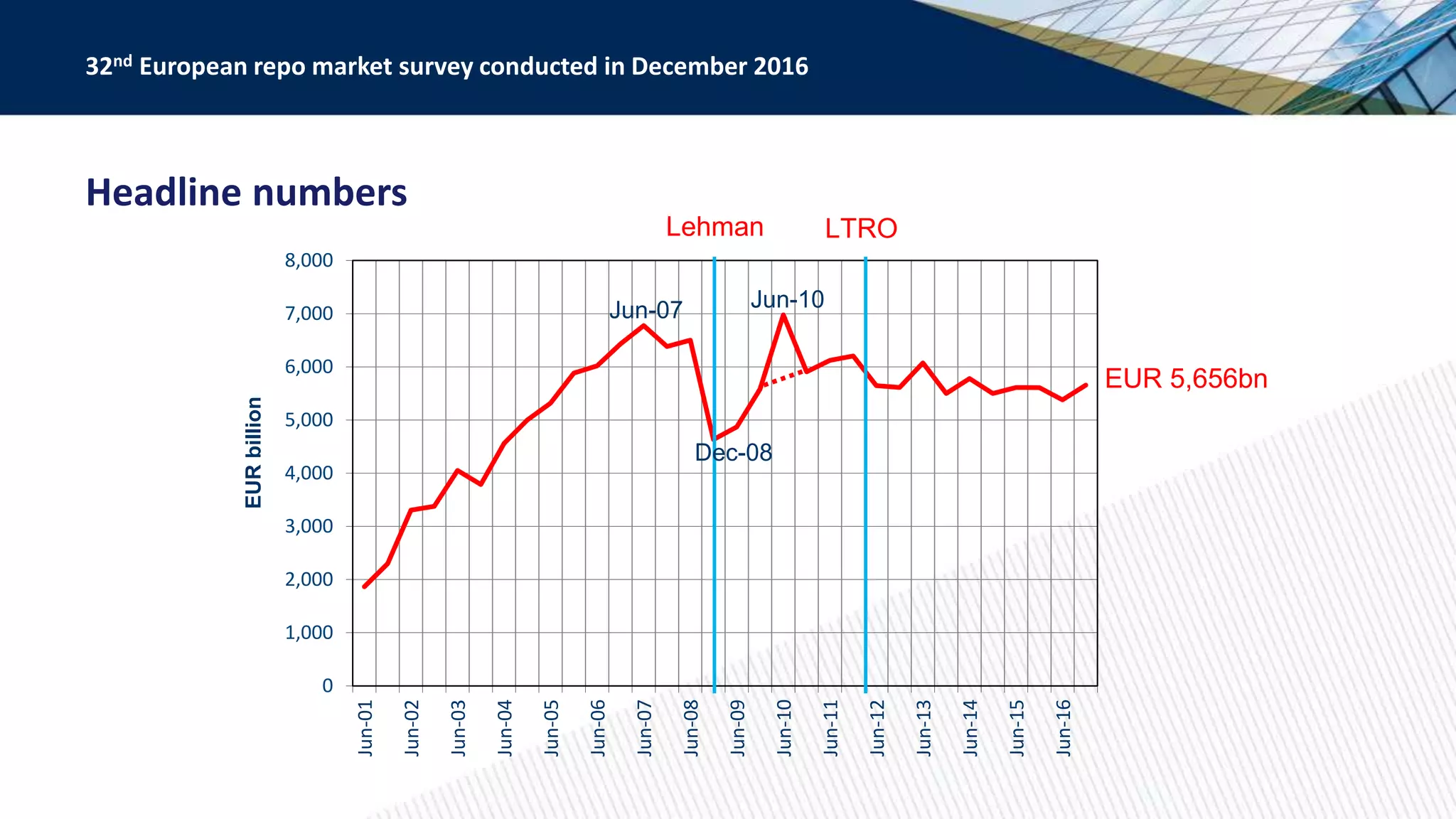

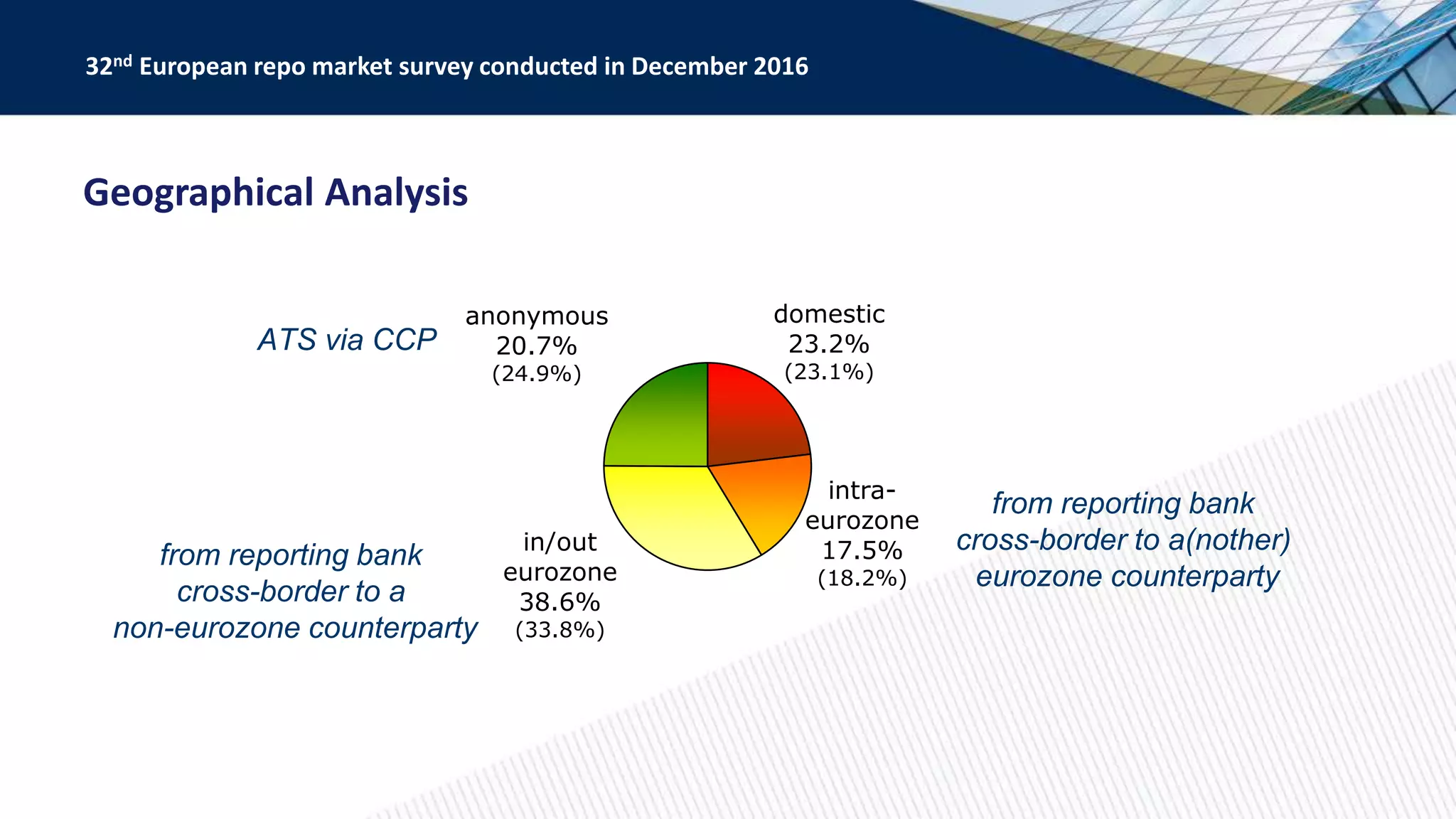

