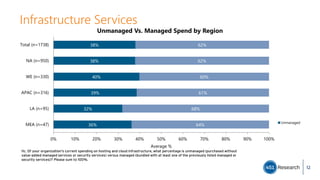

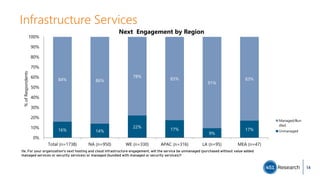

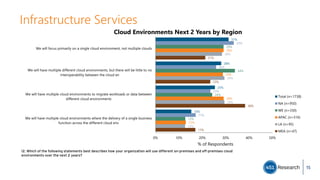

The 2017 study commissioned by Microsoft reveals that 62% of cloud spending is bundled with value-added services, emphasizing the significance of managed infrastructure services. Key insights include a rising trend towards multi-cloud environments, with 41% of organizations already adopting this approach, driven by the need for better resource management and operational efficiency. Service providers are deemed vital for future digital transformation projects, with 60% of organizations willing to pay a premium for comprehensive managed solutions.

![Budgets

41%

39%

42%

41%

39%

40%

30%

36%

30%

30%

32%

32%

16%

13%

16%

16%

17%

16%

13%

12%

12%

14%

12%

12%

MEA (n=47)

LA (n=95)

APAC (n=316)

WE (n=330)

NA (n=950)

Total (n=1738)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Average %

2017 IT Budget Allocation by Region

On-Premises

Infrastructure &

Staff

Hosting Services

SaaS

S8b. Using your best guess, approximately what percentage of your total IT budget in 2017 is allocated to: [sum to 100%]

7](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-7-320.jpg)

![Budgets/Spending

8

26%

25%

26%

26%

25%

26%

19%

18%

21%

20%

19%

20%

18%

18%

18%

18%

19%

18%

18%

20%

18%

17%

19%

18%

18%

20%

17%

19%

18%

18%

MEA

(n=47)

LA

(n=95)

APAC

(n=316)

WE

(n=330)

NA

(n=950)

Total

(n=1738)

0% 20% 40% 60% 80% 100%

Average %

2017 Hosting/Cloud Services Budget

Allocation by Region

Infrastructure

Hosting

Application

Hosting

Managed

Services

Security

Services

Professional

Services

28%

29%

26%

27%

26%

27%

22%

19%

22%

21%

20%

21%

18%

16%

18%

17%

19%

18%

18%

20%

19%

18%

19%

19%

15%

16%

15%

17%

16%

16%

MEA

(n=47)

LA (n=95)

APAC

(n=316)

WE

(n=330)

NA

(n=950)

Total

(n=1738)

0% 20% 40% 60% 80% 100%

Average %

2019 Hosting/Cloud Services Budget

Allocation by Region

Infrastructure

Hosting

Application

Hosting

Managed

Services

Security

Services

Professional

Services

H1. Approximately what percent of your HOSTING & CLOUD SERVICES budget in 2016 is allocated to the following services? [Sum to 100%]

H2. Now thinking out two years, approximately what percent of your HOSTING & CLOUD SERVICES budget will be allocated to the following

services? [Sum to 100%]](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-8-320.jpg)

![Infrastructure Services

48%

43%

47%

47%

45%

46%

52%

57%

53%

53%

55%

54%

MEA (n=47)

LA (n=95)

APAC (n=316)

WE (n=330)

NA (n=950)

Total (n=1738)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Average %

Managed Spend by Region

Basic

infrastructure

Managed

services/security

services

I1d . Thinking about your organization's managed infrastructure spending, what percentage of the spending is allocated to each of the

following? Please sum to 100%. [Sum to 100%]

13](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-13-320.jpg)

![Professional Services

70%

69%

69%

68%

68%

68%

66%

66%

66%

65%

65%

65%

63%

61%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Intgrtn of legacy sys/bus processes w/SaaS fnctnlty

