Inflation

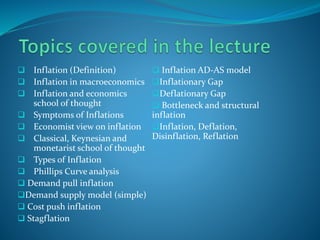

- 1. Inflation (Definition) Inflation in macroeconomics Inflation and economics school of thought Symptoms of Inflations Economist view on inflation Classical, Keynesian and monetarist school of thought Types of Inflation Phillips Curve analysis Demand pull inflation Demand supply model (simple) Cost push inflation Stagflation Inflation AD-AS model Inflationary Gap Deflationary Gap Bottleneck and structural inflation Inflation, Deflation, Disinflation, Reflation

- 2. Inflation vs. Deflation Is inflation essential for economic growth ? Inflation in different time frame. Why Chinese products are cheaper? Who measures inflation in India? How we calculate Inflation? GDP Deflator and Price index. Base year and weighted mean Why we not use GDP deflator as inflation measure. GDP Deflator & Inflation Calculation CPI WPI IIP PPI Real Interest Rate vs Nominal interest rate and purchasing power Inflation through partial and general equilibrium

- 3. Persistent rise in price. Or continuous increase in price. It doesn't means crop failure or drought, war and another severe condition.

- 4. Inflation causes decrease in purchasing power of a currency. •Inflation is a general rise in the price level in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services •Inflation leads to decrease in purchasing power of a money which finally slows down the economic growth.

- 5. Inflation in macroeconomics • When macroeconomist study the economy, they first look at 3 variables • Output-The level of production of an economy as a whole and its growth rate. • The unemployment rate-The proportions of workers in the economy who are not employed, and are looking for the job. • The inflation rate- The rate at which average price of a goods in the economy increases day by day.

- 6. Inflation(Contd.) What is inflation is a subject matter of a long discussion,. How economists tackle inflation is depend on the economist , which school of thought he belongs to. There are many school of thought, but In short I will tell you there are 3 famous school of thought. The Classical school of thought. The Keynesian school of thought. And the monetarist school of thought.

- 7. Symptoms of inflation Abnormal rise in price level. It means price rise in a year is around 8%-10% and above. Price continuously rises for 2 years or more than 2 years. Purchasing power of money continuously decline, year after year.

- 8. Economist view on inflation Crowther- “Inflation is a state in which value of money is falling.” Brooman-Inflation is continuous rise in general price level. Johnson-Inflation is sustained rise in price. Milton Friedman-Inflation is always and everywhere and a monetary phenomenon. Coulborn-Inflation is too much money chasing too few goods.

- 9. Classical school of thought. Its main thinkers are Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. No Government intervention in the economy. Adam Smith invisible hand. Wage – prices are flexible. They believe in laissez –faire. They favoured free trade Full employment is found without inflation. This thought basically focuses on supply side of economy.

- 10. Keynesian School of thought. John Maynard Keynes and his followers like William Baumol, James Duesenberry, John Hicks, Franco Modigliani, etc. Government intervention in the economy is essential. Wage- price are sticky. Economy is not self regulating. Believe in short run. Focus on demand side of the economy. Full employment is an extreme condition.

- 11. Monetarist school of thought. Milton Friedman and others. Monetarist believe that money matters, monetary policy is an effective instrument to control the inflation. Money growth is responsible for the inflation. Milton Friedman is one the most prominent.

- 12. Types of Inflation On the basis of increasing rate or on the basis of speed:- It is of 5 types A) Creeping Inflation (upto 3% ) B) Walking Inflation (4%- 8%) C) Running Inflation (9%-18%) D) Galloping Inflation (19%- 50%) E) Hyper Inflation ( More than 50%, can be 100%, 1000%, or more. No limit of price rise.)

