Cash flow

•Download as PPTX, PDF•

0 likes•602 views

A revision presentation for clients of Aqhuman Financial Training

Report

Share

Report

Share

Recommended

Accounts receivables management 1 copy - copy

Accounts receivables management 1 copy - copyShifas ibrahim MBA student @ ILAHIA SCHOOL OF MANAGEMENT STUDIES

More Related Content

What's hot

Accounts receivables management 1 copy - copy

Accounts receivables management 1 copy - copyShifas ibrahim MBA student @ ILAHIA SCHOOL OF MANAGEMENT STUDIES

What's hot (20)

Accounting 101 for Entrepreneurs - Denver Startup Week 2014

Accounting 101 for Entrepreneurs - Denver Startup Week 2014

Key financial issues and metrics every startup should pay attention to Financ...

Key financial issues and metrics every startup should pay attention to Financ...

Viewers also liked

Viewers also liked (20)

Similar to Cash flow

Similar to Cash flow (20)

Chapter TwelveSmall Business Accounting Projecting and Evalua.docx

Chapter TwelveSmall Business Accounting Projecting and Evalua.docx

98C H A P T E R3 Measuring Business IncomeI ncome, o.docx

98C H A P T E R3 Measuring Business IncomeI ncome, o.docx

Essential Business Tips to Overcome a Slow Economy

Essential Business Tips to Overcome a Slow Economy

MBA+ASAP+Financial+Statement+Glossary+of+Terms (1).pdf

MBA+ASAP+Financial+Statement+Glossary+of+Terms (1).pdf

1_Managerial Aspects of Business and Government Initiatives (1).pptx

1_Managerial Aspects of Business and Government Initiatives (1).pptx

Stop fearing the cash flow roller coaster(finished)

Stop fearing the cash flow roller coaster(finished)

Recently uploaded

Recently uploaded (20)

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

Abortion pills in Saudi Arabia (+919707899604)cytotec pills in dammam

Abortion pills in Saudi Arabia (+919707899604)cytotec pills in dammam

fundamentals of corporate finance 11th canadian edition test bank.docx

fundamentals of corporate finance 11th canadian edition test bank.docx

uk-no 1 kala ilam expert specialist in uk and qatar kala ilam expert speciali...

uk-no 1 kala ilam expert specialist in uk and qatar kala ilam expert speciali...

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

Strategic Resources May 2024 Corporate Presentation

Strategic Resources May 2024 Corporate Presentation

In Sharjah ௵(+971)558539980 *_௵abortion pills now available.

In Sharjah ௵(+971)558539980 *_௵abortion pills now available.

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Cash flow

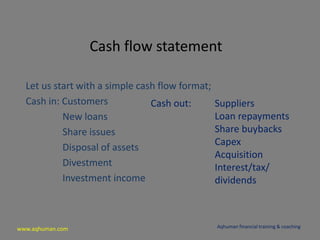

- 1. www.aqhuman.com Cash flow statement Let us start with a simple cash flow format; Cash in: Customers New loans Share issues Disposal of assets Divestment Investment income Aqhuman financial training & coaching Cash out: Suppliers Loan repayments Share buybacks Capex Acquisition Interest/tax/ dividends

- 2. www.aqhuman.com Cash flow statement Cash in X Cash out ( X) Net cash flow X Opening balance X Closing balance X Aqhuman financial training & coaching The cash flow simply shows the cash in and out , the starting position and thus the closing position

- 3. www.aqhuman.com Cash flow statement Cash from operations (customers – suppliers) Cash from financing (new shares-buybacks+new loans-repayments-interest) Cash from investing activities (Disposal of asset+divestments-capex-acquisitions- dividends) Tax paid Aqhuman financial training & coaching The cash flow is normally shown with similar items grouped together

- 4. www.aqhuman.com Cash flow statement The cash flow is popular as: -There are no funny accounting rules; did the cash come in/out or not? -Company survival is a cash matter -Growth only comes from generating cash (in order to hire more staff, buy other companies, buy/lease more buildings ...) Aqhuman financial training & coaching

- 5. www.aqhuman.com Why profit cash flow •The income statement is an activity based statement; sales go in when they are earned, costs when they are used. Neither is shown when they are collected or paid for (ie credit given or taken) •The income statement ignores certain investment activity (buying new equipment, selling a business) •The income statement ignores certain financing activity (share issues, loan repayments) •Depreciation is a cost for p&l purposes but does not represent a cash flow Aqhuman financial training & coaching

- 6. www.aqhuman.com Aqhuman Financial Training Aqhuman’s principal is Kevin Amor, FCA. Kevin qualified as a chartered accountant with PWC. He spent 12 years working in commerce at financial controller/director level. Kevin now has more than 12 years experience in financial training. He trains managers at all levels and gives 1 to 1 financial coaching to senior executives. He also teaches corporate finance and accounting for a number of business schools’ MBA programmes. Aqhuman financial training & coaching