Derivatives Strategy for Volatile Markets

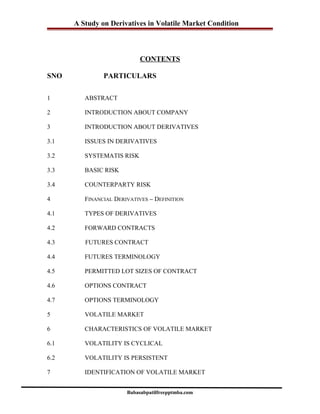

- 1. A Study on Derivatives in Volatile Market Condition CONTENTS SNO PARTICULARS 1 ABSTRACT 2 INTRODUCTION ABOUT COMPANY 3 INTRODUCTION ABOUT DERIVATIVES 3.1 ISSUES IN DERIVATIVES 3.2 SYSTEMATIS RISK 3.3 BASIC RISK 3.4 COUNTERPARTY RISK 4 FINANCIAL DERIVATIVES – DEFINITION 4.1 TYPES OF DERIVATIVES 4.2 FORWARD CONTRACTS 4.3 FUTURES CONTRACT 4.4 FUTURES TERMINOLOGY 4.5 PERMITTED LOT SIZES OF CONTRACT 4.6 OPTIONS CONTRACT 4.7 OPTIONS TERMINOLOGY 5 VOLATILE MARKET 6 CHARACTERISTICS OF VOLATILE MARKET 6.1 VOLATILITY IS CYCLICAL 6.2 VOLATILITY IS PERSISTENT 7 IDENTIFICATION OF VOLATILE MARKET Babasabpatilfreepptmba.com

- 2. A Study on Derivatives in Volatile Market Condition 8 TYPES OF SECURITIES 9 SCIENTIFIC METHOD INVOLVED IN IDENTIFYING SECURITY 9.1 AVERAGE RANGE 9.2 STANDARD DEVIATION 9.3 BETA COEFFICIENT 9.4 R- SQUARED 9.5 GEOMETRIC STANDARD DEVIATION 10 IDENTIFICATION OF SECURITIES 11 COMPARISON OF SECURITIES WITH THE MARKET 12 DERIVATIVE STRATEGY 12.1 STRADDLE 12.2 STRANGLE 12.3 BULL SPREAD WITH CALL OPTION 12.4 BEAR SPREAD WITH CALL OPTION 12.5 BULL SPREAD WITH PUT OPTION 12.6 BEAR SPREAD WITH PUT OPTION 12.7 BOX SPREAD 12.8 BUTTERFLY SPREAD WITH CALL OPTION 12.9 BUTTERFLY SPREAD WITH PUT OPTION 13 CALCULATION OF PAYOFF 14 CONCLUSION AND RECOMMENDATIONS 15 REFERENCES Babasabbpatilfreepptmba.com Page 2

- 3. A Study on Derivatives in Volatile Market Condition 1. Abstract The project began with the study of what derivative is and what are the types of derivatives that has been trading in India and I was taught the basics of future and option trading in India. After getting the basic knowledge about derivatives the project work started with • Identification of volatile market • Identification of securities - High volatile securities - Low volatile securities Babasabbpatilfreepptmba.com Page 3

- 4. A Study on Derivatives in Volatile Market Condition • Comparison of securities with the market • Strategies for volatile market • Payoff calculation for the strategies • Propose the best strategy for the volatile market condition 2. PROFILE OF STOCK HOLDING COPORATION OF INDIA LTD INTRODUCTION Flagged off at the initiative of the Government of India, SHCILenjoys an enviable parentage that includes leading Indian financial institutions and insurance majors like IDBI, UTI, ICICI, LIC GIC and its subsidiaries, IFCI and IIBI. Their original focus was to manage the entire array of post trade activities of Financial Institutions and Foreign Institutional Investors with dedicated client relationship teams and state-of-the-art reporting systems. It has been an eventful journey rewarding them with a 50% market share and the biggest investing bodies of the country for clients. From their inception to achieving and retaining the mantle of the largest Depository Participant in the country, it is their dream and vision that has helped them. Where they have made the difference is at understanding ideas, managing them, at arranging their organizational strengths and translating these new exposures into service and business activities. Their technological support not only holds enormous databases together, but makes sense and searvice out of it too. The State-of-the-art Information Technology tools deployed by SHCIL Babasabbpatilfreepptmba.com Page 4

- 5. A Study on Derivatives in Volatile Market Condition is a laureate of lthe computerworld Honors Program. SHCIL has also received National IT award from the Computer Society of India. Their adaptability to the changing requirement of the market is one of their main strengths. The biggest changeover in the SHCIL story has been expansion and diversification. Year 1996 marked a fundamental shift for the Indian capital markets. The Depository Act changed the way the capital market, specifically the stock exchanges, investors and related organization would function. Securities Exchange Board of India with its guiding Hand, set up a framework for changing over capital market investing and trading from paper to electronic mode. The depository culture has accelerated since then, probably unmatched by any other country. Accordingly, from servicing financial institutions, they have timed their move into the extensive individual investro populace. They have enriched their organisatinal strengths and fine-tuned the front-end interfaces to cater to the distinct needs of the individual investor. A specially trained pool of over 1500 professionals provides personalised service to their client investors. To enable easy reach, they have accelerated their distribution network from four offices in 1997 to over 100 offices across the country. Dedicated leaseline network links across these offices, independent systems setups and off-site backups provide the platform for traditional servicing as also for new e-commerce applications. The results are definite. Four years back, they signed in their first individual investor client. Today, SHCIL serves a satisfied clientele of around seven lakh accounts. They ensure that their financial product offerings are related closely, not just disjointed services added on. Alongside expansion, the thinking has been at diversifying further into areas of financial products and services. Their new products are an echo of market requirements, customer feedback and needs. Rather than coming out with products which would suit their organisational needs, the accent is on channeling technology to make convenience products for financial markets. They formulate new products that give quantum benefits to linvestors, corporatins and brokers and also fit into the mosaic of their product mix. Glolbalisation of the market has led to a manifold increase in investment. New markets have been opened new instruments have been developed and new services have been launched. Besides, a number of opportunities and challenges have also been thrown open. Stock Holding Corporation of India Ltd.,(SHCIL), the premier custodian of Indian capital market providing services of international standards, is gearing up to reposition itself in the changed scenario. With world – acclaimed automation and a team of committed professionals, SHCILis confident of scalilng new heights. Babasabbpatilfreepptmba.com Page 5

- 6. A Study on Derivatives in Volatile Market Condition INTRODUCTION TO THE COMPANY Stock Holding Corporation of India Ltd. (SHCIL) was incorporated under the Companies act 1956 at the initiative of the Government of India. It is promoted by the all India financial and investment institutions and insurance companies viz., IDBI, UTI, ICICI, IFCI, IBI, LIC, GIC, and its subsidiaries. SHCIL commenced operations in August 1988 and has been providing custodial and related services of international standards for nearly a decade to the promoter and other institution, Foreign Instiutional Investors (Flls), Commercial Banks and Mutual Funds. Being a premier custodian of the country. SHCIL today holds more than Rs. 80,000 crores worth of clients assets. The turnover of the corporation exceeds Rs.10,000 crores per annum. SHCIL has been earning profit and declaring dividend right from the inception. SHCIL already has securities worth Rs.26000 crores in electronic form. SHCIL is the first depository participant to be registered with the National Securities Depository Ltd.(NSDL). SHCIL offers the facility of operating beneficiary account for individuals and corporates as well as clearing account for brokers. This manual has been prepared exclusively for their account holder. It gives the overview of the depository system and explains in details, various operation relating to individual accounts. The aim is to impart to their account holders, knowledge about the working of depository system and facilitate a smooth transition from physical to electronic tradings. BRANCHES: SHCIL has a network of more than 120 branches spread across the country providing services at doorstep to their client with Head Office at Mumbai. In Karnataka there are 12 branches spread over the entire region. MISSION “To spread quality services through the innovative use of technology” OBJECTIVES OF THE SHCIL 1. To eliminate paperwork and bring in front of electronic stock market (E-Stock Market) on India 2. To ensure satisfaction through teamwork and professional management. Babasabbpatilfreepptmba.com Page 6

- 7. A Study on Derivatives in Volatile Market Condition 3. To extend effective guidance to brokers, to clearing house Corporation, companies and investor in E-Stock Trading 4. To provide good quality of services on a continuous basis to the satisfaction of clients 5. To encourage every one in the organization to upgrade and enhance there skills and knowledge in computerized environment. 6. To attain specified level of performance every year and ensure compliance with statutory requirements. PRODUCTS AND SERVICES SERVICES: CUSTODIAL SERVICES Since its commencement in 1988 as the premier Custodian in the country, SHCIL has been providing Custodial Services of international standards to Financial Institutions, Foreign Institutional Investors and Domestic Mutual Funds. With almost 70% of the Institutional business to its credit, SHCIL has graduated to providing specialised services to large investing institutions. A dedicated pool of trained professionals working in interconnected offices across the country, linked to client institutions, Stock Exchanges, Depositories and brokers through state-of-the-art telecommunication channels, is at the helm of SHCIL's Custodial services Lodgements and Custodial Services SHCIL has specialized sections catering to all activities (lodgment, objections handling, follow- ups, client reporting etc.) associated with the Lodgment of securities with the respective company and ensuring their quick transfer to the purchaser. On receipt of the transferred securities, securities are held in state-of-the-art, high-security vaults on behalf of the clients. A pioneer in introducing the bar-coding system to track certificates, SHCIL ensures the availability of each and every share certificate at a moments notice Corporate Actions The Corporate Actions cell ensures timely collection of monetary and non-monetary benefits on behalf of the client. It covers all activities relating to Corporate Actions like calculation of Babasabbpatilfreepptmba.com Page 7

