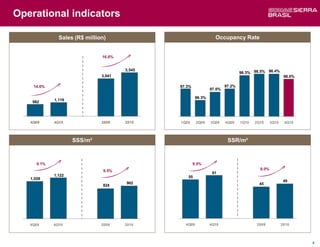

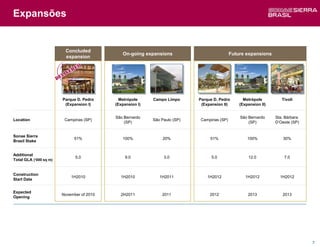

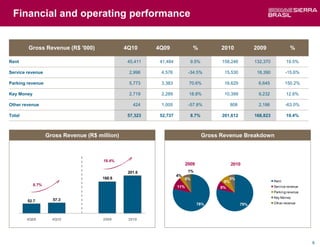

Sonae Sierra Brasil has experienced strong growth in owned GLA and portfolio size over the past decade. Their portfolio currently consists of 12 shopping centers across Brazil with a total GLA of 350,000 square meters, of which 203,000 square meters is owned GLA. Sonae Sierra Brasil is also pursuing expansion of existing properties and development of new greenfield projects, which are expected to increase total owned GLA by over 90% by 2013. Financial results for 2010 showed increases in key metrics such as sales, NOI and adjusted EBITDA compared to the previous year.