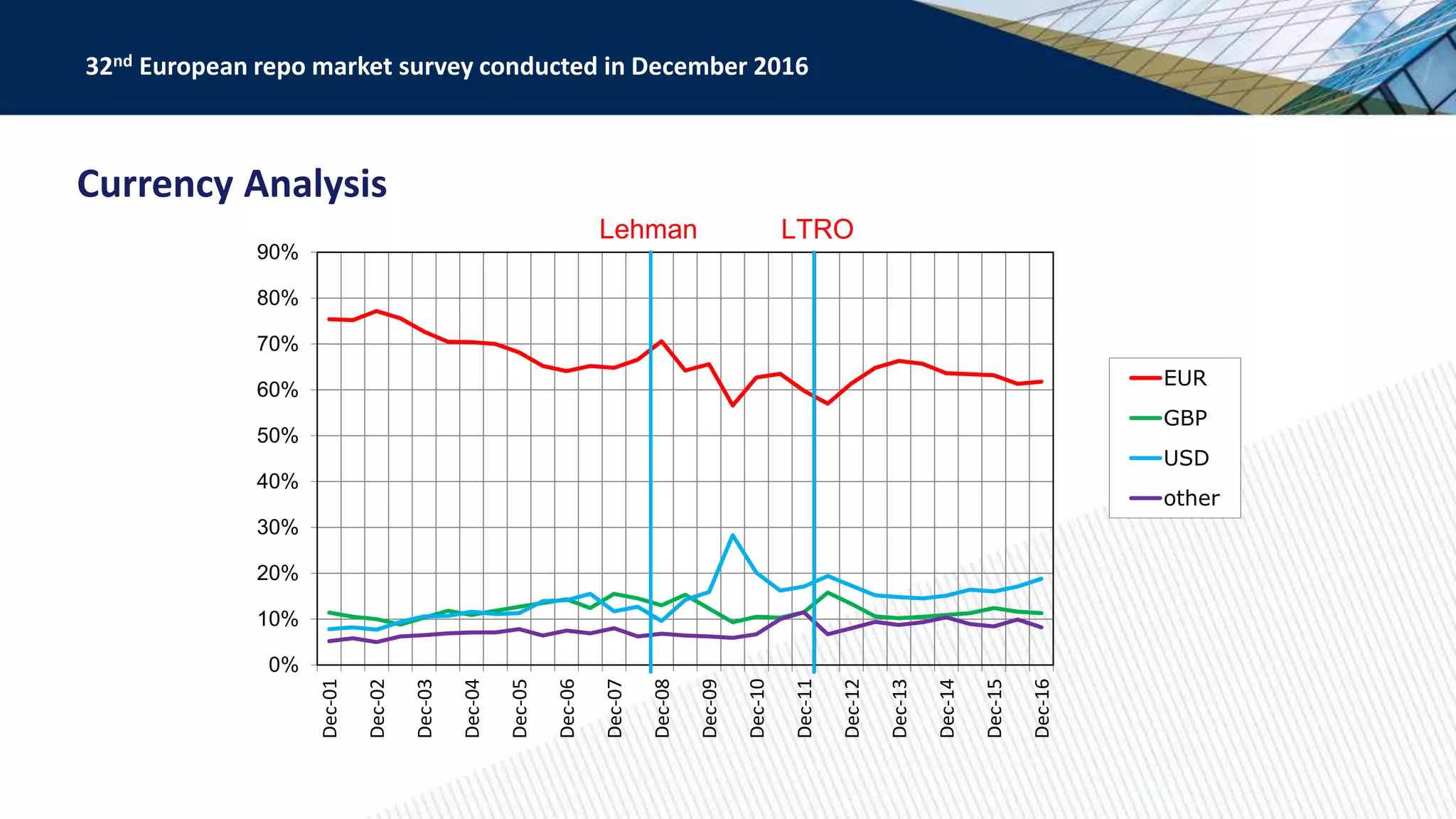

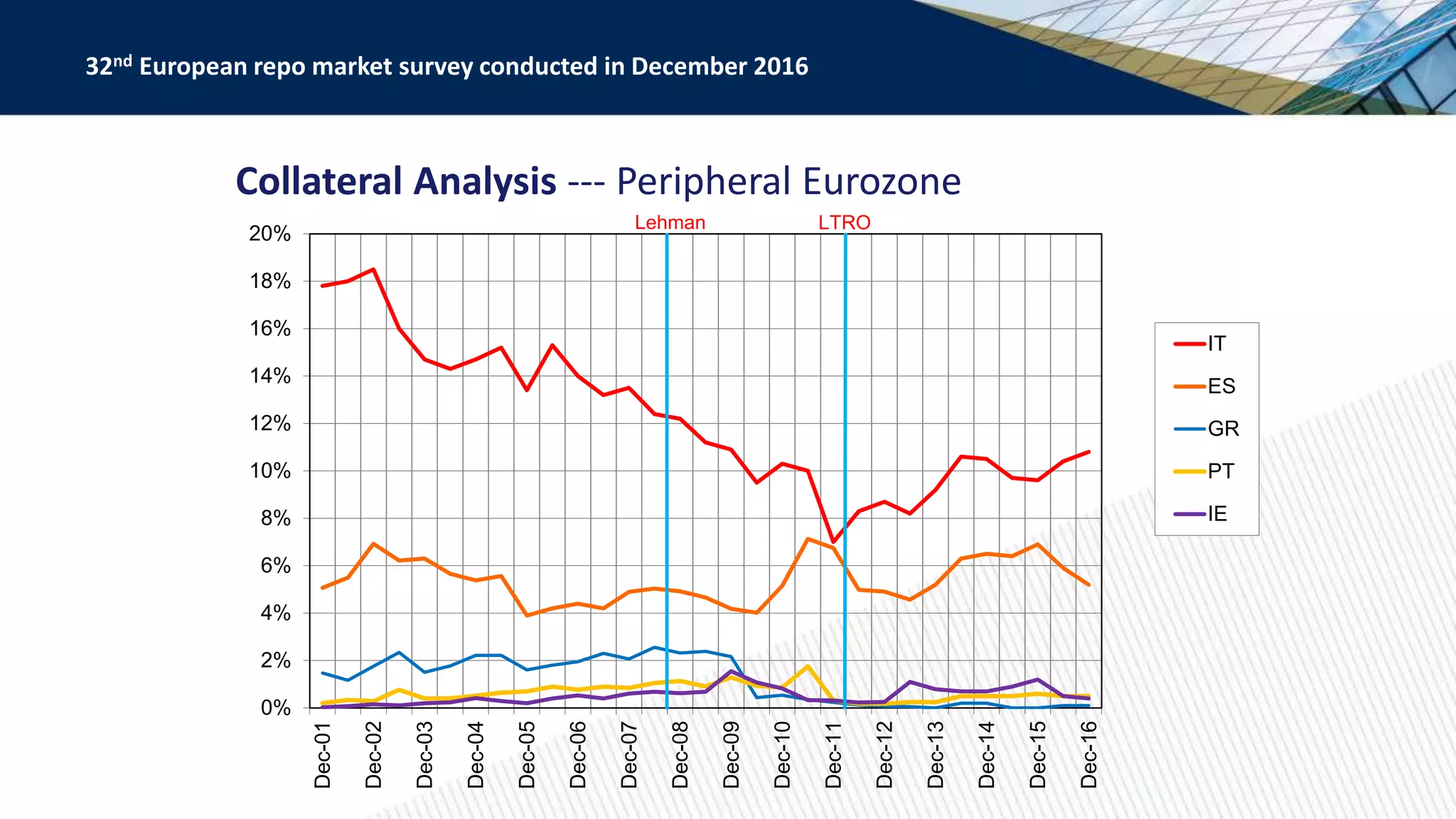

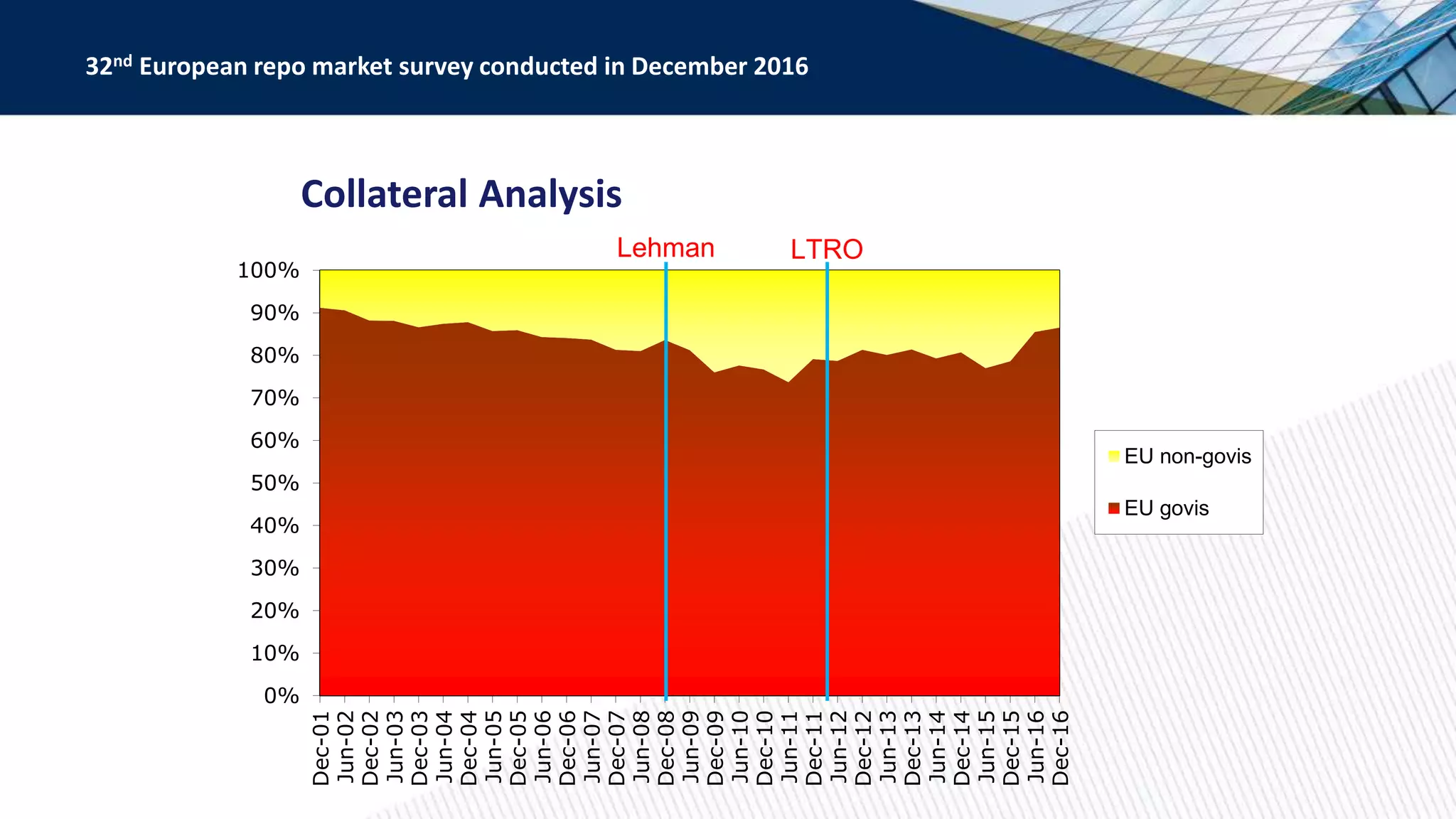

