1. The document outlines an agenda for discussing budgeting and forecasting best practices for high growth companies. It covers definitions of budgets, forecasts, and models.

2. A section explains why taking the time to budget is important, such as setting assumptions, planning for cash flow needs, and understanding growth drivers and costs. Regular review allows revising assumptions based on accuracy.

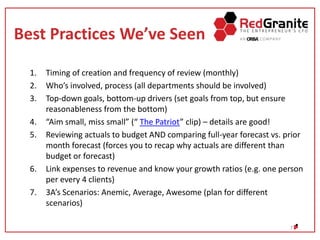

3. Different approaches to budgeting and forecasting at various companies are shared, along with examples of best practices like involving all departments and linking expenses to revenue.