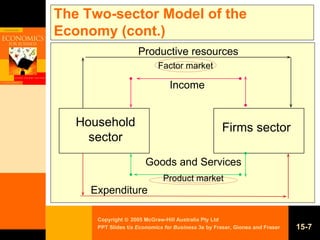

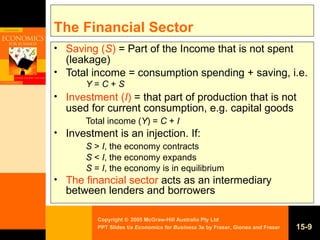

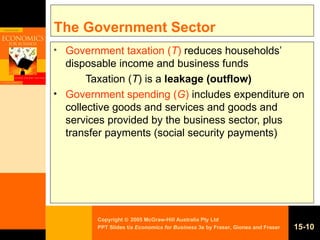

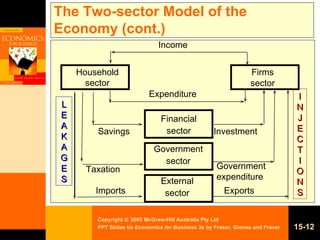

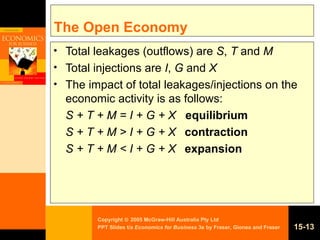

The circular flow model describes the continuous movement of money between households and businesses in an economy. There are five sectors - households, businesses, financial institutions, government and overseas. Money flows as households receive income from selling resources to businesses, then spend it on goods and services from businesses, in an endless circular flow. The financial sector intermediates between savers and borrowers. Government taxation reduces household income while spending injects money back in. Imports and exports affect the flows between the domestic and overseas sectors.