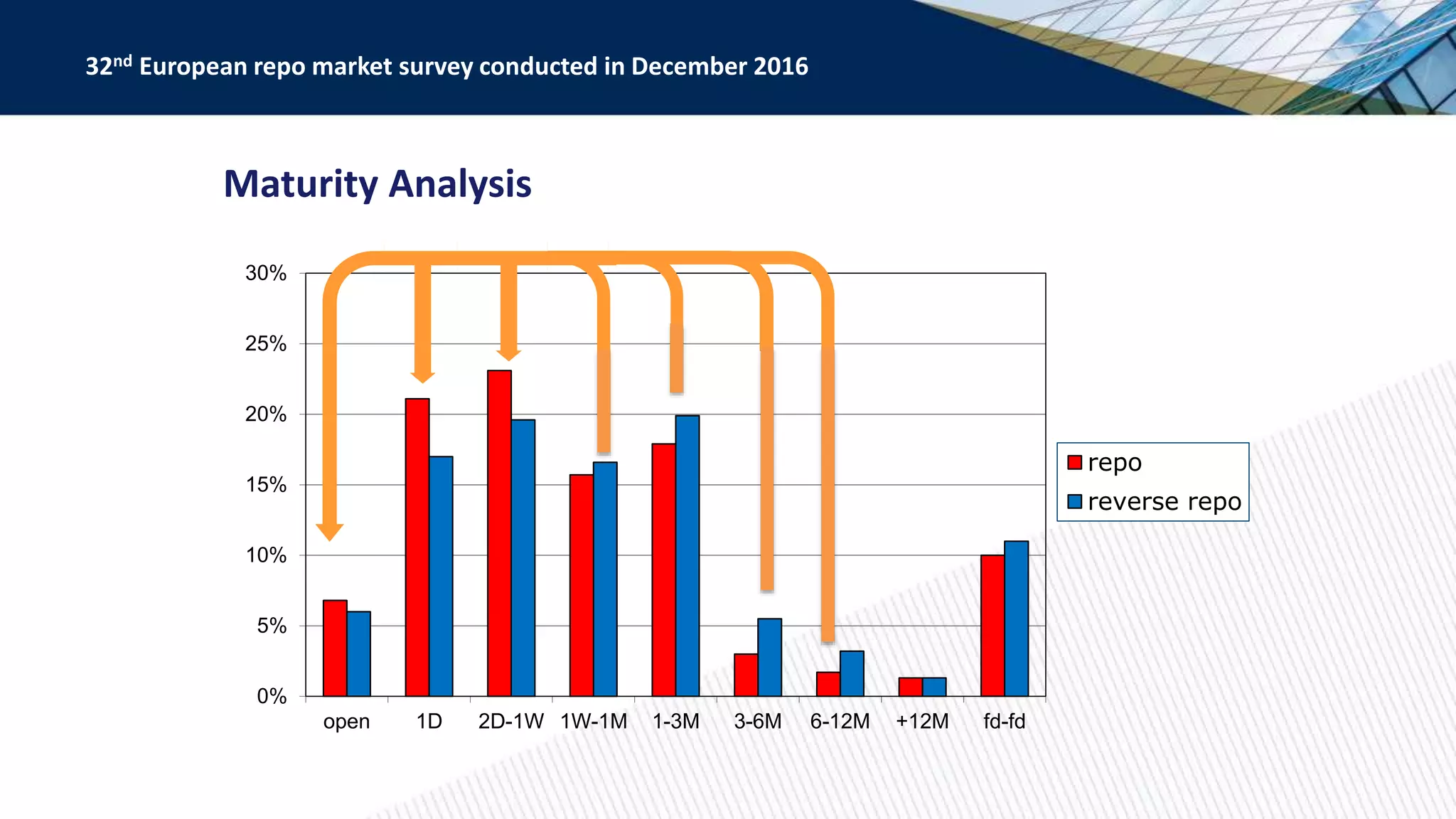

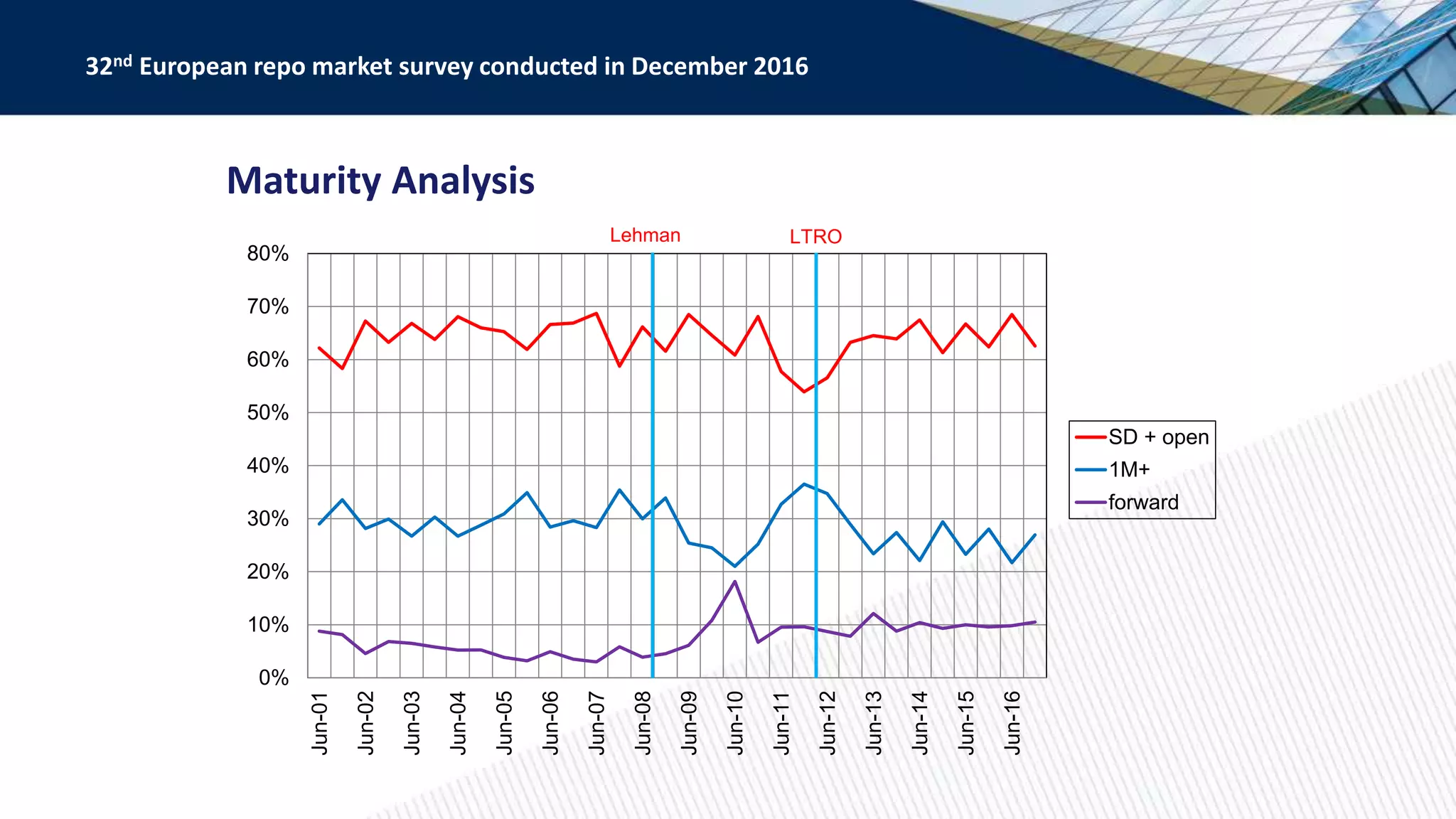