- 8. A Study on Derivatives in Volatile Market Condition entitlements, receipt of monetary Corporate Actions and transfer of the same to clients. Customized reporting to clients on the status of Corporate Actions is done periodically. The Primary Markets cell takes care of applications on behalf of clients for primary market issues, calculates the entitlements, follows up for allotment or refunds and sends customised reports to clients. Data Bank Services To serve clients, the Corporation requires a large amount of information from the Stock Exchanges, Depositories, SEBI, Companies and other entities of the capital market. The Databank department collects, compiles and maintains information that is required by the Corporation for carrying out market obligations. Databank maintains information of approximately 12,500 instruments, 8500 companies, 2500 Registrars, two Depositories and six Stock Exchanges namely BSE, NSE, OTCEI, DSE, CSE and MSE. Databank also maintains the following data : a. Information regarding various scrips ( listed and unlisted) in which our clients have holdings. b. Information pertaining to book closures / record dates for corporate events, ex-dates and no delivery schedules for various Stock Exchanges. c. Details of monetary and non-monetary benefits. d. In the electronic segment, information such as ISIN data, the Registrars handling demat for a company, the scrips under compulsory demat trades as declared by SEBI, scrips included in compulsory rolling segment etc. are also maintained. e. NAV information of all Mutual Fund schemes Reporting - Custodial Services The Client Interface Cell is a single point contact for all Client Issues. Detailed, reconciled statements and customized reports are made available to clients periodically or as and when desired by the clients. Street Name Securities Babasabbpatilfreepptmba.com Page 8

- 9. A Study on Derivatives in Volatile Market Condition This is a special service offered to clients who wish to turn around their portfolio in a speedy manner. The securities purchased by the clients are not sent for registration, but are stored in the safe deposit vaults of the Corporation. Adequate measures are taken to ensure no benefit losses due to corporate events or any document expirations. DEPOSITORY PARTICIPANT SERVICES Introduction: Their Depository Participant services addresses individual investment needs. With a parentage of leading financial institutions and insurance majors and a proven track record in the Custodian business, they have reiterated their past success by establishing themselves as the first ever and largest Depository Participant in India From a tentative foray in 1998 into the individual investor arena to servicing around seven lakh accounts, the have endeavored to constantly add and innovate to make business a pleasure for their client. Over 100 of our networked branches ensure they are available where their client look out. Across the country, fourteen Depository Participant Machines (DPMs) connected to NSDL and seven connected to CDSL ensure fast and direct processing of clients instructions. Their customer-centric account schemes have been designed keeping in mind the investment psyche of their clients. A DP account with SHCIL takes care of client’s Depository needs like dematerialisation, rematerialisation and pledging of shares. . At SHCIL, they place a very high premium on client reporting. Periodic statements sent to client keep them informed of their account status. Dedicated Customer Care lines manned by trained staff answer client’s queries on demat / trades / holdings. The latest in client response at SHCIL is Interactive Voice Response (IVR) system for round the clock information on their account. Registration on theirr website, SHCIL Interactive, enables them to check their account-related information, stock market reports and statistics, Corporate benefits declared by companies, realtime quotes of scrips on BSE and NSE and so much more online. Demat Dematerialisation is the process of conversion of shares from physical form to the electronic mode. Their dedicated demat team enable the client to convert their physical holdings into electronic mode in a quick and hassle-free manner. As per SEBI, scrips can be divided as : Babasabbpatilfreepptmba.com Page 9

- 10. A Study on Derivatives in Volatile Market Condition • Scrips eligible for demat. These scrips can be traded either in physical or electronic form • Scrips falling under compulsory demat. • Scrips can be traded only in electronic form. • Scrips falling under transfer cum demat. In this category, the shares purchased by the client in the physical form can be sent to the Registrar / Company for transfer and dematerialisation at the same time. Process for Dematerialization / Rematerialization Once demat account of client is opened with SHCIL and have received their client identity number, they can start dematerialising their shares. They can submit the shares over the counter at any of their branches. When the company gives credit, those shares will reflect under "free" column in the Client ID. Now client can sell these shares. In case the company is not satisfied with the details furnished, it will reject the shares If the company has rejected Client’s shares, SHCIL will forward the shares to Client on receiving them from the company. CLEARING- MEMBERS SERVICES Introduction SHCIL's long-standing association with Clearing Members has enabled it to develop services based on an understanding of their working and their requirement for timely and accurate information SHCIL accept deposits of base capital and Additional base capital requirements stipulated by NSE for clearing members trading on its capital market segment. Besides, their new products with a broker empanelment clause ensure a mutually beneficial tie-up. Clearing members stand to earn a steady income from their product transactions and this adds to their client-base, while they capitalize on their rapport with the market Babasabbpatilfreepptmba.com Page 10

- 11. A Study on Derivatives in Volatile Market Condition SHCIL currently offer Depository services to more than 680 clearing members of various exchanges connected with NSDL and CDSL. Custodial Services for CM Custodial services for Base Capital / Additional Capital requirements They accept deposits of Base Minimum Capital (Base Capital) and Additional Base Capital as stipulated by NSE for clearing members to be able to trade on its capital market segment. The securities being deposited shall be subject to legal and beneficial ownership of: TM clearing member / spouse in case of individuals. Any of the partners / their spouses in case of partnership Any of the directors in case of corporate TM clearing member. NRI SERVICES Over the years, SHCIL has grown to become a major player in the capital market. With a network of more than 120 offices operating across the country and franchisees operating abroad, SHCIL provides Depository Participant and related services close to 0.7 million satisfied investors out of which over 6000 are NRI Clientele. SHCIL has a full-fledged NRI cell operating specifically to cater needs pertaining to Depository account opening and maintenance. NRI cell co-ordinates with prospective NRI customers, collects and assists in obtaining the relevant documents and ensures the Depository Account is opened hassle free. NRI Cell collects physical certificates to be sent for demat and ensures that the certificates are in order and can be sent for dematerialization under the existing guidelines issued by the depositories. Instructions for trade are accepted by fax on request by NRI Cell to ensure timely settlement of trades. In this case later on the client needs to regularize by sending the original trade delivery instruction. NRI Cell addresses any tariff and billing related query. In short NRI Cell is a single point contact for any matter relating to NRI Depository operations. PRODUCTS: Babasabbpatilfreepptmba.com Page 11

- 12. A Study on Derivatives in Volatile Market Condition ADD Shares This is a product by which SHCIL arranges loans against demat shares for its clients at the competitive interest rates. They can use the shares in their free account as a collateral and take a loan from any of their empanelled banks. SHCIL complete documentation and processing and give the cheques within 48 hours of application to their clients. Features Loan against demat shares held in the DP account with SHCIL SHCIL processes the entire paperwork required with the bank. The service is available at any of over 100 branches of SHCIL. CASH –ON-PAYOUT Usually client need to follow-up with their broker for the funds after they have sold their securities. When they sell through Cash-on-Payout, they give client a cheque on the next day of payout. Cash-on Payout is a variant of Sell-n-Cash and it comes in handy when you don't need immediate payment but at the same time are looking for an timely payment without delays. Cash on Payout has a very competitive service charge which may actually be lesser than what client is currently paying your broker. FUND INVEST Fund Invest is a basket of financial products, ranging from fixed income securities like Fixed deposits, Infrastructure bonds and Capital Gain Bonds to variable income securities like Initial Public Offers (IPOs) of Equities and Mutual Funds. This is a financial product that caters to the various investment needs of their clients. SHCIL is an AMFI Registered Mutual Fund Advisor (ARMFA). Features • At present, they are distributing more than 25 schemes of different Mutual Funds Babasabbpatilfreepptmba.com Page 12

- 13. A Study on Derivatives in Volatile Market Condition • Capital Gains Bonds come under 54 EC Capital Gains Bonds, where investors get exemption from Capital Gain tax. These are 'on -tap ' issues. At present, SHCIL is distributing Capital Gain Bonds of Rural Electrification Corporation, National Housing Bank, Small Industries Development Bank of India and National Highway Authority of India. Infrastructure Bonds are issued by ICICI Bank and IDBI, with Section 88 as the main feature. • Private Placements: Stock Holding distributes Debt papers issued for Private Placement with Structural Obligations by the State and Central Government, typically targeted for Trusts and Provident Funds. • Fixed Deposits: SHCIL distribute fixed Deposits with high investment rating and issued by blue- chip corporate. These papers generally offer 50 to 100 basis points more than bank fixed deposits of comparable period. At present, SHCIL are distributing IDBI Suvidha Fixed Deposits and HDFC Fixed Deposits. • Initial Public Offer: IPOs offered from blue chip corporate can be subscribed from Stock Holding. Issues recently distributed by SHCIL are NDTV, Maruti Udyog, Datamatics Solutions, ONGC etc.. GOI BONDS RBI on behalf of Government of India issues Savings Bonds in two different series. • 6.5% tax free bonds • 8.0% taxable bonds These Bonds are held in electronic form in an account called Bond Ledger Account (BLA). Bond Ledger Accounts can be opened and operated with RBI designated receiving Offices. RBI has designated SHCIL as one of the Receiving Offices for this purpose. Savings Bonds being sovereign in nature are absolutely safe and an attractive investment option in the current volatile market situation. STOCK DIRECT STOCK direct - India's first online trading platform was launched in 1999. Today STOCK direct is the most secure online trading platform which combines encryption technology / digital signature as well as Smart Card security features. Babasabbpatilfreepptmba.com Page 13

