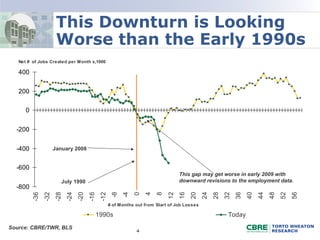

This presentation discusses the state of commercial real estate markets in early 2009. It notes that fundamentals are currently well-aligned across major property types, but refinancing will be a major issue that year. It also compares the current downturn to the early 1990s recession, finding it is looking worse so far. The document outlines how lower mortgage rates are enabling refinancing but changes in capital markets are gradual. It discusses the impacts of layoffs and falling consumer confidence on the economy.