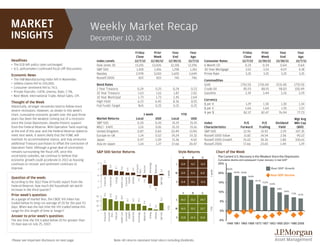

Weekly Market Recap: Stocks Rise Despite Fiscal Cliff Uncertainty

- 1. MARKET Weekly Market Recap INSIGHTS December 10, 2012 Friday Prior Year Year Friday Prior Year Year Close Week End Ago Close Week End Ago Headlines Index Levels 12/7/12 11/30/12 12/30/11 12/7/11 Consumer Rates 12/7/12 11/30/12 12/30/11 12/7/11 • The ECB left policy rates unchanged. Dow Jones 30 13,155 13,026 12,218 12,196 6 Month CD 0.33 0.34 0.64 0.64 • U.S. policymakers continued fiscal cliff discussions. S&P 500 1,418 1,416 1,258 1,261 30 Year Mortgage 3.52 3.53 4.07 4.18 Economic News Nasdaq 2,978 3,010 2,605 2,649 Prime Rate 3.25 3.25 3.25 3.25 • The ISM Manufacturing index fell in November. Russell 2000 822 822 741 746 Commodities • Jobless claims fell to 370,000. Bond Rates Gold 1701.50 1726.00 1531.00 1735.50 • Consumer sentiment fell to 74.5. 2 Year Treasury 0.24 0.25 0.24 0.23 Crude Oil 85.93 88.91 98.83 100.49 • Private Payrolls: +147K; Unemp. Rate: 7.7%. 10 Year Treasury 1.63 1.61 1.87 2.02 Gasoline 3.39 3.44 3.26 3.29 • Next Week: International Trade, Retail Sales, CPI. 10 Year Municipal 1.73 1.73 2.45 2.64 High Yield 6.23 6.45 8.36 8.55 Currency Thought of the Week $ per € 1.29 1.30 1.30 1.34 Historically, stronger recoveries tend to follow more Fed Funds Target N/A 0.25 0.25 0.25 $ per £ 1.60 1.60 1.55 1.57 severe recessions. However, as shown in this week’s ¥ per $ 82.37 82.47 76.94 77.73 chart, cumulative economic growth over the past three 1 week YTD years has been the weakest coming out of a recession Market Returns Local USD Local USD Wgt Avg since the Great Depression, despite historic support S&P 500 0.20 0.20 15.19 15.19 Index P/E P/E Dividend Mkt Cap from the Federal Reserve. With Operation Twist expiring MSCI - EAFE 1.01 0.81 15.33 15.16 Characteristics Forward Trailing Yield (Bill) at the end of this year and the Federal Reserve slated to United Kingdom 0.87 0.83 10.49 13.90 S&P 500 12.92 15.92 2.29 107.35 meet next week, it seems likely that the FOMC will Europe ex-UK 1.14 0.52 19.24 19.32 Russell 1000 Value 11.82 14.54 2.56 90.22 maintain its accommodative stance, and may announce Japan 0.97 1.09 11.36 4.02 Russell 1000 Growth 15.02 18.36 1.80 100.61 additional Treasury purchases to offset the conclusion of Asia ex-Japan 1.14 1.27 17.66 20.47 Russell 2000 17.66 23.65 1.49 1.29 Operation Twist. Although a great deal of uncertainty remains surrounding the fiscal cliff, once this S&P 500 Sector Returns Style Returns Chart of the Week uncertainty subsides, we continue to believe that V B G The Current U.S. Recovery is the Weakest Since the Depression economic growth could accelerate in 2013 as housing Cumulative decline and subsequent 3-year recovery in real GDP 1.7 continues to recover and sentiment continues to 2 L 0.9 0.2 -0.5 25% Technology Consumer Materials 0.9 Telecom 0.7 improve. Real GDP Growth 0.6 0.4 0.4 1 20.2% Discr. 0.2 1 week 1 week M 0.9 0.4 0.0 20% 18.5% 18.4% 0 16.4% Real GDP Decline Question of the week: Financials Industrials Energy Health Care Consumer Staples Utilities S&P 500 -0.2 -0.4 14.1% According to the 3Q12 Flow of Funds report from the -1 S 0.4 0.1 -0.3 15% 13.2% 12.4% Federal Reserve, how much did household net worth -1.4 -2 9.8% -1.8 increase in the third quarter? V B G 10% 8.4% 7.3% Prior week's question: 25.1 23.0 6.7% 30 19.0 18.9 As a gauge of market fear, the CBOE VIX Index has 15.2 L 16.2 15.2 14.7 13.7 13.5 13.3 20 5% 9.4 traded below its long run average of 20 for the past 93 4.7 10 days. When was the last time the VIX traded below this 1.6 YTD YTD M 16.5 15.2 13.7 range for this length of time or longer? 0 0% Financials Consumer Discr. Telecom Health Care Consumer Staples Industrials Technology Materials Energy Utilities S&P 500 Answer to prior week's question: S 13.8 12.4 11.0 The last time the VIX traded below 20 for greater than -5% 93 days was on July 25, 2007. 1948 1981 1960 1969 1973 1957 1953 1990 2001 1980 2008 Please see important disclosure on next page. Note: All returns represent total return including dividends.

