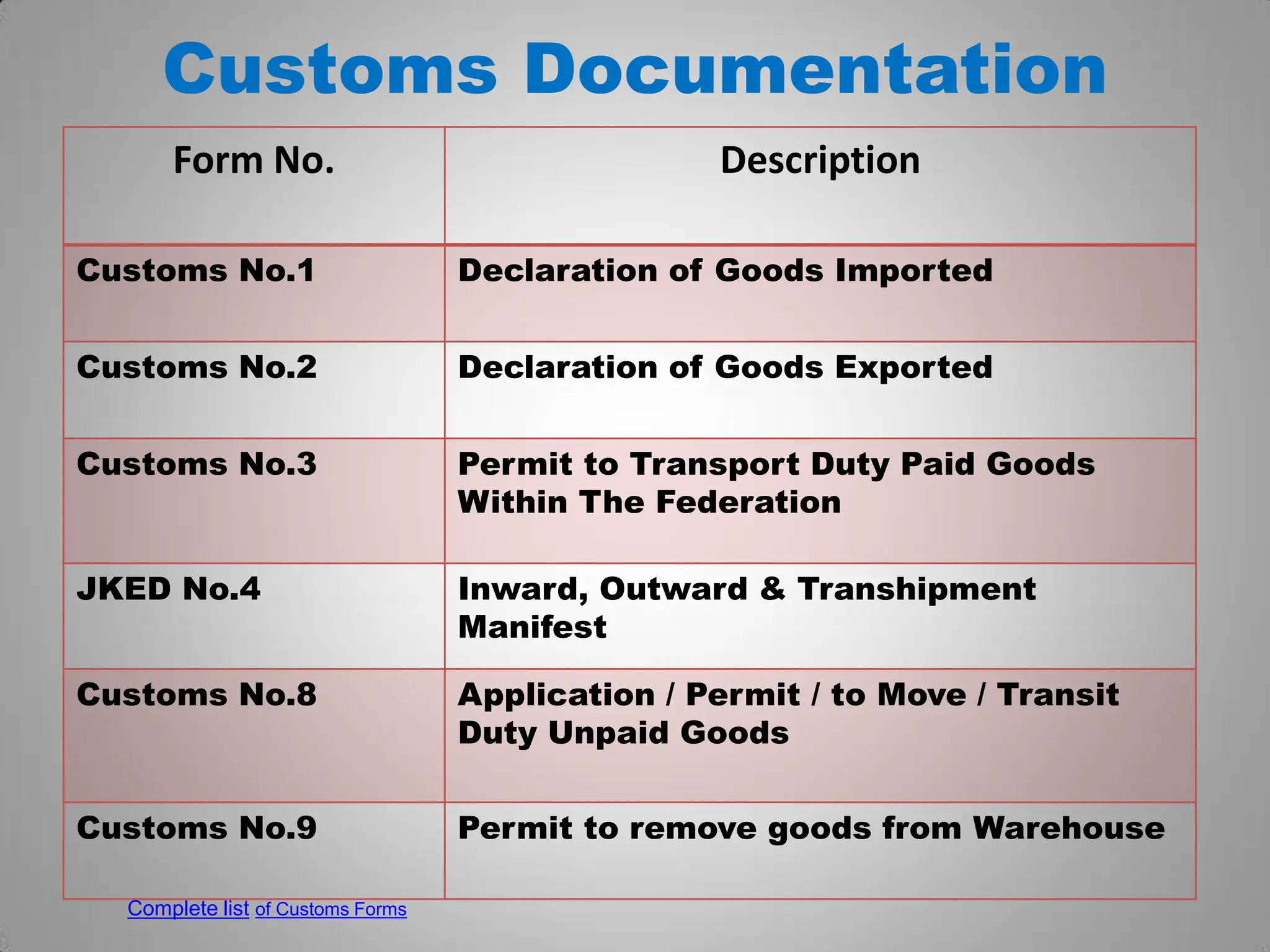

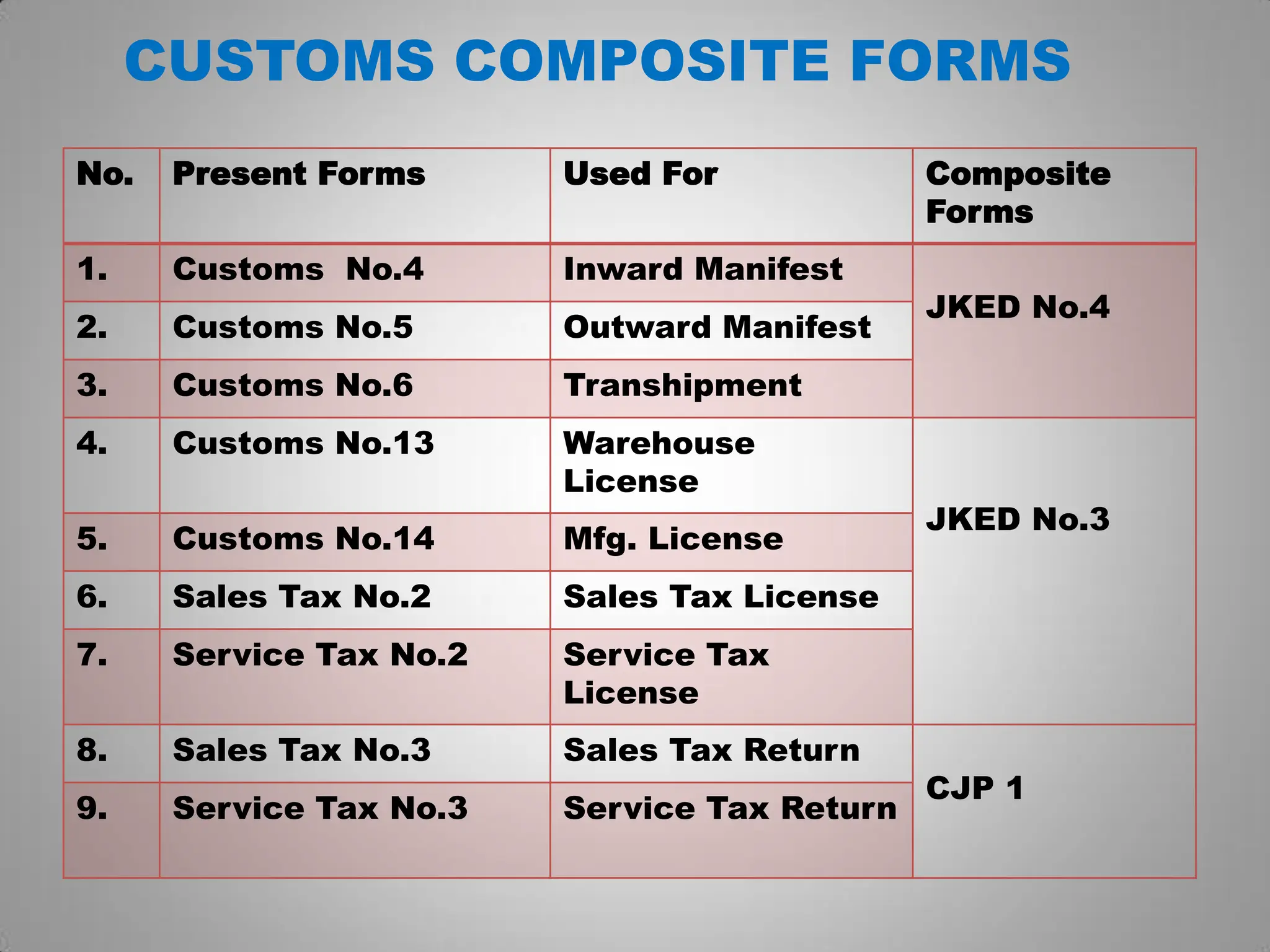

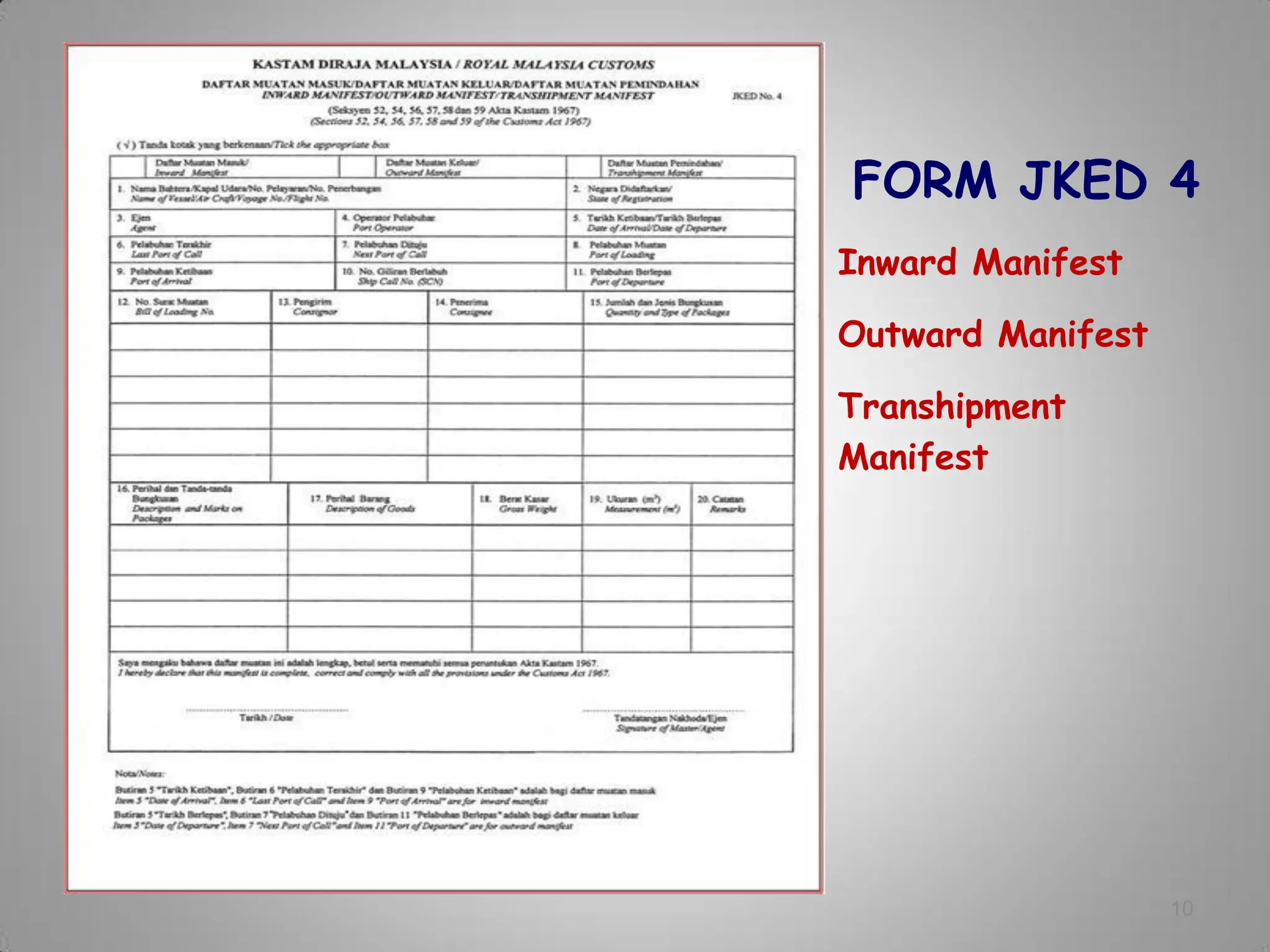

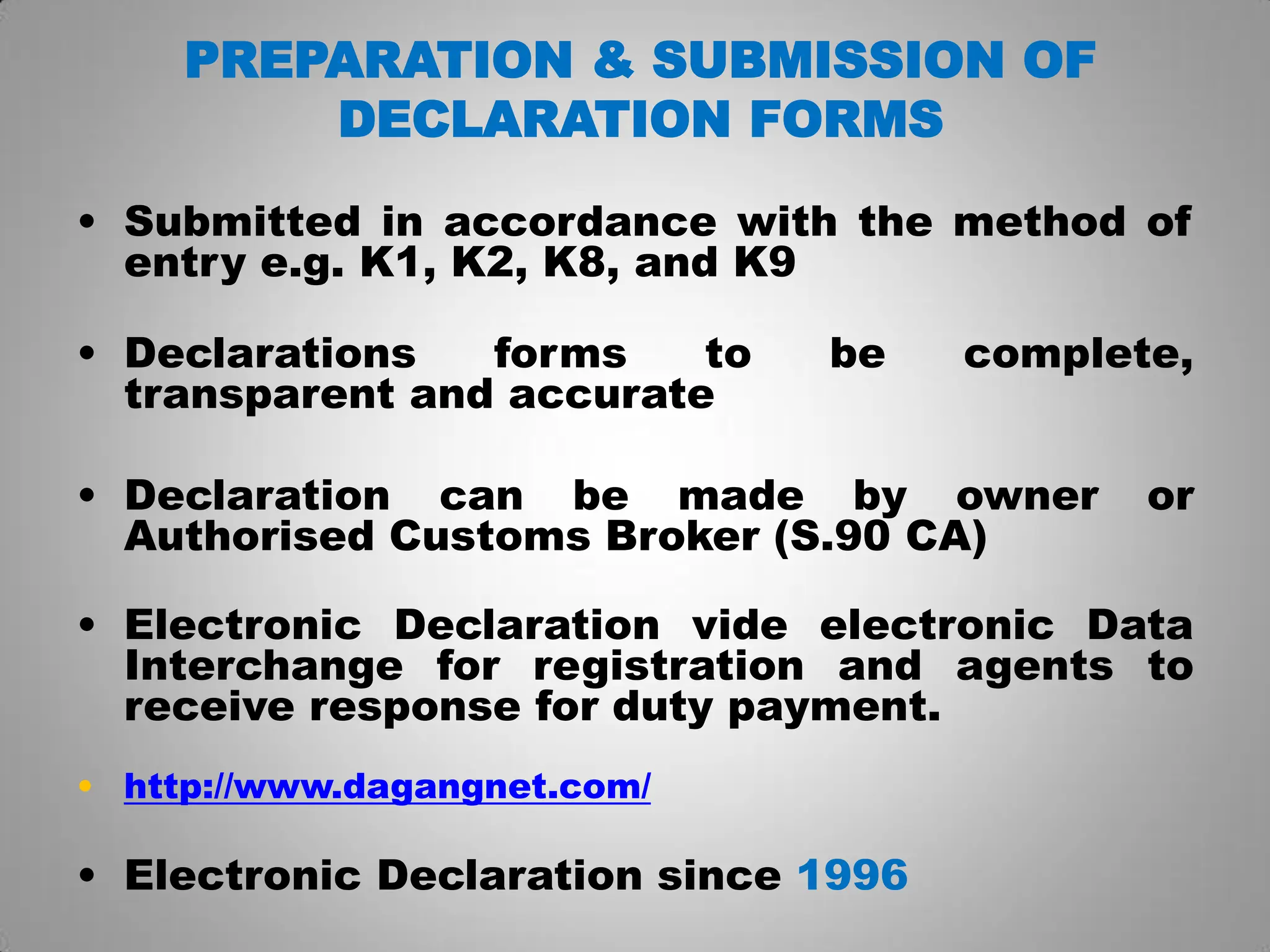

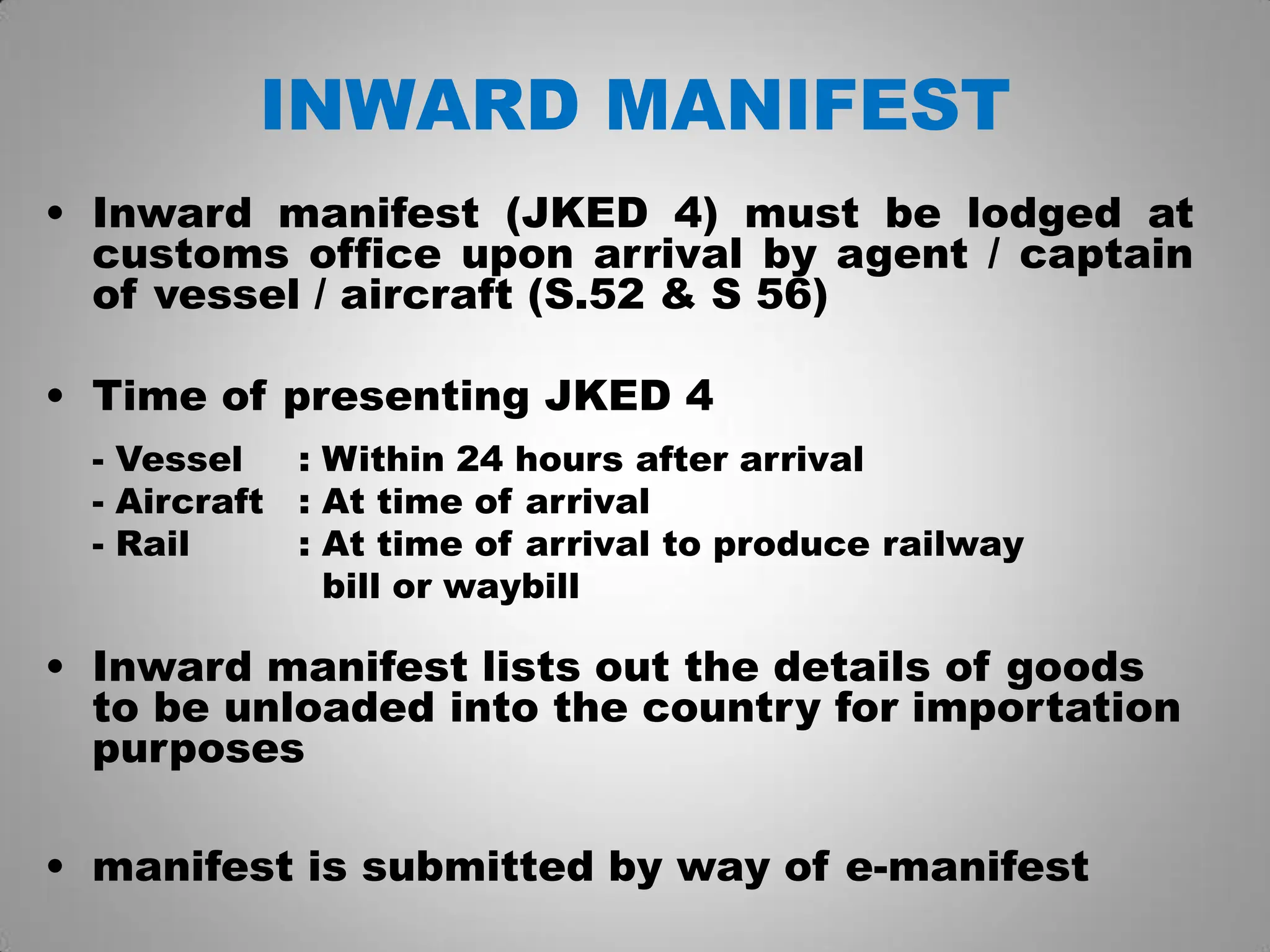

