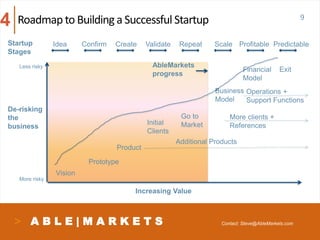

AbleMarkets provides data products to help investment professionals manage real-time risks. They analyze large datasets using big data techniques to develop proprietary indexes that monitor conditions for risks like flash crashes and runaway algorithms. Founded in 2014, AbleMarkets is targeting the growing need for tools to address risks from high-frequency trading. Their products currently analyze market, social media and news data to identify risk factors. They have an initial set of clients and are working to expand their platform and client base.

![A B L E | M A R K E T S

Irene Aldridge – President and Head of Research

• Recognized expert on HFT, 20 years experience in Finance

– most recently, quant trading

– previously, quant risk management, large systems integration, software and

hardware architecture, enterprise Internet security, software development

• BE Electrical Engineering Cooper Union, MS Financial Engineering Columbia U., MBA

INSEA, 2 PhDs – Ops Research (Columbia, ABD), Finance (ABD)

• Member CFTC panel on HFT since 2011

• Author, “High-Frequency Trading” (Wiley, 2009, 2013, translated into Chinese), co-

author of “Real-Time Risk” (Wiley, forthcoming)

Steve Krawciw [kro:sew] – CEO and Head of Institutional Sales

• 20 years of experience in financial product development, launch, business

development, integration and operations

– Launched $4+ billion products at Credit Suisse (7yrs at Credit Suisse in product

development, business development, technology and operations mgmt)

– Previously, asset management CIBC (4 years), 8 years at McKinsey & Co and

Monitor Co in business strategy, spanning financial improvements, corporate

reorganizations and acquisitions, restructuring and process improvements

• MBA (Finance) Wharton, BComm University of Calgary

• Co-author of “Real-Time Risk” (Wiley, forthcoming)

Team- Founders

Contact: Steve@AbleMarkets.com

3 7](https://image.slidesharecdn.com/0553ca0a-c20b-45be-9e2e-6ec87dc3119f-161108205032/85/AbleOverview-20161107-7-320.jpg)