- 13. Inflation on the basis of increasing rate Creeping inflation-It is the initial stage of inflation price rises at slow rate. According to many economist, slow rise in price is necessary for economic progress. It prevents the economy to falling into a stagnant trap.(upto 3%) Walking inflation - It is not a major problem, but central bank will increasing concern about it.(4%-8%) Running inflation – It is warning signal for an economy(9%-18%) Galloping inflation is also known as jumping inflation. In the words of Baumol and Blinder, “Galloping inflation refers to an inflation that proceeds at an exceptionally high.” Galloping inflation has adverse effect on middle and low income groups in the society.

- 14. Inflation: On the basis of increasing rate Hyper Inflation- When monetary authorities lose control on running inflation, it is result of hyper inflation. • It is the last stage of inflation, where there is no limit of price rise. In this stage, prices rise at a very high speed. • Hyper inflation must be avoided at any cost. It creates a huge disorder in economic process. • Example Germany, Zimbabwe, Germany (A case study).

- 15. Inflation on the basis of coverage On the basis of coverage inflation is of two types Comprehensive or Economy wide inflation: Comprehensive inflation is when the prices of all commodities rise in the entire economy. Sporadic Inflation: When the prices of a few commodities in some areas rise, it is called as sporadic inflation. It is sectional in nature. Example: Hike in price of car market.

- 16. Inflation: On the basis of degree of control. On the basis of degree of control, inflation may be classified in open and suppressed inflation. 1. Open inflation: Inflation is called open when prices increase continuously without any obstacle or control. In words of Milton Friedman, "It is an inflationary process in which prices are allowed to increase without stopping through governmental price control and mixed techniques." At the end, it may end in hyper inflation

- 17. Inflation: On the basis of degree of control. 2. Suppressed inflation: Under such kind of inflation, though there are conditions of prices rising, but by use of government policies like price control and rationing, price level is not allowed to increase. Basically it is controlled by government monetary and fiscal policy of the Government. And a policy mix. A policy mix is the combination of fiscal and monetary policy that a country uses to manage its economy.

- 18. Inflation: On the basis of degree of control.(Continued.) Different- different macroeconomic model are used for controlling the inflation. Example: Keynesian cross model, he lead the concept of inflationary gap and deflationary gap. Aggregate demand- aggregate supply model. Popular IS-LM model or Hicks–Hansen model, developed by Sir John Richard hicks and Alvin Harvey Hansen. Phillips curve analysis Policy makers control inflation using these theories.

- 19. Inflation: On the basis of degree of control.(Continued.) Phillips curve analysis- A trade off between inflation and unemployment in the short run. Not in a long run as suggested by Milton Friedman.

- 20. Inflation: On the basis of degree of control.(Continued…) Phillips Curve Phillips curve :-The Phillips curve is an economic concept developed by A. W. Phillips stating that inflation and unemployment have a stable and inverse relationship. The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. However it could not answer phenomenon of stagflation.( inflation+ unemployment) in 1970. When many countries experienced high levels of both inflation and unemployment also known as stagflation

- 21. Inflation: On the basis of degree of control.(Continued..) Phillips Curve Phillips curve was based on adaptive expectations. It means that when you make forecast on the basis past decision only. We use past trend only and predict the future using the data. A.W.Phillips wrote a paper in 1958 titled The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861- 1957, He used data of these period Rational expectations: a when forecasts of future values are made using all available information.

- 22. Inflation: On the basis of degree of control.(Continued..) Rational Expectation. This lead to the development of rational expectation Hypothesis. When economist start consider rational expectation in their macroeconomic model while using policy making. Like expected price and expected inflation. This way of modeling expectations was originally proposed by John F. Muth (1961)and later became influential when it was used by Robert Lucas Jr.

- 23. Inflation: On the basis of cause Credit Inflation- Credit multiplier increase amount of money. This lead to inflation. Currency Inflation- : Inflation created by excessive flow of currency is called currency inflation. It occurs when central bank of a country issue more currency in circulation. Deficit induced inflation-When the government budgetary policy is deficit. It means that revenue is less than expense. To meet this government increases money supply or it mobilizes private saving this will lead inflation. It is also called budget inflation.

