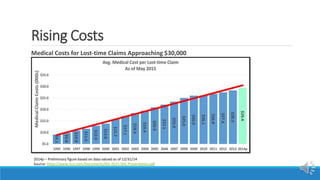

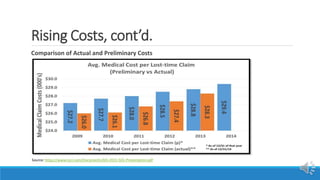

Workers' compensation faces challenges from rising medical and indemnity costs, expansion of opt-out legislation, impact of the Affordable Care Act, and questions around the constitutionality of exclusive remedy. Media reports have also highlighted deficiencies in how injured workers are treated. Internal challenges include rising costs, impact of healthcare reform, and debates around opt-out programs and exclusive remedy protections. External pressures involve scrutiny of inadequate support for injured workers and the impact of consolidation in healthcare.