Bookmakers' return - general betting duty by Keyconsulting UK

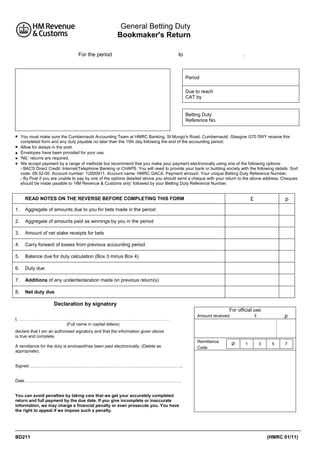

- 1. General Betting Duty Bookmaker's Return For the period to . Period Due to reach CAT by Betting Duty Reference No. You must make sure the Cumbernauld Accounting Team at HMRC Banking, St Mungo's Road, Cumbernauld, Glasgow G70 5WY receive this completed form and any duty payable no later than the 15th day following the end of the accounting period. Allow for delays in the post. Envelopes have been provided for your use. 'NIL' returns are required. We accept payment by a range of methods but recommend that you make your payment electronically using one of the following options: - BACS Direct Credit, Internet/Telephone Banking or CHAPS. You will need to provide your bank or building society with the following details: Sort code: 08-32-00. Account number: 12000911. Account name: HMRC GACA. Payment amount. Your unique Betting Duty Reference Number. - By Post if you are unable to pay by one of the options detailed above you should send a cheque with your return to the above address. Cheques should be made payable to ‘HM Revenue & Customs only’ followed by your Betting Duty Reference Number. READ NOTES ON THE REVERSE BEFORE COMPLETING THIS FORM 1. Aggregate of amounts paid as winnings by you in the period 3. Amount of net stake receipts for bets 4. Carry forward of losses from previous accounting period 5. Balance due for duty calculation (Box 3 minus Box 4) 6. Duty due 7. Additions of any underdeclaration made on previous return(s) 8. p Aggregate of amounts due to you for bets made in the period 2. £ Net duty due Declaration by signatory For official use I, …………………………………………………………………………………………… (Full name in capital letters) Amount received p £ declare that I am an authorised signatory and that the information given above is true and complete. A remittance for the duty is enclosed/has been paid electronically. (Delete as appropriate). Remittance Code Ø 1 3 5 7 Signed …………………………………………………………………………………………….. Date……………………………………………………………………………………………….. You can avoid penalties by taking care that we get your accurately completed return and full payment by the due date. If you give incomplete or inaccurate information, we may charge a financial penalty or even prosecute you. You have the right to appeal if we impose such a penalty. BD211 (HMRC 01/11)

- 2. Notes on completing form BD211 'For the period' – Under the form title, insert the accounting period dates appropriate to this return. (For example: 01/12/2010 to 31/12/2010). These must be the dates agreed by HM Revenue and Customs, which are normally a standard calendar month, but can also include any non-standard accounting periods. Name and address – Include your business name, any trading name, full business address and post code. 'Period' – Insert the accounting period in numbers mm/yyyy (for example: 12/2010). 'Due to reach CAT by' – Insert the 15th day following the end of the accounting period for this return (For example: 15/01/2011). 'Betting Duty Reference No' – Insert your unique 9 digit reference number (such as 123456789 - this reference is only an example and should not be used). IMPORTANT NOTE: Your completed return, with full payment of duty, must reach the Cumbernauld Accounting Team (CAT) no later than the ‘due date’. This will be the 15th day following the end of the accounting period to which the return relates. Where the 15th day is not a business day (that is, a Saturday, Sunday or public holiday), your return and payment must reach CAT by the last business day before the 15th day. Please make sure that all boxes are completed with either figures or, if appropriate, ‘NIL’. Box 1 – include in this box the aggregate value of all the bets made with you, including hedged bets made with you by another bookmaker and ‘free’ bets, in the accounting period whether or not payment for the bet has been received. Box 2 – include in this box the value of winnings paid by you in the accounting period. If you have credit customers you may include winnings notified to them (for example, by sending them statements of account).You should include any amounts returned to customers because of void bets and amounts paid as winnings to other bookmakers for hedged bets with you. Box 3 – show in this box the value in Box 1 less the value in Box 2. This will normally be a positive amount. If the value in Box 2 is greater than the value in Box 1, show the negative amount in brackets to show you have made a loss. Box 4 – show any losses from the previous period, (which is the accounting period immediately prior to this period). Only enter the negative amount taken from Box 5 on the previous return (shown in brackets). You can only show losses for the same class of bets (such as, fixed odds). Use return form BD211A for losses covering spread betting. Note: If you discover a loss, which occurred earlier than the previous accounting period but was not claimed on any return, do not enter here. If you wish to reclaim any overdeclaration of duty resulting from this earlier unrecorded loss, contact Cumbernauld Accounting Team (CAT) for advice on how to make a claim. Box 5 – show the balance for calculating duty (Box 3 minus Box 4). This will always be the same as Box 3 unless you have adjusted for a loss in Box 4. Box 6 – show in this box the duty due for the accounting period. This will normally be the Box 5 amount multiplied by the rate of duty applicable. Note: If the value in Box 5 is zero or a negative amount, enter 'NIL' in Box 6. Box 7 – show in this box any duty underpayments made in previous returns (except those notified in writing by HM Revenue & Customs). Box 8 – this box contains the amount of duty payable and, if there is no entry in Box 7, it will be the same as the Box 6 amount. If you need further help You can download a copy of Notice 451 General Betting Duty from the same website at www.hmrc.gov.uk or phone our Excise Helpline on 0845 010 9000. BD211 (HMRC 01/11)