This document provides a summary of the Coronavirus Aid, Relief, and Economic Security (CARES) Act:

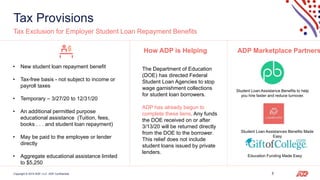

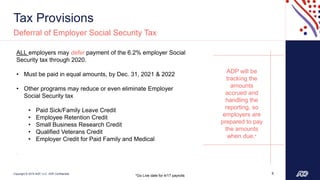

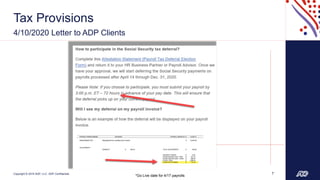

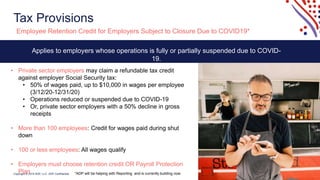

- It outlines several tax provisions including deferral of employer payroll taxes, new refundable employee retention credit for employers, and a tax exclusion for student loan repayment benefits.

- It also summarizes unemployment insurance provisions such as pandemic unemployment assistance and increased benefit amounts.

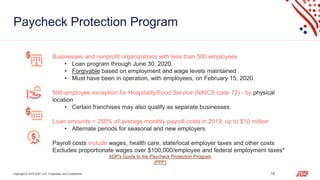

- Details are provided about the Paycheck Protection Program including loan amounts, eligibility, and guidelines for loan forgiveness.

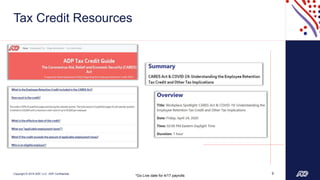

- Resources are listed to help businesses and employers understand and utilize the various programs, including an ADP employer toolkit and guides. ADP pledges to help clients navigate compliance requirements and focus on running their businesses