- 24. Inflation: On the basis of cause Demand Pull inflation- Inflation due to increase in aggregate demand is called demand pull inflation. Cost push inflation-Inflation occurs due to increase in cost of input or raw materials. Stagflation- Inflation+ Unemployment. Phillips curve cannot explain it. Structural and bottleneck inflation

- 25. Demand pull inflation Before that you have to understand simple demand supply model in microeconomics.

- 26. Demand –supply model (exception) Condition-I You have to consider that good is normal , it should not be Veblen and giffen goods. Examples of Veblen goods include designer jewellary, wachts, and luxury cars. The demand curve for a Veblen good is upward sloping, Giffen goods are rare forms of inferior goods that have no ready substitute or alternative such as bread, rice, and potatoes. The only difference from traditional inferior goods is that demand increases even when their price rises, regardless of a consumer's income. The demand curve is upward sloping.

- 27. Demand – supply model Condition-II Ceteris paribus condition means holding other things remaining constant. It means that we consider only equilibrium price and equilibrium quantity Condition-III Partial equilibrium analysis not a general equilibrium analysis Partial equilibrium analysis examines the effects of particular sector or market which is directly affected, ignoring its effect in any other market or industry

- 28. Demand – supply model Simple demand supply model shows that Supply curve is upward sloping and the demand curve is downward sloping. Vertical line represents price and horizontal line represents quantity

- 29. Demand – supply model Why demand curve is downward sloping? Because people are demanding less quantity at higher price. As the price decreases people are demanding more quantity. Why supply curve is upward sloping? Because producer supply more quantity when price of a product rises. Higher the price, the producer has more profit, so new producer can also come into the market or the older producer will produce more when he will get more price of a commodity.

- 30. Demand – supply model Equilibrium rate and equilibrium quantity is decided when supply curve cuts the demand curve. As shown in the figure p is the equilibrium price and q is the equilibrium quantity.

- 31. Demand pull inflation Aggregate demand and aggregate supply model. Equilibrium price and equilibrium quantity is defined where aggregate demand and aggregate supply cuts each other

- 32. Demand pull inflation Component of aggregate demand AD is C+I+G+NX. Where C is consumption function, I is private investment, G is government expenditure and NX is net export. When price is increases by increase in aggregate demand it is called demand pull inflation

- 33. Cost push inflation Cost Push Inflation: Cost push inflation is created when price of raw material, intermediate goods increases and there will be increase in labour costs of productions of the industries. Many factors are responsible for upward movement in costs. Higher wage rate of labours, higher profit margin of producers, higher tax rate, tax burden goes to the consumers,

- 34. Stagflation The economy has an aggregate demand curve. Aggregate demand refers to the total goods and services in the economy that are demanded in the economy that year at different price levels. This is the downward sloping curve. In the same way, there is an aggregate supply curve, it is upward sloping. Equilibrium price decided where both of them cut each other. Y Axis represent Price and X Axis represents GDP. In the case of stagflation the aggregate supply curve shifts leftward. Due to which the price also increases and GDP and Employment goes down.

- 35. Stagflation

- 36. Stagflation Stagflation was first recognized during the 1970's, where many developed economies experienced rapid inflation and high unemployment as a result of an oil shock. Since the 1970's, rising price levels during periods of slow or negative economic growth have become somewhat of the norm rather than an exceptional situation.

- 38. Keynesian cross model Aggregate expenditure or aggregate demand =C+I+G+NX, A 45 degree line shows Aggregate supply. Equilibrium is decided when aggregate expenditure cuts Aggregate supply. GDP is decided at X-axis.

