UNIT V AND VIBBA 3301 Unit V AssignmentInstructions Enter a.docx

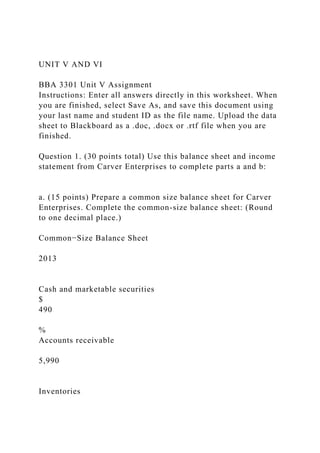

UNIT V AND VI BBA 3301 Unit V Assignment Instructions: Enter all answers directly in this worksheet. When you are finished, select Save As, and save this document using your last name and student ID as the file name. Upload the data sheet to Blackboard as a .doc, .docx or .rtf file when you are finished. Question 1. (30 points total) Use this balance sheet and income statement from Carver Enterprises to complete parts a and b: a. (15 points) Prepare a common size balance sheet for Carver Enterprises. Complete the common-size balance sheet: (Round to one decimal place.) Common−Size Balance Sheet 2013 Cash and marketable securities $ 490 % Accounts receivable 5,990 Inventories 9,550 Current assets $ 16,030 % Net property plant and equipment 17,030 Total assets $ 33,060 % Accounts payable $ 7,220 % Short−term debt 6,800 Current liabilities $ 14,020 % Long−term liabilities 7,010 Total liabilities $ 21,030 % Total owners’ equity 12,030 Total liabilities and owners’ equity $ 33,060 % b. (15 points) Prepare a common-size income statement for Carver Enterprises. Complete the common-size income statement: (Round to one decimal place.) Common−Size Income Statement 2013 Revenues $ 30,020 % Cost of goods sold (19,950) Gross profit $ 10,070 % Operating expenses (7,960) Net operating income $ 2,110 % Interest expense (940) Earnings before taxes $ 1,170 % Taxes (425) Net income $ 745 % Question 2. (10 points total) Use this data table of Campbell Industries liabilities and owners' equity to complete parts a and b. a. (5 points) What percentage of the firm's assets does the firm finance using debt (liabilities)? (Round to one decimal place.) b. (5 points) If Campbell were to purchase a new warehouse for $1.3 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? (Round to one decimal place.) Question 3. (10 points total) (Liquidity analysis)Airspot Motors, Inc. has $2,433,200 in current assets and $869,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other assets and current liabilities remain constant)? (Round to one decimal place.) Question 4. (10 points total) (Efficiency analysis)Baryla Inc. manufactures high quality decorator lamps in a plant located in eastern Tennessee. Last year the firm had sales of $93 million and a gross profit margin of 45 percent. a. (5 points) How much inventory can Baryla hold and still maintain an inventory turnover ratio of at least 6.3 times? (Round to one decimal place.) b. (5 points) Currently, some of Baryla's inventory includes $2.3 million of outdated and damaged goods that simply remain in inventory and are not salable. What inventory ratio must the good inventory maintain in order to achieve an overall turnover ra ...

Recommended

Recommended

More Related Content

Similar to UNIT V AND VIBBA 3301 Unit V AssignmentInstructions Enter a.docx

Similar to UNIT V AND VIBBA 3301 Unit V AssignmentInstructions Enter a.docx (20)

More from marilucorr

More from marilucorr (20)

Recently uploaded

Recently uploaded (20)

UNIT V AND VIBBA 3301 Unit V AssignmentInstructions Enter a.docx

- 1. UNIT V AND VI BBA 3301 Unit V Assignment Instructions: Enter all answers directly in this worksheet. When you are finished, select Save As, and save this document using your last name and student ID as the file name. Upload the data sheet to Blackboard as a .doc, .docx or .rtf file when you are finished. Question 1. (30 points total) Use this balance sheet and income statement from Carver Enterprises to complete parts a and b: a. (15 points) Prepare a common size balance sheet for Carver Enterprises. Complete the common-size balance sheet: (Round to one decimal place.) Common−Size Balance Sheet 2013 Cash and marketable securities $ 490 % Accounts receivable 5,990 Inventories

- 2. 9,550 Current assets $ 16,030 % Net property plant and equipment 17,030 Total assets $ 33,060 % Accounts payable $ 7,220 % Short−term debt 6,800 Current liabilities $ 14,020 % Long−term liabilities 7,010

- 3. Total liabilities $ 21,030 % Total owners’ equity 12,030 Total liabilities and owners’ equity $ 33,060 % b. (15 points) Prepare a common-size income statement for Carver Enterprises. Complete the common-size income statement: (Round to one decimal place.) Common−Size Income Statement 2013 Revenues $ 30,020 % Cost of goods sold (19,950)