- 14. A Study on Derivatives in Volatile Market Condition Client can trade from home on the Internet with a floppy containing the STOCK direct software. For people who are not inclined to trading on the net, SHCIL has Request Transmitting Machines (RTMs) placed at specified SHCIL centers. This is an electronic touch screen kiosk where you can insert your smart card and trade effortlessly. STOCK LENDING SHCIL has been granted the approval to act as Approved Intermediary by SEBI in April, 1998. If client is the lender, client retain all the benefits of ownership other than voting rights. Through Stock lending, your holdings that SHCIL manage, can be temporarily transferred to a third party to earn a fixed income for client. As a borrower, a person can utilize borrowed securities the way he want provided he return the securities along with the accrued benefits at the end of the loan period. Securities deposited with SHCIL by the investors for lending will not be treated as sale and hence will not attract any capital gains tax. The interest income received will be taxed like any other income. Flexible period of borrowing is available from 4 days to 84 days. Securities deposited with SHCIL for lending will not attract any custody charges during the period the securities are lent. But this year the lending license of SHCIL is not renewed by the SEBI. 2. Introduction about derivatives The technical definition is 'a financial contract the value of which is derived from the value of another (underlying) asset, such as an equity, bond or commodity.' Derivatives have been around for a long time, though without stirring much controversy. Forward contracts were used by Flemish traders in the 12th century. Babasabbpatilfreepptmba.com Page 14

- 15. A Study on Derivatives in Volatile Market Condition Contracts resembling today's futures and options were widely used in the 17th century in Amsterdam, when it was the financial capital of the western world, and at about the same time in Osaka's rice market. Organized commodity-futures exchanges were set up in Chicago and New York in the middle of the 19th century. 'Complex' financial instruments are nothing new either. In a quarter of a century the global financial marketplace has undergone a transformation equivalent to replacing a village shop with a shopping mall. In 1986 the total outstanding value of derivatives markets was just over $ 1 trillion; in 1994 it was $ 20 trillion Derivatives have flourished because a series of recent developments have transformed them into a cheap and efficient way of moving risk about within the economic system. After the collapse of the Bretton Woods fixed-exchange-rate regime in the early 1970s, floating exchange rates fuelled demand for ways to cope with the resulting currency risk. This led to the development of exchange-traded foreign-exchange futures in Chicago, a successful innovation that was to spawn many more. The availability of large, low-cost computing capacity was also vital, as pricing some derivatives involves complex number-crunching. Issues in derivatives The three separate issues in derivatives are as follows: • How well the buyer understands what the derivative does; • What the derivative is being used for • What risks are inherent in the derivative itself? Babasabbpatilfreepptmba.com Page 15

- 16. A Study on Derivatives in Volatile Market Condition The first two questions are really about the qualities of the buyer rather than of the product. Many so-called derivatives disasters are in fact speculative disasters that might just as easily have happened if the investor had been punting in shares or equity. Of the risks associated with derivatives themselves, the one that gets the most headlines is Systemic risk The possibility that loss on a derivative contract might cause a bank to go bust, producing knock-on effects throughout the global financial system. This has given nightmares to financial regulators around the world. To improve the quality of their sleep, they have already demanded fuller disclosure of banks' derivative activities and required them to put aside capital to cover potential losses. Further controls are in the pipeline. Derivatives, however, are by no means the only source of systemic risk. Fears of systemic collapse have also been raised recently by the third-world debt crisis and by the collapse of the developed world's commercial-property market. Moreover, although some critics have blamed derivatives for increasing volatility in financial markets (and, among other things, causing the 1987 stock market crash), most investigations into such claims have exonerated them. Indeed, it now looks more likely that it was the volatility in financial markets that boosted demand for derivatives, and that by reducing that volatility they actually lessened systemic risk. Non-financial firms need to watch out for three main risks when using derivatives. They are as follows Babasabbpatilfreepptmba.com Page 16

- 17. A Study on Derivatives in Volatile Market Condition 3.3 Market risk The possibility that the value of the derivative will change. This is essentially no different from the risk involved in buying an equity or bond, or holding a currency - except that the market risk may be magnified many times if the derivative is leveraged; indeed some of the most famous disasters, including Procter & Gamble's losses, were associated with leveraged products. The other difference compared with equities, bonds and so on is that the value of an option changes increasingly quickly as it becomes more likely to be exercised. Basis risk The derivative used may not be a perfect match with whatever it is intended to hedge, so that when the value of the underlying asset falls, the value of the derivative may not raise by the expected amount. Credit or 'Counterparty' risk: The institution concerned will get into trouble and be unable to pay up. Bear in mind, however, that the credit risk on buying a derivative is less than that on, say, making a loan, as the cost of replacing a derivative contract is only the amount to which the market has moved against the buyer since the original contract was drawn up, whereas for the loan it is the entire amount lent. Derivatives bought from banks are exposed to bigger credit risks than those bought from exchange. This is because exchanges guarantee contracts, and, unlike banks, ensure they can cover them by requiring traders to stump up cash ('post-margin') to cover Babasabbpatilfreepptmba.com Page 17

- 18. A Study on Derivatives in Volatile Market Condition potential losses in advance. However, this increases the possibility that a firm might face liquidity problems. If there is any doubt about the financial strength of the firm selling a derivative, the best advice is to leave well alone. Derivatives have brought a neat twist to the relationship between firms and their banks. Increasingly companies, used to having their quality as clients investigated by their banks, are instead sitting in judgment over their banks. 3. Financial Derivatives – Definition Babasabbpatilfreepptmba.com Page 18

- 19. A Study on Derivatives in Volatile Market Condition Financial derivative is a financial instrument whose pay-offs depends on a more primitive or fundamental good. For example a gold futures contract is a derivative instrument, because the value of the future contract depends on the value of the gold that underlies the futures contract. The value of the gold is the key since the value of the gold future contract derives from the value of underlying gold. Types of derivatives • Forward • Futures • Options • Swaps Forward contract A forward contract is an agreement between two parties that commits one to sell and the other to buy a stipulated quantity and grade of a commodity, currency, security, index or other specified item at a set price on or before a given date in the future. Futures contract It involves an obligation on both the parties (i.e.) the buyer and the seller to fulfill the terms of the contract (i.e.) these are predetermined contracts entered today for a date in future. Babasabbpatilfreepptmba.com Page 19

- 20. A Study on Derivatives in Volatile Market Condition Futures terminology • Spot price: The price at which an asset trades in the spot market. • Futures price: The price at which the futures contract trades in the futures market. • Contract cycle: The period over which a contract trades. The index futures contracts on the NSE have one-month, two-months and three-month expiry cycles which expire on the last Thursday of the month. Thus a January expiration contract expires on the last Thursday of January and a February expiration contract ceases trading on the last Thursday of February. On the Friday following the last Thursday, a new contract having a three-month expiry is introduced for trading. • Expiry date: It is the date specified in the futures contract. This is the last day on which the contract will be traded, at the end of which it will cease to exist. • Basis: In the context of financial futures, basis can be defined as the futures price minus the spot price. There will be a different basis for each delivery month for each contract. In a normal market, basis will be positive. This reflects that futures prices normally exceed spot prices. • Cost of carry: The relationship between futures prices and spot prices can be summarized in terms of what is known as the cost of carry. This measures the storage cost plus the interest that is paid to finance the asset less the income earned on the asset. • Initial margin: The amount that must be deposited in the margin account at the time a futures contract is first entered into is known as initial margin. Babasabbpatilfreepptmba.com Page 20

- 21. A Study on Derivatives in Volatile Market Condition • Marking-to-market: In the futures market, at the end of each trading day, the margin account is adjusted to reflect the investor’s gain or loss depending upon the futures closing price. This is called marking–to–market. • Maintenance margin: This is somewhat lower than the initial margin. This is set to ensure that the balance in the margin account never becomes negative. If the balance in the margin account falls below the maintenance margin, the investor receives a margin call and is expected to top up the margin account to the initial margin level before trading commences on the next day. • Contract size: The amount of asset that has to be delivered under one contract. For instance, the contract size on NSE’s futures market is 200 Nifties. Permitted Lot Sizes of Contracts Babasabbpatilfreepptmba.com Page 21

