Embed presentation

Download to read offline

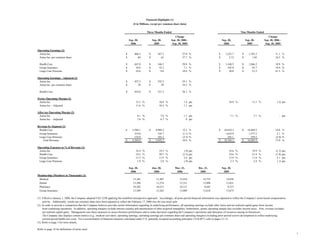

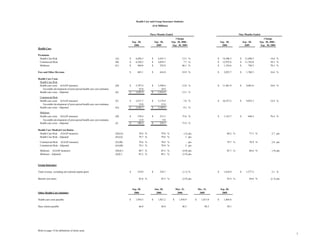

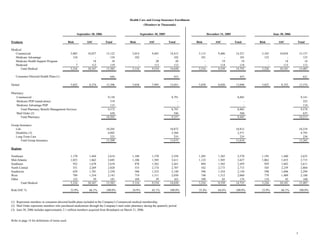

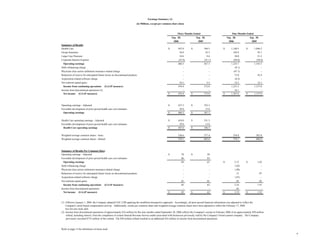

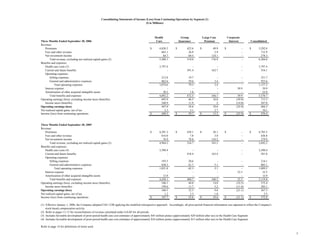

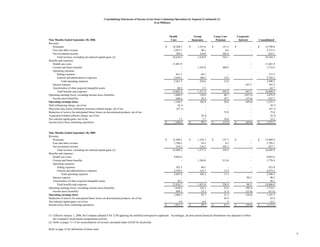

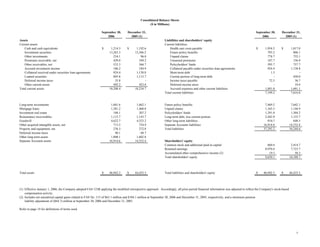

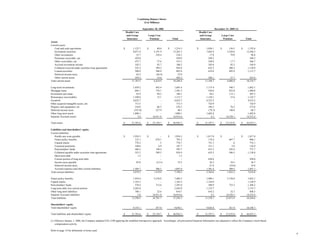

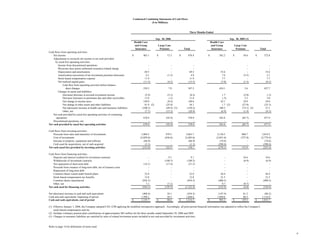

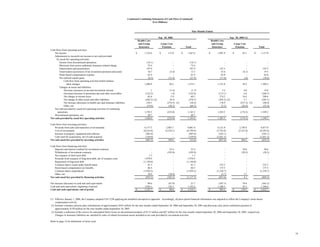

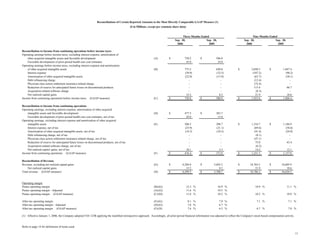

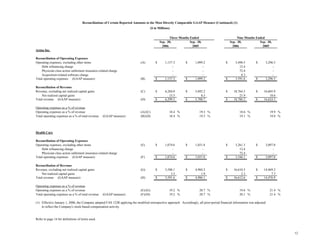

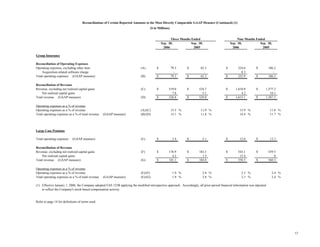

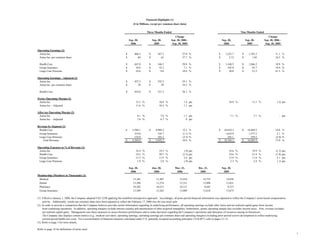

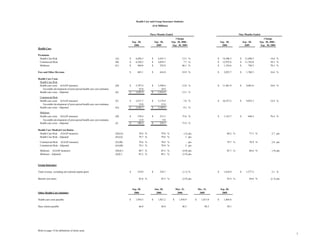

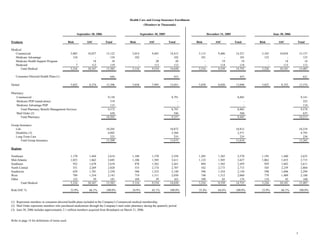

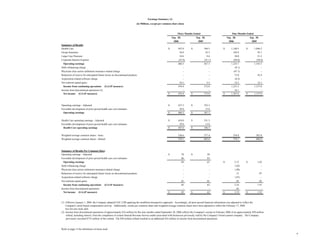

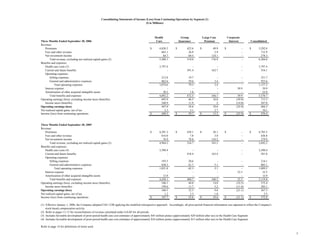

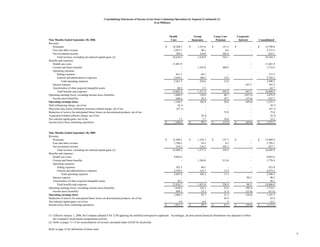

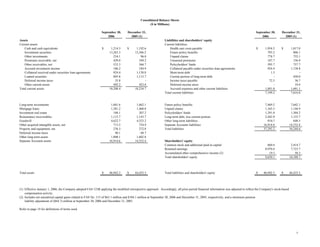

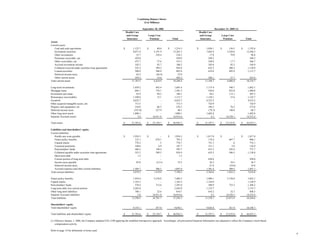

