The document provides an audit report of the accounts of the Government of Ekiti State, Nigeria for the year ended December 31, 2017. It summarizes that actual revenue was N69.3 billion against a budgeted revenue of N101 billion, resulting in a deficit of N5.1 billion. Recurrent revenue was N56.8 billion, achieving 69% of budget. Capital receipts were N12.5 billion, achieving 65% of budget. The report makes recommendations to improve budgeting accuracy and boost capital receipts.

![22

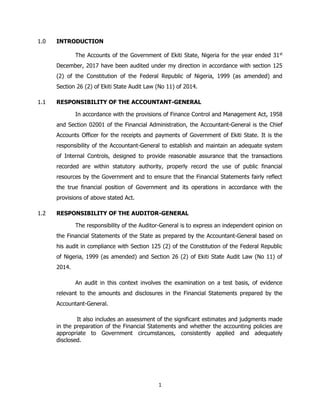

3.5.2 MDAS WITH BUDGETARY PROVISION WITHOUT ANY RELEASES

THROUGHOUT THE YEAR

(a) OVERHEAD COST

S/N HEAD MINISTRY/DEPARTMENT/AGENCY BUDGET

2017

N

ACTUAL

2017

N

BUDGET

VARIANCE

N

PERFORMANCE

%

1 459-1606 OFFICE OF THE SPECIAL ADVISER,GOVERNOR’S

OFFICE (GH&P)

2,535,586.89 - 2,535,586.89 -

2 459-0410 OFFICE OF PRIVATE SECRETARY TO GOVERNOR’S

OFFICE (GH&P)

1,020,507.05 - 1,020,507.05 -

3 459-5901 BOUNDARY TECHNICAL COMMITTEE (D-GOV) 5,669,483.62 - 5,669,483.62 -

4 459-1614 MAINTENANCE OF GOVERNOR’S LODGE 3,061,521.15 - 3,061,521.15 -

5 457-0300 GOVERNMENT PRINTING PRESS 1,700,845.09 - 1,700,845.09 -

6 459-2803 MONITORING AND SPECIAL AUDIT DEPARTMENT 2,000,000.00 - 2,000,000.00 -

7 459- MANAGEMENT SERVICE DEPT. (AG) 2,000,000.00 - 2,000,000.00 -

8 459-070 SUPERVISION AND MONITORING OF PROJECT (BPP) 2,000,000.00 - 2,000,000.00 -

9 451-0600 FADAMA PROJECT 2,000,000.00 - 2,000,000.00 -

3 451-0100 MINISTRY OF AGRICULTURE

AND RURAL DEVELOPMENT

189,000,000.00 8,713,600.00 180,286,400.00 4.61

4 459-3600 OFFICE OF ACCOUNTANT

GENERAL

200,000,000.00 36,314,276.05 163,685,723.95 18.16

5 454-0700 DIRECTORATE OF

INFORMATION

COMMUNICATION AND

TECHNOLOGY (ICT)

42,100,000.00 591,400.00 41,508,600.00 1.40

6 458-0500 OFFICE OF SURVEYOR-

GENERAL OF THE STATE

45,000,000.00 2,854,500.00 42,145,500.00 6.34

7 459-3100 BUDGET AND ECONOMIC

PLANNING[MIN.OF BUDGET]

2,435,151,532.75 428,800,000.00 2,006,351,532.75 17.61

8 458-0200 STATE HOUSING CORPORATION 80,000,000.00 867,000,00 79,133,000.00 1.08

9 454-0500 MINISTRY OF PUBLIC UTILITIES 101,000,000.00 2,270,000.00 98,730,000.00 2.25

10 455-0100 MINISTRY OF EDUCATION,

SCIENCE AND TECHNOLOGY

1,552,000,000.00 354,612,041.27 1,197,387,958.73 22.85

11 455-0500 BOARD FOR TECHNICAL AND

VOCATIONAL EDUCATION

545,250,000.00 89,383,564.53 455,866,435.47 16.39

12 456-0100 MINISTRY OF HEALTH 350,000,000.00 16,048,400.00 333,951,600.00 4.59

13 456-0400 PRIMARY HEALTH CARE

DEVELOPMENT AGENCY

55,000,000.00 3,300,000.00 51,700,000.00 6.00](https://image.slidesharecdn.com/2017auditorgeneralsreport-181106101822/85/2017-Auditor-General-s-Report-22-320.jpg)