Application modernization

Intgrtn of core bus systems & data w/customer-facing bus prcsses

Compliance and risk assessment

Cloud business strategy

Training on cloud platforms

Ntwrk consulting & integration to accommodate cloud envrnmnts

Migration of legacy appls/wrklds to cloud infrastructure envrnmnts

Cloud advisory and planning

Workload Placement

Cloud orchestration and management

Vendor/service provider procrmnt & relationship mgt

Cloud-native application development

Cloud brokerage/marketplace solutions

% TOP BOX (More Important - ratings 8 thru 10)

Importance To Digital Transformation Goals

n=1513

Z2. How important are each of the following to your organization 's digital transformation goals? Rate on a scale of 0-10 where 0= Not at all

Important and 10 = Extremely Important. [TOP BOX RATING OF 8-10]

Note:

‘Straightline”

responses

removed.

36](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-36-320.jpg)

![Professional Services

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Intgrtn of legacy sys/bus processes w/SaaS fnctnlty

Application modernization

Intgrtn of core bus systems & data w/customer-facing bus prcsses

Compliance and risk assessment

Cloud business strategy

Training on cloud platforms

Ntwrk consulting & integration to accommodate cloud envrnmnts

Migration of legacy appls/wrklds to cloud infrastructure envrnmnts

Cloud advisory and planning

Workload Placement

Cloud orchestration and management

Vendor/service provider procrmnt & relationship mgt

Cloud-native application development

Cloud brokerage/marketplace solutions

% TOP BOX (More Important - ratings 8 thru 10)

Importance To Digital Transformation Goals by Region

Total (n=1513)

NA (n=851)

WE (n=274)

APAC (n=262)

LA (n=83)

MEA (n=43)

Z2. How important are each of the following to your organization 's digital transformation goals? Rate on a scale of 0-10 where 0= Not at all

Important and 10 = Extremely Important. [TOP BOX RATING OF 8-10]

Note:

‘Straightline”

responses

removed.

37](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-37-320.jpg)

![Professional Services

12% 15%

9% 10% 7%

3%

14%

15% 24%

4%

12%

13%

16%

16%

23%

9%

4%

38%

19%

19%

19%

19%

22%

21%

17%

18%

13%

16%

30%

13%

11%

10%

7%

16%

10%

8%

11% 8%

4%

28%

13%

5%

Total (n=1282) NA (n=732) WE (n=217) APAC (n=227) LA (n=67) MEA (n=39)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

%ofRespondents

Most Recent Professional Services Cloud Project Spend by Region

$2mil+

$500,000-

<$2mil

$100,000-

$499,999

$25,000-

$99,999

$5,000-$24,999

$1,000-$4,999

<$1,000

Z3. How much did your organization spend on your most recent professional services for cloud enablement project? Please enter a US

dollar value. [OPEN NUMERIC]

38](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-38-320.jpg)

![Professional Services

11% 12%

6%

13% 11% 12%

22% 24%

20%

18% 20% 19%

25%

24%

30% 25% 22% 21%

21%

23%

23%

19%

16%

14%

7%

6%

7%

8% 14%

5%

14% 12% 14% 18% 16%

30%

Total (n=1391) NA (n=778) WE (n=236) APAC (n=255) LA (n=79) MEA (n=43)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

%ofRespondents

Most Recent Professional Services Cloud Project Duration by Region

More than 24

weeks

17-24 weeks

9-16 weeks

5-8 weeks

3-4 weeks

1-2 weeks

Average Weeks13 12 12 14 14 20

Z4. What was the duration (WEEKS) of your organization 's most recent professional services for cloud enablement project?

