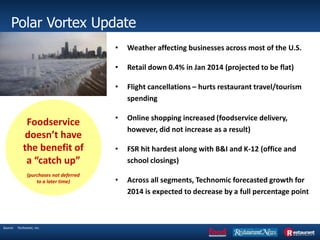

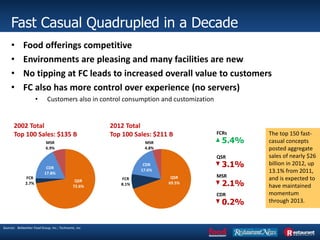

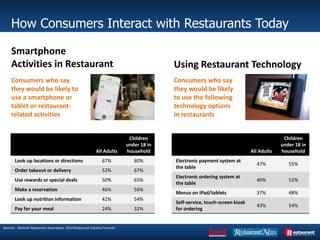

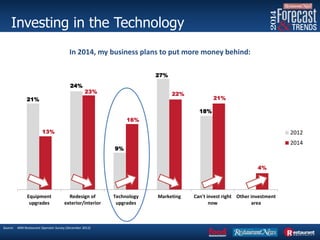

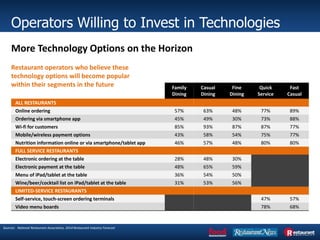

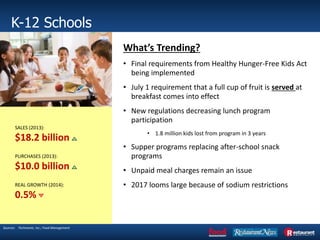

The document provides an overview of the 2014 foodservice industry and key trends. It notes that a polar vortex in early 2014 negatively impacted several segments due to weather-related closings and decreased travel. Fast casual restaurants have quadrupled in sales over the past decade due to competitive food and no-tipping models. The use of smartphones and technology is growing rapidly in the industry, with many operators planning investments in online ordering, mobile payment, and digital menus. The future may see more interactive technologies used at tables and counters. The K-12 school foodservice segment faces ongoing challenges around new nutrition regulations and decreasing lunch program participation.