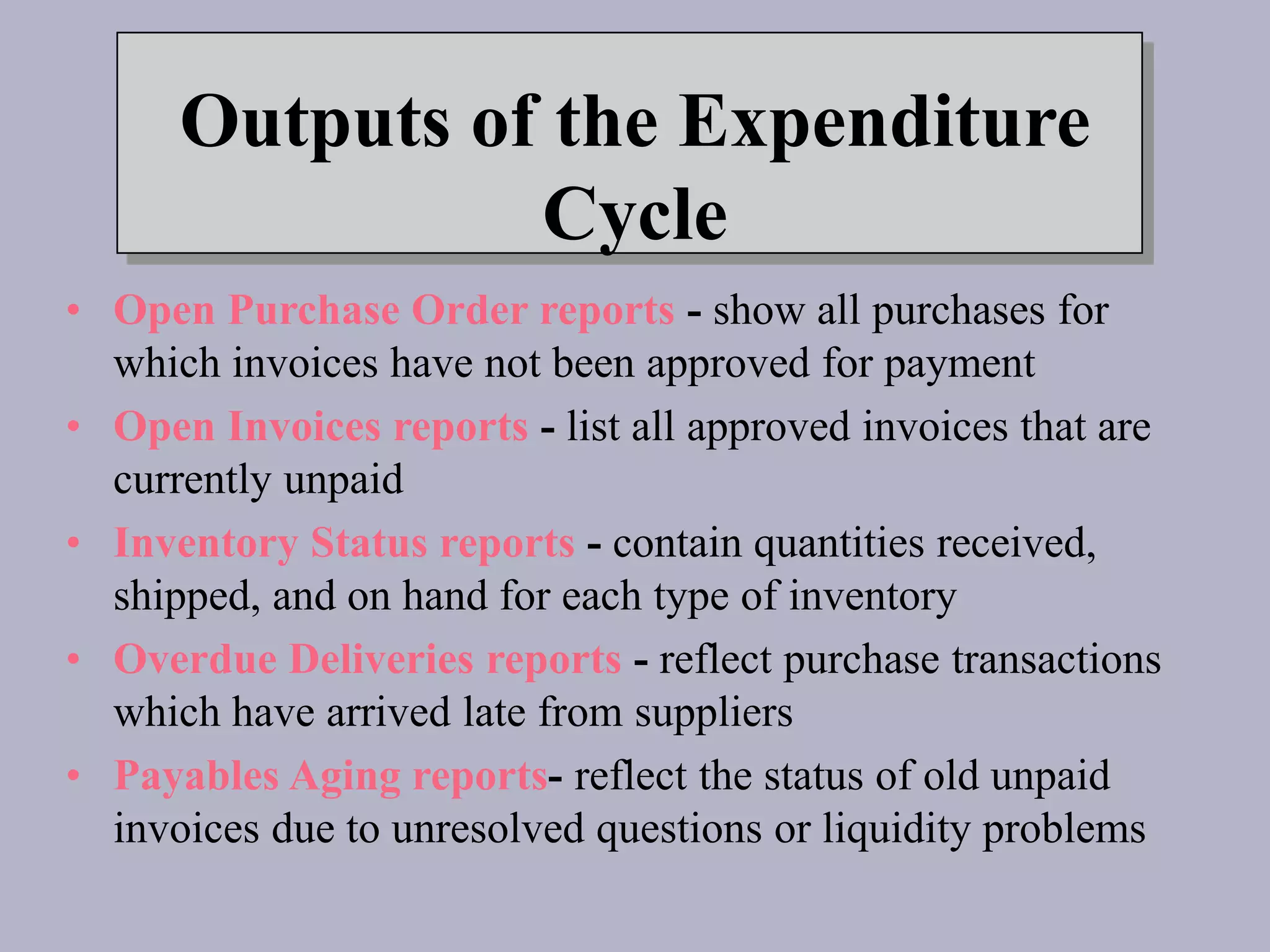

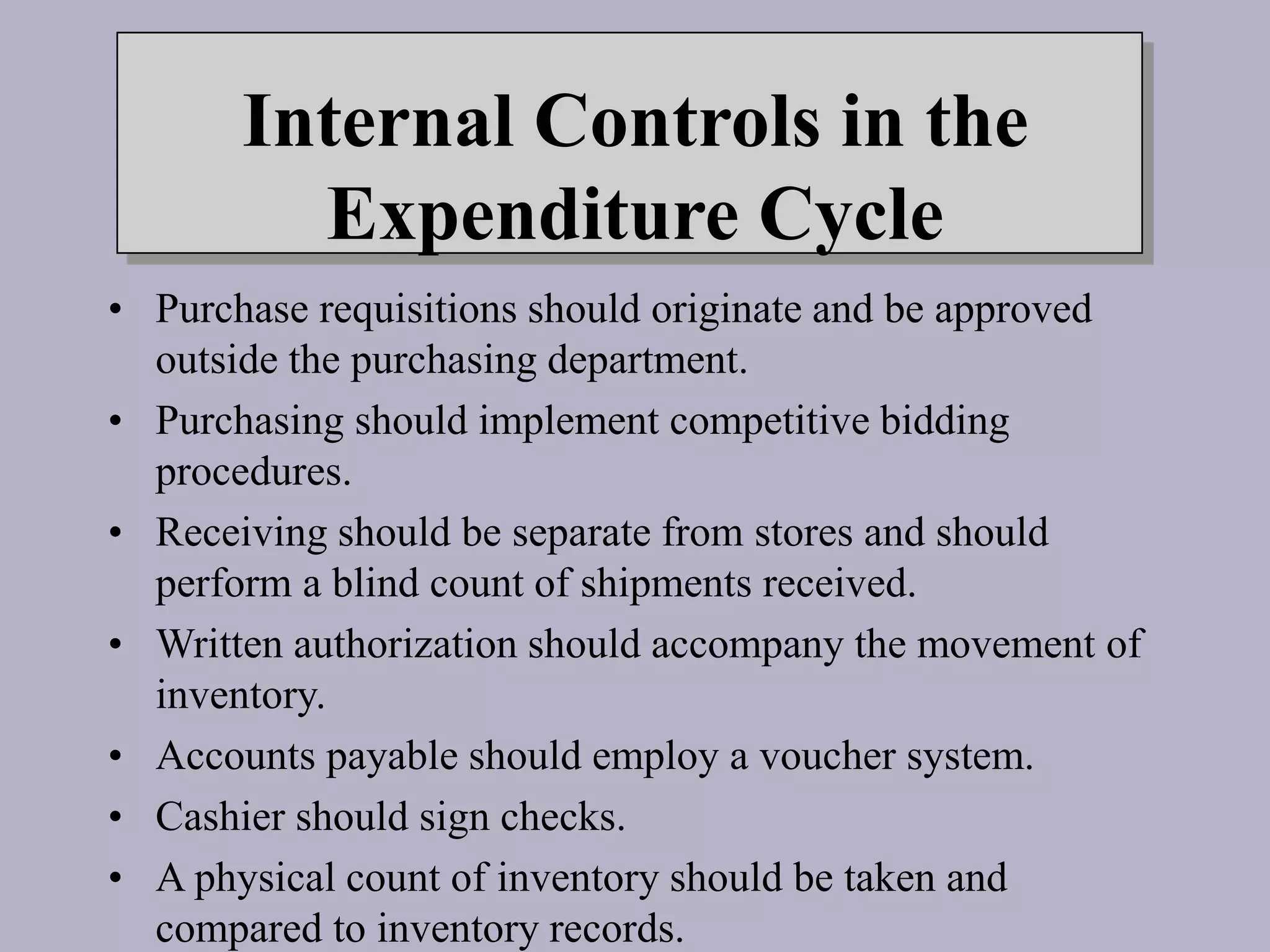

The document summarizes key aspects of revenue, expenditure, and payroll cycles. It describes functions like sales order processing, accounts receivable, purchasing, accounts payable, inventory management, and payroll processing. It also outlines important inputs, outputs, controls, and risks associated with each cycle.