- 22. A Study on Derivatives in Volatile Market Condition Market No. Underlying Symbol Lot 1 S&P CNX Nifty NIFTY 200 2 CNX IT CNXIT 100 Derivatives on Individual Securities 1 Associated Cement Co. Ltd. ACC 1500 2 Andhra Bank ANDHRABANK 4600 3 Arvind Mills Ltd. ARVINDMILL 4300 4 Bajaj Auto Ltd. BAJAJAUTO 400 5 Bank of Baroda BANKBARODA 1400 6 Bank of India BANKINDIA 3800 7 Bharat Electronics Ltd. BEL 550 8 Bharat Heavy Electricals Ltd. BHEL 600 9 Bharat Petroleum Corporation Ltd. BPCL 550 10 Canara Bank CANBK 1600 11 Cipla Ltd. CIPLA 1000 12 Dr. Reddy's Laboratories Ltd. DRREDDY 200 13 GAIL (India) Ltd. GAIL 1500 14 Grasim Industries Ltd. GRASIM 350 15 Gujarat Ambuja Cement Ltd. GUJAMBCEM 1100 16 HCL Technologies Ltd. HCLTECH 1300 Housing Development Finance 17 HDFC 600 Corporation Ltd. 18 HDFC Bank Ltd. HDFCBANK 800 19 Hero Honda Motors Ltd. HEROHONDA 400 20 Hindalco Industries Ltd. HINDALC0 300 21 Hindustan Lever Ltd. HINDLEVER 2000 Hindustan Petroleum Corporation 22 HINDPETRO 650 Ltd. 23 ICICI Bank Ltd. ICICIBANK 1400 24 I-FLEX Solutions Ltd. I-FLEX 300 Babasabbpatilfreepptmba.com Page 22

- 23. A Study on Derivatives in Volatile Market Condition 25 Infosys Technologies Ltd. INFOSYSTCH 200 26 Indian Petrochemicals Corpn. Ltd. IPCL 1100 27 Indian Oil Corporation Ltd. IOC 600 28 ITC Ltd. ITC 300 29 Jet Airways (India) Ltd. JETAIRWAYS 200 30 Mahindra & Mahindra Ltd. M&M 625 31 Maruti Udyog Ltd. MARUTI 400 32 Mastek Ltd. MASTEK 1600 33 Mahanagar Telephone Nigam Ltd. MTNL 1600 34 National Aluminium Co. Ltd. NATIONALUM 1150 National Thermal Power 35 NTPC 3250 Corporation Ltd. 36 Oil & Natural Gas Corp. Ltd. ONGC 300 37 Oriental Bank of Commerce ORIENTBANK 1200 38 Punjab National Bank PNB 1200 39 Polaris Software Lab Ltd. POLARIS 1400 40 Ranbaxy Laboratories Ltd. RANBAXY 400 41 Reliance Energy Ltd. REL 550 42 Reliance Industries Ltd. RELIANCE 600 43 Satyam Computer Services Ltd. SATYAMCOMP 1200 44 State Bank of India SBIN 500 45 Shipping Corporation of India Ltd. SCI 1600 46 Syndicate Bank SYNDIBANK 7600 47 Tata Consultancy Services Ltd TCS 250 48 Tata Power Co. Ltd. TATAPOWER 800 49 Tata Tea Ltd. TATATEA 550 50 Tata Motors Ltd. TATAMOTORS 825 51 Tata Iron and Steel Co. Ltd. TISCO 1350 52 Union Bank of India UNIONBANK 4200 53 Wipro Ltd. WIPRO 600 Babasabbpatilfreepptmba.com Page 23

- 24. A Study on Derivatives in Volatile Market Condition Options contract It is a contract that goes a step further and provides the buyer of the option a right without any obligation to fulfill the terms of the contract. Key features of an options contract • Gives right to buy or sell • It is not an obligation • Consideration is by paying a premium • Quantity is defined Option terminology • Index options: These options have the index as the underlying. Some options are European while others are American. Like index futures contracts, index options contracts are also cash settled. • Stock options: Stock options are options on individual stocks. A contract gives the holder the right to buy or sell shares at the specified price. • Buyer of an option: The buyer of an option is the one who by paying the option premium buys the right but not the obligation to exercise his option on the seller/writer. • Writer of an option: The writer of a call/put option is the one who receives the option premium and is thereby obliged to sell/buy the asset if the buyer exercises on him. Babasabbpatilfreepptmba.com Page 24

- 25. A Study on Derivatives in Volatile Market Condition • Call option: A call option gives the holder the right but not the obligation to buy an asset by a certain date for a certain price. • Put option: A put option gives the holder the right but not the obligation to sell an asset by a certain date for a certain price. • In-the-money option: An in-the-money (ITM) option is an option that would lead to a positive Cash flow to the holder if it were exercised immediately. A call option on the index is said to be in-the-money when the current index stands at a level higher than the strike price (i.e. spot price > strike price). If the index is much higher than the strike price, the call is said to be deep ITM. In the case of a put, the put is ITM if the index is below the strike price. • At-the-money option: An at-the-money (ATM) option is an option that would lead to zero cash flow if it were exercised immediately. An option on the index is at-the-money when the current index equals the strike price (i.e. spot price = strike price). • Out-of-the-money option: An out-of-the-money (OTM) option is an option that would lead to a negative cash flow. A call option on the index is out-of-the- money when the current index stands at a level which is less than the strike price (i.e. spot price < strike price). If the index is much lower than the strike price, the call is said to be deep OTM. In the case of a put, the put is OTM if the index is above the strike price. 4. Volatile markets Babasabbpatilfreepptmba.com Page 25

- 26. A Study on Derivatives in Volatile Market Condition Volatile markets are characterized by wide price fluctuations and considerable trading volume. Reason for volatile market condition Few reasons for market volatility are: • Change in interest rate policy. • Arbitrage causes volatility. Arbitrage is the simultaneous or almost simultaneous buying and selling of an asset to profit from price discrepancies. Arbitrage causes markets to adjust prices quickly. This has the effect of causing information to be more quickly assimilated into market prices. This is a curious result because arbitrage requires no more information than the existence of a price discrepancy. • Another obvious reason for market volatility is dissemination of information and technology factors. This includes more timely information dissemination, improved technology to make trades and more kinds of financial instruments. The faster information is disseminated, the quicker markets can react to both negative and positive news. Improved trading technology makes it easier to take advantage of arbitrage opportunities, and the resulting price alignment arbitrage causes. • Finally, more kinds of financial instruments allow investors more opportunity to move their money to more kinds of investment positions when conditions change. • Most people would say that new information in general causes volatility 5. Characteristics of high volatile market Babasabbpatilfreepptmba.com Page 26

- 27. A Study on Derivatives in Volatile Market Condition Volatility has certain characteristics. They are as follows • Cyclical • Persistency • Mean reversion. Volatility is cyclical Volatility tends to run in cycles, increasing and peaking out, then decreasing until it bottoms out and begins the process all over again. Many traders believe volatility is more predictable than price (because of this cyclical characteristic) and have developed models to capitalize on this phenomenon. Volatility is persistent Persistency is simply the ability of volatility to follow through from one day to the next, suggesting the volatility that exists today will likely to exist tomorrow. That is, if the market is highly volatile today, it will most likely be volatile tomorrow; conversely, if the market not volatile today it will likely not be volatile tomorrow. By the same token, if volatility is increasing today, it will likely continue to increase tomorrow, and if volatility is decreasing today, it will likely continue to decrease tomorrow. 6. Identification of volatile market Babasabbpatilfreepptmba.com Page 27

- 28. A Study on Derivatives in Volatile Market Condition The market is highly volatile for the month of January & February in the year 2005, so I had taken these periods as a highly volatile market for my study. The details of indices for the period are as follows. JANUARY INDEX MOVEMENTS Date Open High Low Close 3-Jan-05 2080 2118.6 2080 2115 4-Jan-05 2116.95 2120.15 2100.55 2103.75 5-Jan-05 2103.75 2105.1 1990.15 2032.2 6-Jan-05 2031.55 2035.65 1984.25 1998.35 7-Jan-05 1998.25 2021.45 1992.55 2015.5 10-Jan-05 2016.75 2025.9 1974.8 1982 11-Jan-05 1982.7 1988.9 1947.35 1952.05 12-Jan-05 1953.6 1966.65 1900.85 1913.6 13-Jan-05 1922.5 1963.4 1916.95 1954.55 14-Jan-05 1954.9 1961.4 1922.85 1931.1 17-Jan-05 1931.75 1944.55 1902.45 1932.9 18-Jan-05 1933.05 1956.95 1925.35 1934.05 19-Jan-05 1934.1 1945.65 1922.35 1926.65 20-Jan-05 1928.1 1940.95 1900.05 1925.3 24-Jan-05 1925.3 1932.75 1902.9 1909 25-Jan-05 1908.85 1934.25 1894.4 1931.85 27-Jan-05 1931.9 1961.75 1929 1955 28-Jan-05 1955.25 2014.25 1950.85 2008.3 31-Jan-05 2008.45 2060.4 2006.35 2057.6 On these above dates the market is highly volatile on January 31st Market movements in the month of January Babasabbpatilfreepptmba.com Page 28

