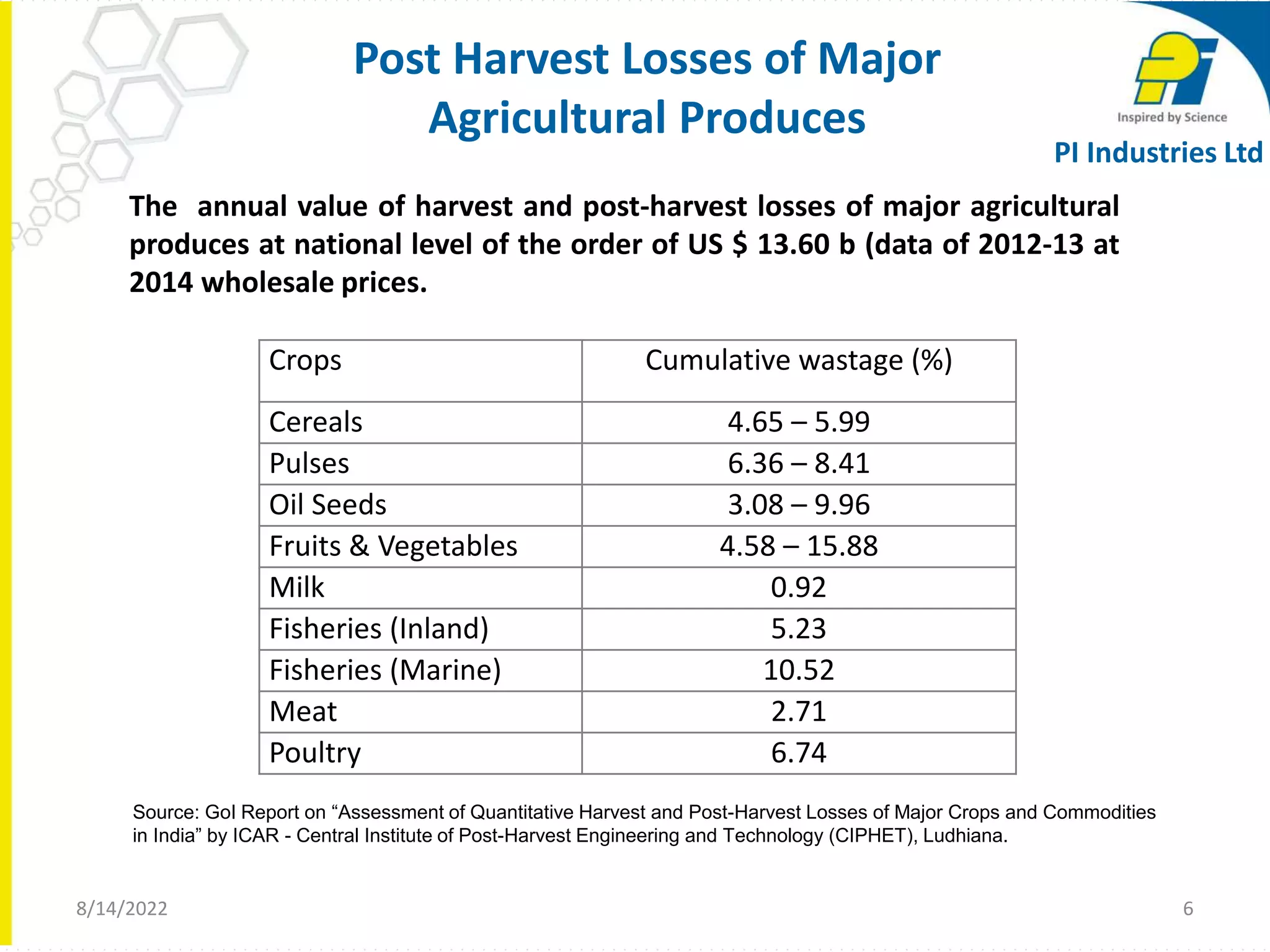

This document discusses opportunities and challenges in India's food processing industry. It notes that food production is projected to double in the next 10 years, with the food and grocery market becoming the world's sixth largest. However, there is currently low levels of food processing in India, with much wastage in fruits and vegetables. There is a need for increased investment in post-harvest infrastructure like storage, logistics and processing to capitalize on India's growth in food production and reduce wastage. This would help meet rising demand and increase value addition from the food sector.