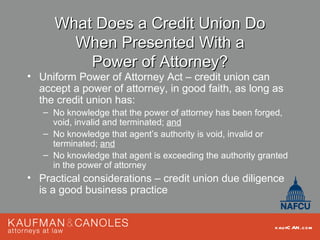

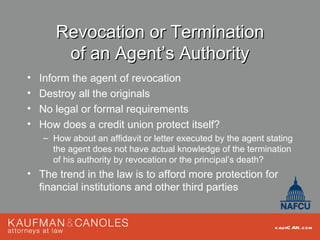

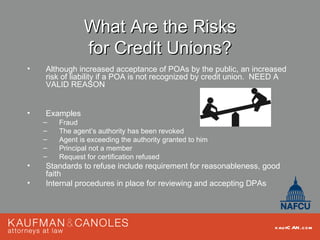

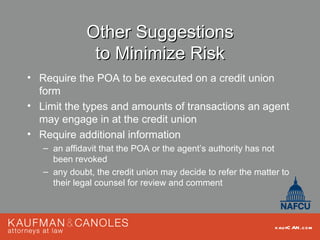

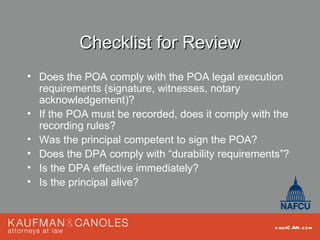

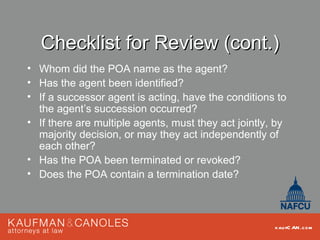

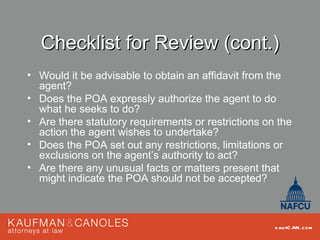

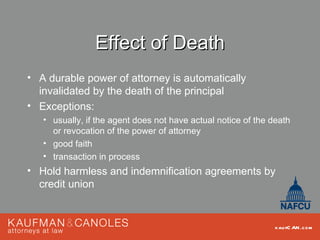

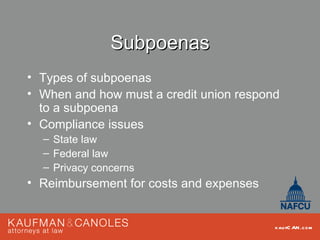

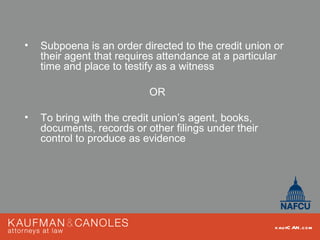

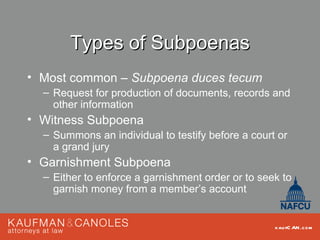

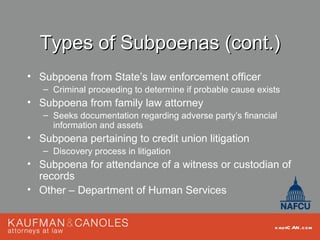

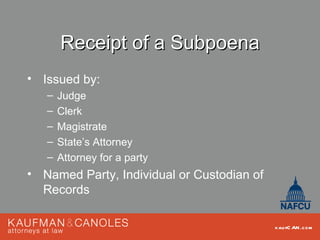

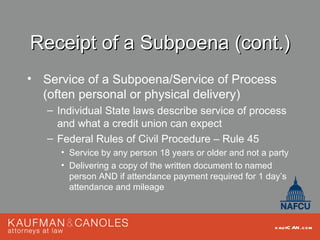

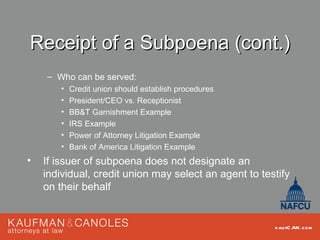

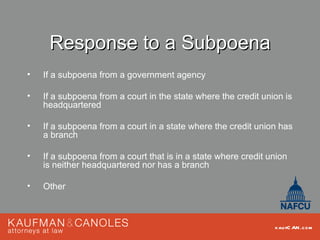

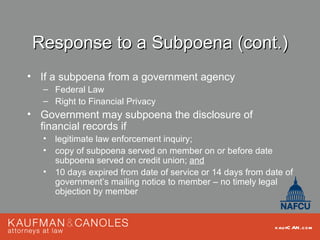

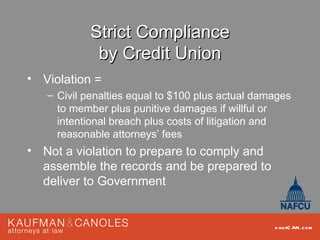

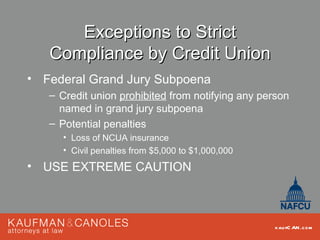

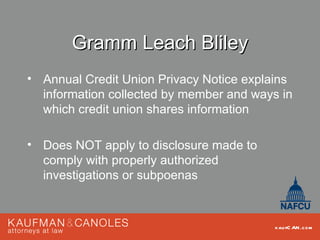

