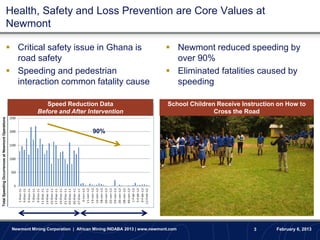

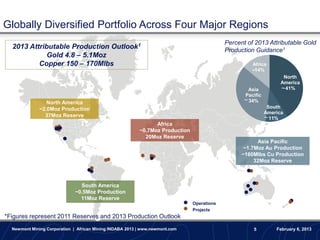

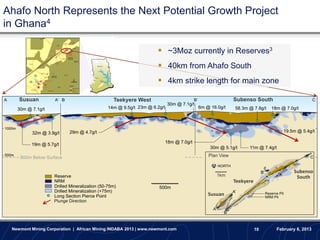

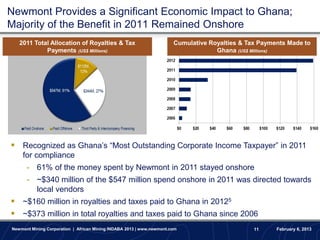

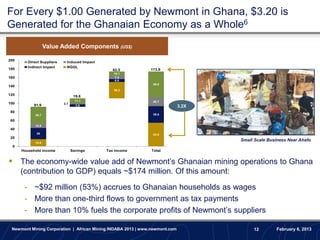

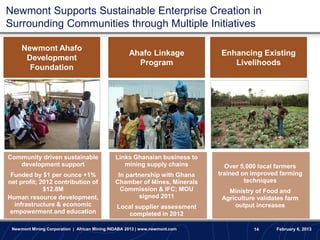

This document contains a presentation from Newmont Mining Corporation's Senior Vice President for Africa Operations given at the African Mining INDABA conference in February 2013. The presentation discusses Newmont's operations and growth opportunities in Africa, including startup of the Akyem mine in late 2013 and an expansion at the Ahafo mine with potential to increase production by 150-200koz of gold annually. It also summarizes Newmont's commitment to health, safety, and returning capital to shareholders.