The document discusses trends impacting molecular diagnostics reimbursement, including:

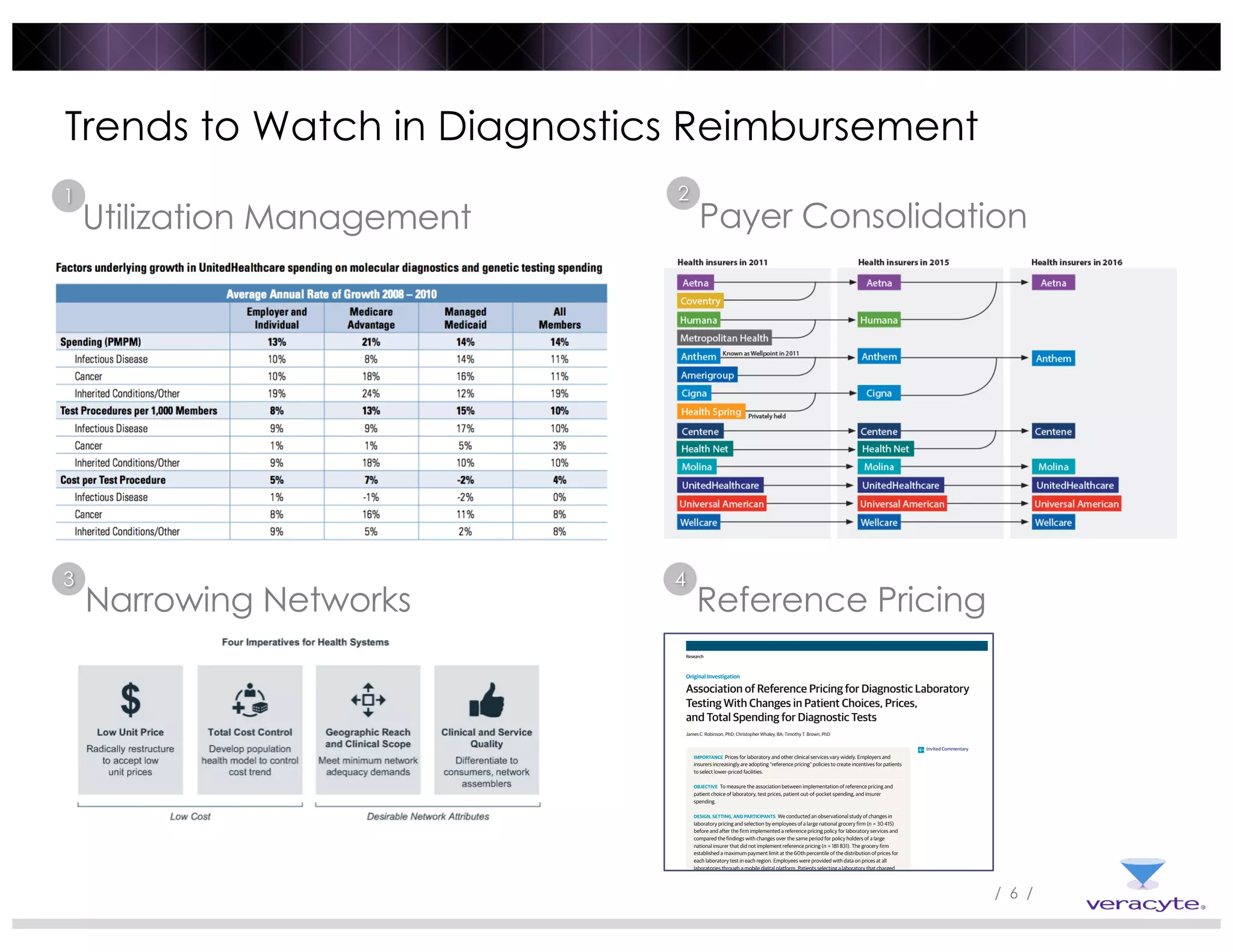

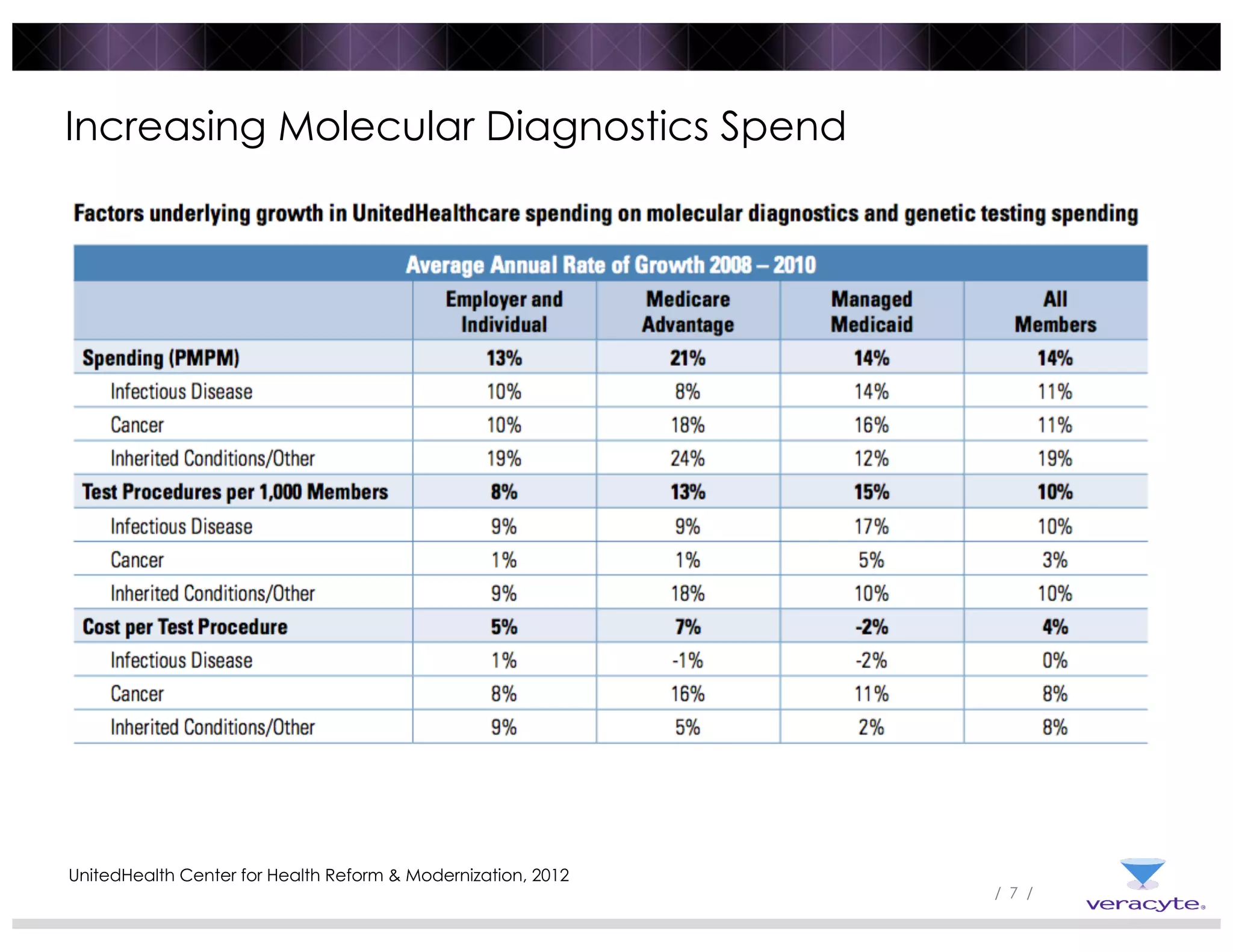

