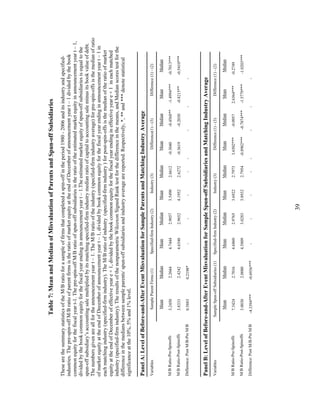

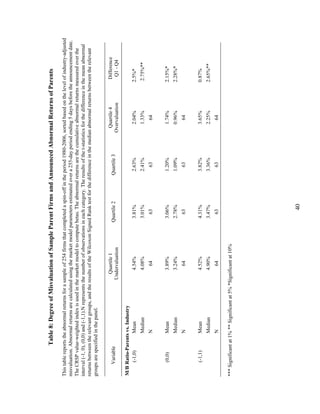

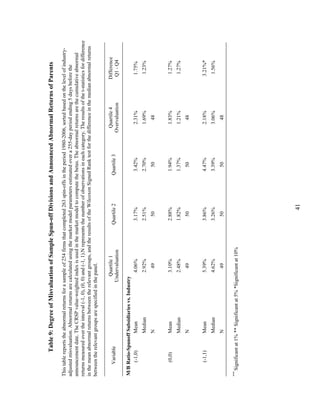

The document discusses a study exploring the relationship between gains from corporate spin-offs and the degree of misvaluation of the parent firms and spun-off divisions. The study finds that parent firms experiencing spin-offs are often undervalued prior to the spin-off, and there is a positive relationship between the degree of undervaluation of parents and abnormal positive stock returns around the spin-off announcement. However, spun-off divisions are sometimes overvalued prior to becoming independent, and giving away a highly overvalued spun-off division can also generate higher market reactions, contradicting efficient market theories. The gains from spin-offs seem primarily due to correcting the undervaluation of parent firms rather than enhancing the value of spun-off divisions.