2013 BioBuzz Employment Report Final

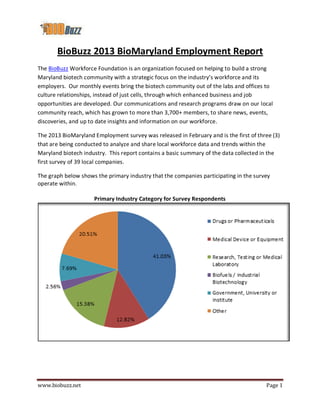

- 1. www.biobuzz.net Page 1 BioBuzz 2013 BioMaryland Employment Report The BioBuzz Workforce Foundation is an organization focused on helping to build a strong Maryland biotech community with a strategic focus on the industry’s workforce and its employers. Our monthly events bring the biotech community out of the labs and offices to culture relationships, instead of just cells, through which enhanced business and job opportunities are developed. Our communications and research programs draw on our local community reach, which has grown to more than 3,700+ members, to share news, events, discoveries, and up to date insights and information on our workforce. The 2013 BioMaryland Employment survey was released in February and is the first of three (3) that are being conducted to analyze and share local workforce data and trends within the Maryland biotech industry. This report contains a basic summary of the data collected in the first survey of 39 local companies. The graph below shows the primary industry that the companies participating in the survey operate within. Primary Industry Category for Survey Respondents

- 2. www.biobuzz.net Page 2 This survey was sent out to Executives and HR personnel at Biotech and Life Science companies throughout the region and was completed by people in the following roles. 41% HR Executive/Director/Manager 23% Executive /CxO 15.3% HR Specialist/Associate/Recruiter 10.2% Operations Director/Manager 10.2% Other The following is a brief analysis and summary of the survey results. I more detailed and comprehensive report will be released this later this year once the remaining surveys and data have been collected and analyzed. This report focuses on employment trends and related business factors for companies within the biotech industry. What type of growth are companies in the Bio industry experiencing? Of the companies polled, 61.3% grew their full time workforce last year in 2012 and 35.7% of companies grew by greater than 10% in 2012. While a majority (51.1%) hired up to 25 new employees last year, more than a quarter of companies (28.1%) hired over 25 people last year. In comparing last year to 2013 expectations, on the low growth side the number of companies that expect to hire between 1-25 people dropped by more than 15 points to 35.8%. However, on the high growth end there was an increase showing that 35.8% expect to hire over 25 people this year; a 7.7% swing upwards. This may reflect the tightening of available Federal research money which has a higher impact on early stage, smaller companies who are more likely to show lower growth numbers between 1-15 people per year. This apparent slowdown is further evident when you examine the companies who didn’t hire at all last year and don’t plan to make any new hires this year. Last year 15.3% of companies hired zero new employees, and that number nearly doubles to 28.2% who do not expect not to hire any new employees in 2013. As we look into what jobs are most in-demand in 2013, R&D and Sales & Marketing jobs are expected to see the greatest growth within biotech. Other categories that topped the list included Clinical & regulatory, Quality and then Manufacturing Operations (in that order). This survey also explored the experience level of the employee who will be in most demand in 2013, and the findings show that companies are expecting to see the greatest growth of new hires amongst ‘experienced’ individual contributors, and then followed by entry level college graduates. Conversely, the lowest expected growth category was non-degreed or tech school entry level hires.