________ Weeks [OPEN NUMERIC]

39](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-39-320.jpg)

![Business Transformation

24 24 23 26 27 30

23 22 23

23

25 20

19 19 20 19

19 20

17 18 17 16

16 16

16 17 16 16 13 14

Total (n=1738) NA (n=950) WE (n=330) APAC (n=316) LA (n=95) MEA (n=47)

Relative Company Goals

Increase

revenue

Improve

product or

service quality

Lower costs

C3. Allocate 100 points among the following five goals to their relative importance within your company or organization? [Sum to 100]

52](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-52-320.jpg)

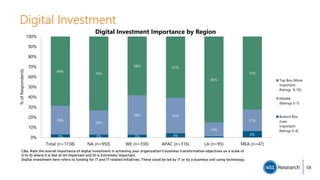

![Digital Investment

12%

6%

6%

4%

6%

4%

40%

43%

41%

42%

37%

38%

31%

49%

51%

53%

54%

57%

58%

69%

Enter into adjacent lines of business (n=78)

Target Cross-sell/Up-sell opportunities within client base

(n=146)

Hire quality staff (n=140)

Optimize Pricing (n=113)

Improve marketing/promotion of products and services

(n=290)

Compete aggressively to increase market share (n=158)

Expand geographically (n=140)

0% 20% 40% 60% 80% 100%

% of Respondents

Digital Investment to Increase Revenue

None

Some

Significant

C9a. What is the level of digital investment that your organization will need to make to deliver on these strategies

[Increase Revenue] over the next two years, based either on your own knowledge or impressions?

59](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-59-320.jpg)

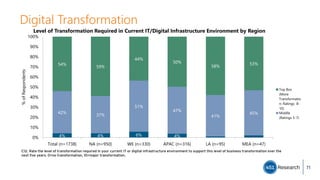

![Digital Investment

10%

9%

5%

3%

3%

49%

39%

42%

42%

39%

38%

37%

40%

52%

53%

55%

58%

59%

60%

Reduce headcount (n=67)

Enable mobile/telecommute workforce (n=99)

Monitor operations in real time (n=79)

Optimize supply chain and logistics (n=147)

Make workforce more productive (n=173)

Improve financial analytics (n=143)

Create more efficient/streamlined business process

(n=290)

0% 20% 40% 60% 80% 100%

% of Respondents

Digital Investment to Lower Costs

None

Some

Significant

C9b. What is the level of digital investment that your organization will need to make to deliver on these strategies

[Lower Costs] over the next two years, based either on your own knowledge or impressions?

60](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-60-320.jpg)

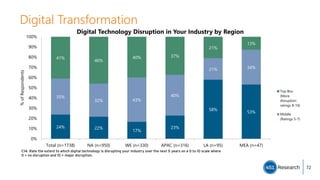

![Digital Investment

4%

4%

5%

3%

3%

3%

52%

49%

42%

42%

39%

41%

39%

38%

32%

28%

46%

47%

55%

56%

56%

57%

59%

59%

66%

70%

Tracking digital identities of customers (n=63)

Offer self-service products/services (n=51)

Use analytics to predict or recover from errors (n=84)

Build online communities (n=66)

Find, develop and retain talent (n=135)

Focus on customer convenience (n=129)

Single cstmr exprnce across digital & physical srvcs/devices/pltfrms…

Personalize customer experience (n=102)

Deliver digital products (vs physical products) (n=79)

Innovate or deliver new products or services (n=224)

0% 20% 40% 60% 80% 100%

% of Respondents

Digital Investment to Improve Product or Service Quality

None

Some

Significant

C9c. What is the level of digital investment that your organization will need to make to deliver on these strategies

[Improve Product or Service Quality] over the next two years, based either on your own knowledge or impressions?

