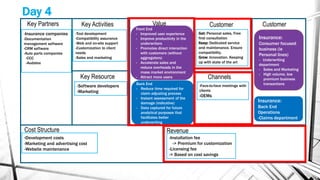

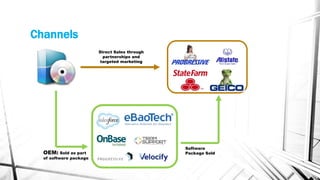

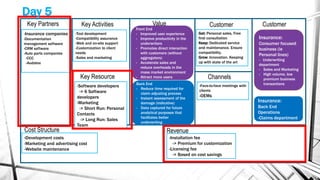

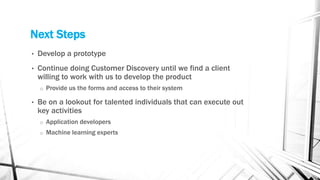

The document summarizes the key findings from a 5 day customer discovery process for a Picture to Data (P2D) product. Over the 5 days, the team interviewed potential customers, refined their value propositions, identified target customer segments in the insurance industry, and conceptualized an initial minimum viable product and revenue model. The next steps identified are to develop a prototype, continue customer discovery to find a client to partner with, and hire additional talent.