- 4. Gross profit $ 10,070 % Operating expenses (7,960) Net operating income $ 2,110 % Interest expense (940) Earnings before taxes $ 1,170 % Taxes (425) Net income $ 745 %

- 5. Question 2. (10 points total) Use this data table of Campbell Industries liabilities and owners' equity to complete parts a and b. a. (5 points) What percentage of the firm's assets does the firm finance using debt (liabilities)? (Round to one decimal place.) b. (5 points) If Campbell were to purchase a new warehouse for $1.3 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? (Round to one decimal place.) Question 3. (10 points total) (Liquidity analysis)Airspot Motors, Inc. has $2,433,200 in current assets and $869,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other assets and current liabilities remain constant)? (Round to one decimal place.) Question 4. (10 points total) (Efficiency analysis)Baryla Inc. manufactures high quality decorator lamps in a plant located in eastern Tennessee. Last year the firm had sales of $93 million and a gross profit margin of 45 percent.

- 6. a. (5 points) How much inventory can Baryla hold and still maintain an inventory turnover ratio of at least 6.3 times? (Round to one decimal place.) b. (5 points) Currently, some of Baryla's inventory includes $2.3 million of outdated and damaged goods that simply remain in inventory and are not salable. What inventory ratio must the good inventory maintain in order to achieve an overall turnover ratio of at least 6.3 (including the unsalable items)? (Round to one decimal place.) Question 5. (15 points total) (Profitability and capital structure analysis)In the year that just ended, Callaway Lighting had sales of $5,470,000 and incurred cost of goods sold equal to $4,460,000. The firm's operating expenses were $128,000 and its increase in retained earnings was $42,000 for the year. There are currently 99,000 common stock shares outstanding and the firm pays a $4.770 dividend per share. The firm has $1,180,000 in interest-bearing debt on which it pays 7.7 percent interest. a. (5 points) Assuming the firm's earnings are taxed at 35%, construct the firm's income statement. Income Statement Revenues

- 7. $ Cost of Goods Sold Gross Profit $ Operating Expenses Net Operating Income $ Interest Expense Earnings before Taxes $ Income Taxes Net Income $ b. (5 points) Calculate the firm's operating profit margin and net profit margin. (Round to one decimal place.) The operating profit margin is % The net income margin is %

- 8. c. (5 points) Compute the times interest earned ratio. The times interest earned ratio is % What does this tell you about Callaway's ability to pay its interest expense? (Fill in the blank with the times interest earned ratio from above and select the best choice.) 1) Callaway's operating income can fall as much as ______ times the interest expense and the company would still be able to service its debt. 2) Callaway's interest expense is _______ times higher than its competitors. 3) Callaway's gross profit can fall as much as ______ times and still be able to service its debt. 4) Callaway's operating income can fall as much as ______ times and still be able to repay its debt. Answer: What is the firm's return on equity? (Select the best choice.) 1) The firm's return on equity is the same as the net profit margin, 9.4%. 2) The firm's return on equity is the sum of the operating profit margin and the net profit margin, 25.5%. 3) There is not enough information to answer this question. 4) The firm's return on equity is the same as the operating profit margin, 16.1%. Answer:

- 9. Question 6. (5 points total) (Market value analysis) Lei Materials' balance sheet lists total assets of $1.16 billion, $132 million in current liabilities, $415 million in long-term debt, $613 million in common equity, and 58 million shares of common stock. If Lei's current stock price is $52.08, what is the firm's market-to-book ratio? (Round to one decimal place.) Question 7. (5 points total) (DuPont analysis)Bryley, Inc. earned a net profit margin of 5.1 percent last year and had an equity multiplier of 3.49. If its total assets are $109 million and its sales are $157 million, what is the firm's return on equity? (Round to one decimal place.) Question 8. (15 points total) (Calculating financial ratios) Use the balance sheet and income statement for the J. P. Robard Mfg. Company to calculate the following ratios: Current ratio (Round to two decimal places.) Times interest earned (Round to two decimal places.)

- 10. times Inventory turnover (Round to two decimal places.) times Total asset turnover (Round to two decimal places.) Operating profit margin (Round to one decimal places.) % Operating return on assets (Round to one decimal places.) % Debt ratio (Round to one decimal places.) % Average collection period (Round to one decimal places.) days Fixed asset turnover (Round to two decimal places.) Return on equity (Round to one decimal places.) %

- 11. BBA 3310 Unit VI Assignment Instructions: Enter all answers directly in this worksheet. When finished select Save As, and save this document using your last name and student ID as the file name. Upload the data sheet to Blackboard as a .doc, .docx or .rtf file when you are finished. Question 1: (10 points). (Bond valuation) Calculate the value of a bond that matures in 12 years and has $1,000 par value. The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 12 percent. Round to the nearest cent. The value of the bond is Question 2: (10 points). (Bond valuation) Enterprise, Inc. bonds have an annual coupon rate of 11 percent. The interest is paid semiannually and the bonds mature in 9 years. Their par value is $1,000. If the market's required yield to maturity on a comparable-risk bond is 14 percent, what is the value of the bond? What is its value if the interest is paid annually and semiannually? (Round to the nearest cent.) a. The value of the Enterprise bonds if the interest is paid semiannually is $ b. The value of the Enterprise bonds if the interest is paid annually is $ Question 3: (10 points). (Yield to maturity) The market price is