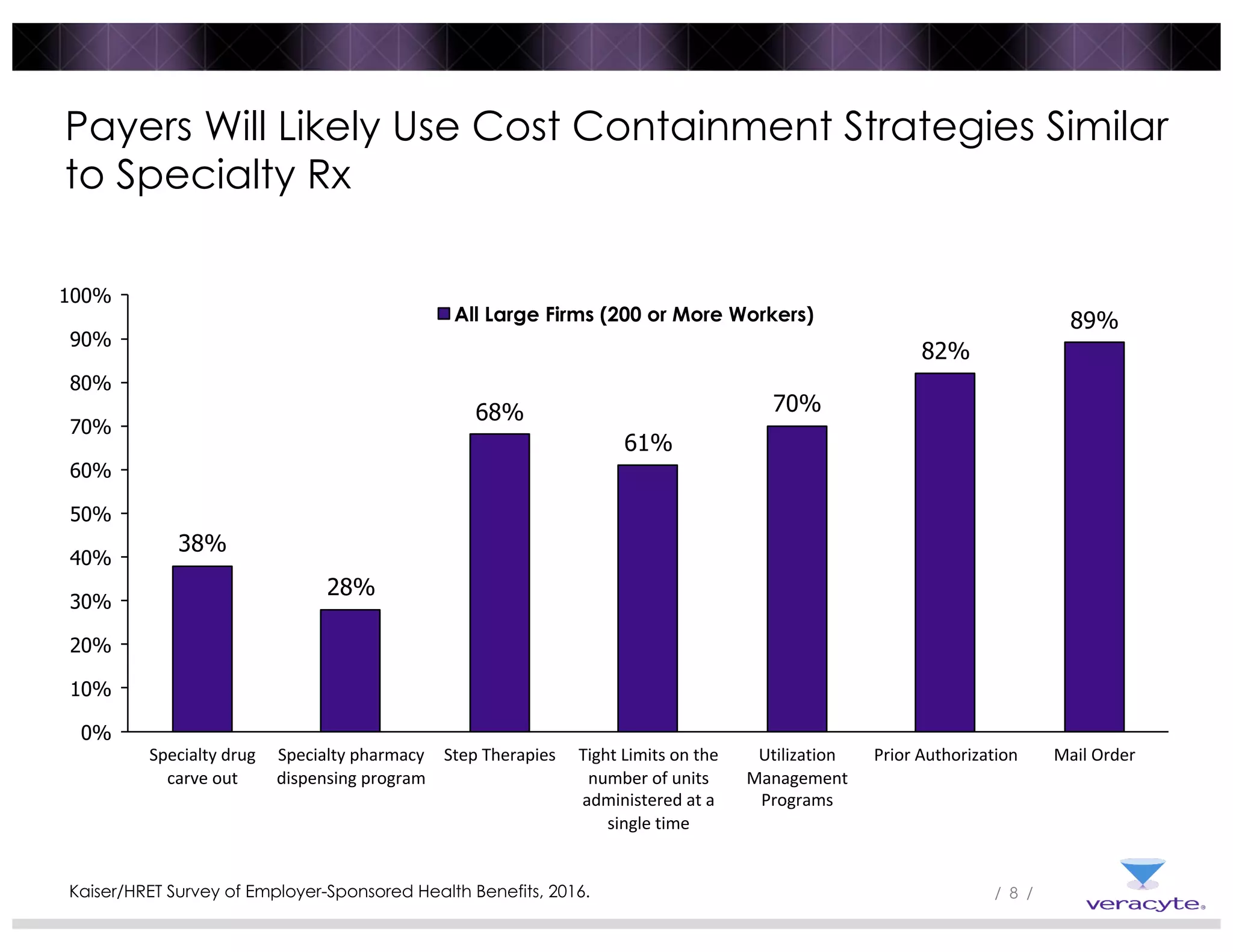

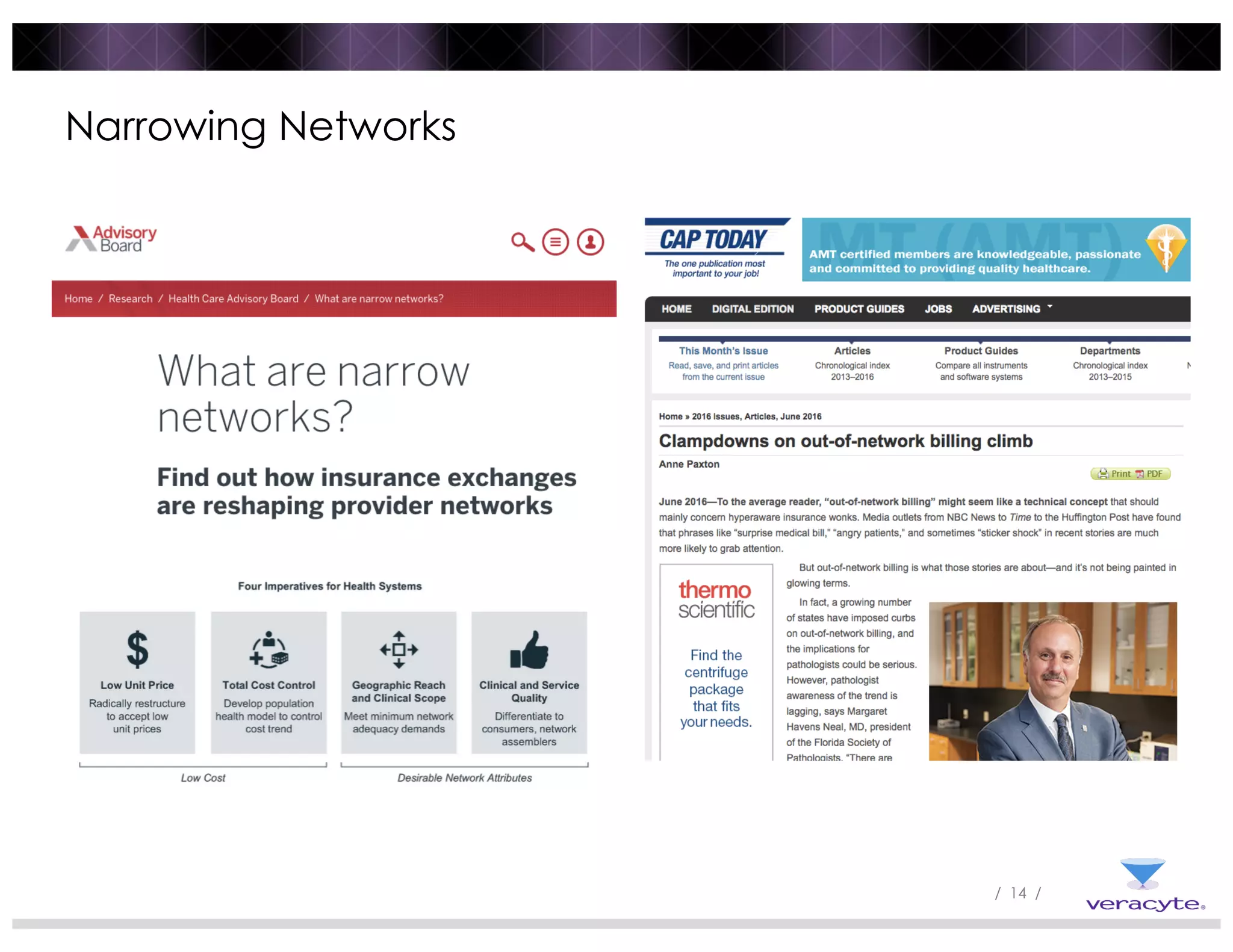

1) Commercial payers are increasingly adopting strategies like specialty drug carve-outs, step therapies, prior authorization, and utilization management programs to contain costs, similar to strategies used for specialty drugs.

