Increasing Capital Budgeting Insight Using Monte Carlo Simulation / War Gaming with NPV / EVA Models

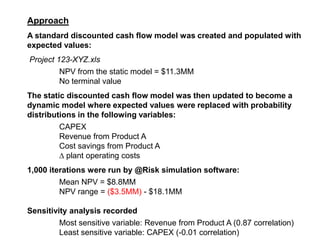

- 1. Approach A standard discounted cash flow model was created and populated with expected values: Project 123-XYZ.xls NPV from the static model = $11.3MM No terminal value The static discounted cash flow model was then updated to become a dynamic model where expected values were replaced with probability distributions in the following variables: CAPEX Revenue from Product A Cost savings from Product A ∆ plant operating costs 1,000 iterations were run by @Risk simulation software: Mean NPV = $8.8MM NPV range = ($3.5MM) - $18.1MM Sensitivity analysis recorded Most sensitive variable: Revenue from Product A (0.87 correlation) Least sensitive variable: CAPEX (-0.01 correlation)

- 3. Discounted to 2009 USD

- 4. All expected values came from expected values in SR model titled: Project 123-XYZ Base Case EVA 10 year 5.20.08.xls

- 5. 3% inflation of Product A revenues, fuel savings, and ∆ plant costs

- 6. 20 year straight-line depreciation

- 8. No ∆ in working capitalInputs & Assumptions:

- 10. Could be up to 5% less

- 12. Could be up to 25% less

- 15. Could be +/- 10%∆ in plant costs (due to Product A)

- 17. Discounted @ 8%

- 19. Discounted @ 8%

- 20. No ∆working capitalNPV is guaranteed to not be exactly $11.3MM. How much +/- is a matter of many probabilities combining. (Model forecasts 30% prob. NPV will be >$11MM)

- 23. Yearly revenue from Product A is ~2x the value of fuel savings from Product A

- 24. Plant costs each year are about the same as the revenue from Product A. However, plant costs have more certainty than the revenue estimatesCost Savings Cost Savings Cost

- 26. Will Holcim close a kiln?

- 27. If so, which year?

- 28. If so, how much volume will we get?

- 29. Will Holcim close two kilns?

- 30. …

- 31. … and any other uncertainty we may have.Competitor A Comp. B Competitor B reduce capacity? Competitor B exit the market completely?