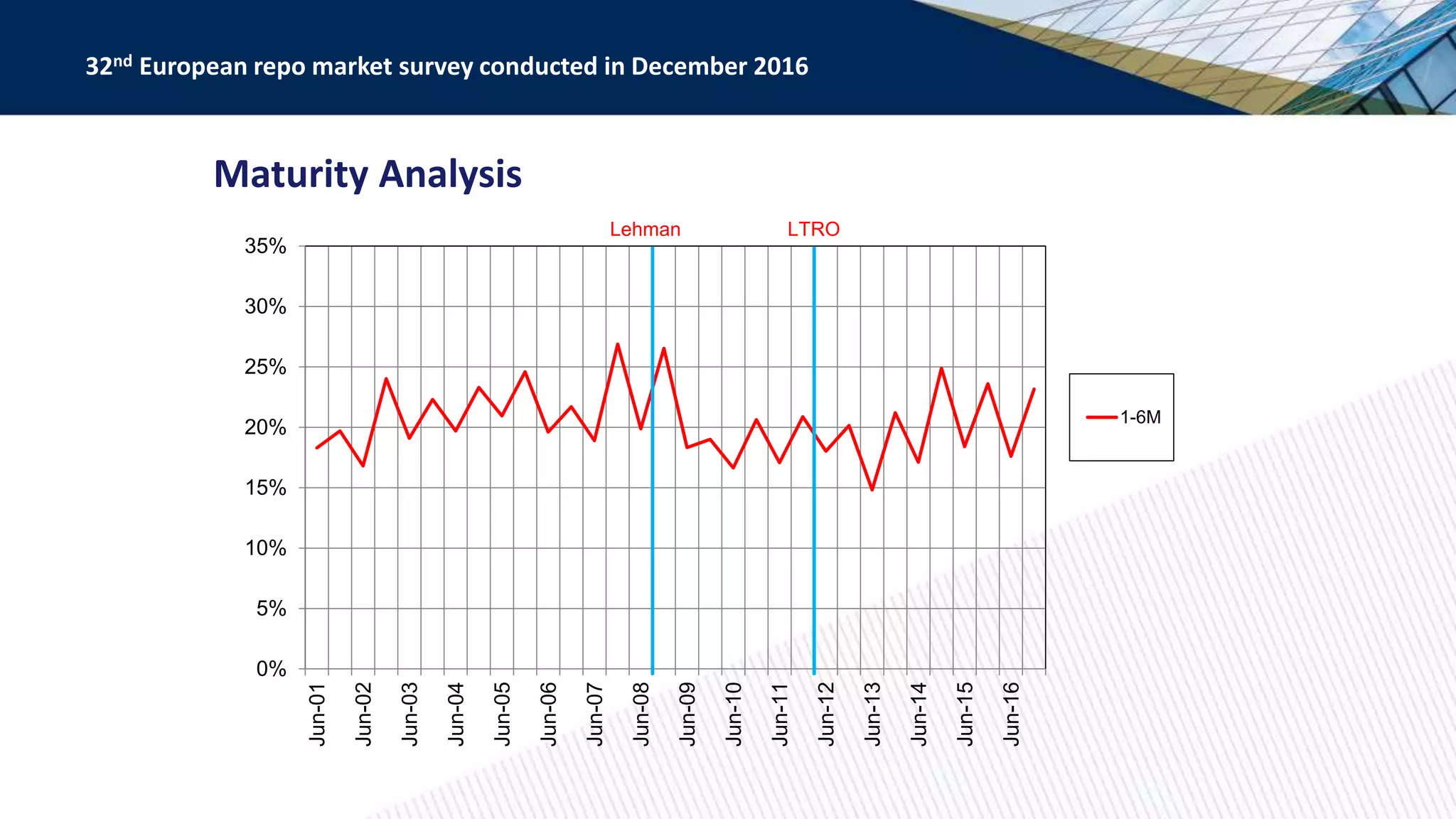

The 32nd European Repo Market Survey, conducted in December 2016, shows a slight year-on-year growth of 0.9% and an increase of 5.2% since June 2016. The survey also highlights the distribution of repo transactions by method, currency, and collateral type, indicating ongoing shifts in market practices. Key metrics include the predominant use of EUR for transactions and an evolution in collateral types, reflecting broader trends in the European financial market.