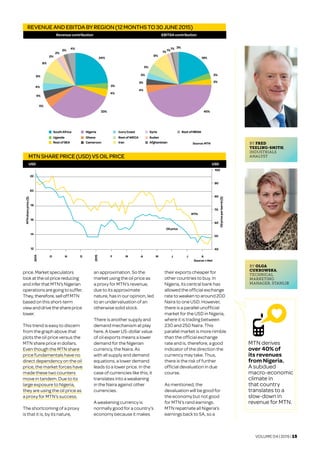

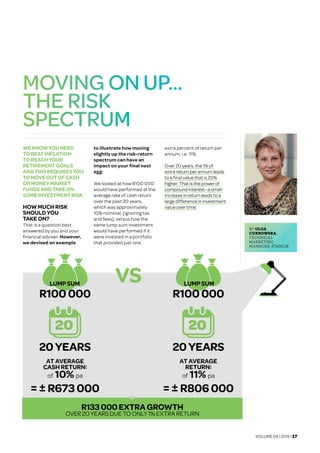

The document is a newsletter from STANLIB, an investment management company. It discusses various topics related to the South African and global economic and investment environment.

The main article analyzes five options for growing South Africa's economy in the current challenging conditions: 1) Increasing government spending, but debt levels are already high; 2) Private business expansion and new ventures, but confidence is low; 3) Increasing exports, but world trade growth is slow; 4) Boosting household consumption, but job losses are a risk; 5) Public-private partnerships to develop infrastructure, which could attract private funding and ease the government's budget. None of the options on their own are seen as sufficient to meaningfully lift growth

![VOLUME 04 | 2015 | 07

HOW DO WE CREATE

WEALTH IN THE

CURRENT CYCLE?

RETURNSARE

TEMPORARYFROMHERE

Howdowecreatewealth

fromthispointforwardin

thecurrentcycle?Before

answeringthisquestion,it’s

importanttounderstandthe

currentmarketconditions.

Webelievethisisbest

explained bythe testimony

ofAdolphMiller,former

FederalReservemember,

beforethe USSenate in 1931.

Hewastestifyingaboutthe

Fed’s1927interestratecuts

andaccelerationofopen

marketpurchases,which

fuelledthespeculationand

lowqualitycreditexpansion

thatculminated inthe1929

stockmarketpeakandthen

collapse:

“Itwasthegreatestand

boldestoperationever

undertakenbytheFederal

ReserveSystem,and,in my

judgment, resulted inone

ofthemostcostlyerrors

committed byitoranybanking

systeminthelast75 years…

Businesscould notuseand

wasnotaskingforincreased

moneyatthattime.”

Insimpleterms,Millerwas

sayingifconsumersor

businessarenotdemanding

moneyyetcentralbanksflood

themwithexcessivemoney,

thisleadstoamisallocation

ofcapital. Bothinvestors

andbusinessesallocate

theirwealthtoanyasset

givingthemabetterreturn

thanzero.Thismisallocation

resultsinexcessiverisk-taking

andthecreationofassetprice

bubbles.

Alltoooften,investment

discussionsmoveawayfrom

thesimpleprincipleatthe

heartofa goodinvestment

decision: howdo youcreate

realwealthoveracycle?

Aclient'sageorwhenthey

needtheirwealthisonly

relevanttothedegree

ofexcessiveriskyouare

preparedtotaketogenerate

thatrealwealth. Whethera

clientis20or82thesimple

goalisrealwealthcreation.

AREWEINABUBBLE…?

Setting aside the technical

debates about what defines

an asset bubble, we look at

the risk of a loss of wealth for

clients over the next part of

the cycle. We don’t attempt

to forecast the market; we

simply look at what the risks

are to clients’ wealth if they

are invested in the current

set of market conditions.

Historically, we have seen

that deep losses of clients’

wealth occur when the

market is expensive, as

illustrated in the graph below.

It shows that investing in

the market at the current

valuation level historically

has resulted in a loss of

more than half of the clients’

wealth within the next three

years. So, for example, you

can see that at single digit

price to earnings ratios (PEs)

the biggest loss a client

suffered historically was less

than 20%, while investing

in the market at PEs above

15, losses historically have

reached above 50%.

BY ROBIN EAGAR

HEAD OF STANLIB

MULTI-ASSET

FRANCHISE

S&P500 PE VS DEEPEST SUBSEQUENT 3-YEAR LOSS

6"(C"30"A"(

!

! <!Q,&!2#(.)+/ 0&%!WX!VF,/++&(!WXY 9!Q#>/2:0 ![ !#(!0/.1+4!)2!#+%!

! )*/#2!#?&(!]W9!)++!0)4!*,&!0).&!*,/27 R!

3(& !

*# ^?)+3&%!.)(;&*!#2!1&);!.)(7/20 !*# # !_

-#(!'+/&2*0< !

:! <!D&*3(2 0 !

9! !

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

0,0 2,5 5,0 7,5 10,0 12,5 15,0 17,5 20,0 22,5 25,0 27,5

S&P500 PE

Source: STANLIB Research/I-Net BFA

Current PE](https://image.slidesharecdn.com/4f50253a-5079-419c-8fdb-ed9267c65ea2-160910153940/85/15430-STANDPOINT-October-2015-F-PDF-7-320.jpg)