![23

10 458-0300 PLANNING PERMIT AGENCY 2,000,000.00 - 2,000,000.00 -

11 455-0106 MONITORING OF PUBLIC SCHOOLS 2,721,352.14 - 2,721,352.14 -

12 457-0607 GOVERNMENT PUPILS IN CHILDREN HOME NURSERY

AND PRIMARY SCHOOL

3,000,000.00 - 3,000,000.00 -

13 455- SUBEB STAFF HOUSING LOANS BOARD 2,000,000.00 - 2,000,000.00 -

14 NEWLY CREATED MDAs 6,577,333.58 - 6,577,333.58 -

(b) TRANSFER TO OTHER FUNDS

(c) CAPITAL RELEASES TO MINISTRIES/DEPARTMENTS/AGENCIES

S/N HEAD MINISTRY/DEPARTMENT/

AGENCY

BUDGET

2017

N

ACTU

AL

2017

N

BUDGET

VARIANCE

N

PERFORMANC

E

%

1 459-2200 HOUSE OF ASSEMBLY SERVICE

COMMISION

20,669,483.62 - 20,669,483.62 -

2 457-0100 MINISTRY OF INFORMATION, SOCIAL

DEVELOPMENT SPORTS AND

CULTURE

16,441,502.49 16,441,502.49 -

3 459-2800 STATE AUDITOR-GENERAL’S OFFICE 10,000,000.00 - 10,000,000.00 -

4 459-1800 CHRISTIAN PILGRIMS BOARD 20,000,000.00 - 20,000,000.00 -

5 459-1900 MUSLIM PILGRIMS BOARD 25,000,000.00 - 25,000,000.00 -

6 459-3900 CIVIL SERVICE COMMISSION 2,267,793.45 - 2,267,793.45 -

7 459-4500 OFFICE OF PUBLIC DEFENDER 8,000,000.00 - 8,000,000.00 -

8 BUREAU OF TOURISM, ARTS AND

CULTURE

5,000,000.00 - 5,000,000.00 -

9 454-0200 JOB CREATION AND EMPLOYMENT

AGENCY

5,669,483.62 - 5,669,483.62 -

10 459-3200 BUREAU OF STATISTICS 10,000,000.00 - 10,000,000.00 -

11 457-0500 SPORTS COUNCIL 19,691,050.50 - 19,691,050.50 -

12 455-0400 SUBEB 2,000,000.00 - 2,000,000.00 -

S/N HEAD MINISTRY/DEPARTMENT/

AGENCY

BUDGET

2017

N

ACTUAL

2017

N

BUDGET

VARIANCE

N

PERFORMANCE

%

1 459-1500 OFFICE OF THE DEPUTY GOVERNOR 15,000,000.00 - 15,000,000.00 -

2 459-5400 EKITI STATE BOUNDARY

COMMISSION

2,600,000.00 - 2,600,000.00 -

3 458-1200 STATE EMERGENCY MANAGEMENT

AGENCY [SEMA]

12,500,000.00 - 12,500,000.00 -

4 459-0700 BUREAU OF PUBLIC PROCUREMENT

(BPP)

11,000,000.00 - 11,000,000.00 -

5 459-0500 OFFICE OF THE SECRETARY TO THE

STATE GOVERNMENT (SSG)

3,000,000.00 - 3,000,000.00 -

6 459-1200 POLITICAL AND INTER-PARTY

AFFAIRS[P&E]

2,500,000.00 - 2,500,000.00 -

7 459-5000 EKITI STATE STOMACH

INFRASTRUCTURE AGENCY

100,000,000.00 - 100,000,000.00 -](https://image.slidesharecdn.com/2017auditorgeneralsreport-181106101822/85/2017-Auditor-General-s-Report-23-320.jpg)