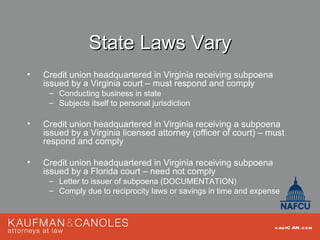

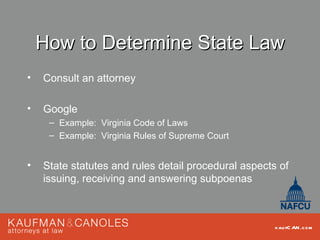

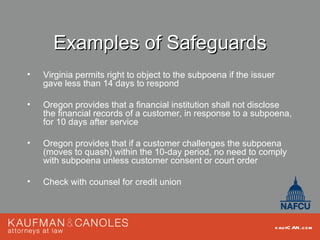

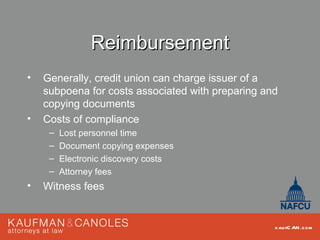

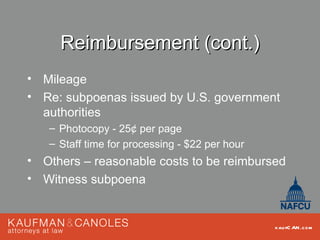

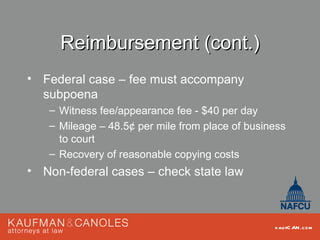

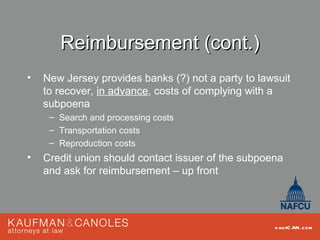

Powers of attorney and subpoenas present risks and potential liabilities for credit unions. When presented with a power of attorney, credit unions must verify the document is valid and the agent's authority is not terminated. Credit unions should establish policies for reviewing powers of attorney to minimize fraud risks. When served a subpoena, credit unions must comply with applicable state and federal laws while protecting members' privacy. Procedures are needed for timely and secure response to subpoenas and requesting reimbursement of costs.