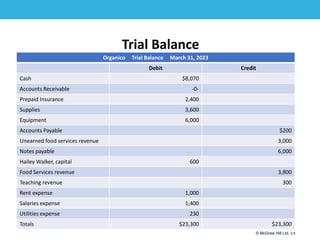

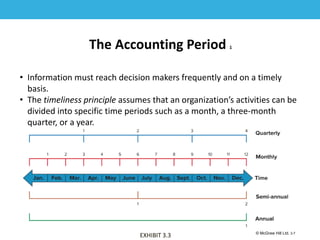

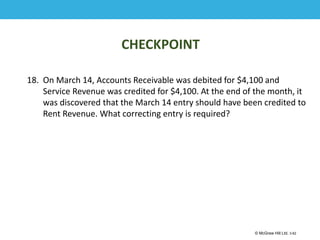

This document discusses adjusting accounts at the end of an accounting period. It covers several key topics:

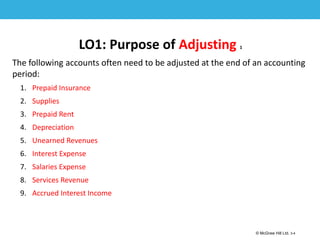

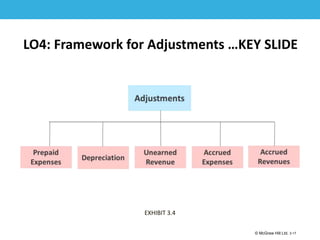

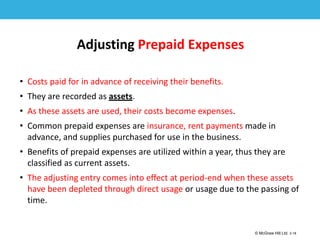

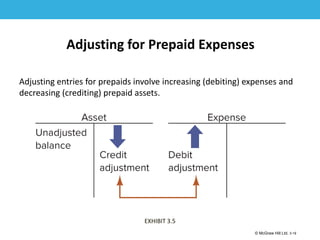

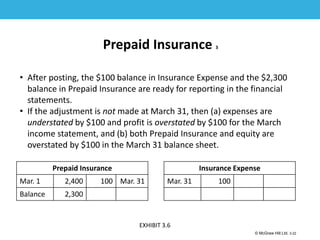

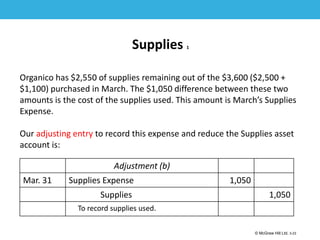

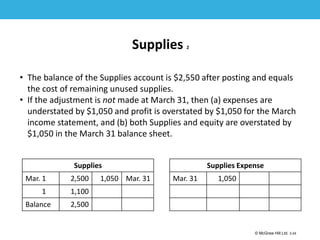

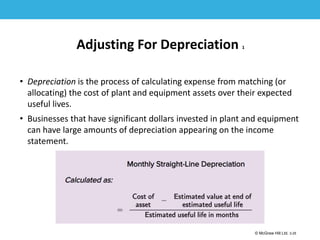

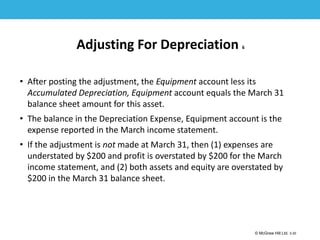

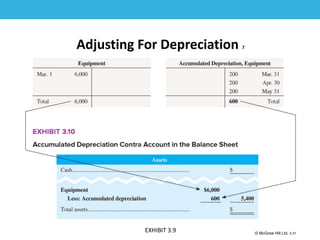

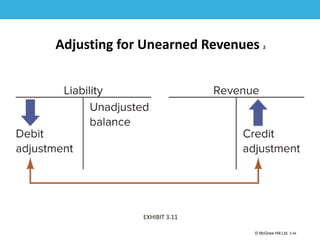

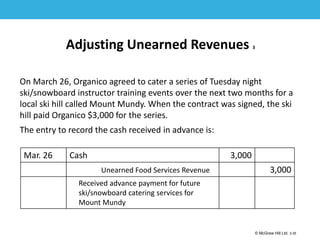

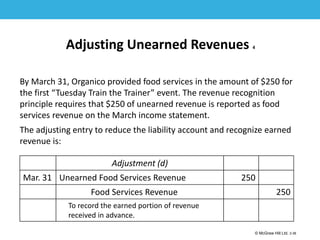

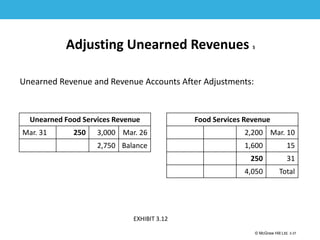

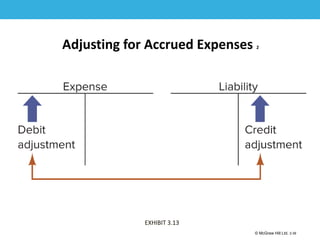

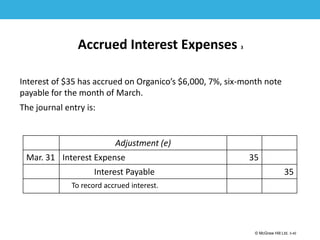

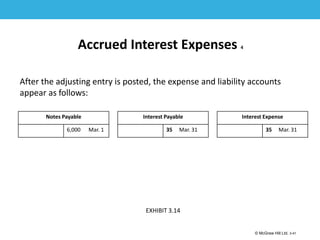

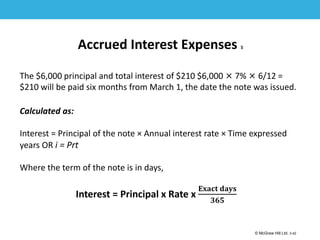

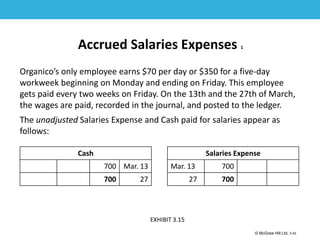

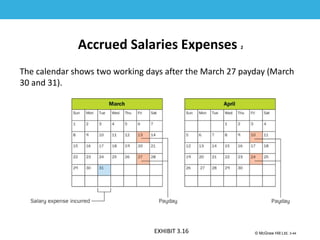

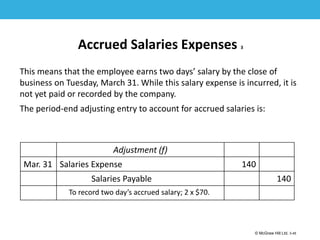