- 29. A Study on Derivatives in Volatile Market Condition 2135 2110 2085 2060 market movements 2035 2010 1985 1960 1935 1910 1885 1860 4-Jan-05 7-Jan-05 5-Jan-05 6-Jan-05 10-Jan-05 11-Jan-05 13-Jan-05 14-Jan-05 19-Jan-05 27-Jan-05 28-Jan-05 12-Jan-05 17-Jan-05 18-Jan-05 20-Jan-05 24-Jan-05 25-Jan-05 31-Jan-05 date Market movement on January 31st 31-Jan-05 2080 2060 2040 2020 31-Jan-05 2000 1980 1960 1 2 3 4 February index movements Babasabbpatilfreepptmba.com Page 29

- 30. A Study on Derivatives in Volatile Market Condition Date Open High Low Close 1-Feb-05 2057.75 2072.5 2045.25 2059.85 2-Feb-05 2062.15 2074.5 2045.5 2052.25 3-Feb-05 2052.35 2083.75 2052.35 2079.45 4-Feb-05 2079.4 2099.2 2060.8 2077.95 7-Feb-05 2097.45 2098 2049.85 2055.1 8-Feb-05 2055 2065 2043.6 2055.15 9-Feb-05 2055.2 2077.7 2055.2 2070 10-Feb-05 2070.1 2075.1 2049.85 2063.35 11-Feb-05 2063.35 2084.5 2063.35 2082.05 14-Feb-05 2083.05 2110.15 2083.05 2098.25 15-Feb-05 2098.25 2101.6 2081.2 2089.95 16-Feb-05 2090 2103.4 2059.45 2068.8 17-Feb-05 2069.1 2069.15 2045.85 2061.9 18-Feb-05 2062.45 2076.7 2048.85 2055.55 21-Feb-05 2055.15 2065.75 2039.9 2043.2 22-Feb-05 2043.4 2061.65 2036.6 2058.4 23-Feb-05 2058.7 2065.15 2051.35 2057.1 24-Feb-05 2057.75 2070.5 2052.4 2055.3 25-Feb-05 2057.3 2081.85 2051.2 2060.9 28-Feb-05 2061.2 2106.2 2047.7 2103.25 Babasabbpatilfreepptmba.com Page 30

- 31. A Study on Derivatives in Volatile Market Condition Identification of volatile market Difference Difference between Difference between Open Open and between Date Open High and High Percentage Low Low High and Low Close 2057. 1-02-05 75 2072.5 14.75 0.712% 2045.25 -12.5 -27.25 2059.9 2062. 2-02-05 15 2074.5 12.35 0.595% 2045.5 -16.65 -29 2052.3 2052. 3-02-05 35 2083.75 31.4 1.507% 2052.35 0 -31.4 2079.5 2079. 4-02-05 4 2099.2 19.8 0.943% 2060.8 -18.6 -38.4 2078 2097. 7-02-05 45 2098 0.55 0.026% 2049.85 -47.6 -48.15 2055.1 8-02-05 2055 2065 10 0.484% 2043.6 -11.4 -21.4 2055.2 2055. 9-02-05 2 2077.7 22.5 1.083% 2055.2 0 -22.5 2070 10-02- 2070. 05 1 2075.1 5 0.241% 2049.85 -20.25 -25.25 2063.4 11-02- 2063. 05 35 2084.5 21.15 1.015% 2063.35 0 -21.15 2082.1 14-02- 2083. 05 05 2110.15 27.1 1.284% 2083.05 0 -27.1 2098.3 15-02- 2098. 05 25 2101.6 3.35 0.159% 2081.2 -17.05 -20.4 2090 16-02- 05 2090 2103.4 13.4 0.63% 2059.5 -30.55 -44 2069 17-02- 2069. 05 1 2069.15 0.05 0.002% 2045.85 -23.25 -23.3 2061.9 18-02- 2062. 05 45 2076.7 14.25 0.686% 2048.85 -13.6 -27.85 2055.6 21-02- 2055. 05 15 2065.75 10.6 0.513% 2039.9 -15.25 -25.85 2043.2 22-02- 2043. 05 4 2061.65 18.25 0.885% 2036.6 -6.8 -25.05 2058.4 23-02- 2058. 05 7 2065.15 6.45 0.312% 2051.35 -7.35 -13.8 2057.1 24-02- 2057. 05 75 2070.5 12.75 0.616% 2052.4 -5.35 -18.1 2055.3 Babasabpatilfreepptmba.com

- 32. A Study on Derivatives in Volatile Market Condition 25-02-05 2057.3 2081.85 24.55 1.179% 2051.2 -6.1 -30.65 2060.9 28-02-05 2061.2 2106.2 45 2.13% 2047.7 -13.5 -58.5 2103 op- hi - low- Date close %ge close close 1-02-05 2.1 0.102% -12.65 14.6 2-02-05 -9.9 -0.482% -22.25 6.75 3-02-05 27.1 1.303% -4.3 27.1 4-02-05 -1.45 -0.070% -21.25 17.15 7-02-05 -42.35 -2.061% -42.9 5.25 8-02-05 0.15 0.007% -9.85 11.55 9-02-05 14.8 0.715% -7.7 14.8 10-02- 05 -6.75 -0.327% -11.75 13.5 11-02- 05 18.7 0.898% -2.45 18.7 14-02- 05 15.2 0.724% -11.9 15.2 15-02- 05 -8.3 -0.397% -11.65 8.75 16-02- - 05 -21.2 1.025% -34.6 9.35 17-02- 05 -7.2 -0.349% -7.25 16.05 18-02- 05 -6.9 -0.336% -21.15 6.7 21-02- 05 -11.95 -0.585% -22.55 3.3 22-02- 05 15 0.729% -3.25 21.8 23-02- 05 -1.6 -0.078% -8.05 5.75 Babasabbpatilfreepptmba.com Page 32

- 33. A Study on Derivatives in Volatile Market Condition 24-02- 05 -2.45 -0.119% -15.2 2.9 25-02- 05 3.6 0.175% -20.95 9.7 28-02- 05 42.05 1.999% -2.95 55.55 Market movements in the month of February Market Movements 2120 2110 2100 2090 2080 2070 Nifty 2060 2050 2040 2030 2020 2/2 5 2/5 5 2/6 5 2/7 5 2/8 5 2/1 5 /05 2/4 5 2/9 5 2/1 05 2/1 05 2/1 05 2/1 05 2/1 05 2/1 05 2/2 05 2/2 05 2/2 05 2/2 05 5 2/1 5 2/1 5 2/1 05 2/2 05 2/2 05 2/2 05 2/2 5 2/2 05 /0 /0 /0 /0 /0 /0 /0 /0 8/0 0/0 5/0 4/0 1/ 2/ 3/ 4/ 7/ 8/ 9/ 0/ 2/ 3/ 6/ 7/ 6/ 1/ 5/ 2/1 2/3 Date In the month of February the market is highly volatile on february28th Market movement on February 28th Babasabbpatilfreepptmba.com Page 33

- 34. A Study on Derivatives in Volatile Market Condition 28-Feb-05 2120 2110 2106.2 2103.25 2100 2090 2080 2070 28-Feb-05 2060 2061.2 2050 2047.7 2040 2030 2020 2010 1 2 3 4 7. Types of securities • Highly volatile securities • Non volatile securities 8. Scientific methods involved in identification of securities There are several different ways of measuring volatility • Beta calculation of securities. • Standard deviation • Geometric standard deviation • Beta coefficient • R-squared • 10-day average true range (ATR). Babasabbpatilfreepptmba.com Page 34

- 35. A Study on Derivatives in Volatile Market Condition • Average range (high – low) • True range Average range One of the easiest ways is to take the average range (high – low) over a given period. The number of days (or hours, or weeks, etc.) will give a picture of the volatility over that time period. A five-day average range calculation will give an idea of how volatile the market has been the past week, but it won't reflect anything about the past six months. A 100-day average range calculation would reflect volatility over a much longer period. . Standard Deviation The most common and basic measure of volatility is called standard deviation, where volatility is measured in relation to a defined time frame. It takes into account the way a security has performed in the past, and estimates the probability as the whether it will perform in the same manner in the future. The most common way to calculate standard deviation is to determine the deviation from an average monthly return over a 36-month time period, and then annualize that number. As a general rule, the higher the standard deviation, the more volatile the security. However, standard deviation is not a 'relative measure', and has no base reference point by which to compare. Thus, the logical way to use standard deviation is to compare one security's standard deviation to that of a similar security. The Beta Coefficient Babasabbpatilfreepptmba.com Page 35

- 36. A Study on Derivatives in Volatile Market Condition Beta is used to measure the volatility of a security in relation to that of the stock market as a whole. To determine the beta of any security, you need to know the security's monthly returns and the returns of a benchmark index. For stocks and mutual funds that hold stocks, the Standard & Poor's 500 Stock Index is the most frequently used index, and is assigned a beta coefficient of one (1.0). For bonds and bond mutual funds, the Lehman Brothers Aggregate Bond Index is the most prevalent benchmark, and is also assigned a beta coefficient of one also. Any security with a beta higher than one is more volatile than the relative market index, while any security with a beta less than one is less volatile than the index. Like standard deviation, beta is typically measured using data over a 36-month period. Beta is useful in providing a measurement of a security's past volatility relative a specific benchmark or index, but it's important to verify that the most relevant benchmark is used. R-Squared Whenever beta is used to measure volatility, you are likely to find an R-squared statistic as well. Where the beta coefficient to measure volatility, R-squared measures the reliability of the information used to determine beta. The lower the R-squared figure (on a scale of 1 — 100), the less reliable the information. Geometric Standard Deviation It has become customary in the Mechanical Investing community to measure volatility with a statistic known as the Geometric Standard Deviation (GSD), which is defined as the exponential of the annual volatility: GSD = exp[ ]. Babasabbpatilfreepptmba.com Page 36