- 3. www.biobuzz.net Page 3 What is hiring technical workers like for Bio companies? The top three resources used to hire technical/scientific employees were (1) LinkedIn/social media, (2) employee referrals and then (3) online job adds. In fact, LinkedIn and employee referrals were responsible for approximately 53% of all new hires last year. Third party recruiting firms and online resume databases (bioscpace, careerbuilder, monster, etc) rounded out the top 5 resources and each accounted for about 20% of new hires in 2012. Respondents found that Clinical, Regulatory and R&D (in that order) were the most difficult skill areas for them to hire qualified workers for. Administrative, Accounting and Finance, and Manufacturing (in that order) were the easiest positions for companies to hire for. Most companies (38.4%) found that it takes greater than 3 months to hire qualified technical employees, and some (10.2%) found that it takes on average as long as between 6-9 months to make a qualified technical hire. However, the greatest majority of companies found that it takes about 2 months on average to do so, while a few companies (10.2%) are able to make those hires in less than 1 month. Though many factors probably influence those time frames, we’ll try to find out what factors are most responsibly for improving hiring times and share those in a later report. While a majority of companies, 58.9%, feel that the workforce in Maryland is both qualified and available to access for job opportunities; 17.9% found that though they were qualified they were not available. We found that 76.8% of companies find the Maryland workforce to be ‘qualified’ and most of them (58.9%) felt that they were relatively available when seeking to hire; however, 17.9% felt that the workforce was unavailable for new jobs. Only 10.1% felt that the workforce in MD was unqualified. So, what can be done to improve that 10% of unqualified workers? The companies surveyed ranked the following initiatives in order of importance for improving our biotech workforce; 1. Improved workforce/industry specific skills training programs for graduates/post docs 2. Improved workforce/industry specific skills training programs for undergraduates 3. Greater access to mentor or internship programs for students 4. Improved 4 year degree programs 5. Certificate training programs (pmp, CSO, Clinical Trial, etc) 6. Improved workforce/industry specific skills training programs for unemployed workers 7. Greater emphasis on K-12 STEM education 8. Improved trade school or 2 year degreed programs

- 4. www.biobuzz.net Page 4 What resources are available for Bio companies in Maryland? Many life science and biotech companies rely on support from State and Federal programs, especially to navigate the early hurdles of an early stage company. Maryland offers dozens of assistance programs that are aimed to help companies in the biotech industry and is one of the reasons that Maryland is a location of choice for so many. In closing, we wanted to examine how companies were utilizing the available programs and also help make those resources known to companies who may not yet be aware of them. Here is what we found. Which state related assistance programs are being utilized? 10 Companies (25.6%) have utilized the R&D Tax Credit 7 Companies (18%) have used the Biotechnology Investor tax credit 5 Companies (12.8%) have utilized TEDCO 4 Companies (10%) have utilized the state jobs growth tax credit 3 Companies (7.6%) have utilized the MD Venture Fund 3 Companies (7.6%) have utilized subsidized tickets to educational or networking events through BioMaryland Center 2 Companies have utilized the Maryland Biotechnology Center Commercialization/Translational Research award 1 Company has used the Business Plan feedback from the BioMaryland Center 1 Company has used the Market Research Database from the BioMaryland Center About the BioBuzz Employment Reports: This information represents a summary of the first of three surveys that are being conducted this year. A final, comprehensive report that includes the findings from all three surveys will be released later this Fall. Please keep an eye out for the second survey and we greatly appreciate your help in sharing the survey with others to help us gather the most detailed and accurate data to present. If you have additional information that you would like to contribute, comments about the report and its findings, or would like to learn about opportunities to volunteer with or get involved with the BioBuzz Workforce Foundation, please email Chris Frew at chris@biobuzz.net or Andy Eckert at eckertae@biobuzz.net To make sure that you are included in the future reports, and to stay informed about BioBuzz and our monthly networking events, please visit us online (www.biobuzz.net) to sign up for our mailing list and join our LinkedIn group.

- 5. www.biobuzz.net Page 5 SURVEY SPONSORS: A special thanks to all of our sponsors whose support and efforts helped us to collect responses from so many companies and deliver these insights. Learn more about all of our sponsors below. BioMaryland Center: www.bio.maryland.gov JHU Montgomery County Campus: www.mcc.jhu.edu WeWorkForHealth: www.weworkforhealth.org/maps/MD Tech USA: www.techusa.net Human Resources Bioscience Alliance: www.hrbioalliance.org

- 6. www.biobuzz.net Page 6 PARTICIPATING BIOTECH COMPANIES Below is a list of the many Biotech companies that participated in the BioMaryland Employment Survey. Survey data was collected in a manner as to respect the privacy of individual companies responding so that only aggregate data could be analyzed. Thank you for all who participated. ABL Inc. Aeras BioMarker Strategies Chiesi Pharmaceuticals Inc. ClinicalRM Emergent Biosolutions Federation of Families for Children's Mental Health Fina BioSolutions Intrexon KPL, Inc. Medimmune MSD Noxilizer Otsuka Pharmaceutical QIAGEN Shimadzu Scientific Instruments Sigma-Tau Pharmaceuticals, Inc. SNBL Sucampo Pharmaceuticals Supernus Pharmaceuticals terumo medical corp United Therapeutics US Pharmacopeia Vaxin, Inc Viracor IBT - formerly Cylex Wellstat Zyngenia