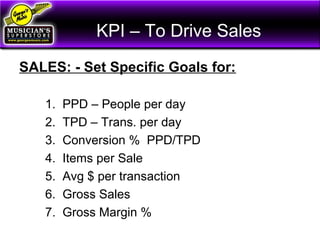

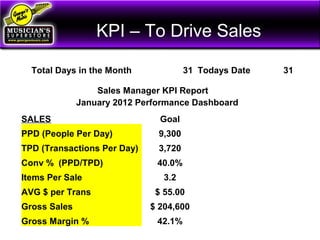

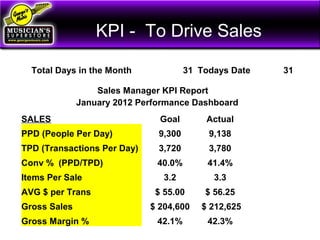

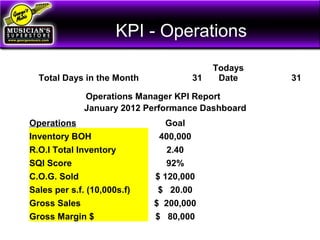

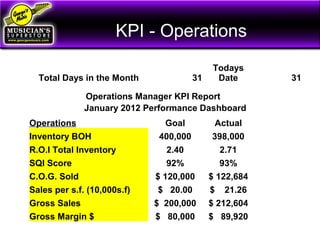

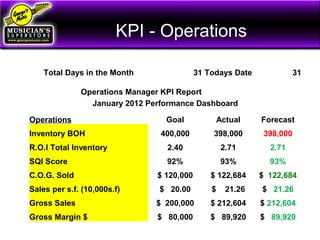

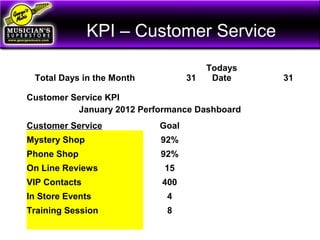

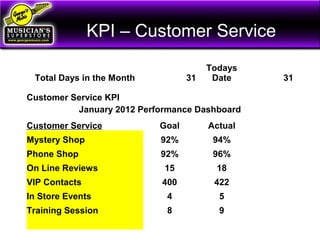

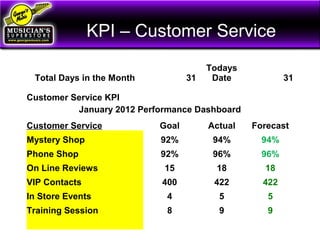

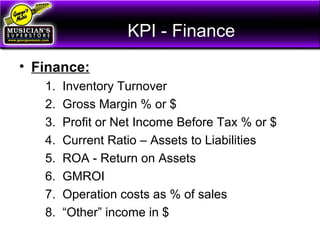

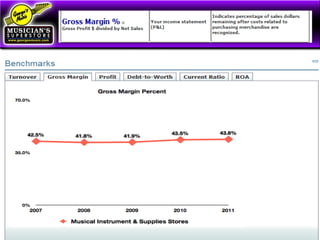

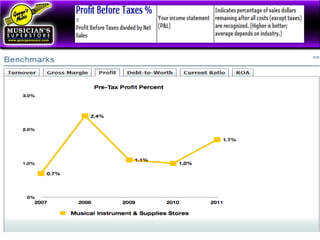

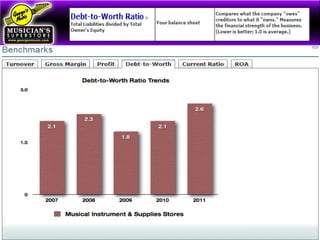

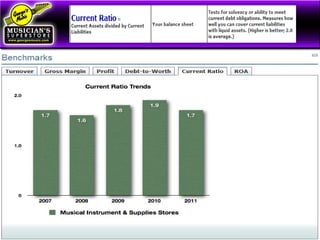

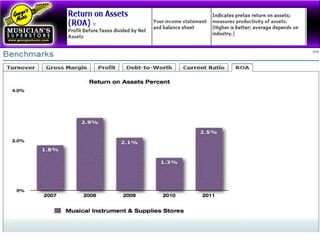

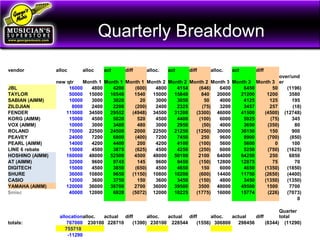

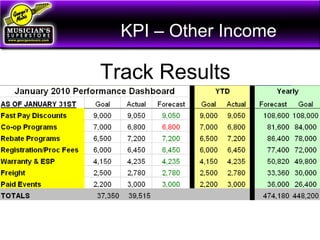

The document is a presentation from George Hines of George's Music, Inc. discussing the use of key performance indicators (KPIs) to drive growth and profits through defined company culture. It provides examples of KPIs that could be tracked for sales, operations, customer service, and finance to establish accountability, action plans, and measure progress. Specific metrics include people per day, sales per transaction, inventory levels, customer satisfaction scores, and profitability ratios. Data from January 2012 shows most metrics either met or exceeded initial goals.