- 37. A Study on Derivatives in Volatile Market Condition The notation GSD(M) is occasionally used to indicate that the GSD was calculated from monthly data. By extension, the notations GSD(A) and GSD(D) mean that the GSD was calculated from annual and daily data, respectively. Needless to say, GSD(A) is highly unreliable because of the paucity of data from which it is calculated. In a later section we shall see exactly how reliable these measures are, by studying their sampling variation. By convention, CAGR and GSD figures are reported in "percentage" terms, where the following relationships apply: CAGR% = 100( CAGR – 1 ), GSD% = 100( GSD – 1 ). To summarize, when setting out to measure volatility or growth, three decisions need to be made in advance: (a) the units in which time is measured, (b) the number of observations per time unit, and (c) whether the result is to be given in instantaneous or annualized form. Confusion can be avoided only when all three decisions are made with total clarity. 9. Identification of securities Securities identification for the month of January UNDERLYING DAILY UNDERLYING ANNUALISED DATE SYMBOL VOLATILITY VOLATILITY 31-1-05 BANKINDIA 4.823796 92.15848 7.679874 2.85607767 31-1-05 SYNDIBANK 4.65439 88.922 7.410167 2.75577675 31-1-05 ANDHRABANK 4.123097 78.77165 6.564304 2.44120725 31-1-05 ARVINDMILL 3.69901 70.66948 5.889123 2.19011308 31-1-05 CANBK 3.909708 74.69487 6.224572 2.31486433 31-1-05 UNIONBANK 3.368426 64.35369 5.362807 1.99438117 31-1-05 BANKBARODA 3.280567 62.67515 5.222929 1.94236208 31-1-05 MASTEK 3.102795 59.27882 4.939901 1.83710633 Babasabbpatilfreepptmba.com Page 37

- 38. A Study on Derivatives in Volatile Market Condition 31-1-05 POLARIS 3.022807 57.75064 4.812553 1.78974625 31-1-05 TATAPOWER 3.248215 62.05706 5.171422 1.92320667 31-1-05 SCI 2.991383 57.15029 4.762524 1.77114075 31-1-05 ORIENTBANK 2.688226 51.3585 4.279875 1.59164858 31-1-05 SBIN 2.605544 49.77885 4.148238 1.54269367 31-1-05PNB 3.412083 65.18775 5.432313 2.02022967 31-1-05 GAIL 2.659431 50.80836 4.23403 1.57459883 31-1-05 CIPLA 2.519124 48.12779 4.010649 1.49152542 31-1-05 MARUTI 2.634009 50.32266 4.193555 1.55954617 31-1-05 NATIONALUM 2.364218 45.16832 3.764026 1.39980833 31-1-05 NTPC 2.404578 45.9394 3.828283 1.42370492 31-1-05 HINDPETRO 2.309823 44.12911 3.677425 1.36760242 31-1-05 REL 2.616271 49.98378 4.165315 1.54904392 31-1-05 ITC 2.646245 50.55644 4.213036 1.56679133 31-1-05 HDFCBANK 2.551352 48.7435 4.061959 1.5106065 31-1-05 GUJAMBCEM 2.592657 49.53263 4.12772 1.5350625 31-1-05 MTNL 2.898799 55.38148 4.615123 1.716324 31-1-05 I-FLEX 2.359378 45.07586 3.756321 1.39694333 31-1-05 HEROHONDA 2.654795 50.71978 4.226649 1.57185358 31-1-05 SATYAMCOMP 2.405864 45.96397 3.830331 1.42446708 31-1-05 M&M 2.192303 41.88389 3.490324 1.29802092 31-1-05 IPCL 2.045748 39.08396 3.256997 1.21124867 31-1-05 ACC 2.292868 43.80519 3.650432 1.35756433 31-1-05 ICICIBANK 1.919359 36.6693 3.055775 1.13641608 31-1-05 RANBAXY 2.253274 43.04873 3.587394 1.33412025 31-1-05 BPCL 2.443998 46.69252 3.891043 1.44704508 31-1-05 TISCO 2.029524 38.77401 3.231168 1.2016435 31-1-05 WIPRO 2.121333 40.528 3.377334 1.25600067 31-1-05 BAJAJAUTO 2.21483 42.31426 3.526189 1.3113585 31-1-05 TATAMOTORS 1.993018 38.07656 3.173047 1.18002867 31-1-05 TATATEA 1.825975 34.8852 2.9071 1.08112483 31-1-05 BEL 1.643575 31.40046 2.616705 0.97312967 31-1-05 INFOSYSTCH 1.897003 36.24219 3.020183 1.12317967 31-1-05 HCLTECH 1.798322 34.35689 2.863074 1.06475183 31-1-05 DRREDDY 1.742509 33.29059 2.774216 1.03170658 31-1-05 HINDALC0 1.810941 34.59798 2.883165 1.07222425 31-1-05 IOC 1.626786 31.07971 2.589976 0.96318983 31-1-05 BHEL 1.888885 36.0871 3.007259 1.11837367 31-1-05 RELIANCE 1.60721 30.7057 2.558808 0.95159833 31-1-05 CNXIT 1.677221 32.04326 2.670271 0.99305025 Babasabbpatilfreepptmba.com Page 38

- 39. A Study on Derivatives in Volatile Market Condition 31-1-05 HINDLEVER 1.752933 33.48973 2.790811 1.03787808 31-1-05 GRASIM 1.585475 30.29046 2.524205 0.93872975 31-1-05 TCS 1.591563 30.40678 2.533898 0.94233492 31-1-05 HDFC 1.752687 33.48504 2.79042 1.03773267 31-1-05 NIFTY 1.413499 27.00486 2.250405 0.83690625 31-1-05 ONGC 1.254692 23.97086 1.997571 0.74287925 31-1-05 NSE10YZC 0.734767 14.0377 1.169808 0.43504133 31-1-05 NSETB91D 0.517025 9.877749 0.823146 0.30612075 31-1-05 NSE10Y06 0.51106 9.763789 0.813649 0.30258908 FUTURES VOLATILITY FUTURES ANNUALISED VOLATILITY Final volatility 4.809467 91.88475 7.657062 4.800985 1.944907 4.739768 90.55314 7.546095 4.790318 2.034541 4.216492 80.55597 6.712998 4.27179 1.830583 3.811807 72.82448 6.068706 3.878593 1.68848 3.826831 73.1115 6.092625 3.777761 1.462896 3.514454 67.14355 5.595296 3.600915 1.606533 3.41875 65.31514 5.442928 3.500566 1.558204 3.247103 62.03581 5.169651 3.332545 1.495438 3.1744 60.64683 5.053902 3.264156 1.47441 3.158247 60.33822 5.028185 3.104979 1.181772 3.027994 57.84974 4.820811 3.049671 1.27853 2.86699 54.77377 4.564481 2.972833 1.381184 2.802188 53.53572 4.46131 2.918616 1.375923 3.031505 57.91683 4.826402 2.806173 0.785943 2.698241 51.54982 4.295819 2.72122 1.146621 2.593143 49.54193 4.128495 2.636969 1.145444 2.604842 49.76544 4.14712 2.587574 1.028028 2.49412 47.6501 3.970841 2.571033 1.171225 2.4841 47.45866 3.954888 2.531183 1.107478 2.447403 46.75758 3.896465 2.528862 1.16126 2.538711 48.50201 4.041834 2.49279 0.943746 2.547011 48.66057 4.055048 2.488256 0.921465 2.506722 47.89086 3.990905 2.480298 0.969692 2.521281 48.16902 4.014085 2.479022 0.94396 2.630356 50.25288 4.18774 2.471416 0.755092 Babasabbpatilfreepptmba.com Page 39