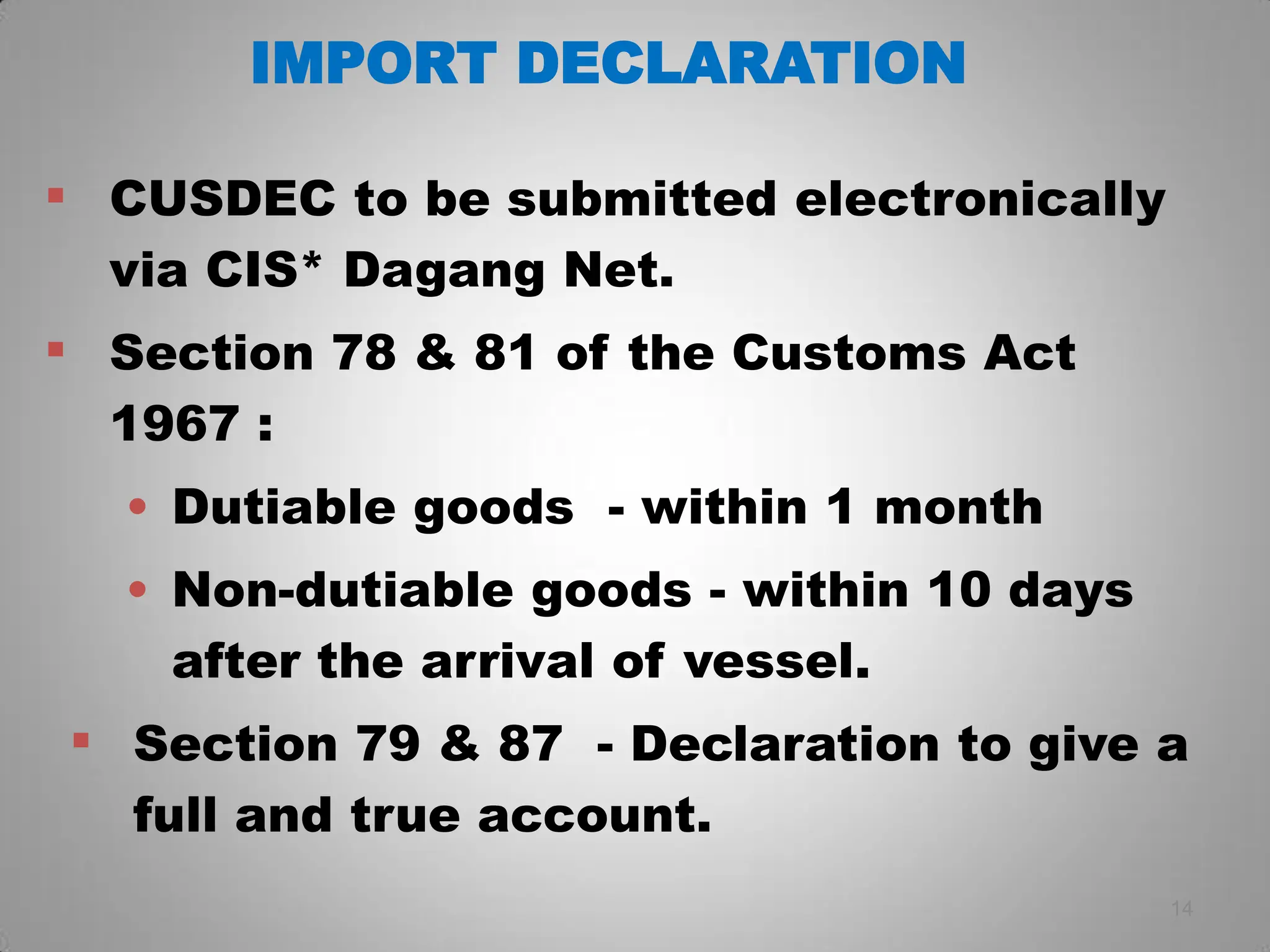

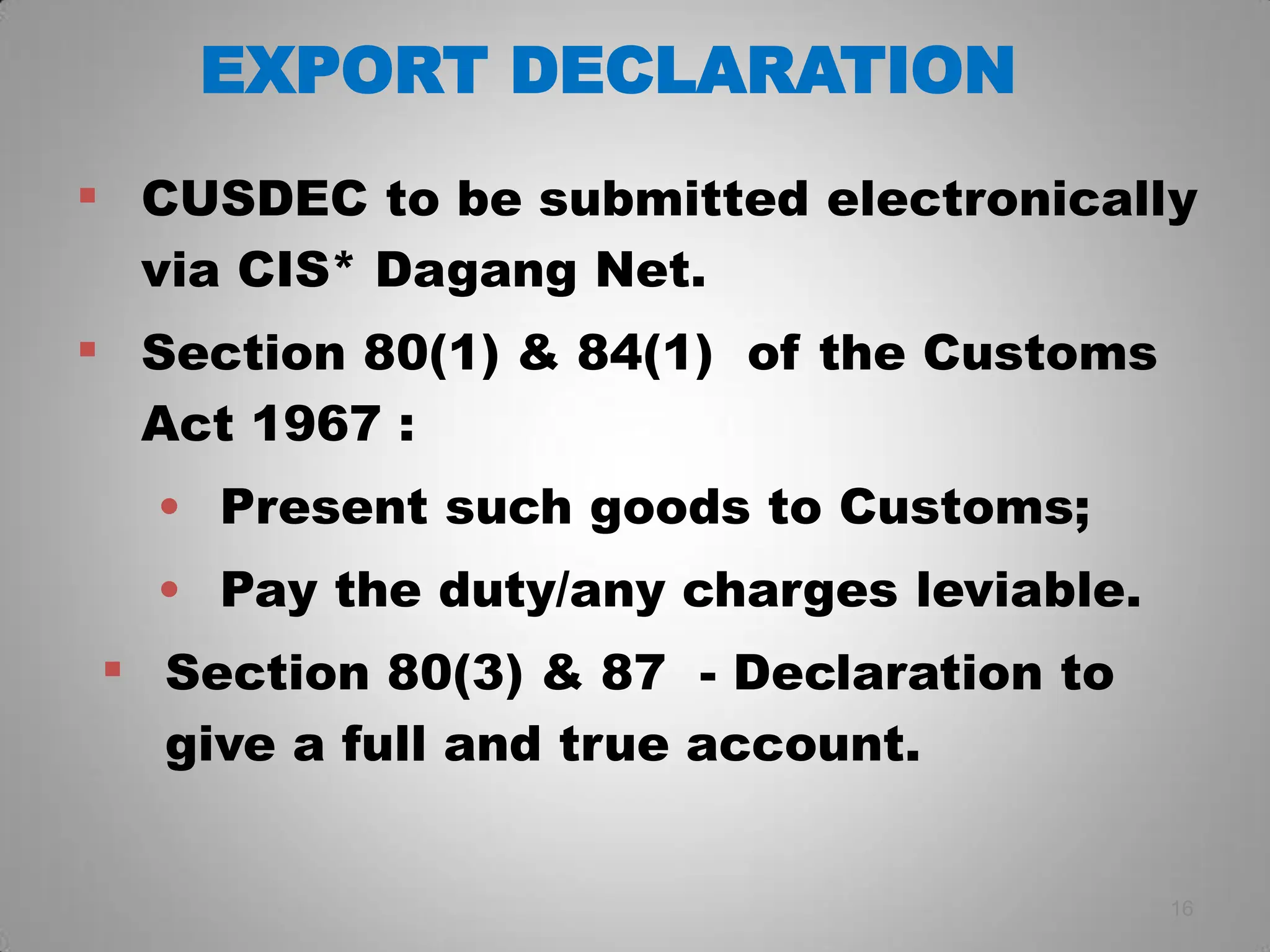

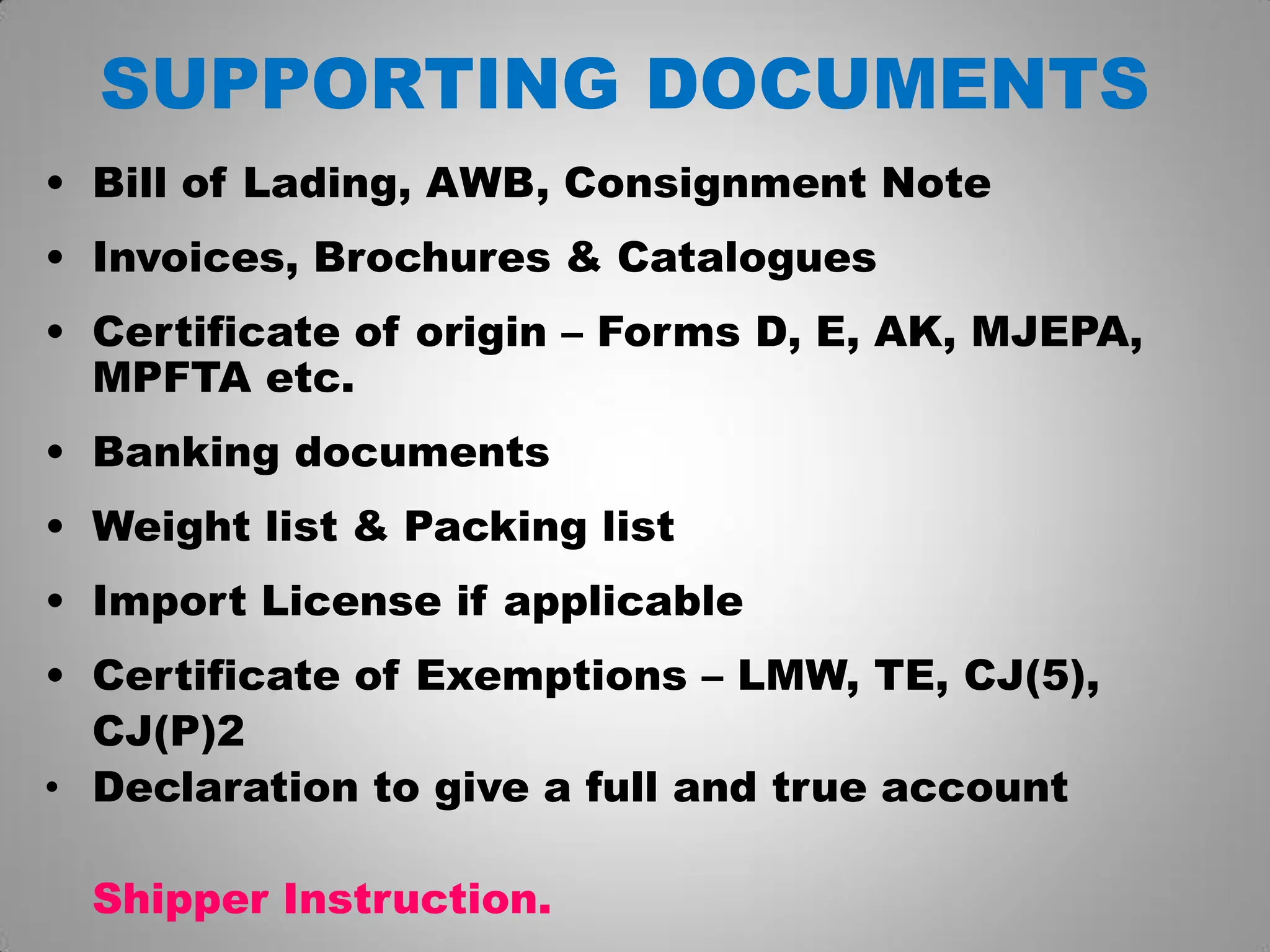

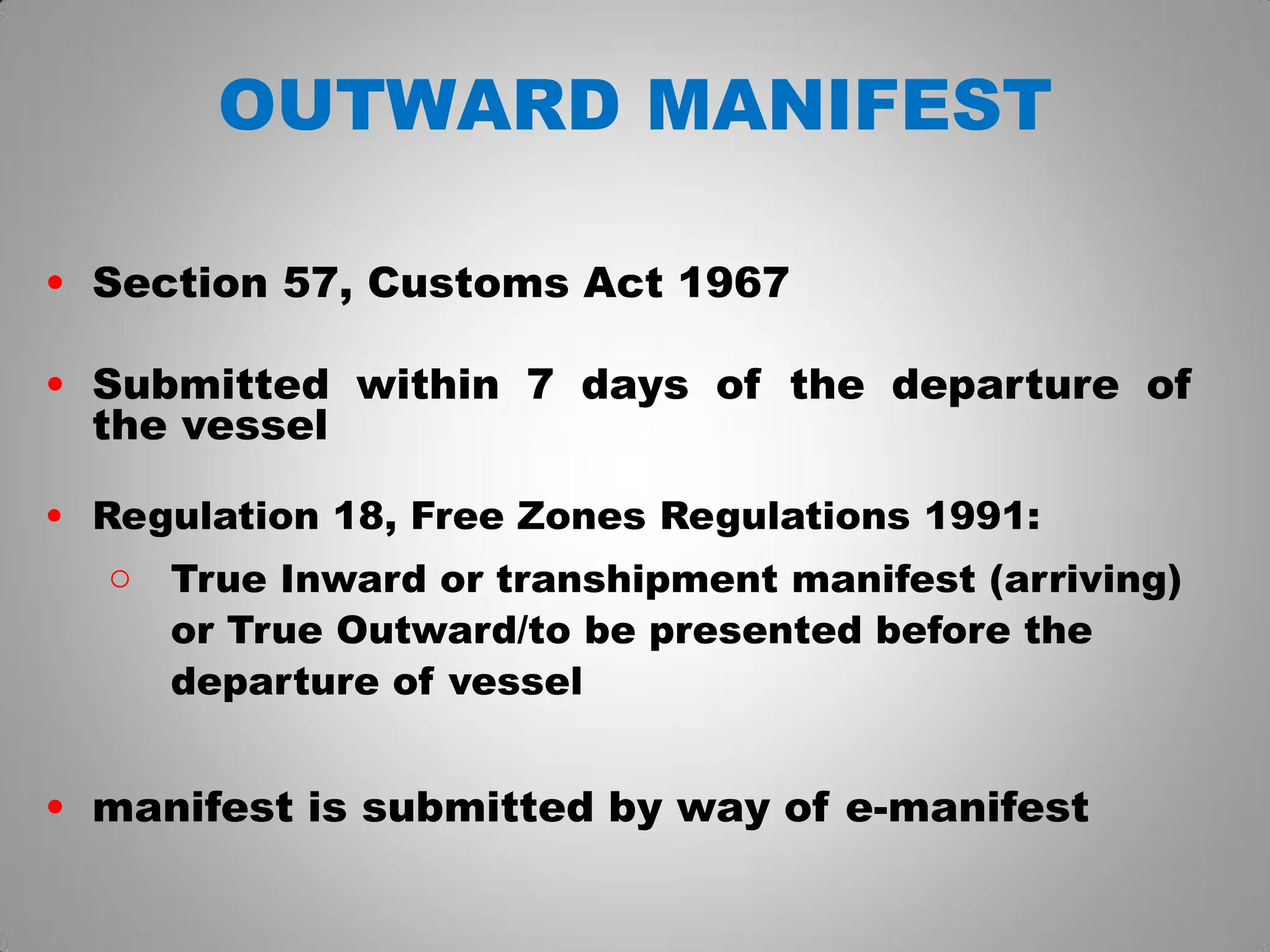

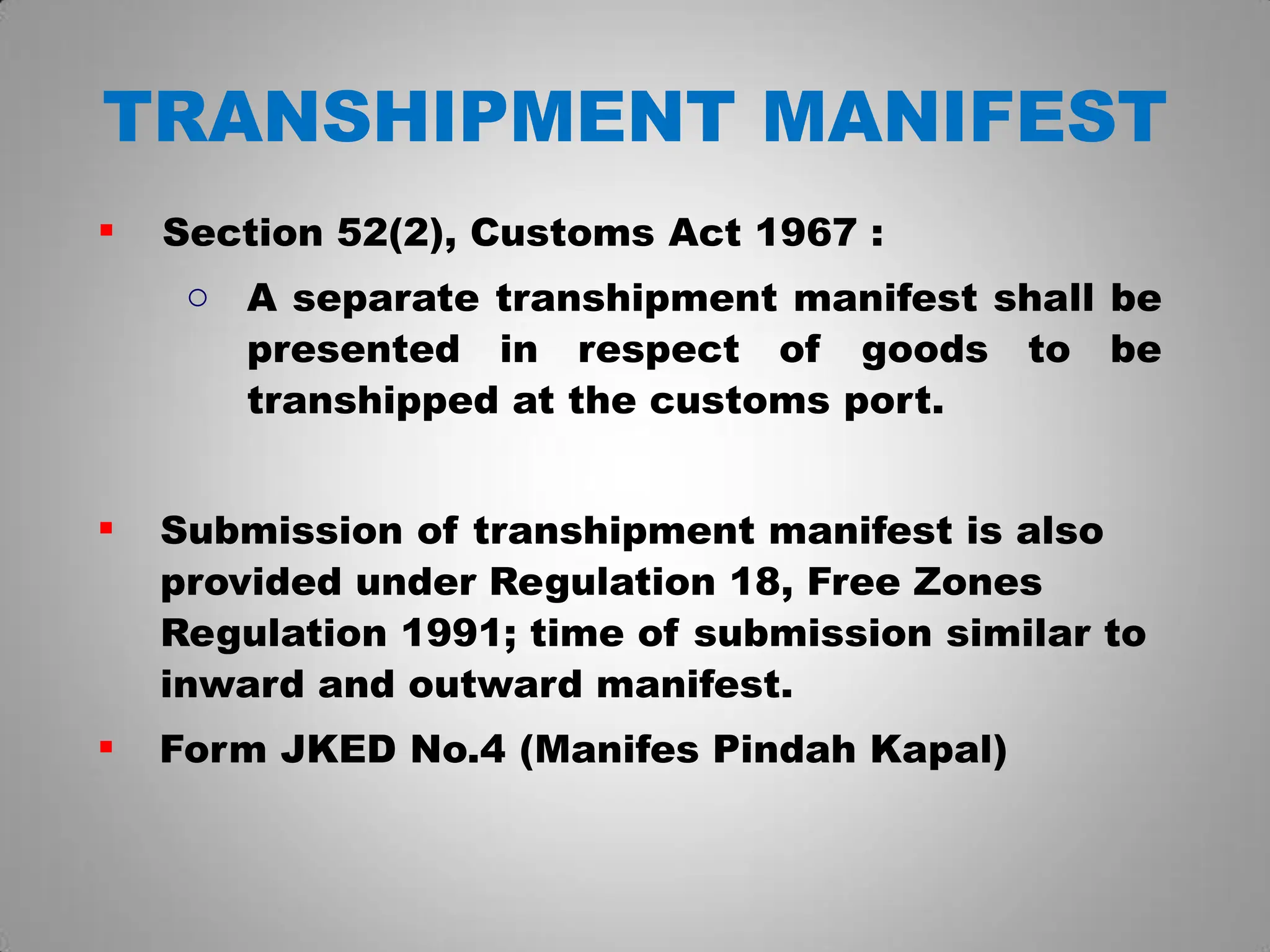

