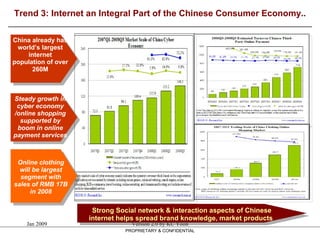

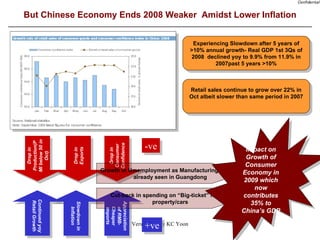

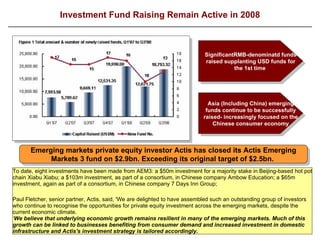

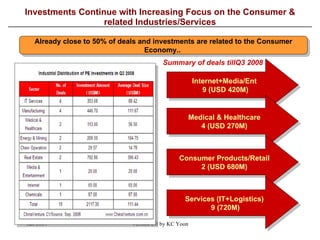

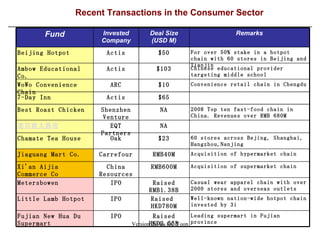

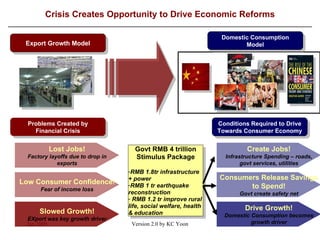

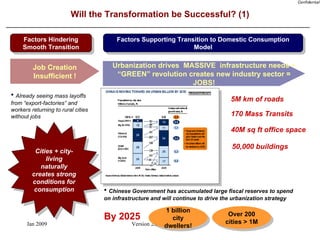

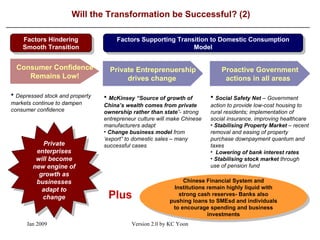

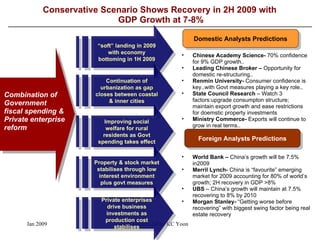

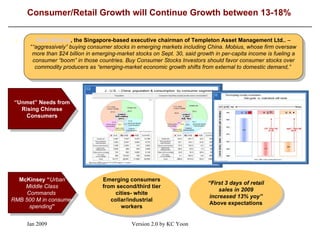

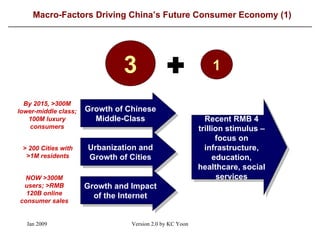

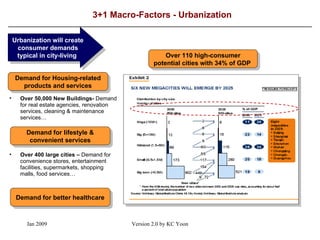

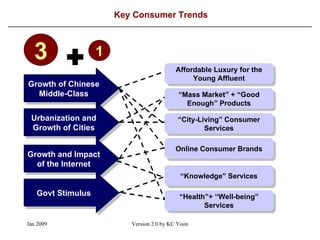

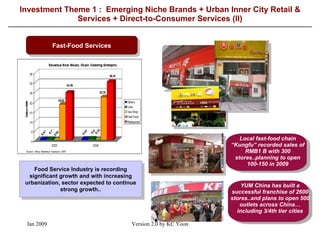

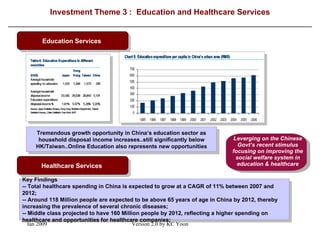

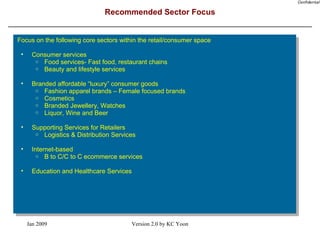

The document discusses opportunities for investment in China's consumer economy in 2009 amidst the global financial crisis. It predicts that China will successfully transform to a domestic consumption-driven model through government stimulus measures and private sector reforms. Key trends driving future consumer demand include urbanization, growth of the middle class, and increased internet usage. Recommended investment themes focus on emerging niche brands, urban retail and services, direct-to-consumer services, and branded consumer products along the evolving retail value chain.