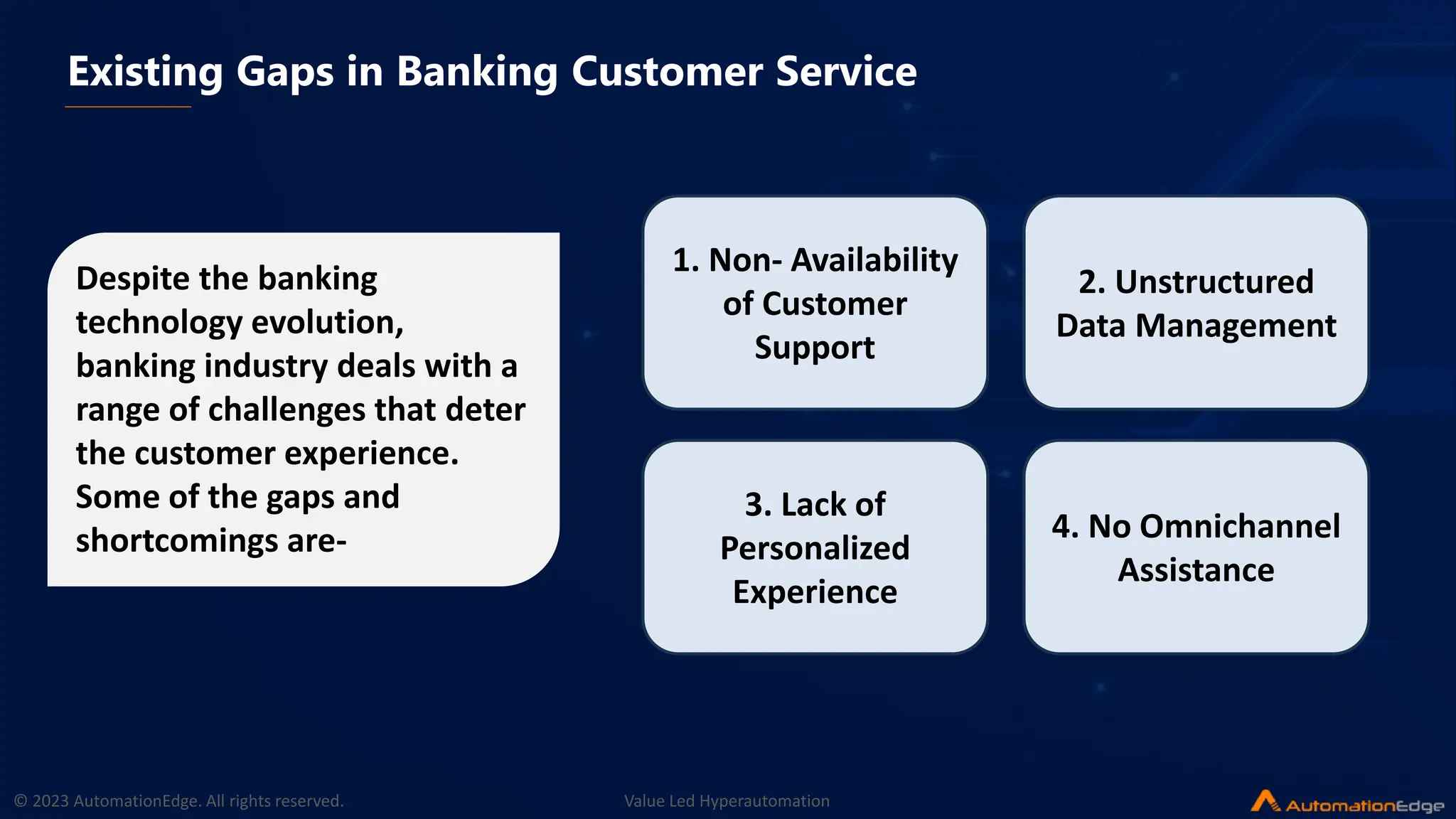

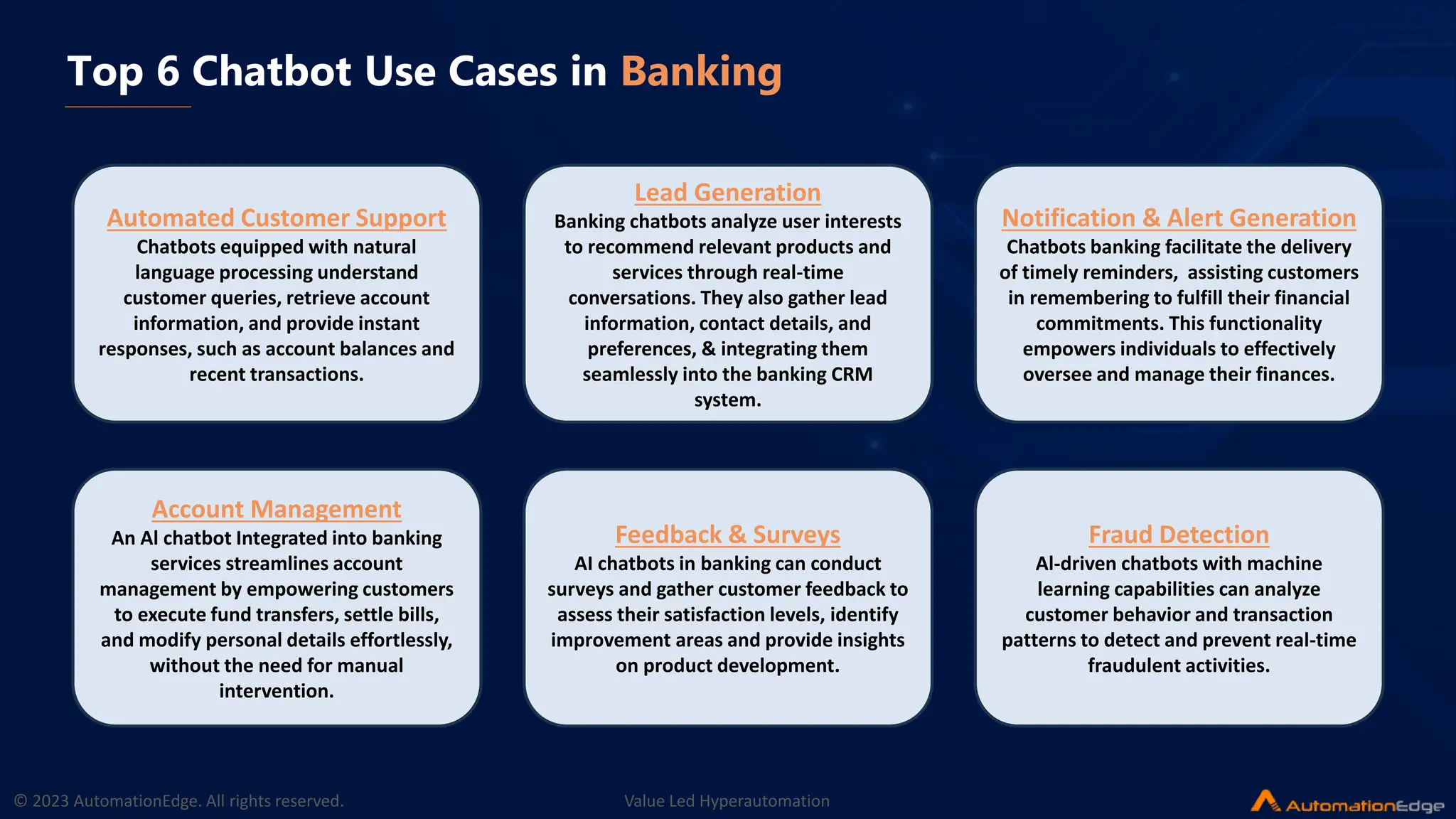

The document discusses the growing importance of AI chatbots in the banking sector as customers increasingly prefer digital solutions over traditional customer service methods. Chatbots enhance customer engagement by providing efficient, personalized assistance and addressing common banking queries in real-time, while also improving banks' serviceability through automation. Notable use cases include automated support, lead generation, account management, and fraud detection, underscoring the shift towards hyperautomation in banking.