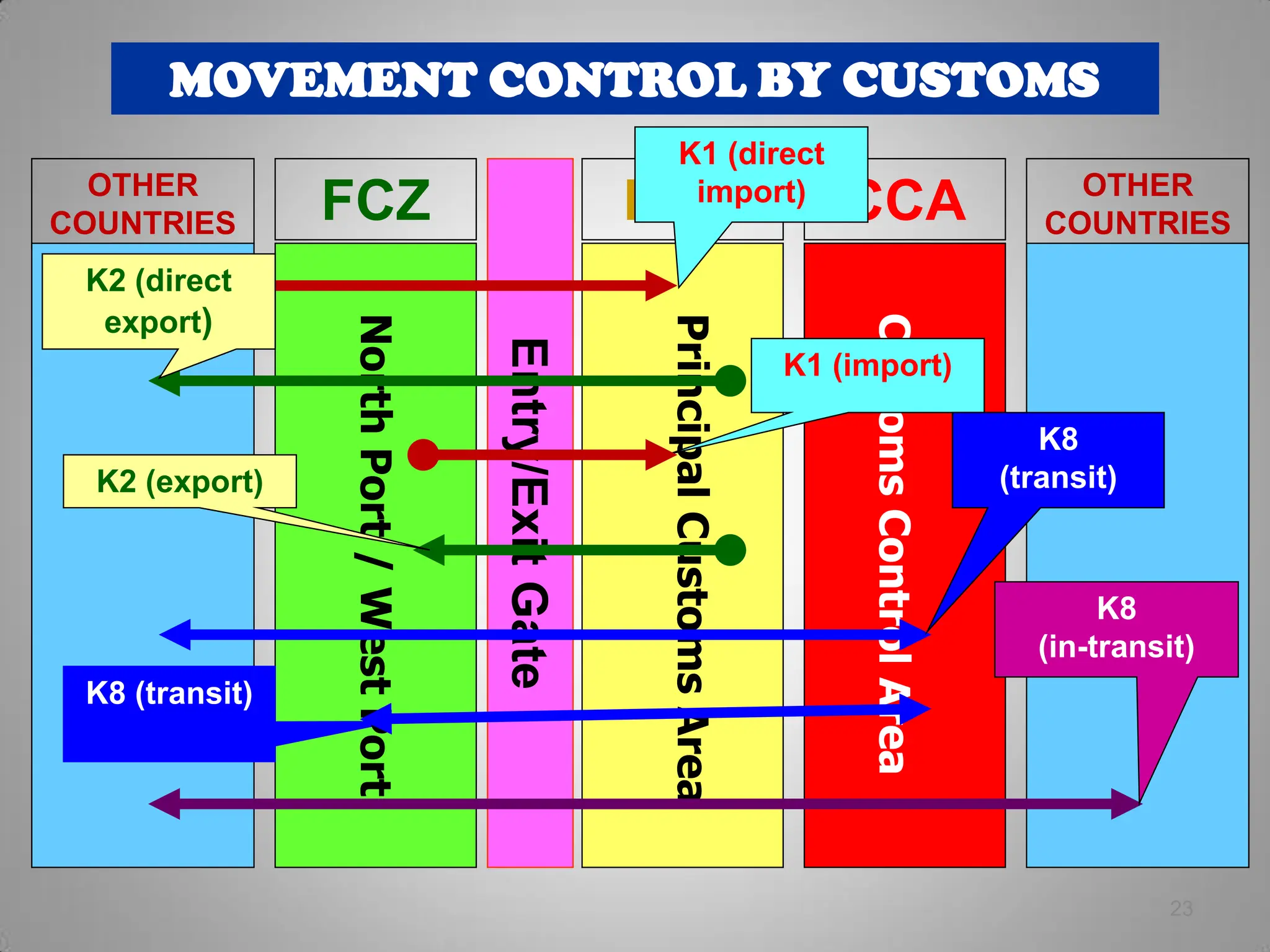

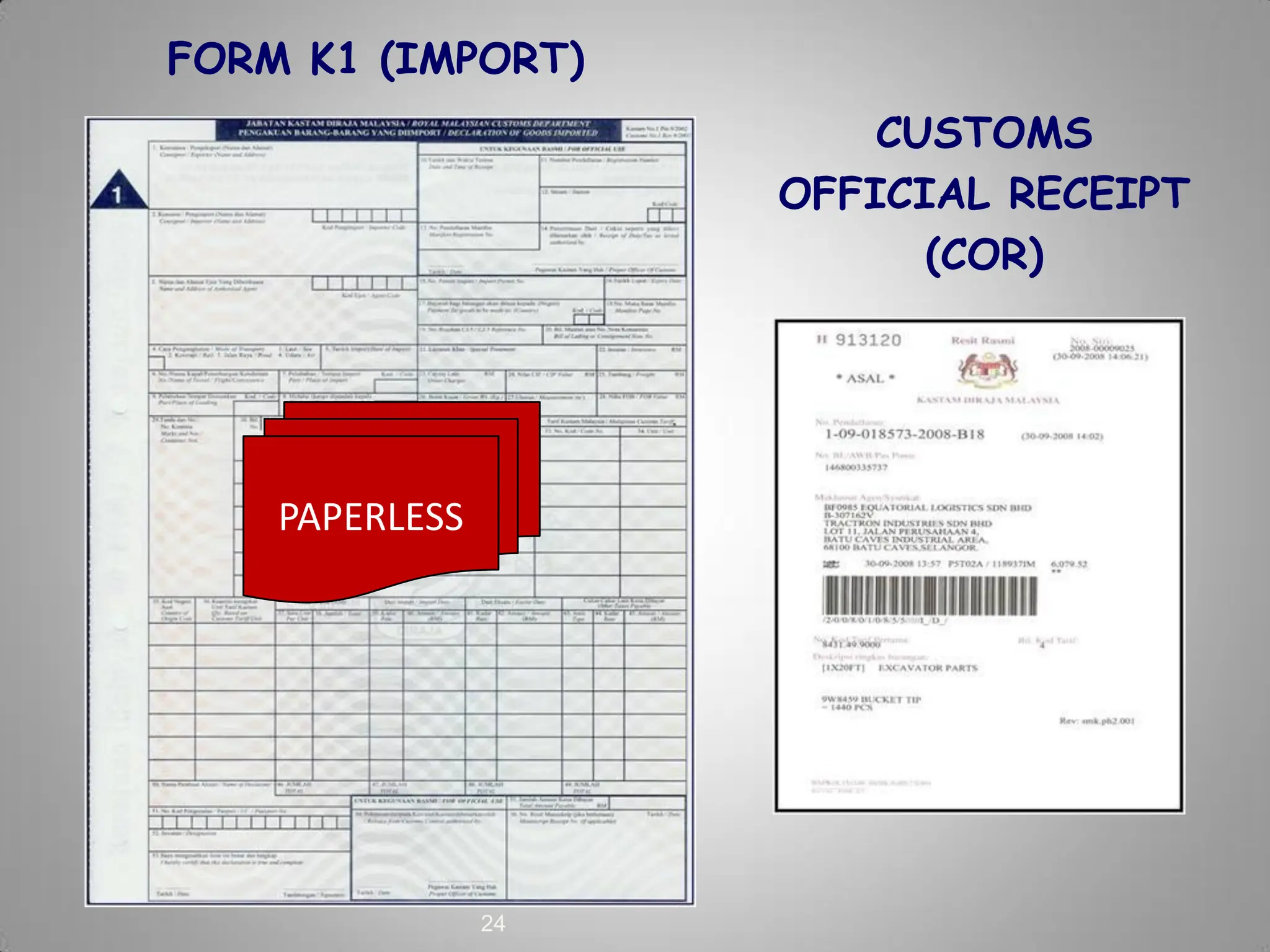

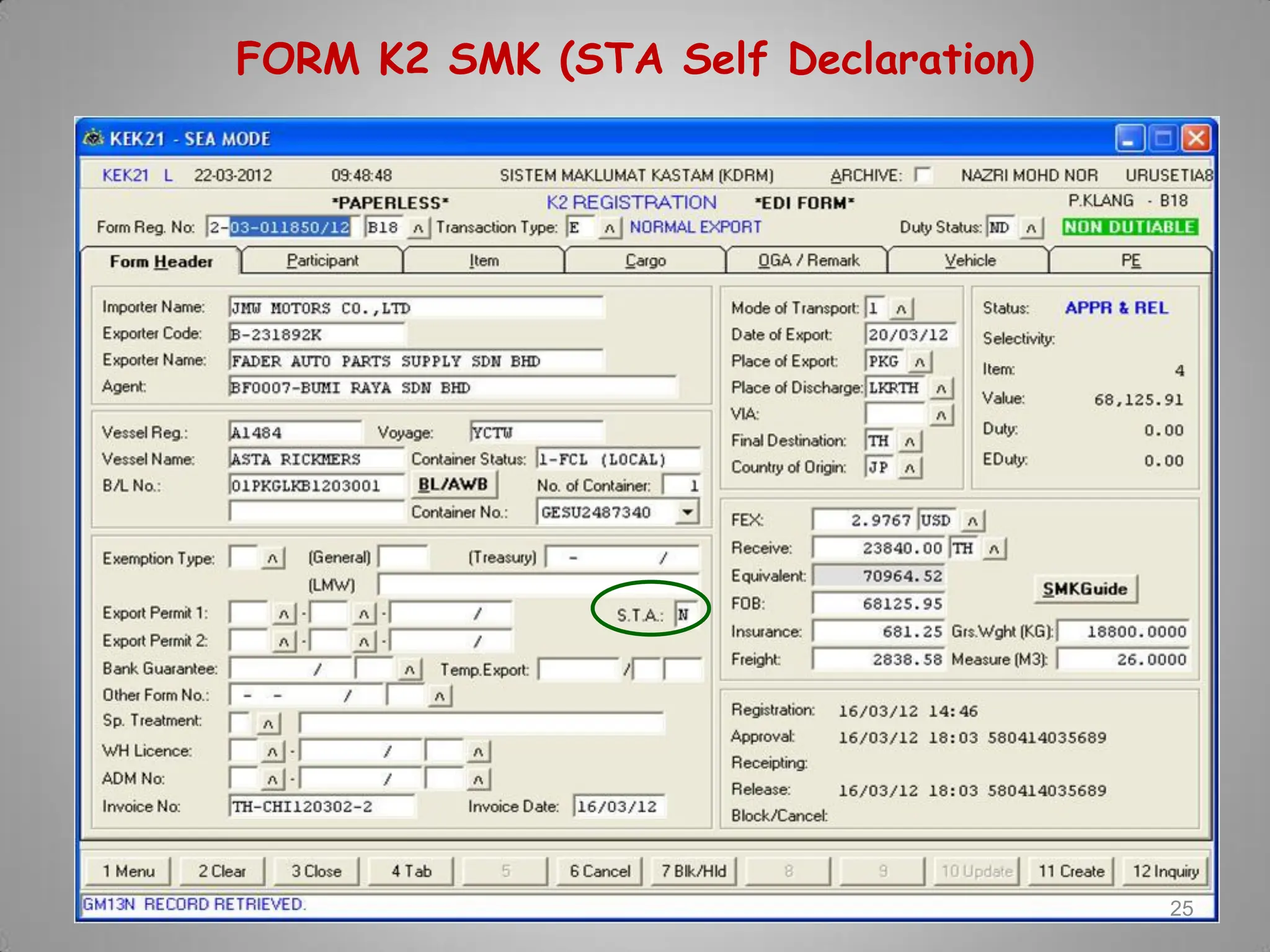

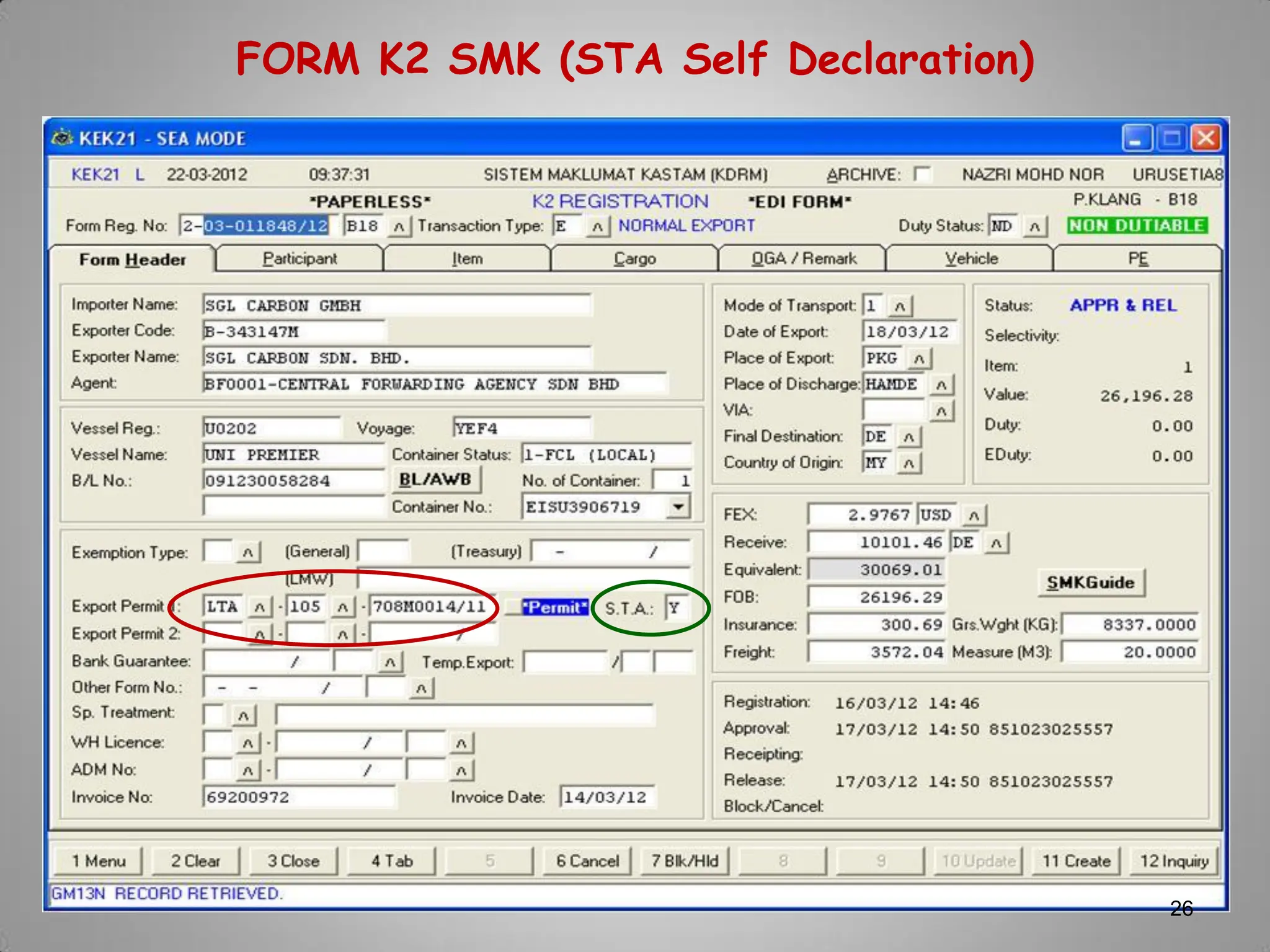