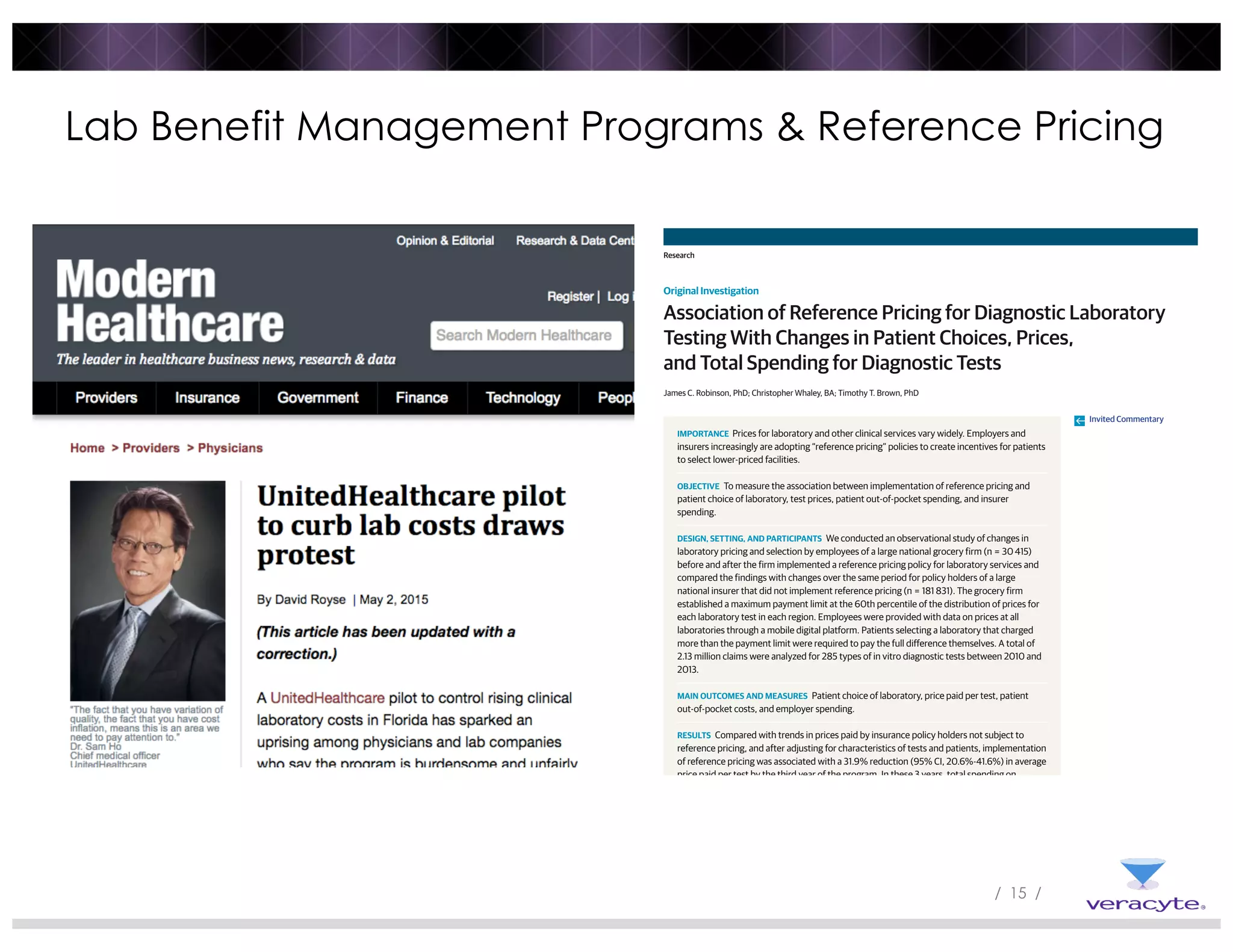

2) Reference pricing and lab benefit management programs that provide price transparency and incentivize use of lower-cost providers have been associated with reduced prices and spending while maintaining patient access.