- 12. $750 for a 20-year bond ($1,000 par value) that pays 9 percent annual interest, but makes interest payments on a semiannual basis (4.5 percent semiannually). What is the bond's yield to maturity? (Round to two decimal places.) The bond's yield to maturity is % Question 4: (10 points). (Yield to maturity) A bond's market price is $950. It has a $1,000 par value, will mature in 14 years, and has a coupon interest rate of 8 percent annual interest, but makes its interest payments semiannually. What is the bond's yield to maturity? What happens to the bond's yield to maturity if the bond matures in 28 years? What if it matures in 7 years? (Round to two decimal places.) The bond's yield to maturity if it matures in 14 years is % The bond's yield to maturity if it matures in 28 years is % The bond's yield to maturity if it matures in 7 years is % Question 5: (15 points). (Bond valuation relationships) Arizona Public Utilities issued a bond that pays $70 in interest, with a $1,000 par value and matures in 25 years. The markers required yield to maturity on a comparable-risk bond is 8 percent. (Round to the nearest cent.) For questions with two answer options (e.g. increase/decrease) choose the best answer and write it in the answer block.

- 13. Question Answer a. What is the value of the bond if the markers required yield to maturity on a comparable-risk bond is 8 percent? $ b. What is the value of the bond if the markers required yield to maturity on a comparable-risk bond increases to 11 percent? $ c. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond decreases to 7 percent? $ d. The change in the value of a bond caused by changing interest rates is called interest-rate risk. Based on the answer: in parts b and c, a decrease in interest rates (the yield to maturity) will cause the value of a bond to (increase/decrease): By contrast in interest rates will cause the value to (increase/decrease): Also, based on the answers in part b, if the yield to maturity (current interest rate) equals the coupon interest rate, the bond will sell at (par/face value): exceeds the bond's coupon rate, the bond will sell at a (discount/premium): and is less than the bond's coupon rate, the bond will sell at a (discount/premium):

- 14. e. Assume the bond matures in 5 years instead of 25 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 8 percent? $ 960.07 Assume the bond matures in 5 years instead of 25 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 11 percent? $ f. Assume the bond matures in 5 years instead of 25 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 7 percent? $ g. From the findings in part e, we can conclude that a bondholder owning a long-term bond is exposed to (more/less) interest-rate risk than one owning a short-term bond. Question 6: (5 points). (Measuring growth) If Pepperdine, Inc.'s return on equity is 14 percent and the management plans to retain 55 percent of earnings for investment purposes, what will be the firm's growth rate? (Round to two decimal places.) The firm's growth rate will be % Question 7: (10 points). (Common stock valuation) The common stock of NCP paid $1.29 in dividends last year. Dividends are expected to grow at an annual rate of 6.00 percent for an

- 15. indefinite number of years. (Round to the nearest cent.) a. If your required rate of return is 8.70 percent, the value of the stock for you is: $ b. You (should/should not) make the investment if your expected value of the stock is (greater/less) than the current market price because the stock would be undervalued. Question 8: (10 points). (Measuring growth) Given that a firm's return on equity is 22 percent and management plans to retain 37 percent of earnings for investment purposes, what will be the firm's growth rate? If the firm decides to increase its retention rate, what will happen to the value of its common stock? (Round to two decimal places.) a. The firm's growth rate will be: b. If the firm decides to increase its retention ratio, what will happen to the value of its common stock? An increase in the retention rate will (increase/decrease) the rate of growth in dividends, which in turn will (increase/decrease) the value of the common stock. Question 9: (10 points). (Relative valuation of common stock) Using the P/E ratio approach to valuation, calculate the value of a share of stock under the following conditions: · the investor's required rate of return is 13 percent, · the expected level of earnings at the end of this year (E1) is $8, · the firm follows a policy of retaining 40 percent of its

- 16. earnings, · the return on equity (ROE) is 15 percent, and · similar shares of stock sell at multiples of 8.571 times earnings per share. Now show that you get the same answer using the discounted dividend model. (Round to the nearest cent.) a. The stock price using the P/E ratio valuation method is: $ b. The stock price using the dividend discount model is: $ Question 10: (10 points) (Preferred stock valuation) Calculate the value of a preferred stock that pays a dividend of $8.00 per share when the market's required yield on similar shares is 13 percent. (Round to the nearest cent.) a. The value of the preferred stock is $ Per share