- 40. A Study on Derivatives in Volatile Market Condition 2.401469 45.88001 3.823334 2.426391 1.029447 2.506194 47.88077 3.990064 2.418211 0.846357 2.366134 45.20492 3.767077 2.34261 0.918143 2.276861 43.49937 3.624948 2.326927 1.028906 2.222136 42.45386 3.537821 2.326573 1.115324 2.309996 44.13241 3.677701 2.320136 0.962572 2.104468 40.2058 3.350483 2.214067 1.077651 2.21547 42.32649 3.527207 2.193087 0.858967 2.252484 43.03366 3.586138 2.139093 0.692048 2.085943 39.85189 3.320991 2.119348 0.917704 2.082119 39.77883 3.314902 2.058902 0.802901 2.06249 39.40382 3.283651 1.972293 0.660934 1.950185 37.25824 3.104853 1.924824 0.744796 1.887168 36.0543 3.004525 1.9234 0.842275 1.817383 34.72105 2.893421 1.920291 0.947161 1.894873 36.20151 3.016792 1.893613 0.770433 1.853643 35.4138 2.95115 1.886398 0.821646 1.806343 34.51013 2.875844 1.844137 0.812431 1.817348 34.72038 2.893365 1.821141 0.748917 1.712828 32.72353 2.726961 1.763771 0.800582 1.805952 34.50267 2.875222 1.756849 0.638475 1.688983 32.26797 2.688997 1.737399 0.785801 1.67777 32.05375 2.671146 1.678095 0.685045 1.66763 31.86003 2.655002 1.617124 0.579246 1.583032 30.24378 2.520315 1.581586 0.642856 1.573663 30.06479 2.505399 1.563064 0.62073 1.600695 30.58123 2.548436 1.510703 0.472971 1.426953 27.2619 2.271825 1.434919 0.598013 1.345791 25.71129 2.142608 1.399729 0.656849 0.665337 12.71125 1.059271 0.624229 0.189188 0.470852 8.995614 0.749635 0.443514 0.137393 0.434825 8.307326 0.692277 0.389688 0.087099 Securities identification for the month of February UNDERLYING UNDERLYING DAILY ANNUALISED DATE SYMBOL VOLATILITY VOLATILITY Babasabbpatilfreepptmba.com Page 40

- 41. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 NSETB91D 0.318904 6.092646 0.507721 0.188817 28-Feb- 05 NSE10Y06 0.368082 7.032202 0.586017 0.217935 28-Feb- 05 NSE10YZC 0.559194 10.68339 0.890283 0.331089 28-Feb- 05 NIFTY 1.02725 19.62559 1.635466 0.608216 28-Feb- 05 ONGC 1.179421 22.53281 1.877734 0.698313 28-Feb- 05 GRASIM 1.196704 22.86299 1.905249 0.708545 28-Feb- 05 CNXIT 1.307356 24.977 2.081417 0.774061 28-Feb- 05 TCS 1.318359 25.18721 2.098934 0.780575 28-Feb- 05 HINDALC0 1.32757 25.36319 2.113599 0.786029 28-Feb- 05 RELIANCE 1.375077 26.27082 2.189235 0.814158 28-Feb- 05 DRREDDY 1.448611 27.67567 2.306306 0.857695 28-Feb- 05 TATAMOTORS 1.534429 29.31522 2.442935 0.908506 28-Feb- 05 IOC 1.539658 29.41512 2.45126 0.911602 28-Feb- 05 RANBAXY 1.542023 29.46031 2.455026 0.913003 28-Feb- 05 TISCO 1.548294 29.58012 2.46501 0.916716 28-Feb- 05 NATIONALUM 1.556019 29.7277 2.477309 0.92129 28-Feb- 05 INFOSYSTCH 1.59107 30.39734 2.533112 0.942042 Babasabbpatilfreepptmba.com Page 41

- 42. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 NTPC 1.59162 30.40785 2.533987 0.942367 28-Feb- 05 ITC 1.60338 30.63253 2.55271 0.94933 28-Feb- 05 ICICIBANK 1.61902 30.93133 2.577611 0.958591 28-Feb- 05 HDFC 1.619342 30.93749 2.578124 0.958782 28-Feb- 05 HCLTECH 1.628412 31.11076 2.592563 0.964151 28-Feb- 05 ACC 1.636131 31.25823 2.604853 0.968722 28-Feb- 05 M&M 1.661675 31.74626 2.645522 0.983847 28-Feb- 05 BAJAJAUTO 1.670042 31.90612 2.658843 0.988801 28-Feb- 05 BEL 1.675728 32.01473 2.667894 0.992166 28-Feb- 05 CIPLA 1.708552 32.64184 2.720153 1.011601 28-Feb- 05 BHEL 1.741348 33.2684 2.772367 1.031019 28-Feb- 05 TATATEA 1.773471 33.88213 2.82351 1.050039 28-Feb- 05 WIPRO 1.77514 33.914 2.826166 1.051026 28-Feb- 05 IPCL 1.775798 33.92657 2.827214 1.051416 28-Feb- 05 MTNL 1.814013 34.65667 2.888056 1.074043 28-Feb- 05 SATYAMCOMP 1.819592 34.76326 2.896938 1.077346 28-Feb- 05 HINDPETRO 1.836468 35.08568 2.923806 1.087338 Babasabbpatilfreepptmba.com Page 42

- 43. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 GUJAMBCEM 1.845992 35.26763 2.938969 1.092977 28-Feb- 05 I-FLEX 1.869849 35.72342 2.976951 1.107102 28-Feb- 05 ORIENTBANK 1.874766 35.81735 2.984779 1.110013 28-Feb- 05 REL 1.875299 35.82754 2.985628 1.110329 28-Feb- 05 BPCL 1.933961 36.94827 3.079023 1.145062 28-Feb- 05 HDFCBANK 1.942202 37.10571 3.092143 1.149941 28-Feb- 05 POLARIS 1.951512 37.28359 3.106965 1.155453 28-Feb- 05 SCI 2.02046 38.60084 3.216737 1.196277 28-Feb- 05 SBIN 2.078229 39.70452 3.30871 1.230481 28-Feb- 05 MARUTI 2.086856 39.86933 3.322444 1.235588 28-Feb- 05 TATAPOWER 2.086968 39.87147 3.322622 1.235654 28-Feb- 05 HINDLEVER 2.095563 40.03567 3.336306 1.240743 28-Feb- 05 GAIL 2.134789 40.78509 3.398757 1.263968 28-Feb- 05 MASTEK 2.143458 40.9507 3.412559 1.269101 28-Feb- 05 HEROHONDA 2.323041 44.38164 3.69847 1.375429 28-Feb- 05 PNB 2.356346 45.01793 3.751494 1.395148 28-Feb- 05 BANKBARODA 2.603147 49.73306 4.144422 1.541275 Babasabbpatilfreepptmba.com Page 43

- 44. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 CANBK 2.765265 52.83031 4.402526 1.637261 28-Feb- 05 ARVINDMILL 2.878989 55.00301 4.583584 1.704595 28-Feb- 05 ANDHRABANK 3.16201 60.41012 5.034176 1.872166 28-Feb- 05 SYNDIBANK 3.35685 64.13253 5.344378 1.987528 28-Feb- 05 BANKINDIA 3.383669 64.64491 5.387076 2.003407 28-Feb- 05 UNIONBANK 3.411358 65.17391 5.431159 2.019801 On these particular days BANK OF INDIA and PUNJAB NATIONAL BANK are the highly volatile securities because it is characterized with high price fluctuations and a good trading volume and TCS is the low volatile security with low price fluctuation and a considerable trading volume. for the above reasons I have selected these securities. 10. Comparison of securities with the market Behavior of volatile securities when the market is volatile SYMBOL OPEN HIGH LOW CLOSE PNB 442 463.35 437 457.5 S&P CNX NIFTY 2061.2 2106.2 2047.7 2103.25 BANKINDIA 84 89.9 83.8 88.85 S&P CNX NIFTY 2061.2 2106.2 2047.7 2103.25 Babasabbpatilfreepptmba.com Page 44

- 45. A Study on Derivatives in Volatile Market Condition PNB VS S&P CNXNIFTY 50 470 2120 465 460 2100 455 2080 450 PNB 445 2060 440 NIFTY 50 435 2040 430 2020 425 420 2000 OPEN HIGH LOW CLOSE BANK OF INDIA VS S&P CNXNIFTY 50 91 2120 90 2110 89 2100 88 2090 87 2080 86 2070 BANKINDIA 85 2060 NIFTY 50 84 2050 83 2040 82 2030 81 2020 80 2010 OPEN HIGH LOW CLOSE Behavior of nonvolatile securities when the market is volatile Babasabbpatilfreepptmba.com Page 45

- 46. A Study on Derivatives in Volatile Market Condition SYMBOL OPEN HIGH LOW CLOSE TCS 1379 1385 1340 1380.9 S&P CNX NIFTY 50 2061.2 2106.2 2047.7 2103.25 TCS VS S&P CNXNIFTY 50 1390 2120 1380 2100 1370 1360 2080 TCS 1350 2060 1340 NIFTY 50 2040 1330 1320 2020 1310 2000 OPEN HIGH LOW CLOSE 11. Derivative strategies After classifying the securities, we need to identify the suitable derivative strategies for volatile market movements. In general, the following derivative strategies are prevalent in the market • Bull spread with call option • Bull spread with put option • Bear spread with call option • Bear spread with put option • Bull call spread • Bear put spread • Strangle Babasabbpatilfreepptmba.com Page 46

- 47. A Study on Derivatives in Volatile Market Condition • Straddle • Box spread • Butterfly spread with calls • Butterfly spread with calls The pay-off for the above strategies are calculated and we will be identifying the suitable derivative strategy(s) for volatile market. The same exercise would be followed for all three classification viz., volatile, low volatile and normal securities. 12.1 Straddle A straddle consists of a call and a put option with the same exercise price and the same expiration. The buyer of a straddle buys the call and put, while the seller of a straddle sells the same two options. 12.2 Strangle Like a straddle, strangle consists of a put and a call option with the same expiration date but with different exercise price. In a strangle, the call option has an exercise price above the stock price and the put option has an exercise price below the stock price. 12.3 Bull spread with call option A bull spread in the options market is a combination of options designed to profit if the price of the underlying good rises. A bull spread utilizing call options requires two calls with the same underlying stock and the same expiration date, but with the different Babasabbpatilfreepptmba.com Page 47