- 39. Inflationary gap Inflationary gap: Aggregate demand > Aggregate supply (at full employment level)

- 40. Deflationary gap Deflationary gap: Aggregate demand < Aggregate supply (at full employment level)

- 41. Structural and bottleneck inflation Bottle neck inflation: It is the inflation that takes place when supply falls drastically and demand remains at same level. This creates excess demand in the economy as the supply cannot match with it and thus prices rise. Such situations arise due to supply-side accidents, hazards or mismanagement. Structural Inflation:- Structural Inflation is another form of Inflation mostly prevalent in the Developing and Low-Income Countries due to weak structure of their economy.

- 42. Structural and bottleneck inflation It was given by Gunnar Myrdal and Paul Streeten THEY EXPLAINED INFLATION IN TERMS OF DEVELOPING COUNTRIES LIKE LATIN AMERICA AND INDIA. The structural theory explains three types of bottlenecks: 1. Agricultural bottlenecks 2. Government Budget constraint bottlenecks. 3. Foreign Exchange Bottlenecks

- 43. Agricultural bottlenecks In developing countries food grains production do not increases due to bottleneck in agriculture , so, agricultural output is inelastic to rising income. Bottlenecks in agriculture includes a) disparity in land ownership and defective land tenure system. b) use of primitive technology in agriculture. c) lack of knowledge and access to finance.

- 44. Agricultural bottlenecks d) dependency on weather e) low agricultural infrastructural facilities So food supply increases relatively less than increase in demand on account of increasing population or income. » AD>AS » gap » price rises » inflation Further hoarding accentuates the prices up.

- 45. Government Budget constraint bottlenecks Budget deficit leads A)Expenses side- Defense, agriculture, industries, infrastructure, PSU, require huge amount to run. B) Revenue side-Low tax base, large scale tax evasion, inefficient and corrupt tax administration. C) Insufficient external borrowings, grants and aids. Lead to deficit financing » Ms (AD) » Output(GDP) do not increases(AS) » gap between demand and supply increases AD>AS » pushes the prices up » inflation.

- 46. Foreign Exchange Bottlenecks LDCs are characterised by shortage of foreign exchange or currency due to: a) Dependency on import for their developmental activities like— capital goods, industrial raw material etc, b) Exports of these nations are low due to low exportable surplus, poor quality product, restrictive world trade policies It means, import >export ; payment > earning

- 47. Foreign Exchange Bottlenecks To fill this gap b/w export and import, LDCs opt 1. restrictive import policies ---- to reduce import 2. devaluation of currency----- to increase export Both of these measures lead to rise in price in the domestic nation. Both lead to inflation (demand pull inflation domestic and foreign demand)

- 48. These are interrelated terms which are quite confusing, for learning this terminology, you have to understand the concept of business cycle. Business cycle is a big topic, different economist has expressed their view on the business cycle. We are not going into the discussion of business cycle given by John Maynard Keynes, Nicholas kaldor, J.R. hicks, Paul Samuelsson, Schumpeter, Goodwin, Milton Friedman and other economist. We only have to discuss about the phases of the business cycle.

- 49. Business Cycle Economy of an any country is not in a steady state, it always moves. (Don’t confuse with Solow model of steady state that is another topic). Business cycle- it is simply fluctuation in GDP with respect to time.

- 51. Inflation, Deflation, Disinflation, Reflation What is disinflation? Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services over a period of time. For example if the annual inflation rate for the month of January is 5% and it is 4% in the month of February, the prices disinflated by 1% but are still increasing at a 4% annual rate. What is deflation? Deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%.

- 53. Inflation, Deflation, Disinflation, Reflation Reflation- Reflation is the act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy back up to the long-term trend, following a dip in the business cycle. It is the opposite of disinflation, which seeks to return the economy back down to the long-term trend. It is the opposite of disinflation, which seeks to return the economy back down to the long-term trend.

- 55. Inflation vs. Deflation If inflation is so bad, does this imply that deflation (negative inflation) is good? The answer is no. First, high deflation (a large negative rate of inflation) would create many of the same problems as high inflation, from distortions to increased uncertainty. Second, as we shall see later in the book, even a low rate of deflation limits the ability of monetary policy to affect output. So what is the ‘best’ rate of inflation? Most macroeconomists believe that the best rate of inflation is a low and stable rate of inflation, somewhere between 0 and3%.(It doesn’t mean 0%, it should be more than 0%)

- 56. Is inflation essential for economic growth ? It is just like an air in the vehicle tyre , if it is low , the economy of a country cannot run and if it is high, again the tyre may burst, the same thing happen with the economy . It will not move or run.

- 57. Is inflation essential for economic growth ? Proper air is required to move the wheel, similarly proper amount of inflation is required to move the economy. Workers wants salary should hike after a period of time. Landlord want their rent should be increase. Similarly the producer wants the price will rise so that he will earn profit. Even central bank of any country also desires inflation. In india it is RBI

- 58. Inflation in different time frame. Time frame are most important frame in the economics. These are short run , medium run and long run. In short run, say a few year, the movement of price and output is primarily driven by the movement in the demand function. Or the Aggregate demand. Changes in demand, perhaps due to changes in consumer confidence or other factors, can lead to a decrease in output (a recession) or an increase in output (an expansion). And increase in price(inflation) or decrease in price(deflation).

- 59. Inflation in different in frame. In the medium run, say, a decade(10 years) Over the medium run, the economy tends to return to the level of output determined by supply factors: the capital stock, the level of technology and the size of the labour force. And, over a decade or so, these factors move sufficiently slowly that we can take them as given. In the long run, say, a few decades or more, the output and price level are determined by the level of capital accumulation, technology, capital output ratio and human capital. Human capital plays a big role in the economy.(specialist)

- 60. Why Chinese products are cheaper? To under-stand why China has been able to achieve such a high growth rate since 1980, we must understand why both capital and the level of technology in China are increasing so fast. To do so, we must look at factors such as the education system, the saving rate, and the role of the government. Because the latest technology, and human capital will increase the level of production, which ultimately leads to increase in the output and decrease in price as well as reduce in the cost of manufacturers. However china practice dumping.

- 61. Why Chinese products are cheaper? Dumping occurs when a country or company exports a product at a price that is lower in the foreign importing market than the price in the exporter's domestic market.

- 62. Who measures inflation in India? It is measured by MOSPI. Ministry of statistics and program implementations. The Ministry of Statistics and Programme Implementation (MOSPI) came into existence as an Independent Ministry on 15.10.1999 after the merger of the Department of Statistics and the Department of Programme Implementation. It has two wings, one relating to Statistics and the other Programme Implementation.

- 63. How we calculate Inflation? GDP Deflator, Price index. Inflation is calculated in two ways: First one is GDP Deflator. Second One is Price Index, Whether it will be CPI, WPI,PPI, IIP, etc. It is calculated through the concept of index number and weighted mean. Price index consists of A basket of goods-It contains goods and services from various sectors of the economy. There prices are monitored over a period of time.

- 64. How we calculate Inflation? (Base Year) Base year-This is the first year with which the prices of subsequent years are compared. The price of each commodity is given the value of 100. The base year chosen is a typical year in the sense that there is neither very low or very high inflation, nor any extraordinary occurrences like wars.

- 65. How we calculate Inflation? Weight and weighted mean Some commodities are more important in the economy as compared to other commodities. To find out the true effect of inflation. Weights are added to different products and services according to their importance in the society. A product which has a more serious affect is given a higher weight. For example food products which form a staple diet of the society are assigned more weightage than luxury products (perfumes). As the pattern of consumers spending changes over time so the Price Index will have to change the weights assigned to different commodities.

- 66. Mean and weighted mean Suppose in the examination you got 80% marks in theory and 90% marks in the practical. The average (80%+90%)/2= 170%/2=85% Now think another aspect (80%+90%)/2 (80%/2+90%/2) or you can say that ½(80%)+1/2(90%) You can say that 1 = 100% or ½=50% here the weighted is 50% of both marks . Because these are equal.

- 67. Weighted mean Suppose in the examination you got 80% marks in theory and 90% marks in the practical. But here weight assigned for theory is 80% and weight assigned in practical is 20%. As you know that the value of 80% is 0.8 and value of 20% is 0.2 Multiply it by initial value i.e.{(80X0.8)+ (90X0.2)}% {(64)+(18)}% or 82% Here you can see that the average value is shifted towards 80% because its weight is more.

- 68. GDP Deflator GDP deflator is also known as implicit price deflator. GDP Deflator=Nominal GDP/Real GDP It measures the impact of inflation on the GDP of an economy during the period of a fiscal year. GDP deflator is a much broader and comprehensive measure than CPI and WPI. The GDP deflator also includes the prices of investment goods, government services and exports, and excludes the price of imports.

- 69. Why GDP deflator is not used as inflation measures ? 1) It excludes imported items. 2) WPI and CPI are available on monthly basis whereas GDP deflator comes with a lag (yearly or quarterly, after quarterly GDP data is released). Hence, monthly change in inflation cannot be tracked using GDP deflator.

- 70. Nominal GDP Suppose GDP of a country A is 10 million in 1980 and 1 billion in 2020. Can we say the economy of that very country is 10 times from today? The answer is no Because in these time price has also increased, and it is measured by inflation rate. And the price of a commodity is not same when it was measured in 1980 and now when it is measured in 2020. Nominal GDP is sum of GDP multiplied by current price not the price of previous year or base year.

- 71. Base Year(GDP) The base period or base year refers to the year in which an index number series begins to be calculated. This will invariably have a starting value of 100. The last series has changed the base to 2011-12 from 2004-05. The Ministry of Statistics and Programme Implementation (MOSPI) is considering changing of base year for GDP calculation from 2011-12 to 2017- 18.

- 72. Nominal GDP & Real GDP GDP increases over the time for two reasons:- a)The production of goods must increases over the time. b) The price of goods must increased over time. Our main motive to know how much production has increased over time this is called Real GDP. Real GDP measures how much economy has increased over a period of time.(Base Year) While nominal GDP represents the total GDP at current price.

- 73. Nominal GDP and Real GDP Suppose that a hypothetical economy produces two goods only. Chicken and Fish. And base Year is 2018 Nominal GDP: GDP at Current Price Real GDP: GDP at Constant Price or base year price Year Price of chicken Quantity of chicken Price of fish Quantity of fish 2018 200 100 150 200 2019 210 100 160 210 Year Nominal GDP Real GDP 2018 (200X100)+(150X200)=50000 (200X100)+(150X200)=50000 2019 (210X100)+(160X210)=54600 (200X100)+(150X210)=51500

- 74. GDP Deflator & Inflation Calculation GDP Deflator=(Nominal GDP/Real GDP)X100 In year 2018, GDP Deflator=(Nominal GDP/Real GDP)X100 (50000/50000)X100= 1X100=100 In year 2019, GDP Deflator=(Nominal GDP/Real GDP)X100 (54600/51500)X 100 (1.060194)X 100= 106.0194 Inflation is 106.01-100.00=6.01%

- 75. CPI CPI (Consumer Price Index) also known as the cost of living Index. Base Year, Basket of Goods and services Inflation=Price of current year/Price of base year X 100% Example= 108/100 X 100%=108% Base year price was 100 and current year price 108 so price of basket of goods and services has increased by (108-100)% or 8 % Introduced by raghuram rajan Base year is 2012

- 76. CPI(Continued..) Six Categories of CPI 1. Food Beverage.(54.18%) 2. Miscellaneous.(27.26%) 3. Housing not included in Rural CPI 4. Pan, tobacco, intoxicants (3.26%) 5. Clothing and footwear (7.36%) 6. Fuel and light(7.94%)

- 77. CPI(Continued..) CPI (Consumer Price Index) also known as the cost of living Index. It measures the average change in price paid by a specific class of consumers. There are four series, the CPI UNME (Urban Non-Manual Employee), CPI UNME series is published by the Central Statistical Organization which is under the Central Statistics Office is a governmental agency in India under the Ministry of Statistics and Programme Implementation. CPI AL (Agricultural Labourer) is published by the Department of Labour.