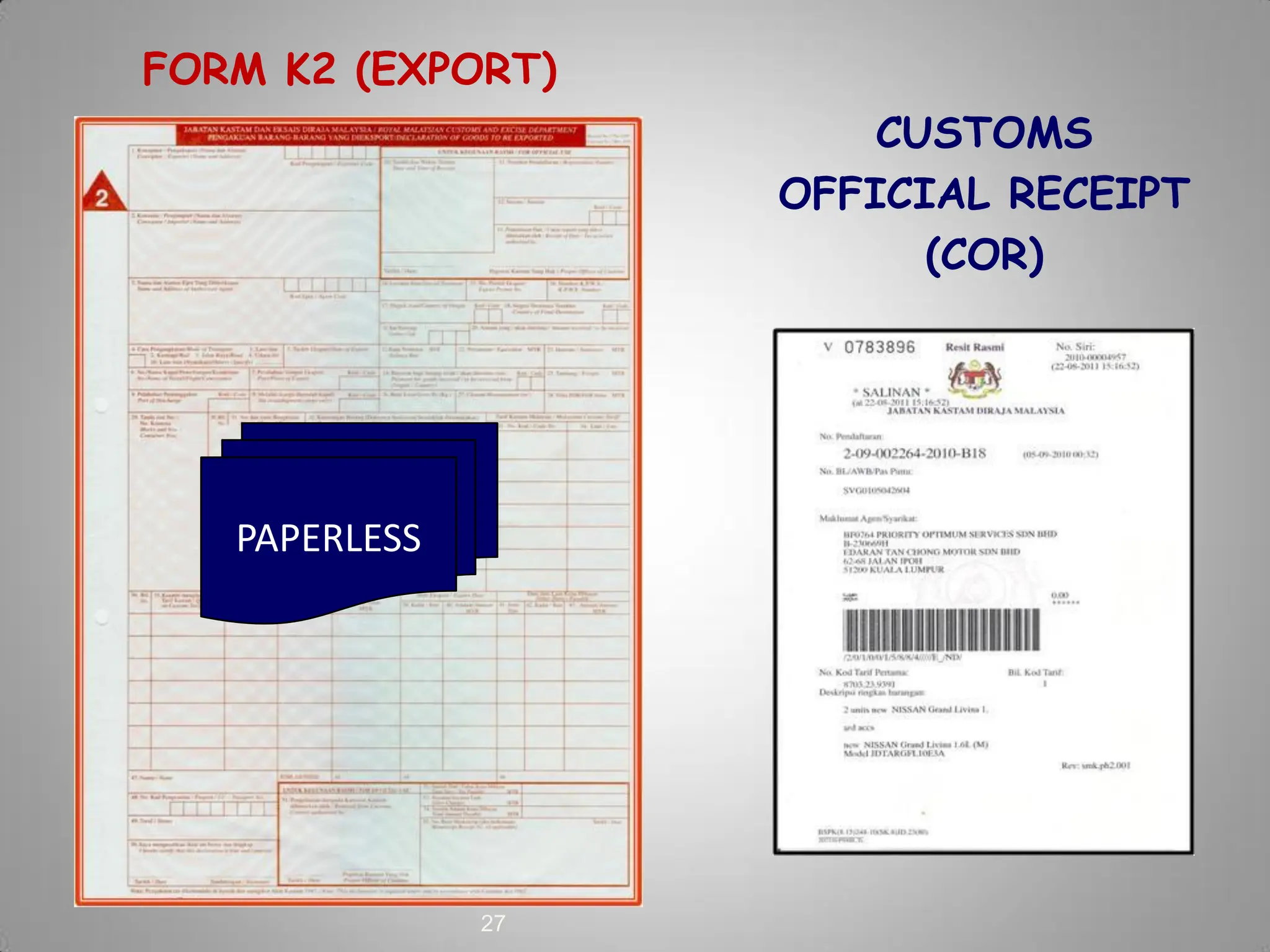

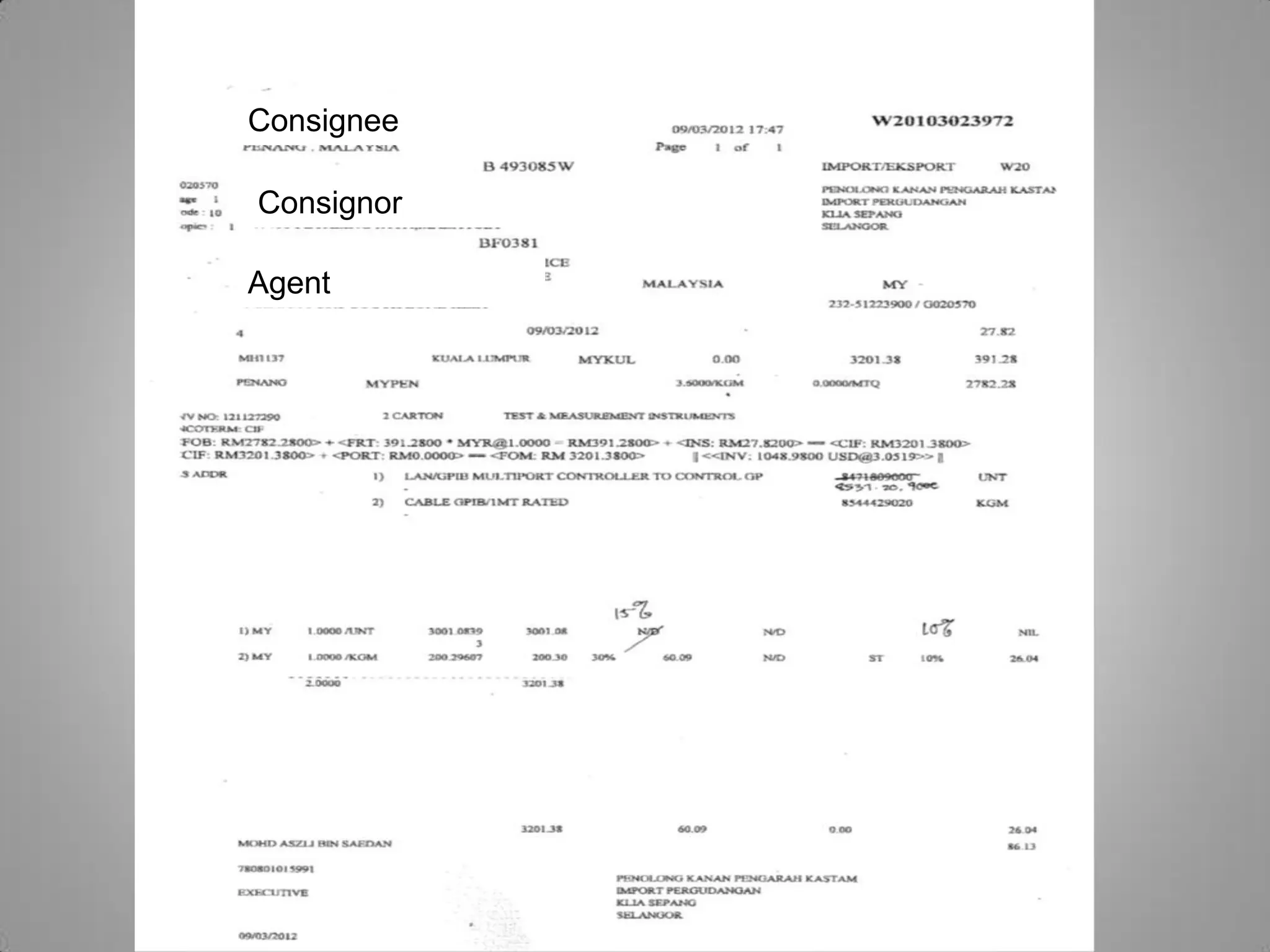

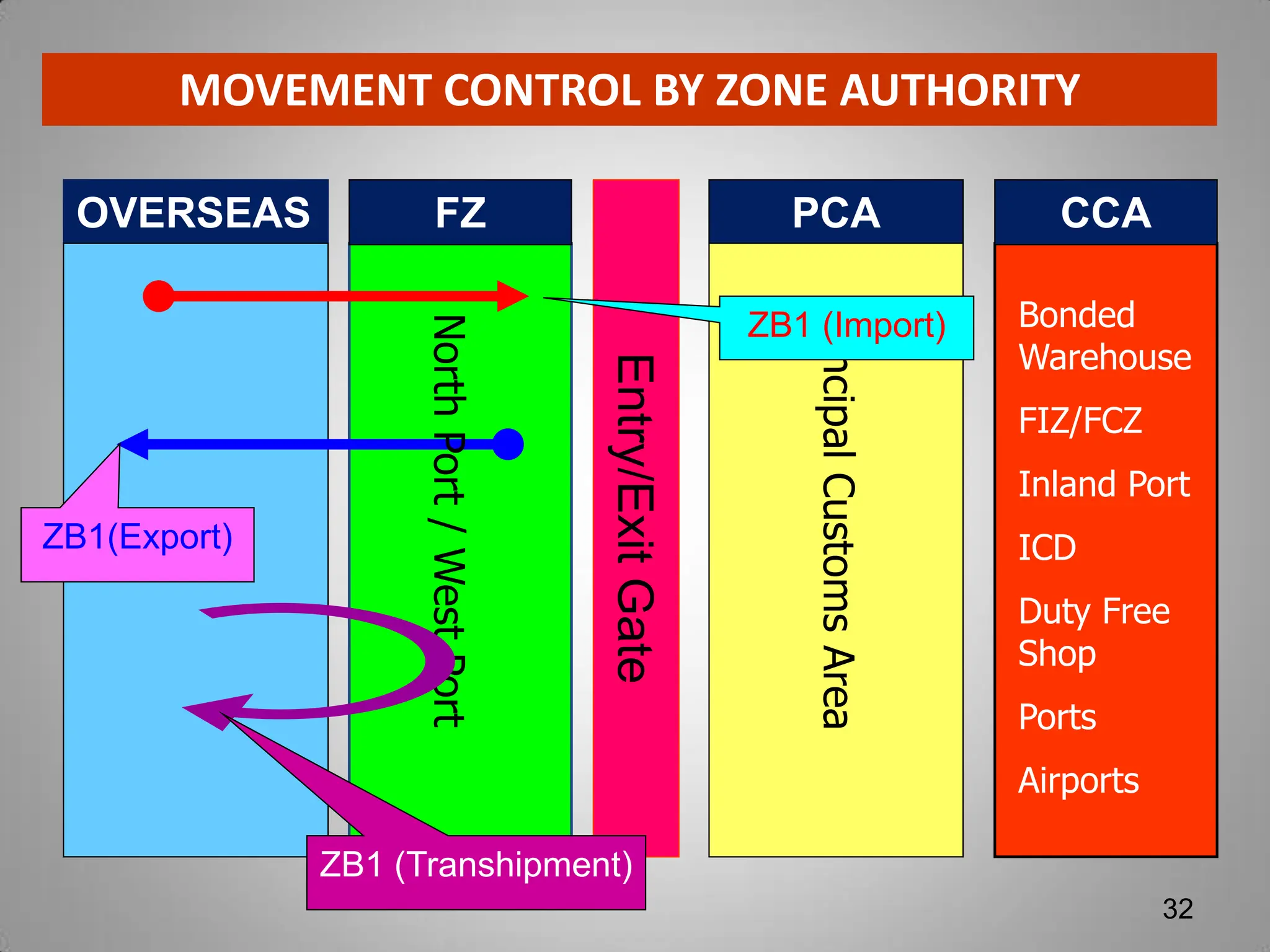

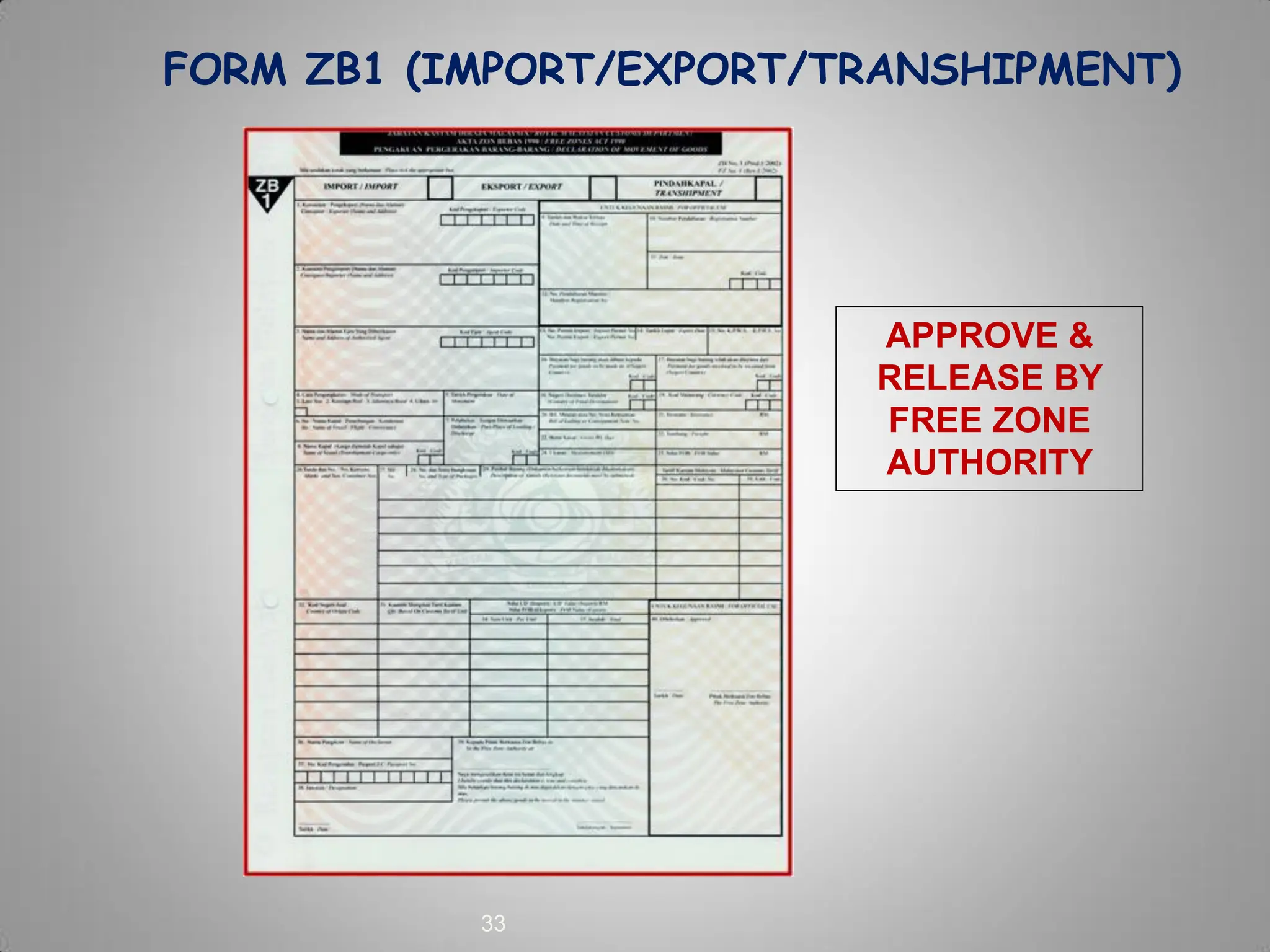

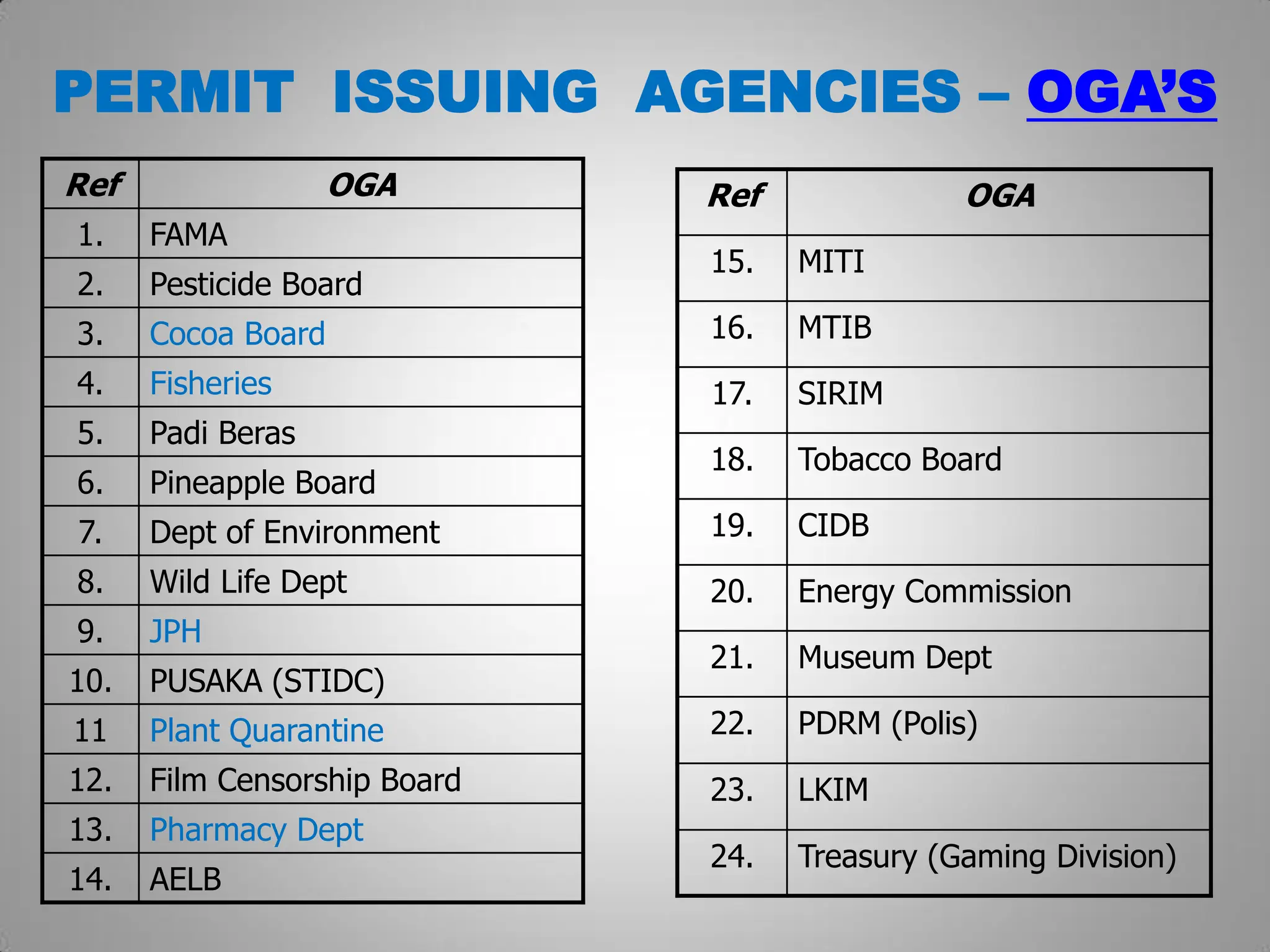