61](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-61-320.jpg)

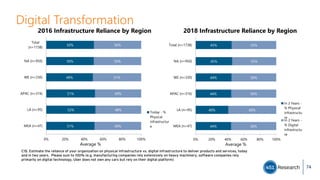

![Digital Investment

6%

4%

39%

41%

40%

39%

38%

34%

37%

55%

56%

58%

59%

60%

62%

63%

Cultivate a culture of risk taking...to accelerate development (n=101)

Encourage knowledge sharing & collaboration among employees

(n=135)

Invest in research and development (n=133)

Integrate customer feedback through communities or analytics

(n=132)

Automate business processes (n=145)

Use data to drive strategic decision making (n=149)

Improve production processes (n=189)

0% 20% 40% 60% 80% 100%

% of Respondents

Digital Investment to Speed Time to Market

None

Some

Significant

C9d. What is the level of digital investment that your organization will need to make to deliver on these strategies

[Speed Time to Market] over the next two years, based either on your own knowledge or impressions?

62](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-62-320.jpg)

![Digital Investment

42%

41%

38%

36%

27%

56%

58%

60%

62%

71%

Minimize risk making decisions with data (n=177)

Analytics to recognize risks sooner (n=217)

Building Digital Trust competencies (n=162)

Identify threats in business exposure or competition

(n=241)

Focus on reducing Cybersecurity attacks (n=186)

0% 20% 40% 60% 80% 100%

% of Respondents

Digital Investment to Lower Risk

None

Some

Significant

C9e. What is the level of digital investment that your organization will need to make to deliver on these strategies [Lower Risk]

over the next two years, based either on your own knowledge or impressions?

63](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-63-320.jpg)

![Digital Investment

3%

3%

4%

4%

25%

24%

20%

26%

25%

26%

19%

51%

42%

50%

44%

44%

45%

45%

24%

28%

26%

24%

27%

26%

29%

4%

4%

3%

Expand geographically (n=140)

Compete aggressively to increase market share (n=158)

Improve marketing/promotion of products and services

(n=290)

Optimize Pricing (n=113)

Target Cross-sell/Up-sell opportunities within client base

(n=146)

Enter into adjacent lines of business (n=78)

Hire quality staff (n=140)

0% 20% 40% 60% 80% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Increase Revenue

None

Few

Many

All

C10a. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment

required for these strategies [Increase Revenue] , based either on your own knowledge or what you heard?

64](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-64-320.jpg)

![Digital Investment

3%

9%

13%

23%

20%

21%

24%

24%

28%

45%

52%

52%

48%

46%

44%

28%

42%

23%

26%

25%

28%

26%

28%

3%

5%

6%

Improve financial analytics (n=143)

Monitor operations in real time (n=79)

Create more efficient/streamlined business process

(n=290)

Make workforce more productive (n=173)

Optimize supply chain and logistics (n=147)

Enable mobile/telecommute workforce (n=99)

Reduce headcount (n=67)

0% 20% 40% 60% 80% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Lower Costs

None

Few

Many

All

Don't know

C10b. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment

required for these strategies [Lower Costs], based either on your own knowledge or what you heard?

65](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-65-320.jpg)

![Digital Investment

3%

5%

14%

15%

19%

18%

17%

18%

15%

17%

20%

21%

55%

48%

57%

50%

46%

50%

39%

52%

50%

46%

29%

36%

24%

29%

36%

26%

43%

27%

26%

24%

3%

5%

4%

Offer self-service products/services (n=51)

Build online communities (n=66)

Tracking digital identities of customers (n=63)

Innovate or deliver new products or services (n=224)

Single customer experience across digital and physical services, devices or platforms…

Use analytics to predict or recover from errors (n=84)

Deliver digital products (vs physical products) (n=79)

Personalize customer experience (n=102)

Focus on customer convenience (n=129)

Find, develop and retain talent (n=135)

0% 20% 40% 60% 80% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Improve Product or Service

Quality

None

Few

Many

All

C10c. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment

required for these strategies [Improve Product or Service Quality] , based either on your own knowledge or what you heard?

