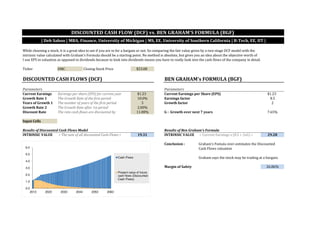

The document compares two valuation methods - discounted cash flows (DCF) and Ben Graham's formula - to determine the intrinsic value of a stock. Using parameters like current earnings per share, growth rates, and discount rate, the DCF model estimates the stock's intrinsic value at $19.31, while Graham's formula estimates it at $29.28. The conclusion is that Graham's formula may overestimate the value compared to DCF, but both methods can provide an initial view of a stock's worthiness as a bargain.