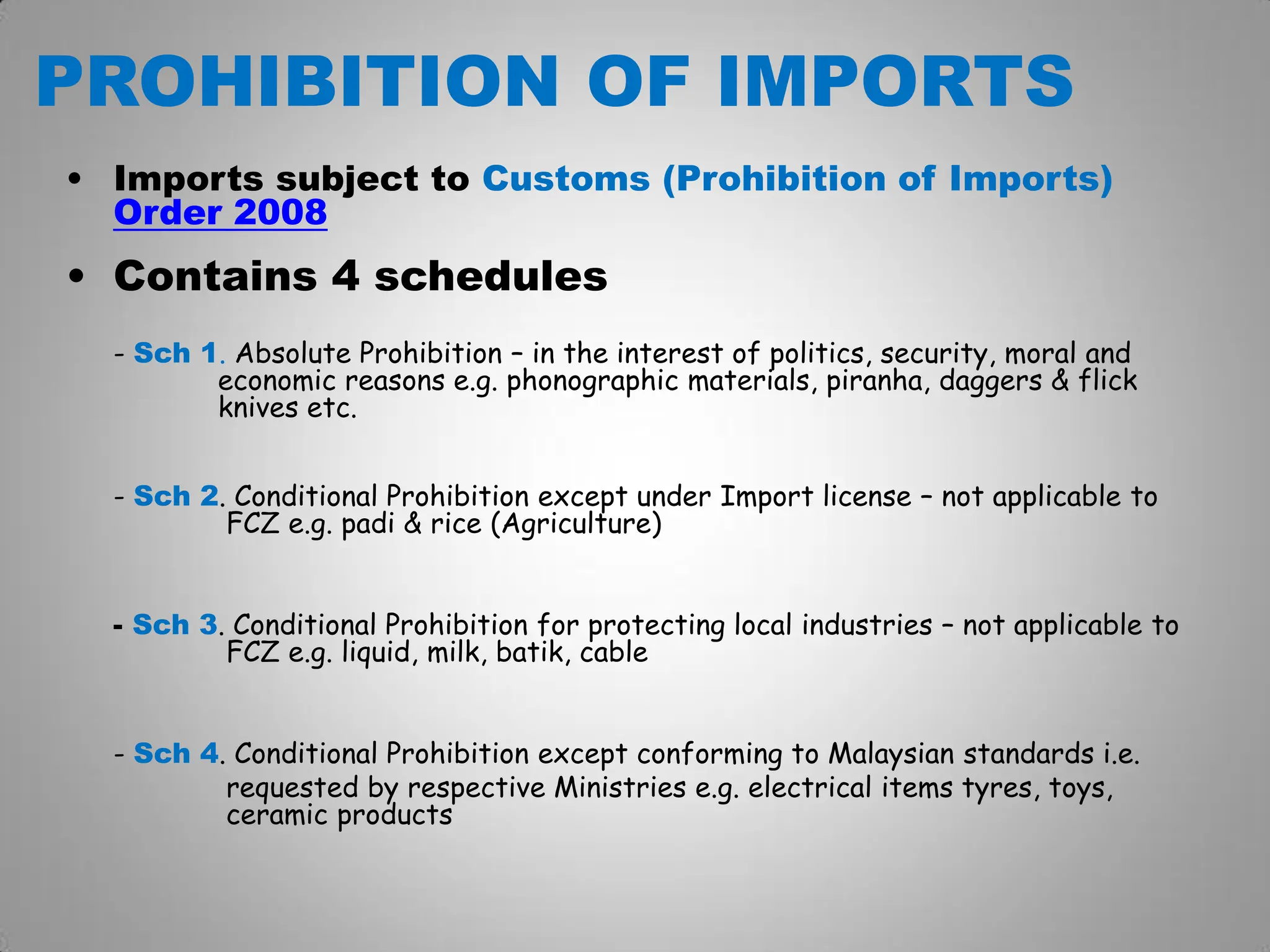

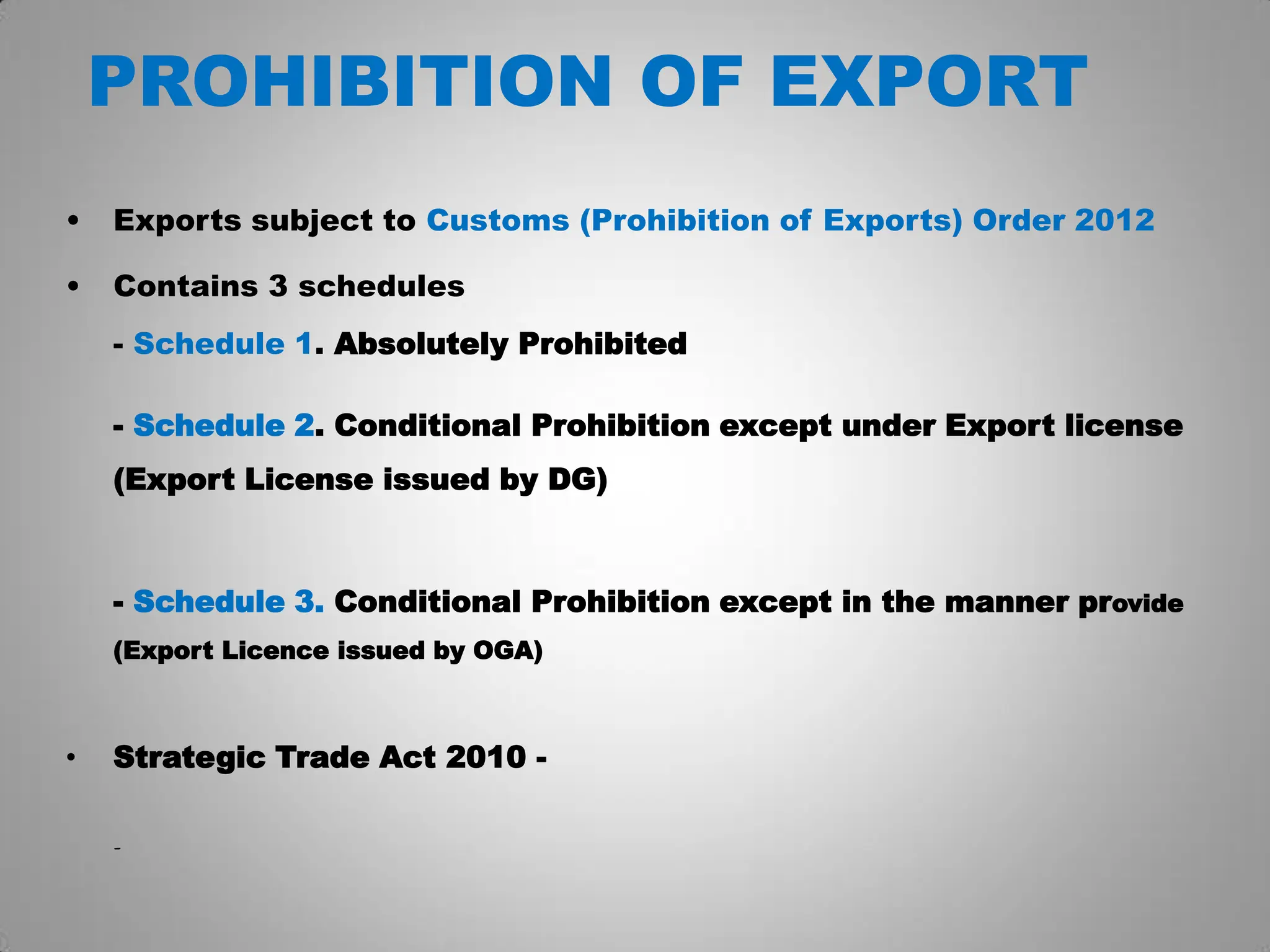

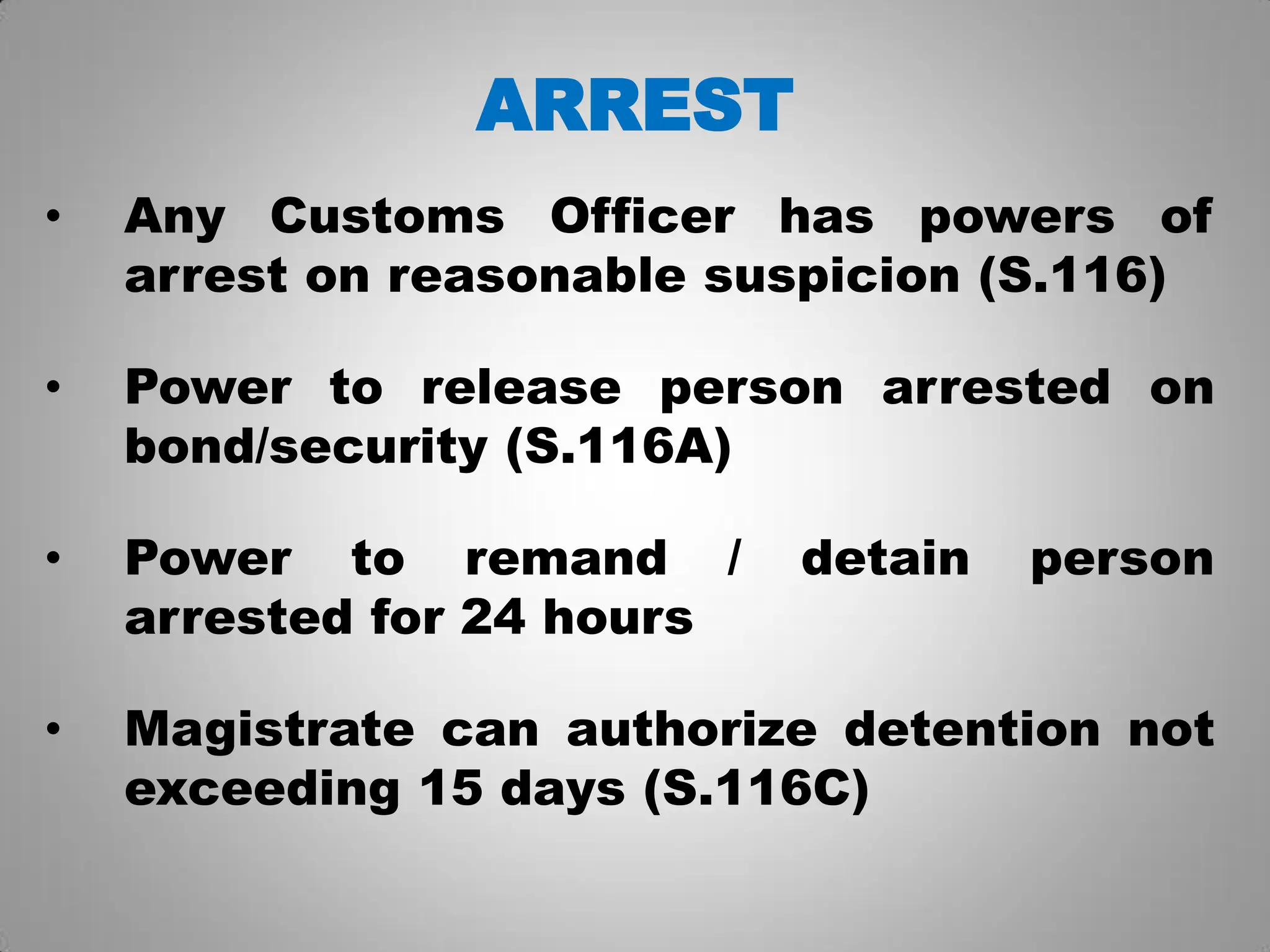

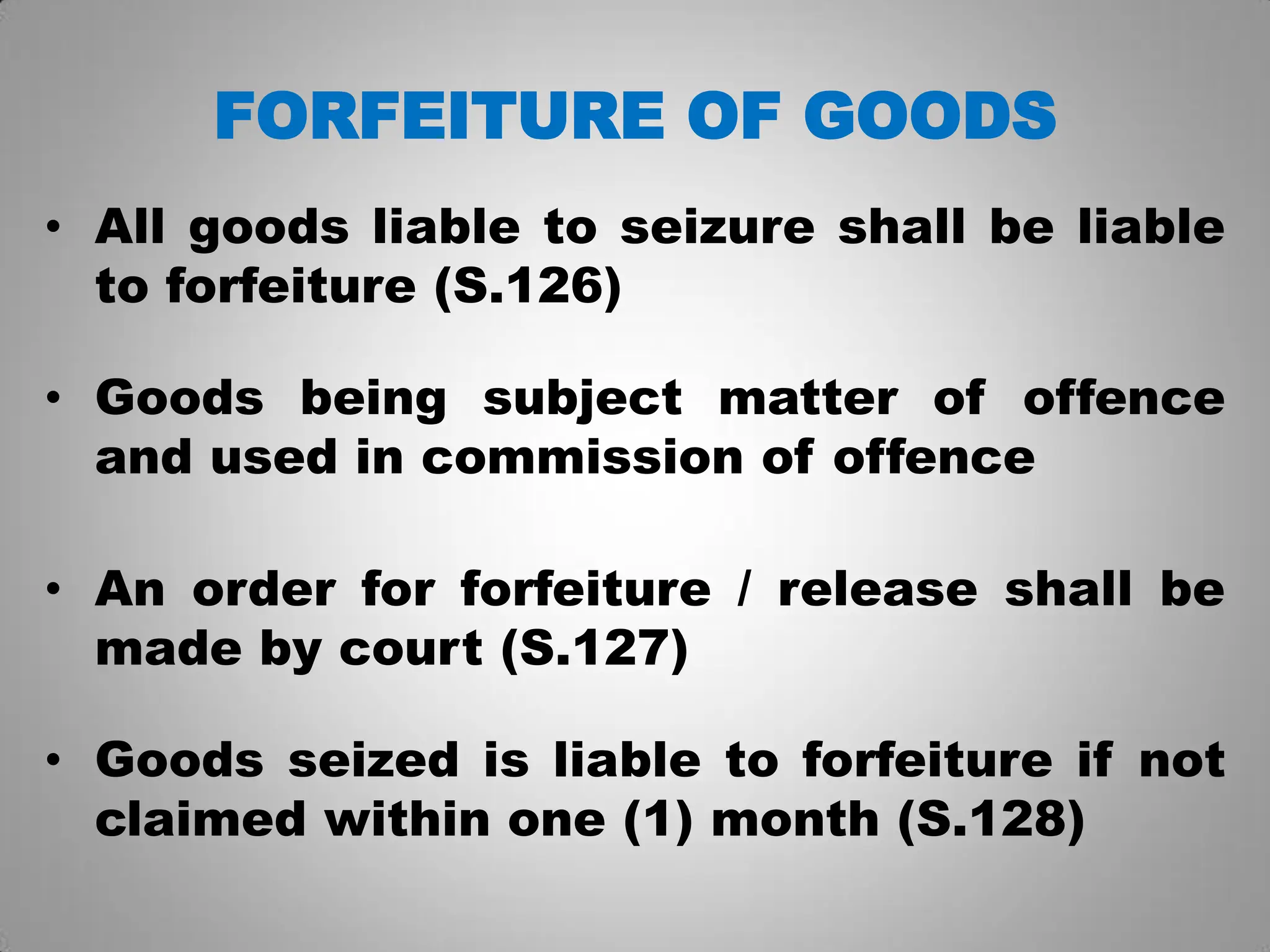

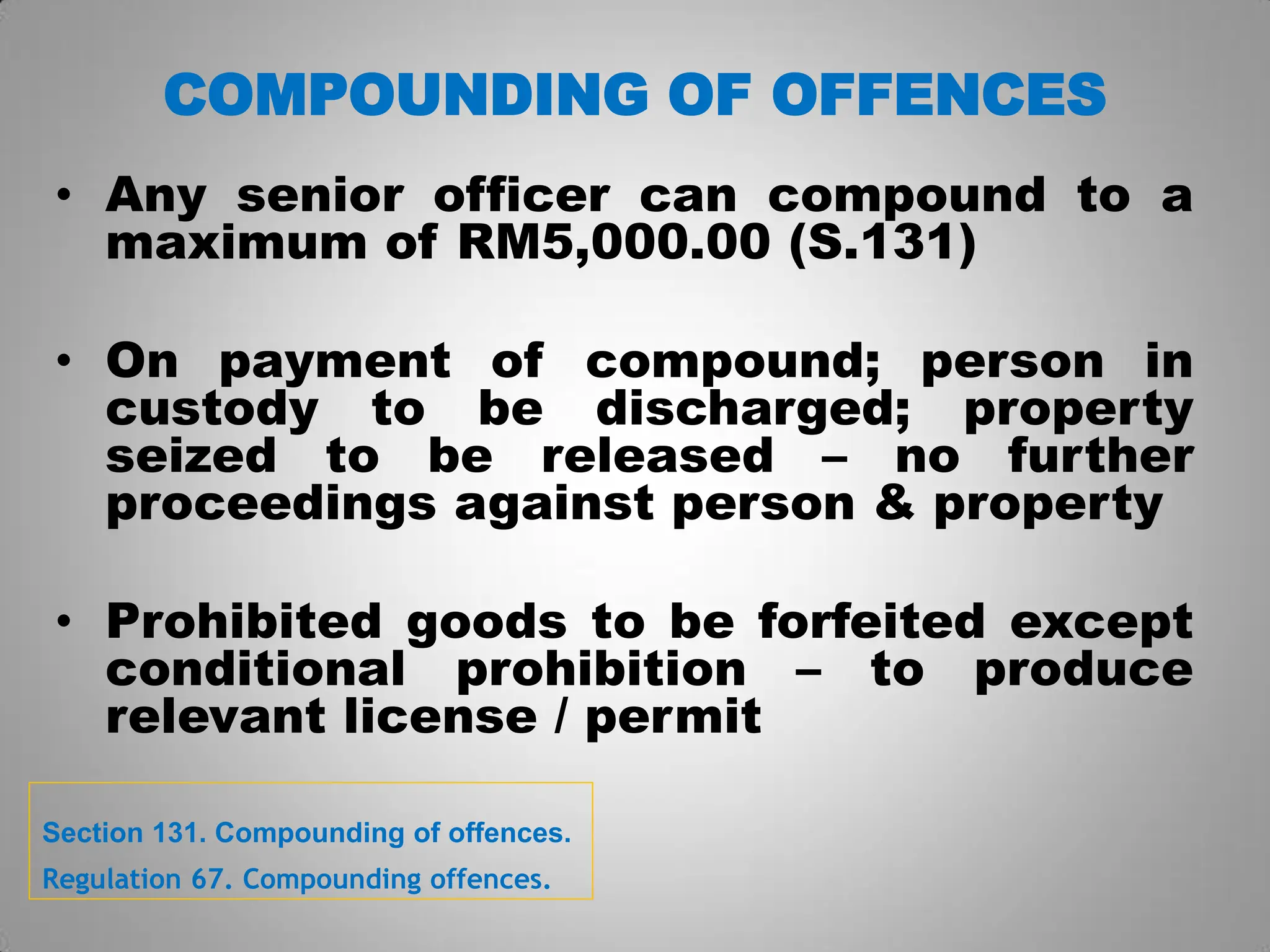