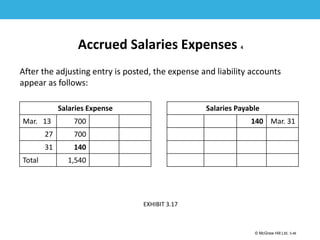

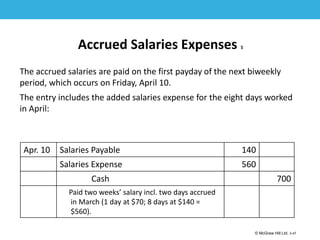

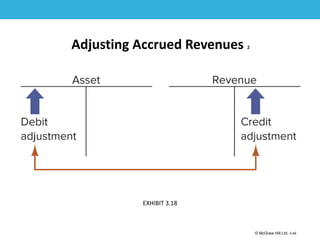

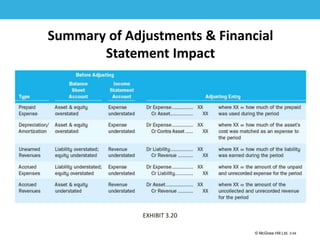

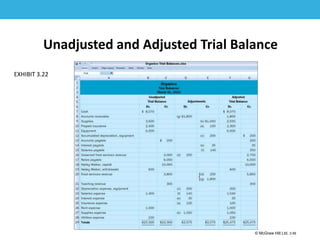

1) The purpose of adjusting accounts is to ensure expenses and revenues are recorded in the proper period according to accrual accounting principles like the matching principle. This involves adjusting accounts like prepaid expenses, depreciation, unearned revenues, and accrued expenses.

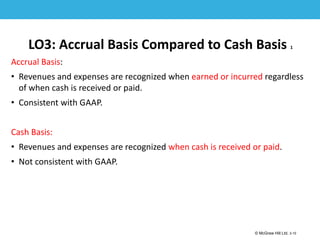

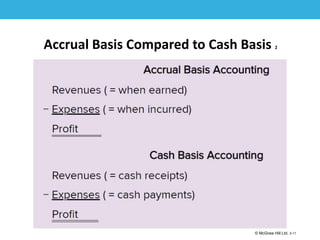

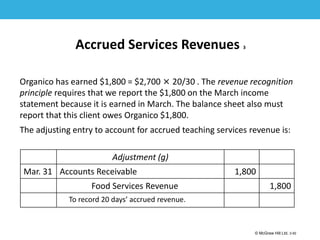

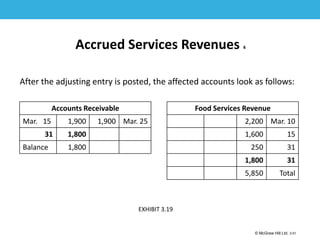

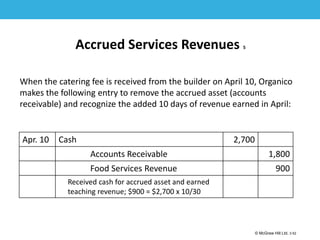

2) Adjustments are based on GAAP principles like timeliness, matching, and revenue recognition to ensure the financial statements represent the economic activities for the period. Accrual accounting records revenues and expenses when earned/incurred rather than when cash is received/paid.

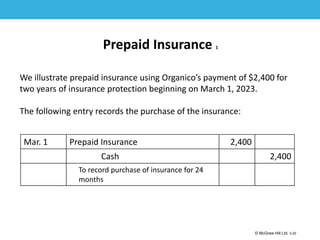

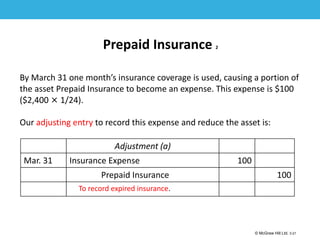

3) Examples are provided for adjusting prepaid insurance, supplies, and de