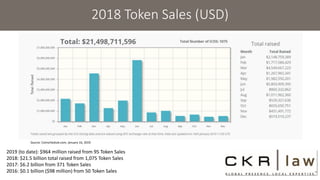

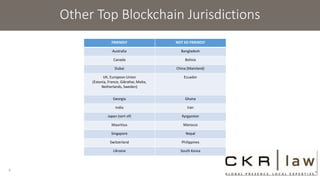

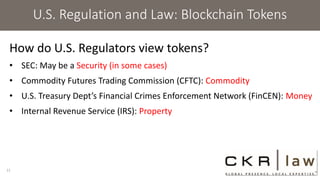

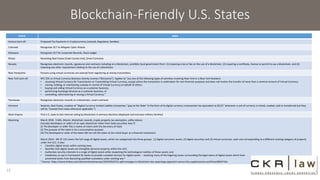

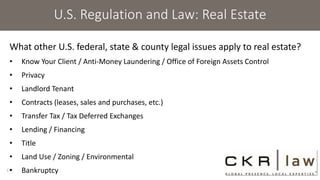

The document discusses the state of blockchain and cryptocurrency regulation in the U.S. as of May 2019, including insights into token sales and the perspectives of various regulatory bodies. It highlights data on token sales, identifies blockchain-friendly states, and underscores the importance of legal counsel in navigating the complex regulatory landscape. Additionally, it introduces the Token Taxonomy Act and mentions various organizations involved in blockchain advocacy.