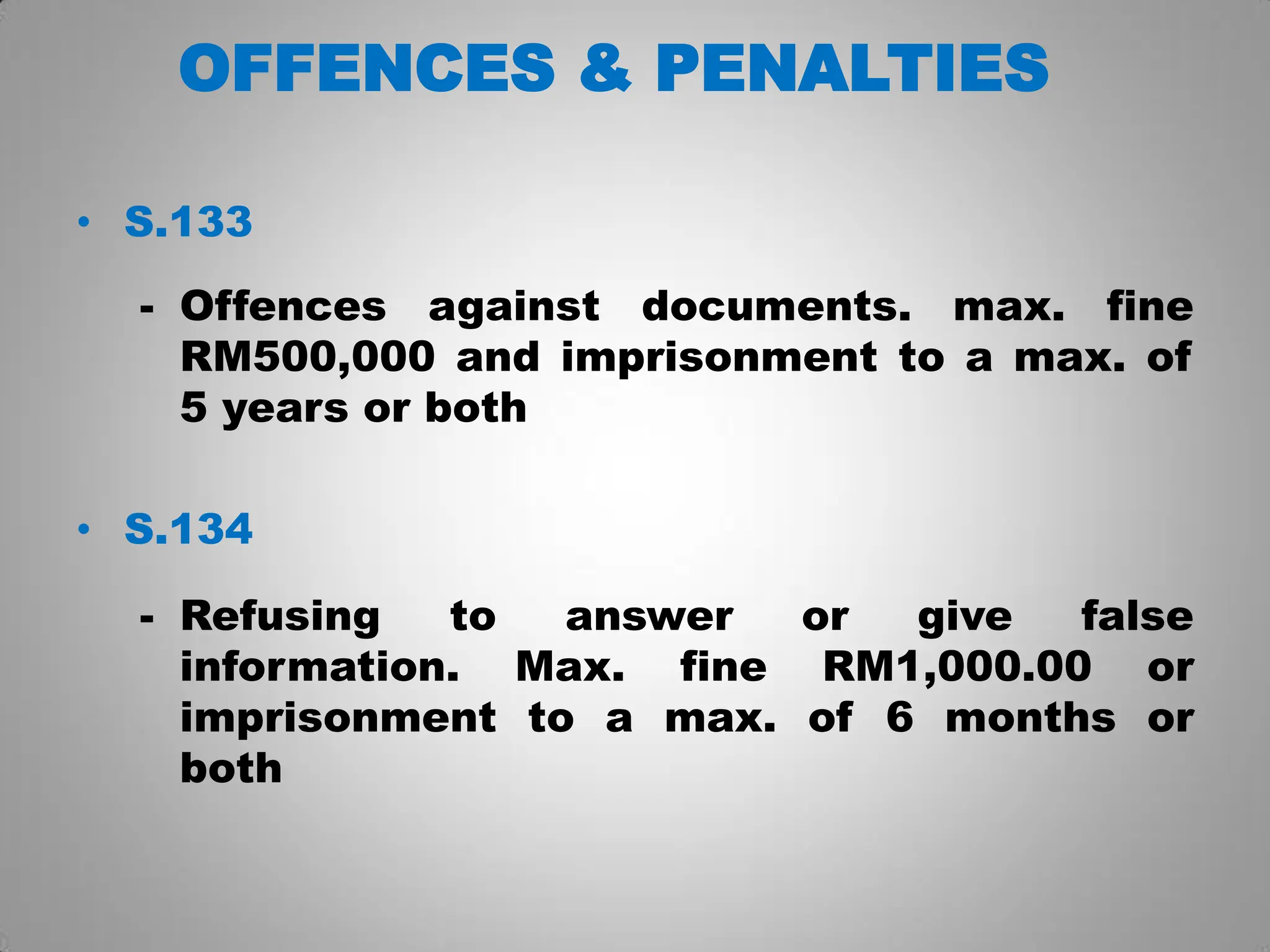

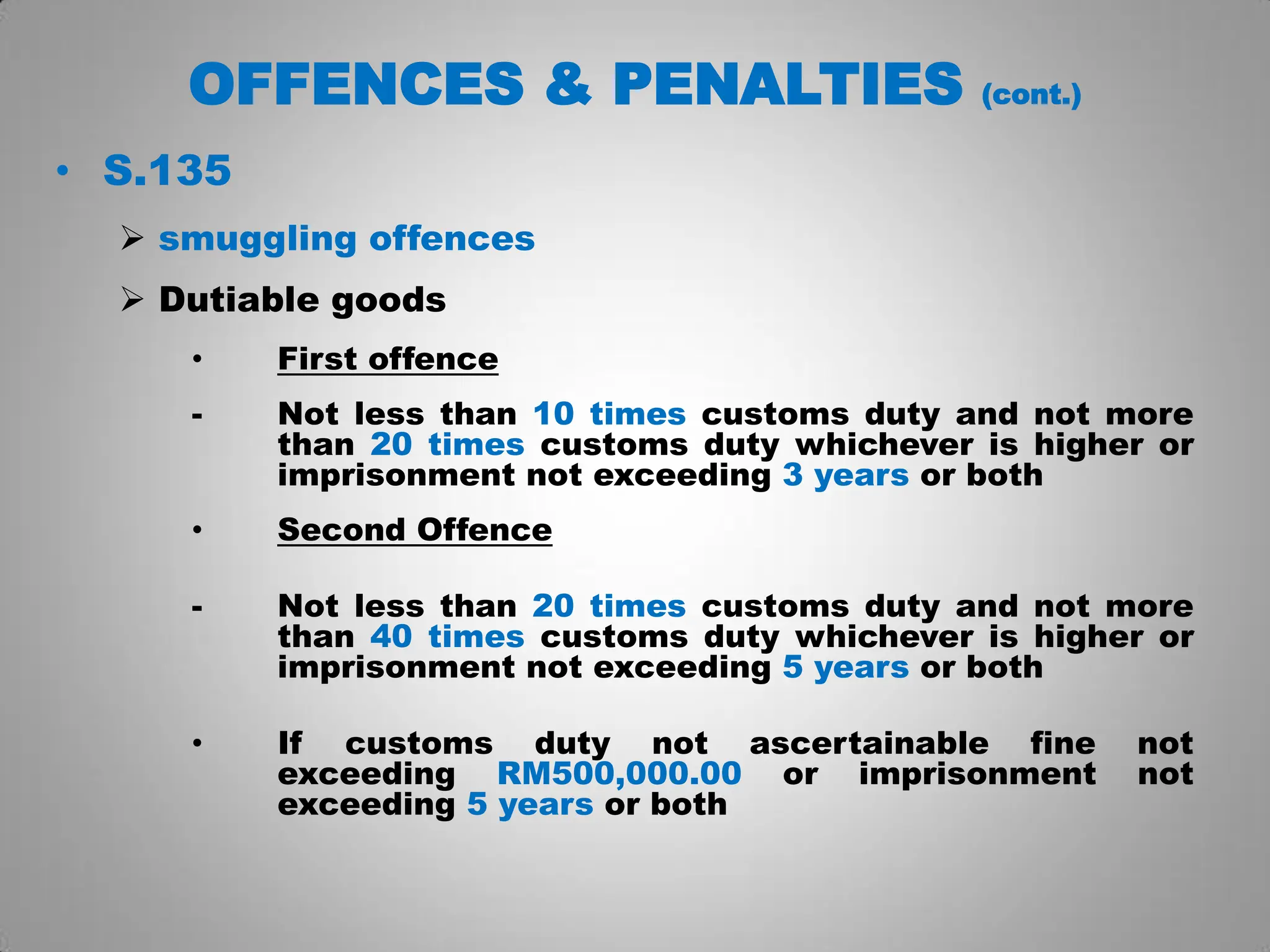

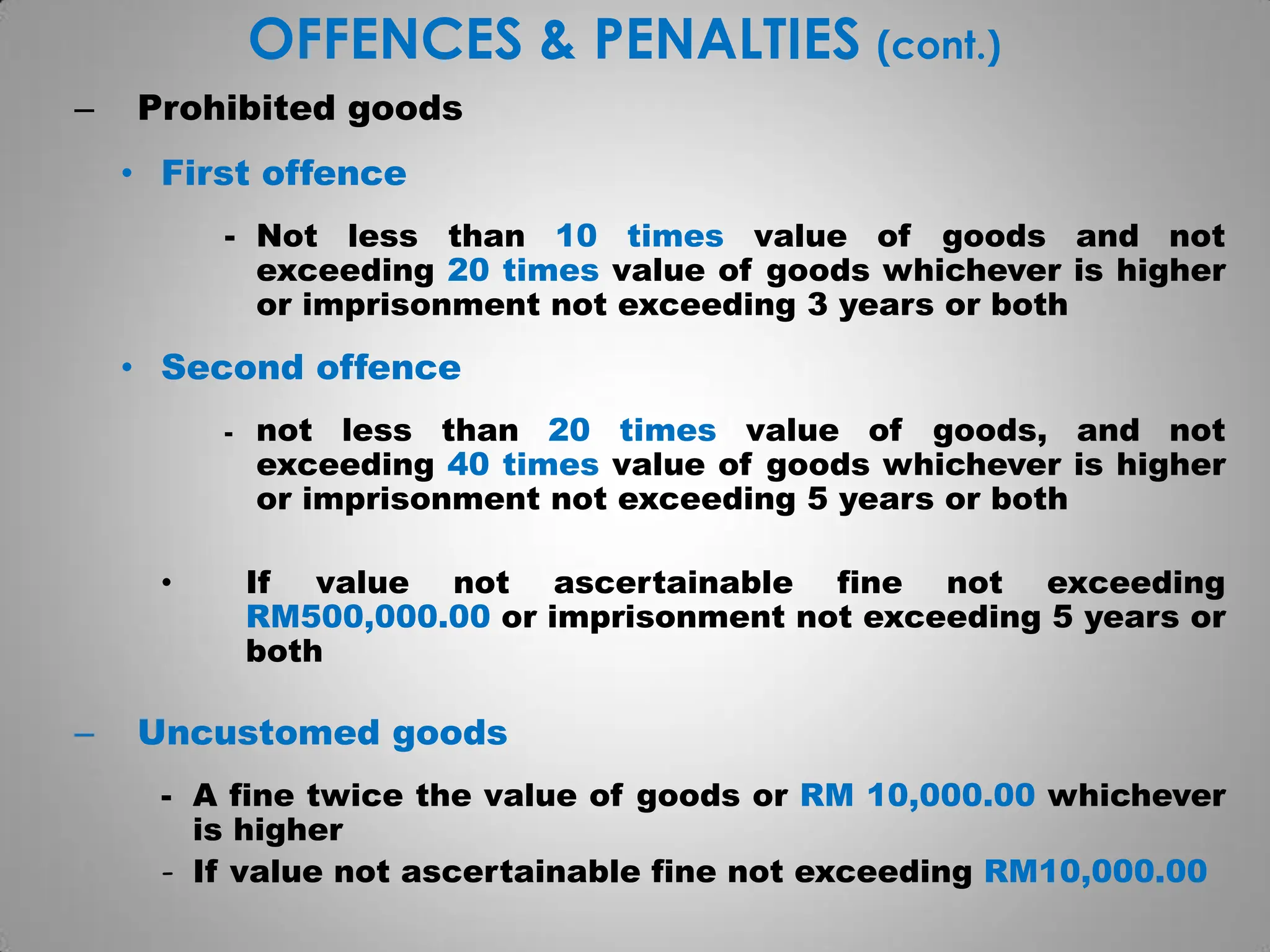

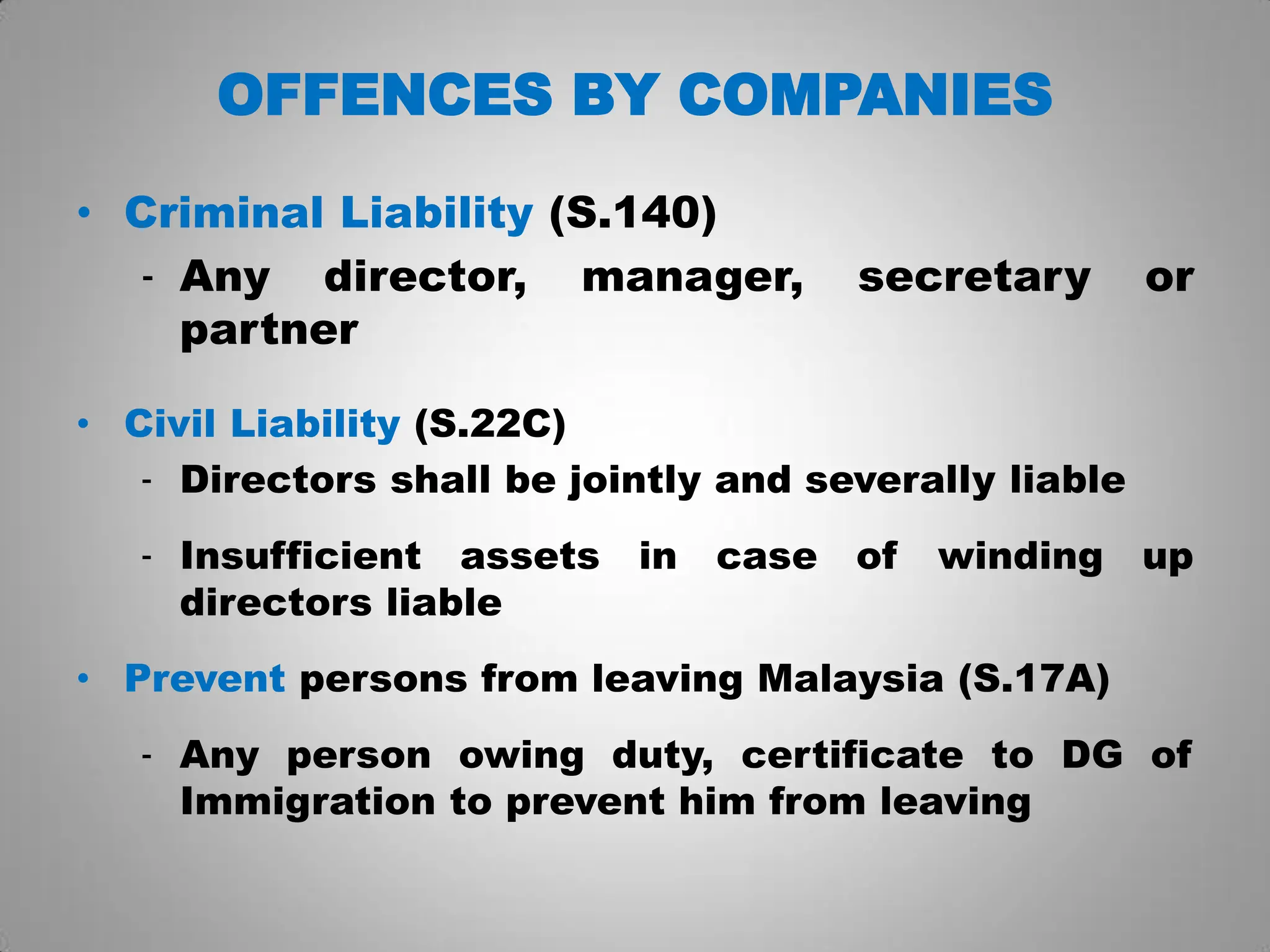

The document outlines the roles and responsibilities of the Royal Malaysia Customs Department (RMCD), focusing on revenue collection, smuggling prevention, and trade facilitation. It details the relevant legislation, customs procedures, and documentation required for imports, exports, and transit activities. Additionally, it covers compliance, inspection protocols, and penalties for violations related to customs regulations.