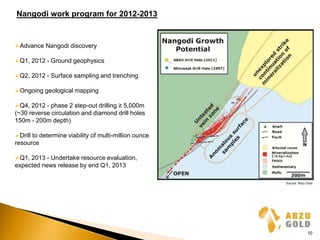

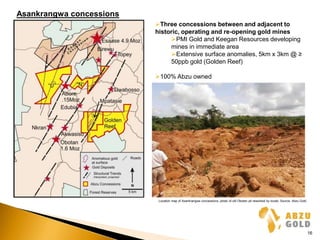

Abzu Gold is a gold exploration company focused on projects in Ghana, West Africa. It has two main projects - the Nangodi gold deposit, which has the potential to become a multi-million ounce resource, and the Asafo project, which also shows potential as a multi-million ounce deposit. Abzu plans to advance both projects through continued exploration, drilling, and resource evaluations to determine their commercial viability. It is partnered with Kinross Gold at Nangodi and fully owns the Asafo project. Ghana is considered a top tier jurisdiction for gold mining with an established mining industry and supportive policies.