66](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-66-320.jpg)

![5%

14%

15%

19%

18%

17%

18%

15%

17%

20%

21%

55%

48%

57%

50%

46%

50%

39%

52%

50%

46%

29%

36%

24%

29%

36%

26%

43%

27%

26%

24%

3%

5%

4%

Offer self-service products/services (n=51)

Build online communities (n=66)

Tracking digital identities of customers (n=63)

Innovate or deliver new products or services (n=224)

Single customer experience across digital and physical services, devices or platforms (n=111)

Use analytics to predict or recover from errors (n=84)

Deliver digital products (vs physical products) (n=79)

Personalize customer experience (n=102)

Focus on customer convenience (n=129)

Find, develop and retain talent (n=135)

0% 20% 40% 60% 80% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Improve Product or Service

Quality

None

Few

Many

All

Digital Investment

C10c. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment required for

these strategies [Improve Product or Service Quality] , based either on your own knowledge or what you heard?

67](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-67-320.jpg)

![Digital Investment

C10d. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment required

for these strategies [Speed Time to Market], based either on your own knowledge or what you heard?

17%

15%

15%

14%

20%

12%

19%

54%

54%

58%

51%

50%

51%

50%

26%

30%

26%

33%

30%

33%

28%

3%Automate business processes (n=145)

Use data to drive strategic decision making (n=149)

Integrate customer feedback through communities or analytics

(n=132)

Invest in research and development (n=133)

Improve production processes (n=189)

Encourage knowledge sharing & collaboration among employees

(n=135)

Cultivate a culture of risk taking...to accelerate development

(n=101)

0% 20% 40% 60% 80% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Speed Time to

Market

None

Few

Many

All

68](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-68-320.jpg)

![Digital Investment

C10e. Estimate the PROPORTION of cloud and hosting providers that could deliver services to support the digital investment required for

these strategies [Lower Risk], based either on your own knowledge or what you heard?

11%

15%

19%

15%

14%

47%

42%

40%

42%

41%

38%

40%

36%

38%

43%

3%

4%

5%

Focus on reducing Cybersecurity attacks (n=186)

Identify threats in business exposure or competition

(n=241)

Analytics to recognize risks sooner (n=217)

Minimize risk making decisions with data (n=177)

Building Digital Trust competencies (n=162)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

% of Respondents

Proportion of Providers Can Support Digital Investment to Lower Risk

None

Few

Many

All

69](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-69-320.jpg)

![Digital Transformation

C15. What is the level of your organization's commitment to implementing digital/online operations for each of the

following business functions? (Randomize) Rate on a scale of 0-10 where 0 = Not at all Committed and 10 = Completely

Committed. [TOP BOX RATING OF 8-10]

67%

66%

64%

63%

73%

72%

71%

70%

54%

52%

51%

45%

60%

59%

54%

56%

78%

80%

68%

72%

66%

54%

49%

54%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Customer service/support

Sales

Marketing

Automated internal business

workflows

% TOP BOX (More Committed - ratings 8 thru 10)

Commitment to Implementing Digital/Online Operation by Region

Total (n=1502)

NA (n=844)

WE (n=271)

APAC (n=265)

LA (n=81)

MEA (n=41)

Note:

‘Straightline”

responses

removed.

73](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-73-320.jpg)

![Digital Transformation

C16c. How important are each of the following for your organization's digital innovation strategy over the next five years?

Rate on a 0-10 scale where 0 = Not at all important and 10 = Extremely Important. (Randomize) [TOP BOX RATING OF 8-10]

72%

72%

65%

63%

79%

78%

72%

70%

62%

63%

50%

48%

62%

59%

57%

58%

81%

82%

81%

68%

74%

77%

49%

58%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Engaging Customers

Optimizing Business Operations

Empowering employees

Transforming Products

% TOP BOX (More Important - ratings 8 thru 10)

Importance to Digital Innovation Strategy by Region

Total (n=1573)

NA (n=870)

WE (n=310)

APAC (n=278)

LA (n=72)

MEA (n=43)

Note:

‘Straightline”

responses

removed.

