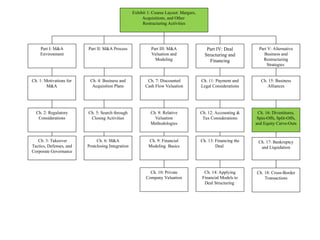

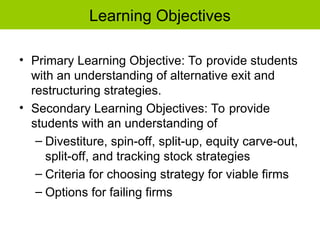

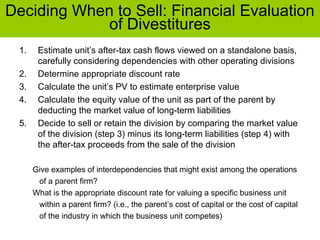

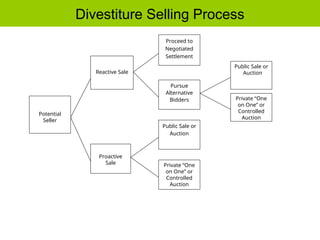

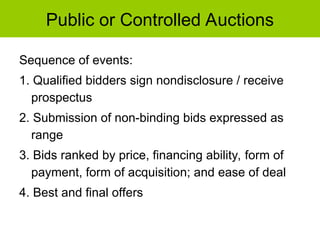

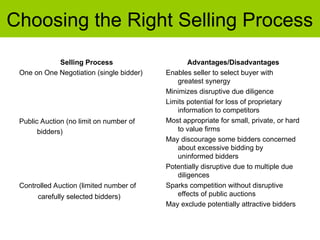

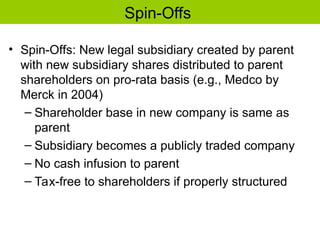

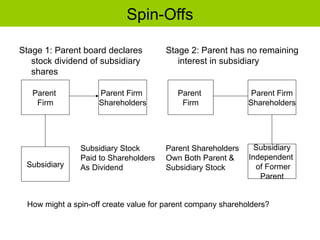

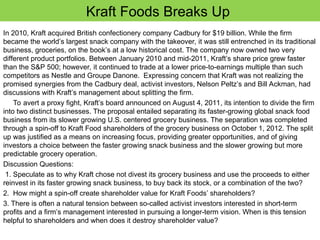

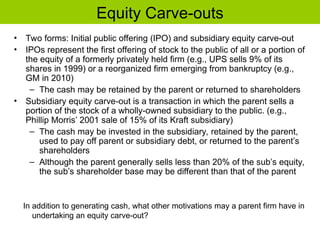

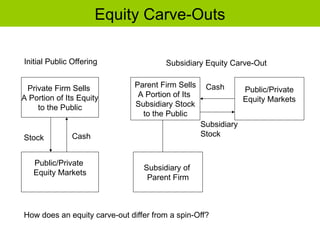

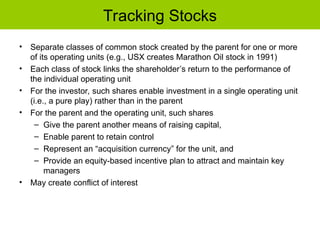

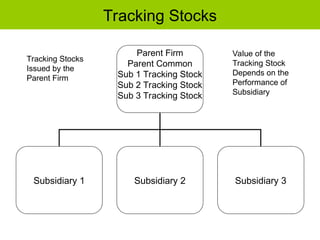

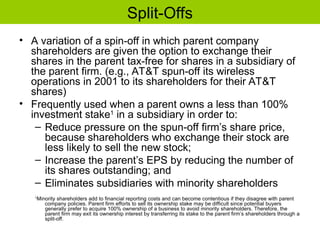

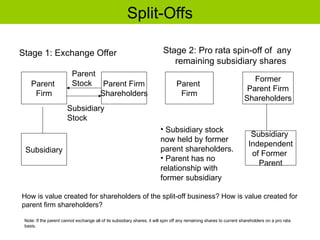

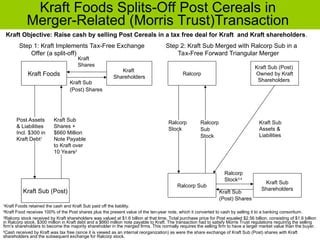

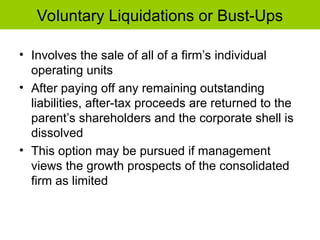

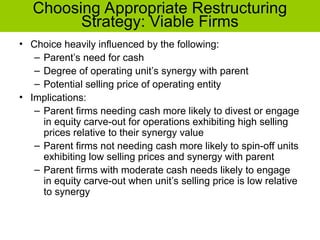

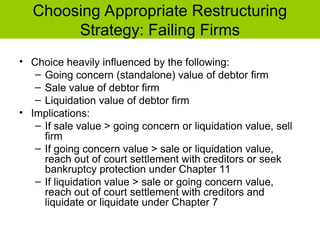

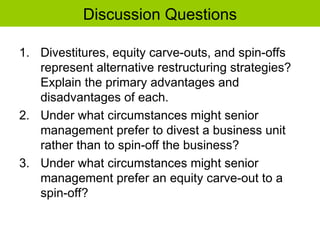

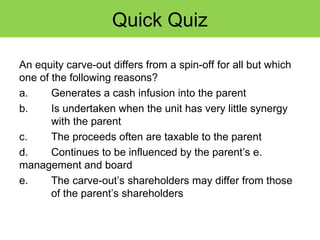

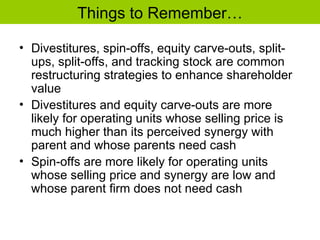

The document outlines various restructuring strategies, including divestitures, spin-offs, and equity carve-outs, aimed at enhancing shareholder value. It details the processes, advantages, and disadvantages of these strategies, particularly focusing on how firms can divest or split operations based on financial conditions and market evaluations. The learning objectives emphasize understanding these strategies' impact on corporate focus, financial performance, and shareholder returns.