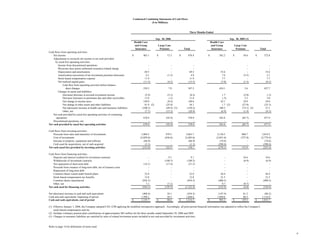

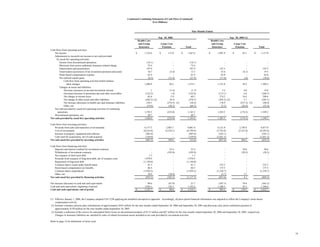

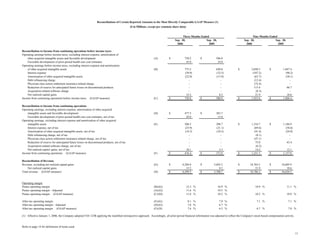

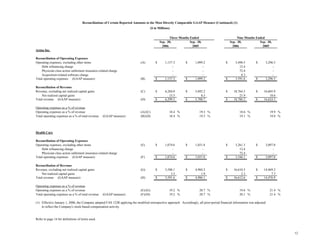

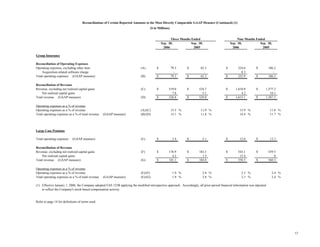

This document provides a financial supplement to Aetna's third quarter 2006 earnings press release. It includes tables with statistics on health care enrollment, revenues, costs, and margins. Key details include: - Health care and group insurance statistics such as premiums, fees, costs, and medical cost ratios for the third quarter and first nine months of 2006 compared to the same periods in 2005. - Consolidated membership numbers for medical, dental, pharmacy, and group insurance as of September 30, 2006 compared to prior periods. - Consolidating statements of income and balance sheets for Aetna's business segments for the third quarter of 2006. - Reconciliations of certain reported amounts to