- 2. MARKET Weekly Market Recap | December 10, 2012 INSIGHTS Chart of the Week: Source: BEA, NBER, J.P. Morgan Asset Management. reinvestment of dividends. The Index used from L to R, top to bottom are: S&P 500 Index (Index represents Thought of the Week: Source: BEA, NBER, Federal Reserve, J.P. Morgan Asset Management. the 500 Large Cap portion of the stock market, and is comprised of 500 stocks as selected by the S&P Index Committee), Russell 1000 Value Index (Measures the performance of those Russell 1000 companies Question of the Week: Source: Federal Reserve, J.P. Morgan Asset Management. with lower price-to-book ratios and lower forecasted growth values), Russell 1000 Growth Index (Measures Market Returns: All data represents total return including the reinvestment of dividends for stated period. the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted Index: MSCI – EAFE; provided by: MSCI – gross official pricing. Index: UK; provided by: MSCI – gross official growth values), Russell Mid Cap Value Index (Measures the performance of those Russell Mid Cap pricing. Index: Europe ex-UK; provided by: MSCI – gross official pricing. Index: Japan; provided by: MSCI – companies with lower price-to-book ratios and lower forecasted growth values), Russell Mid Cap Index gross official pricing. Index: Asia ex-Japan; provided by: MSCI – gross official pricing. Index: S&P 500 Index; (The Russell Midcap Index includes the smallest 800 securities in the Russell 1000), Russell Mid Cap provided by: IDC. Growth Index (Measures the performance of those Russell Mid Cap companies with higher price-to-book (MSCI EAFE is a Morgan Stanley Capital International Index that is designed to measure the performance of ratios and higher forecasted growth values), Russell 2000 Value Index (Measures the performance of the developed stock markets of Europe, Australia, and the Far East). those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values), Russell 2000 Index (The Russell 2000 includes the smallest 2000 securities in the Russell 3000), Russell Dow Jones-UBS Commodity Index (DJ-UBSCI) is a broadly diversified index composed of futures contracts 2000 Growth Index (Measures the performance of those Russell 2000 companies with higher price-to- on physical commodities. The index is designed to minimize concentration in any one commodity or sector. book ratios and higher forecasted growth values). It includes 19 commodity futures in five groups. Contact JPMorgan Distribution Services, Inc. at 1-800-480-4111 for a fund prospectus. You can Bond Rates: Fed Funds Target, EcoWin; 2 Year Treasury, IDC; 10 Year Treasury, IDC; 10 Year Muni, Barclays also visit us at www.jpmorganfunds.com. Investors should carefully consider the investment Capital; High Yield, Barclays Capital High-yield Index. objectives and risks as well as charges and expenses of the mutual fund before investing. The Consumer Rates: 6 Month CD, Federal Reserve; 30 Year Mortgage, Mortgage Bankers Association (MBA); prospectus contains this and other information about the mutual fund. Read the prospectus Prime Rate: Federal Reserve. carefully before investing. Commodities: Gold, EcoWin; Crude Oil (WTI), EcoWin; Gasoline, EcoWin. Past performance does not guarantee future results. Currency: Dollar per Pound, IDC; Dollar per Euro, IDC; Yen per Dollar, IDC. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Index Price Levels: Reflects closing price level for each index as of stated date. Dow Jones Industrial 30 Opinions and estimates offered constitute our judgment and are subject to change without notice, as are (The Dow Jones is a price-weighted index composing of 30 widely-traded blue chip stocks.): IDC, S&P 500 statements of financial market trends, which are based on current market conditions. We believe the Index (The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market, this information provided here is reliable, but do not warrant its accuracy or completeness. This material is not world-renowned index includes a representative sample of 500 leading companies in leading industries of intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with strategies described may not be suitable for all investors. This material has been prepared for approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market.): IDC, NASDAQ informational purposes only, and is not intended to provide, and should not be relied on for, accounting, Composite Index (The NASDAQ Index is a market-value weighted index of all common stocks listed on the legal or tax advice. References to future returns are not promises or even estimates of actual returns a NASDAQ stock exchange.): IDC, Russell 2000 Index: IDC. Indexes are not available for direct investment. client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not S&P Index Characteristics: Trailing P/E price is provided by Factset Pricing database while trailing earnings to be relied upon as advice or interpreted as a recommendation. is provided by Compustat. Dividend Yield provided by FactSet Pricing database. Fwd. P/E is a bottom-up The price of equity securities may rise, or fall because of changes in the broad market or changes in a weighted Harmonic average using First Call Mean estimates for the "Next 12 Months" (NTM) period. company's financial condition, sometimes rapidly or unpredictably. International investing involves a Marketcap is a bottom-up weighted average based on share information from Compustat and Price greater degree of risk and increased volatility. There is no guarantee that companies that can issue information from FactSet's Pricing database as provided by Standard & Poor's. dividends will declare, continue to play, or increase dividends. Investments in commodities may have Russell 1000 Value Index, Russell 1000 Growth Index, and Russell 2000 Index Characteristics: Trailing P/E greater volatility than investments in traditional securities, particularly if the instruments involve leverage. is provided directly by Russell. Fwd. P/E is a bottom-up weighted harmonic average using First Call Mean J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan estimates for the "Next 12 Months" (NTM) period. Marketcap is a bottom-up weighted average based on Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., share information from Compustat and Price information from FactSet's Pricing database as provided by Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Russell. Inc. Sector Returns: Sectors are based on the GICS Classification model. Return data are calculated by FactSet JPMorgan Distribution Services, Inc., member FINRA/SIPC using constituents and weights as provided by Standard & Poor’s. Returns are cumulative total return for © JPMorgan Chase & Co., December 2012. stated period, including reinvestment of dividends. Unless otherwise stated, all data is as of December 7, 2012 or as of most recently available. Style Returns: Style box returns based on Russell Indexes with the exception of the Large-Cap Blend box, which reflects the S&P 500 Index. All values are cumulative total return for stated period including the NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE