More Related Content

More from nadinesullivan (20)

Les 21 2

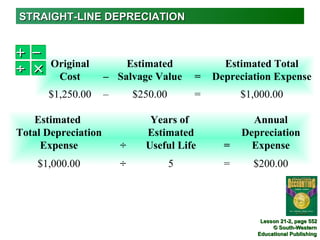

- 1. STRAIGHT-LINE DEPRECIATION

+ −

Original Estimated Estimated Total

÷ ×

Cost – Salvage Value = Depreciation Expense

$1,250.00 – $250.00 = $1,000.00

Estimated Years of Annual

Total Depreciation Estimated Depreciation

Expense ÷ Useful Life = Expense

$1,000.00 ÷ 5 = $200.00

Lesson 21-2, page 552

© South-Western

Educational Publishing

- 2. CALCULATING DEPRECIATION EXPENSE FOR PART

OF A YEAR

+ −

Annual Months Monthly

÷ ×

Depreciation in a Depreciation

Expense ÷ Year = Expense

$900.00 ÷ 12 = $75.00

Monthly Number of Partial Year’s

Depreciation Months Asset Depreciation

Expense × Is Used = Expense

$75.00 × 5 = $375.00

Lesson 21-2, page 552

© South-Western

Educational Publishing

- 3. CALCULATING ACCUMULATED DEPRECIATION

+ − 20X2 20X3 20X3

÷ × Accumulated Depreciation Accumulated

Depreciation + Expense = Depreciation

$400.00 + $200.00 = $600.00

CALCULATING BOOK VALUE

Original Accumulated Ending

Cost – Depreciation = Book Value

$1,250.00 – $600.00 = $650.00

Beginning Annual Ending

Book Value – Depreciation = Book Value

$850.00 – $200.00 = $650.00

Lesson 21-2, page 553

© South-Western

Educational Publishing

- 4. TERMS REVIEW

depreciation expense

estimated salvage value

straight-line method of depreciation

accumulated depreciation

book value of a plant asset

Lesson 21-2, page 554

© South-Western

Educational Publishing