- 78. CPI (Continued..) CPI RL (Rural Labourer) is published by the Department of Labour. and CPI IW (Industrial Worker)is published by the Department of Labour. CPI IW (industrial workers) base year is 2016 The Labour Bureau has started the exercise of revising the base year for consumer price index for agricultural and rural labours (CPIAL/RL) to 2019-20, from 1986- 87, Agricultural, rural labour CPI base year to be revised to 2019-20. But not revised yet.

- 79. CPI (Continued..) From February 2011 the CPI (UNME) released by CSO is replaced as CPI (urban), CPI (rural), and CPI (combined). Price data are collected from selected towns by the Field Operations Division of NSSO and from selected villages by the Department of Posts. Price data are received through web portals being maintained by the National Informatics Centre (NIC).

- 80. Why we need CPI? The GDP deflator gives the average price of output – the final goods produced in the economy – but consumers care about the average price of consumption – the goods they consume. Some of the goods in GDP are sold not to consumers but to firms (machine tools, for example), to the government or to foreigners. Some of the goods bought by consumers are not produced domestically but are imported from abroad.

- 81. CPI in different-different Country In the USA, the CPI has been in existence since 1917 and is published monthly. In Europe, the price index which is most frequently used is the harmonised index of consumer prices, or HICP, HICP is measured by Eurostat, the Statistical Office of the European Communities. The HICP gives com-parable measures of inflation in the euro area, the EU, the European Economic Area (EEA, which includes Norway, Iceland and Liechtenstein, besides the EU) and for other countries

- 82. CPI in different-different Country In the USA, BLS ,bureau of labour and statistics publishes monthly. In the UK, ONS, Office for national statistics publishes monthly.

- 83. WPI Here wholesale price are considered not retail price are considered. In India, this basket is composed of three groups: Primary Articles (22.62% of total weight), Fuel and Power (13.15%) and Manufactured Products (64.23%).

- 84. WPI Calculation number is 100 in weighted mean Base year is 2011-2012 There are 3 category primary , fuel and manufacturing Primary- Laspeyres Index formula is called headline WPI Core inflation WPI= Headline inflation WPI-(Food and Fuel It is calculated by office of economic advisor under ministry of commerce and industry.

- 85. IIP Manufacturing (77.63%), mining(14.37%) and electricity(8%). The eight core industries include coal, crude oil, natural gas, refinery products, fertilizers, steel, cement and electricity. These are called core industries because of their likely impact on general economic activity as well as other industrial activity. In the case of Index of Industrial Production India, IIP data is compiled and published by CSO every month. CSO or Central Statistical Organisation operates under the Ministry of Statistics and Programme Implementation (MoSPI). Base year for IIP is 2011-2012

- 86. PPI PPI, or producer price index, which is an index of prices of domestically produced goods in manufacturing, mining, agriculture, fishing, forestry and others. It excludes tax. The Producer Price Index or PPI is an index used to calculate the movement of price from the seller’s point of view. In India PPI haven't been in use yet, NITI Aayog have created a roadmap to introduce PPI soon.

Editor's Notes

- Why we need to study inflation ? Salary is not increases as much amount.

- Govt fiscal policy, monetary policy, gdp growth rate, money growth rate, expectations

- He and harry Dexter white played an important role in opening of world bank and IMF, at that time he also predict that bretton woods system will be collapse.

- Solow and tobin view of phillips curve.

- Obviously products are less and consumers are more price will be hike.

- Dumping

- Dumping

- What is European economic area ?

- What is European economic area ?

- Show data