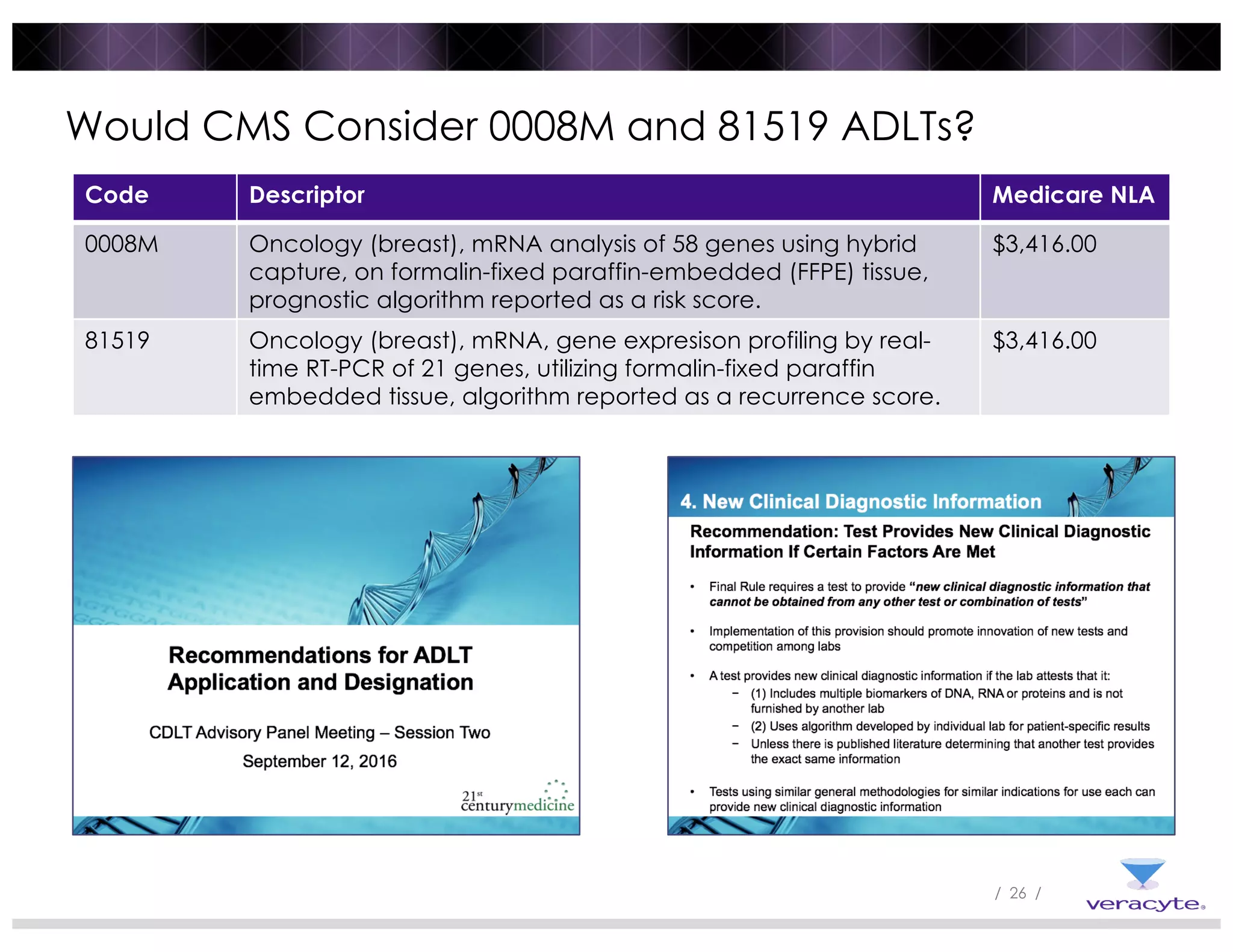

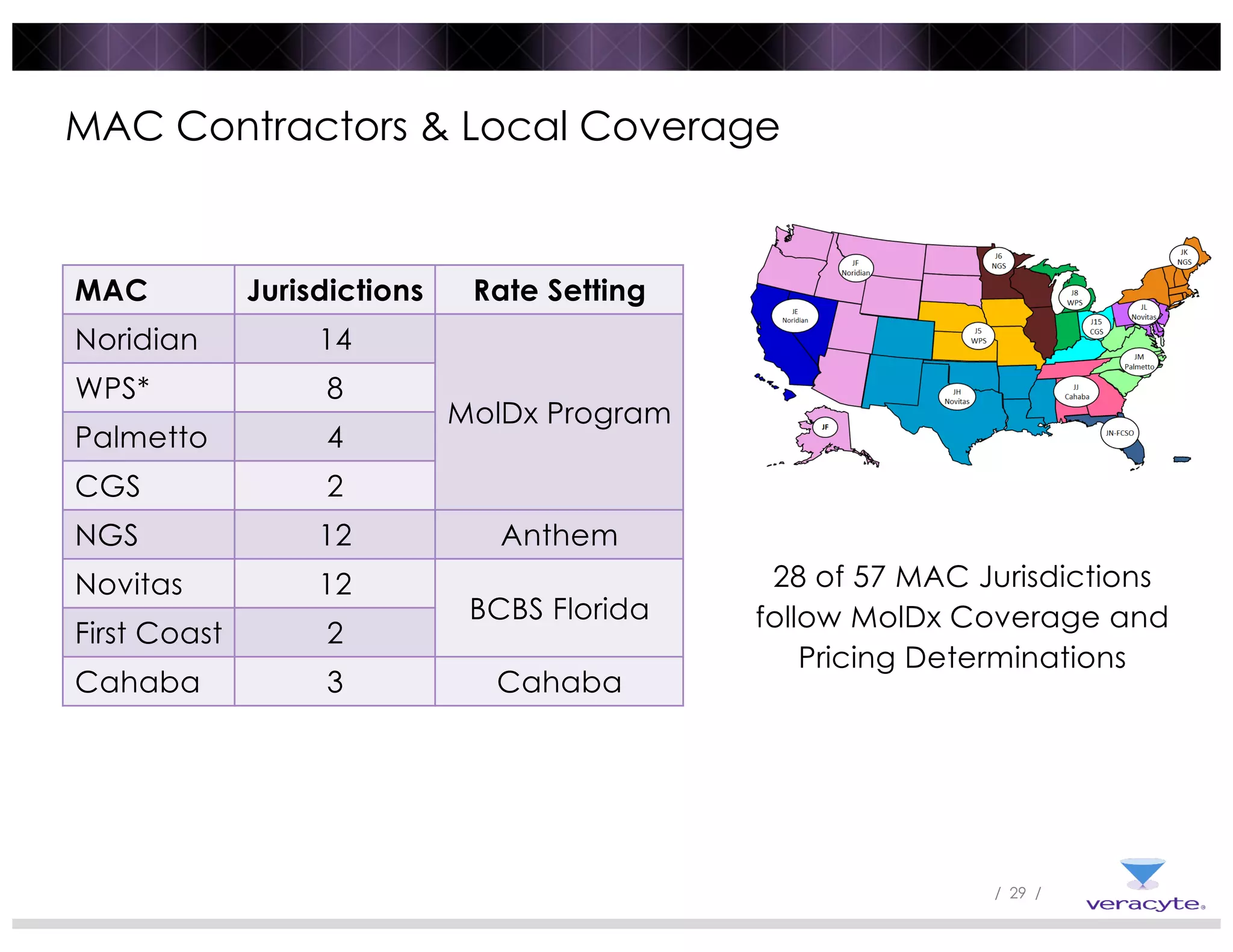

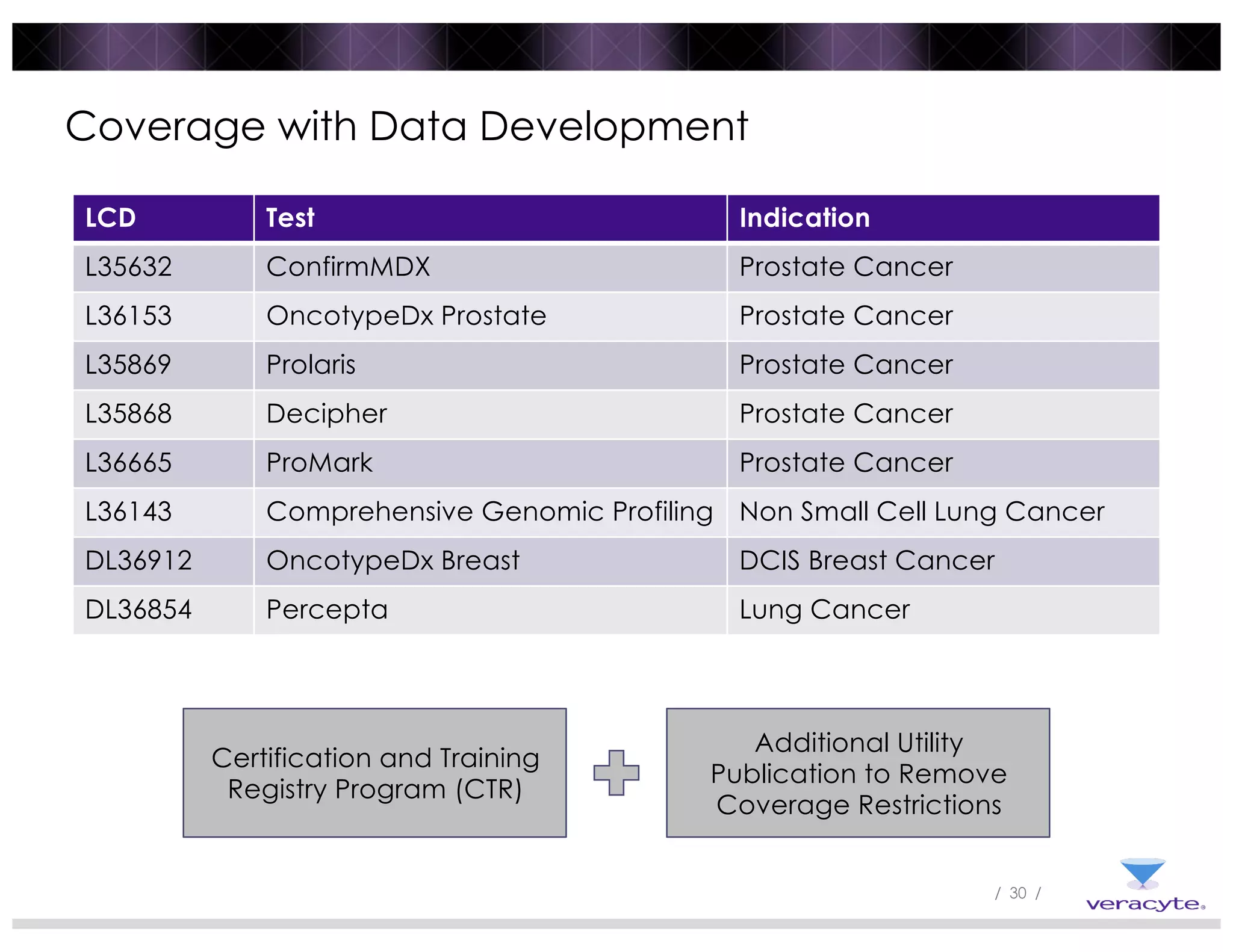

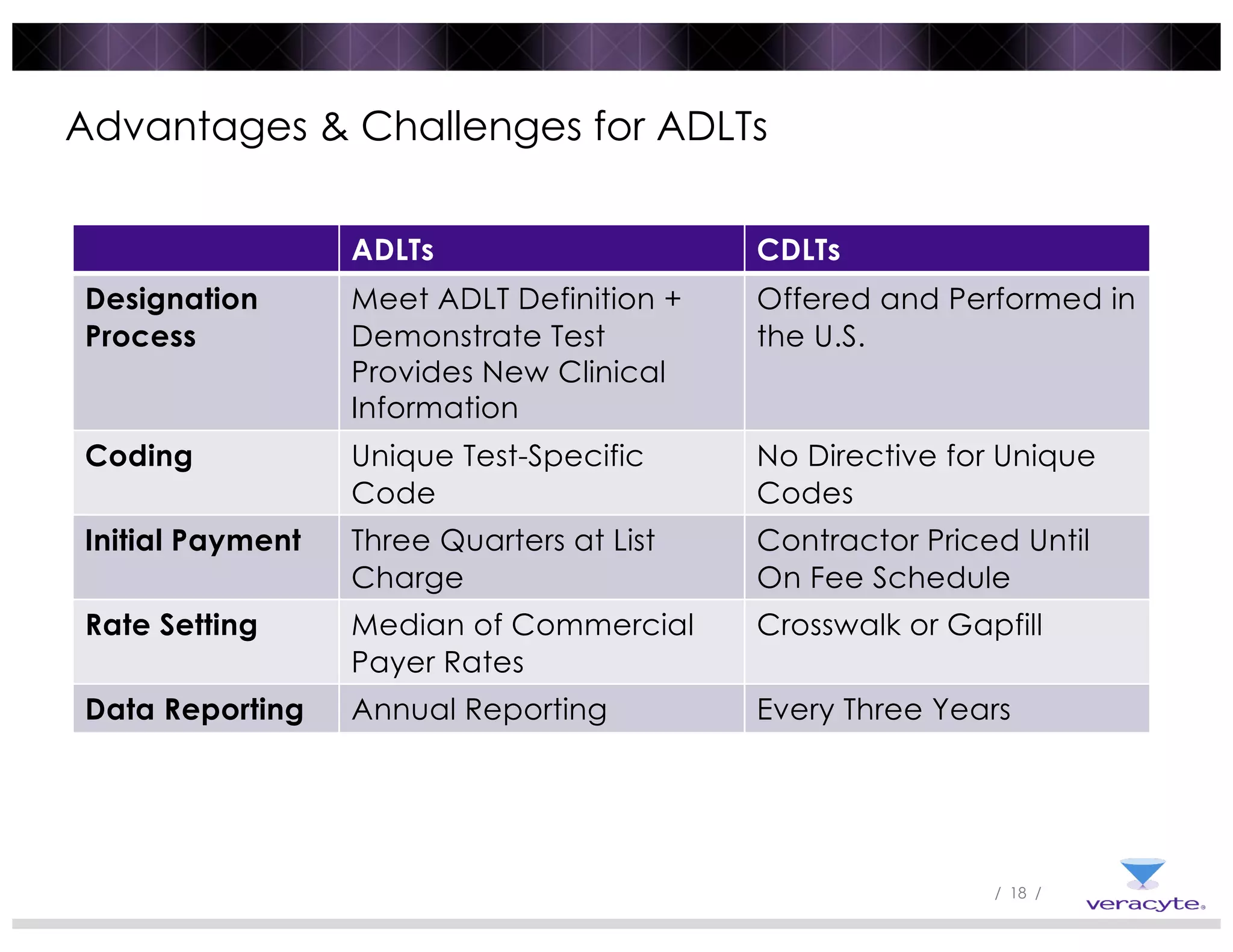

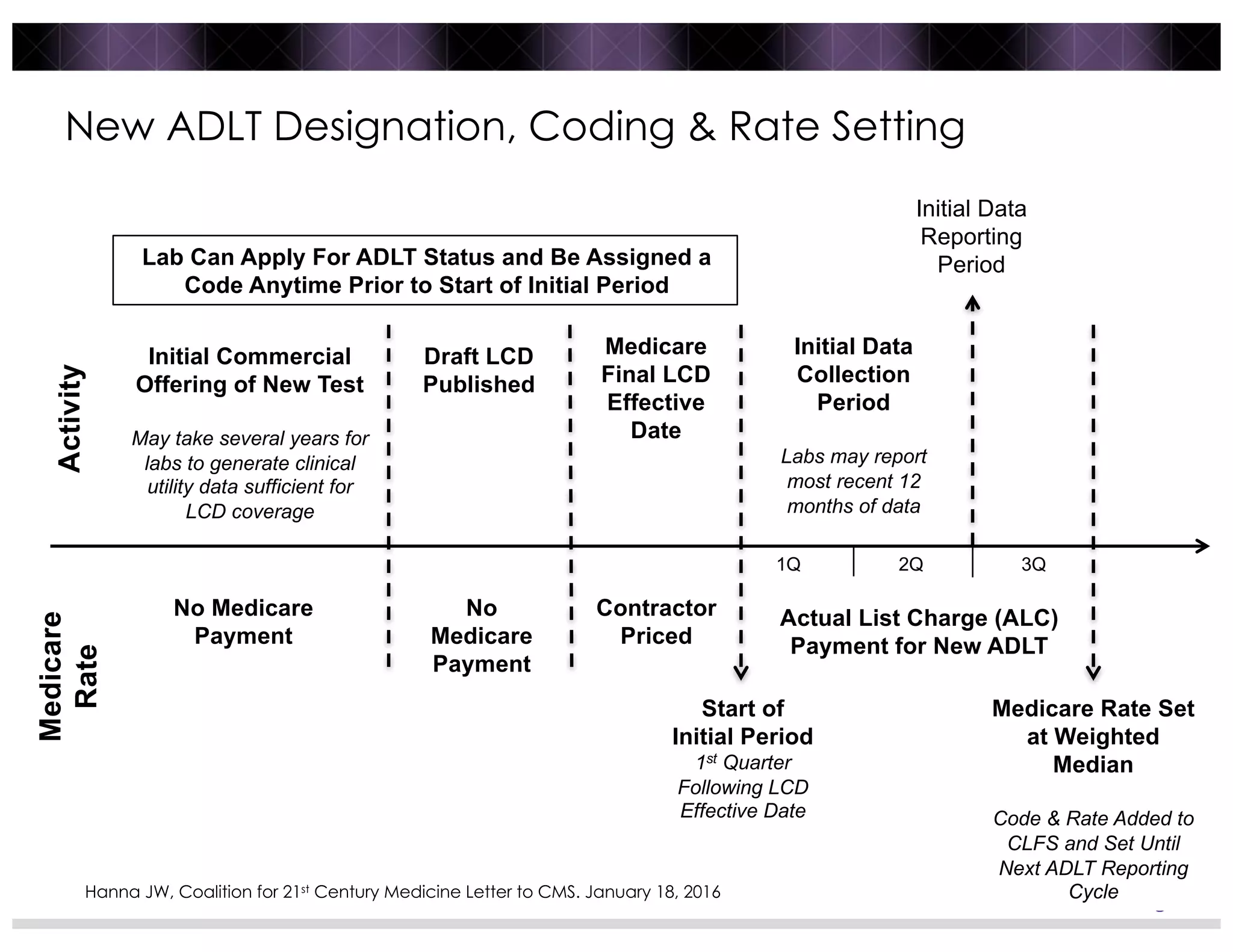

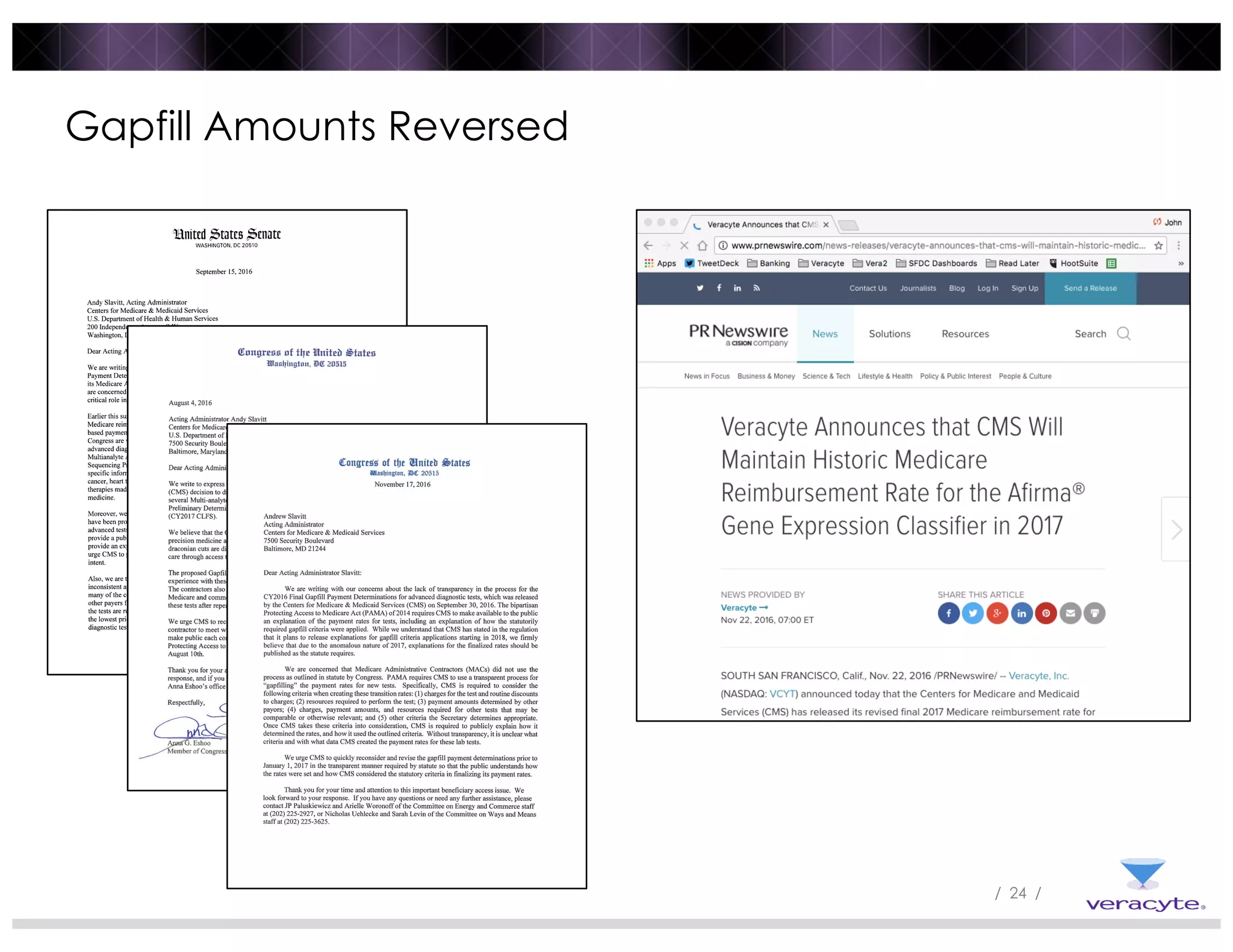

3) Post-PAMA reforms like ADLT designation and Medicare clinical lab fee schedule updates aim to balance innovation and access for new tests, but challenges remain around coding, rate-setting, and determining what constitutes "new clinical information".

![/ 25 /

New Clinical Information – The Curse of Rule Making

“The test must provide new clinical diagnostic information

that cannot be obtained from any other existing test on the

market or combination of tests.”

“Based on our view that ADLTs that meet the criterion are

innovative tests that are new and different from any prior

test already on the market and provide the individual

patient with valuable genetic information to predict the

trajectory of the patient’s disease process or response to

treatment of the patient’s disease that could not be gained

form another test or [combination of] tests on the market.”

CMS PAMA Final Rule 42 CFR 414 [CMS-1621-F]](https://image.slidesharecdn.com/hannapresntationq1-161228212954/75/Advanced-Diagnostics-in-the-Post-PAMA-Era-25-2048.jpg)