- 48. A Study on Derivatives in Volatile Market Condition exercise prices. The buyer of a bull spread buys a call with an exercise price below the stock price and sells a call option with an exercise price above the stock price. This spread is a bull spread because the trader hopes to profit from a price rise in the stock. The trade is a spread because it involves buying one option and selling a related option. 12.4 Bear spread with call option A bear spread in the options market is a combination of options designed to profit from falling stock prices. A bear spread utilizing call options requires two calls with the same underlying stock and the same expiration date. The two calls however have different exercise prices. To execute a bear spread with calls, a trader would sell the call with the lower exercise price and buy the call with higher exercise price. In other words, the bear spread with calls is just the short position to the bull spread with calls. 12.5 Bull spread with put option A bull spread utilizing put options requires two calls with the same underlying stock and the same expiration date, but with the different exercise prices. The bull spread consists of buying a put option with a lower exercise price and selling the put option with higher exercise price. 12.6 Bear spread with put option A bear spread utilizing put options requires two calls with the same underlying stock and the same expiration date, but with the different exercise prices. The bear spread consists of buying a put option with a higher exercise price and selling the put option with lower exercise price. 12.7 Box spread Babasabbpatilfreepptmba.com Page 48

- 49. A Study on Derivatives in Volatile Market Condition A box spread consist of a bull spread with calls plus a bear spread with puts, with the two spreads having the same pairs of exercise prices. 12.8 Butterfly spread with call option A butterfly spread can be executed by using three calls with the same expiration date on the same underlying stock. • The long trader buys one call with a low exercise price, buys one call with high exercise price, and sells two calls with intermediate exercise price. • The short trader sells one call with a low exercise price, sells one call with high exercise price, and buying two calls with intermediate exercise price. 12.9 Butterfly spread with put option A butterfly spread can be executed by using three calls with the same expiration date on the same underlying stock. • The long trader buys a put with a low exercise price, buys one put with high exercise price, and sells two calls with intermediate exercise price. • The short trader sells a put with a low exercise price, sells a put with high exercise price, and buys two puts with intermediate exercise price. 12. Calculation of pay offs Payoffs for volatile security Babasabbpatilfreepptmba.com Page 49

- 50. A Study on Derivatives in Volatile Market Condition Straddle SCRIPT NAME PNB OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 420 23.5 37 13.5 1200 16200 28-Feb- 05 PA 420 20.25 12.3 -7.95 1200 -9540 6660 Strangle SCRIPT NAME PNB OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 420 23.5 37 13.5 1200 16200 28-Feb- 05 PA 400 10.9 5.5 -5.4 1200 -6480 9720 Bull call spread SCRIPT NAME PNB OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 420 23.5 37 13.5 1200 16200 28-Feb- 05 CA 440 10 19.25 9.25 1200 11100 27300 Babasabbpatilfreepptmba.com Page 50

- 51. A Study on Derivatives in Volatile Market Condition Bear put spread SCRIPT NAME PNB OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 PA 420 20.25 12.3 -7.95 1200 -9540 28-Feb- 05 PA 400 10.9 5.5 -5.4 1200 -6480 -16020 Bull spread with call option SCRIPT NAME PNB OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 CA 420 23.5 37 13.5 1200 16200 28-Feb- 05 CA 460 6.1 8.85 2.75 1200 3300 19500 Bear spread with put option SCRIPT NAME PNB OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL Babasabbpatilfreepptmba.com Page 51

- 52. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 PA 400 10.9 5.5 -5.4 1200 -6480 28-Feb- 05 PA 450 25.25 26.5 1.25 1200 1500 -4980 Box spread SCRIPT NAME PNB OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 CA 420 23.5 37 13.5 1200 16200 28-Feb- 05 CA 460 6.1 8.85 2.75 1200 3300 28-Feb- 05 PA 400 10.9 5.5 -5.4 1200 -6480 28-Feb- 05 PA 450 25.25 26.5 1.25 1200 1500 14520 Butterfly spread with call option SCRIPT NAME PNB OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 430 13.5 28 14.5 1200 17400 28-Feb- 05 CA 410 31.8 31.8 0 1200 0 28-Feb- 05 CA 420 23.5 21.1 -2.4 2400 -5760 11640 Babasabbpatilfreepptmba.com Page 52

- 53. A Study on Derivatives in Volatile Market Condition Butterfly spread with put option SCRIPT NAME PNB OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 PA 440 23.3 21 -2.3 1200 -2760 28-Feb- 05 PA 420 20.25 12.3 -7.95 1200 -9540 28-Feb- 05 PA 400 10.9 5.5 -5.4 2400 -12960 -25260 Pay off for low volatile security Straddle SCRIPT NAME TCS OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 1350 53.5 62.75 9.25 250 2312.5 28-Feb- 05 PA 1350 44 23.6 -20.4 250 -5100 -2788 Babasabbpatilfreepptmba.com Page 53

- 54. A Study on Derivatives in Volatile Market Condition Strangle SCRIPT NAME TCS OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 1350 53.5 62.75 9.25 250 2312.5 28-Feb- 05 PA 1290 16 15 -1 250 -250 2062.5 Bull call spread SCRIPT NAME TCS OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb- 05 CA 1350 53.5 62.75 9.25 250 2312.5 28-Feb- 05 CA 1440 14 15.8 1.8 250 450 2762.5 Bear put spread SCRIPT NAME TCS OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL Babasabbpatilfreepptmba.com Page 54

- 55. A Study on Derivatives in Volatile Market Condition 28-Feb- 05 PA 1290 16 15 -1 250 -250 28-Feb- 05 PA 1350 44 23.6 -20.4 250 -5100 -5350 Bull spread with call option SCRIPT NAME TCS OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 CA 1350 53.5 62.75 9.25 250 2312.5 28-Feb- 05 CA 1410 26 27.45 1.45 250 362.5 2675 Bear spread with put option SCRIPT NAME TCS OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 PA 1350 44 23.6 -20.4 250 -5100 28-Feb- 05 PA 1380 35 35 0 250 0 -5100 Babasabbpatilfreepptmba.com Page 55

- 56. A Study on Derivatives in Volatile Market Condition Box spread SCRIPT NAME TCS OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- 05 CA 1350 53.5 62.75 9.25 250 2312.5 28-Feb- 05 CA 1410 26 27.45 1.45 250 362.5 28-Feb- 05 PA 1350 44 23.6 -20.4 250 -5100 28-Feb- 05 PA 1380 35 35 0 250 0 -2425 Butterfly spread with call option SCRIPT NAME TCS OPTIO STRIKE COST SELLLIN LOTSIZ DATE N PRICE PRICE G PRICE SP-CP E TOTAL 28-Feb-05 CA 1470 15.95 15.95 0 250 0 28-Feb-05 CA 1410 26 27.45 1.45 250 362.5 28-Feb-05 CA 1440 14 15.8 1.8 500 900 1262.5 Butterfly spread with put option SCRIPT NAME TCS OPTIO STRIKE COST SELLLING LOTSIZ DATE N PRICE PRICE PRICE SP-CP E TOTAL 28-Feb- PA 1470 15.95 15.95 0 250 0 Babasabbpatilfreepptmba.com Page 56

- 57. A Study on Derivatives in Volatile Market Condition 05 28-Feb- 05 PA 1410 26 27.45 1.45 250 362.5 28-Feb- 05 PA 1440 14 15.8 1.8 500 900 1262.5 13. Conclusion and Recommendations The main aim of this project work is to find out the best strategy that gives maximum pay offs to the investor in the volatile market condition. The payoff for both volatile and non – volatile securities are calculated and the best strategy for the volatile security in the volatile market condition after taking in to following constraints such as brokerage charges, and a supportive strategy that will not make loss to the investor. As per the payoffs calculated for the volatile security in the volatile market condition (i.e. Pnb) the best strategy would be box spread, which has two- call option, and two put option, and it gives the maximum payoff. Babasabbpatilfreepptmba.com Page 57

- 58. A Study on Derivatives in Volatile Market Condition The best strategy for non-volatile security (i.e. Tcs) in the volatile market condition would be strangle because it has both call and put option so the possibility of incurring loss is comparatively low, and the second best strategy would be bull call spread. 14. References www.nseindia.com www.ivolatility.com www.mof.nic.in www.ndtv.com www.derivativesindia.com www.sebi.gov.in Futures, options and swaps by Robert W. Kolb. Understanding futures market by Robert W. Kolb. Futures and options by Hans R.Stoll and Robert E. Whaley. Rules, regulations and bye – laws, (F &O segment) of NSE & NSCCL Babasabbpatilfreepptmba.com Page 58

- 59. A Study on Derivatives in Volatile Market Condition NSE NCFM material. Babasabbpatilfreepptmba.com Page 59