75](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-75-320.jpg)

![Digital Transformation: Optimizing Business Operations

C17. Rate the level of investment in the following technologies needed over the next 5 years to meet your

organization's business goals: 0 = No investment, 10= Significant Investment (Randomize) [TOP BOX RATING OF 8-10]

66%

65%

65%

64%

62%

61%

57%

56%

56%

55%

55%

53%

51%

49%

49%

49%

48%

0% 10% 20% 30% 40% 50% 60% 70%

Cybersecurity protection

Mobile platforms and applications

Customer experience management systems

Data integration across multiple lines of business &…

Data mining and analytics

Agile software development processes for fast feedback

Social-media enabled business process

Sensor-based technology

Governance/regulatory tools

Serverless computing

Machine learning

Artificial intelligence

Robotics

Containers

Wearables

Nanotechnology

3D printing

% TOP BOX (More Investment - ratings 8 thru 10)

Technology Investment Ratings

Note: “Straightline” responses removed.n=1731

76](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-76-320.jpg)

![Digital Transformation: Digital Skills

C18. How capable are staff in the following groups at your organization in understanding how digital technologies could

transform your business? 0=not at all capable, 10=very capable (Randomize) [TOP BOX RATING OF 8-10]

76%

68%

67%

62%

62%

59%

80%

75%

75%

71%

71%

66%

67%

55%

49%

43%

48%

45%

68%

59%

57%

53%

49%

51%

88%

72%

80%

78%

62%

53%

72%

57%

79%

60%

64%

62%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

IT

Security

Executive team

Line of Business

Support functions: HR, Finance

Legal

% TOP BOX (More Capable - ratings 8 thru 10)

Staff Capability to Understand Digital Technology Transformation by Region

Total

(n=1639)

NA (n=900)

WE (n=310)

APAC (n=297)

LA (n=85)

77](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-77-320.jpg)

![Digital Transformation – IT Service Providers

T7. Please rate the strategic importance of IT service providers for this digital transformation project. [% TOP BOX RATING (More

Strategic 8 thru 10)]

77%

61%

63%

60%

71%

67%

LA (n=92)

APAC

(n=276)

MEA (n=46)

WE (n=285)

NA (n=847)

Total

(n=1546)

90](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-90-320.jpg)

![Digital Transformation

T9a. Considering all the IT skill sets required for successful completion of this digital transformation project, allocate 100 points among the following

capabilities. [Rating Displayed as MEAN]

64%

79%

80%

81%

94%

52%

59%

59%

60%

70%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Orchestrati

on

Integration

Hardware

Manageme

nt

Software

Total (n=1546)

NA (n=847)

WE (n=285)

MEA (n=46)

APAC (n=276)

LA (n=92)

96](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-96-320.jpg)

![Digital Transformation - Managed Services

X1. Thinking about the managed services you are currently using / planning to use, rate the impact of these services on

your organization’s ability to do the following. Use a 0 to 10 scale where 0 = No Impact and 10 = Significant Impact. [% TOP

BOX RATING (Most Impactful 8 thru 10)]

63%

64%

66%

71%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Empower your

employees

Transform your

products

Engage your customers

Optimize your

operations

Total (n=1707)

NA (n=936)

WE (n=321)

MEA (n=47)

APAC (n=309)

LA (n=95)

107](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-107-320.jpg)

![Digital Transformation – Business Goals

X2. Still thinking about the managed services you are currently using or planning to use rate the role of these

services have/had in accomplishing the following business goals, using a 0 to 10 scale where 0 = Not at All

Important and 10 = Extremely Important.[% TOP BOX RATING (Most Important 8 thru 10)]

68%

67…

67%

73%

74%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Lower costs

Speed time to market

Lower risk

Increase revenue

Improve product or service

quality

Total (n=1707)

NA (n=936)

WE (n=321)

MEA (n=47)

APAC (n=309)

LA (n=95)

108](https://image.slidesharecdn.com/2017microsofthostingandcloudstudy-170412003031/85/2017-Microsoft-hosting-and-cloud-study-108-320.jpg)