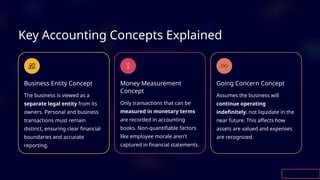

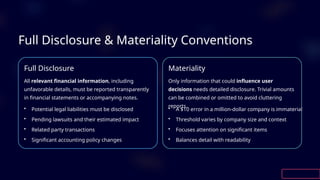

Accounting concepts are the fundamental assumptions and rules that guide how financial transactions are recorded and reported. Accounting conventions, on the other hand, are the customs and practices that help interpret and present financial statements clearly. Concepts are the established theory, while conventions are the practical applications that ensure consistency and comparability.