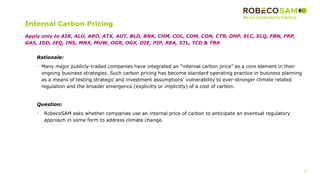

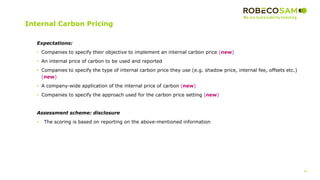

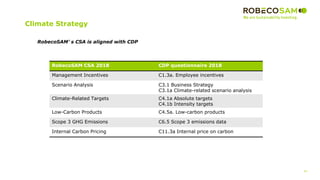

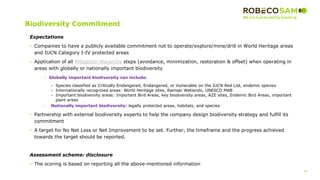

The document discusses proposed changes to the RobecoSAM Corporate Sustainability Assessment (CSA) methodology for 2018. Key changes include strengthening the corporate governance component, updating questions related to tax strategy, climate strategy, and policy influence. For climate strategy, new questions have been added on management incentives, scenario analysis, and expanding industry applicability. The changes aim to better align with frameworks like the TCFD and updates to the CDP questionnaire.