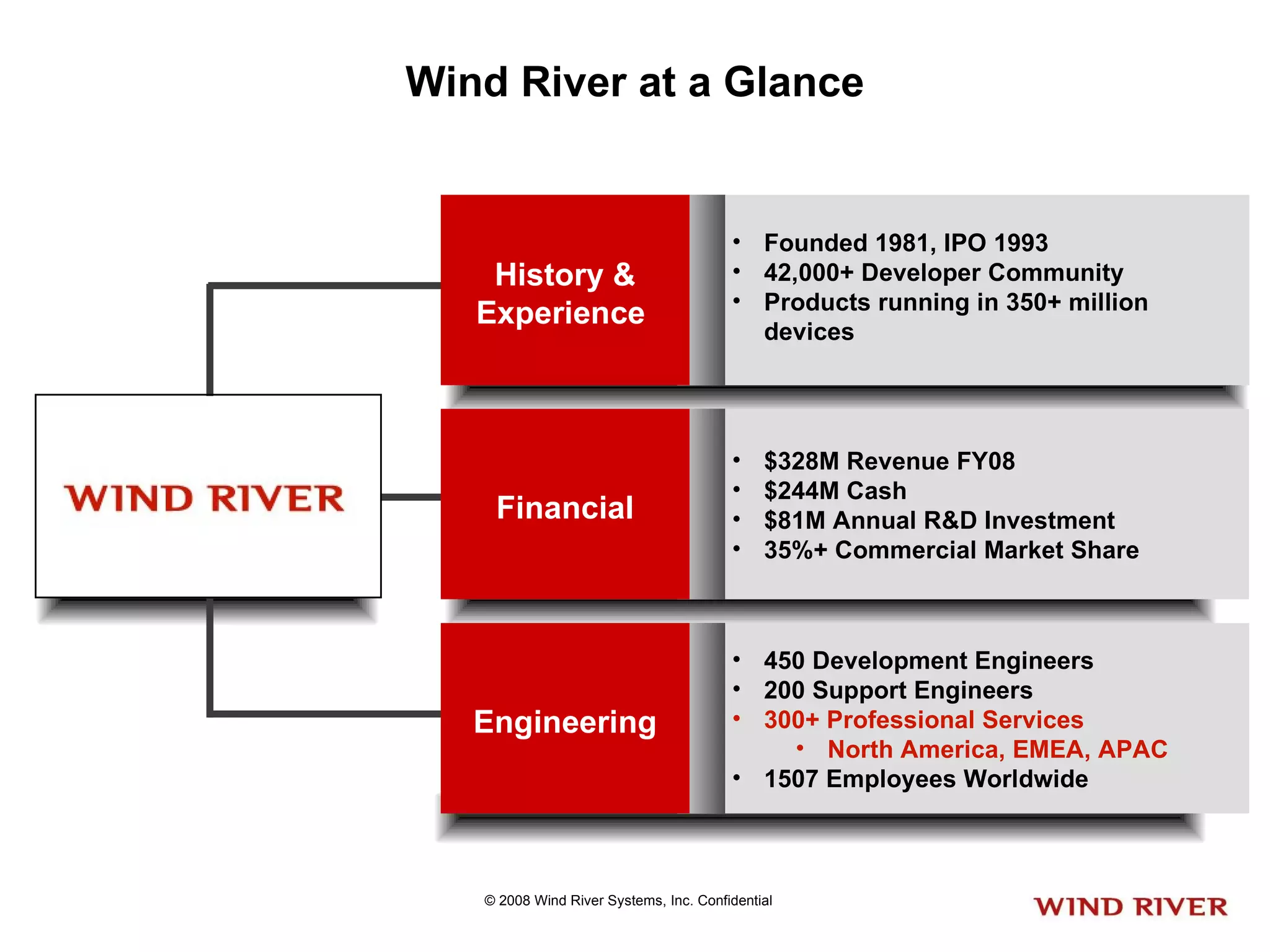

Wind River is a software company founded in 1981 with over 42,000 developers. It has $328M in revenue and focuses on embedded operating systems, development tools, and professional services. It has over 1,500 employees worldwide working on products that are used in over 350 million devices.

![Boston Scientific To Start-Ups: Don’t Call Us, We’ll Call You Boston Scientific CEO Jim Tobin went out of his way in a speech last week to dissuade start-up firms from expecting investment from his company. In the current climate, "It is only in almost rare instances that we get out our checkbook and write a check," Tobin said Nov. 12 at the Cleveland Clinic's Medical Innovation Summit in Cleveland. "We have been spending $600 million a year for most of the 10 years that I have been involved in this thing," he said. But now "we are going to expect more from [small firms], and we are not going to overpay. The old days are over, and I don't think they are coming back." In truth, Boston Scientific has emphasized sell-offs over technology acquisitions since well before the credit crisis mushroomed to its current level. The need to pay off the substantial debt created by the 2006 purchase of Guidant for $28 billion led the company to divest more than a billion dollars in assets in the past year. But Tobin suggests that the Guidant debt is no longer the primary factor defining Boston Scientific's investment strategy. The debt has declined from $8 billion a couple of years ago to its current level of $5 billion, and it is "coming down practically every day," he said in Cleveland.](https://image.slidesharecdn.com/CoffeePitchMedicalv22-12284293796-phpapp02/85/VIP-Roundtable-Medical-Devices-4-320.jpg)