FINANCIAL AWARENESS PROGRAM by Jyotirmoy Kashyap

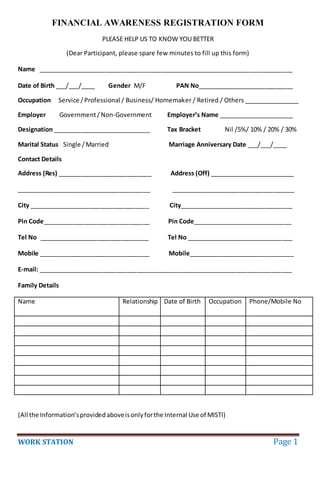

- 1. WORK STATION Page 1 FINANCIAL AWARENESS REGISTRATION FORM PLEASE HELP US TO KNOW YOU BETTER (Dear Participant, please spare few minutes to fill up this form) Name __________________________________________________________________________ Date of Birth ___/___/____ Gender M/F PAN No____________________________ Occupation Service /Professional / Business/ Homemaker / Retired / Others ________________ Employer Government/ Non-Government Employer’s Name ______________________ Designation ____________________________ Tax Bracket Nil /5%/ 10% / 20% / 30% Marital Status Single /Married Marriage Anniversary Date ___/___/____ Contact Details Address (Res) ___________________________ Address (Off) _________________________ _______________________________________ ____________________________________ City ___________________________________ City_________________________________ Pin Code_______________________________ Pin Code_____________________________ Tel No ________________________________ Tel No _______________________________ Mobile ________________________________ Mobile_______________________________ E-mail: __________________________________________________________________________ Family Details Name Relationship Date of Birth Occupation Phone/Mobile No (All the Information’sprovidedaboveisonlyforthe Internal Use of MISTI)

- 2. WORK STATION Page 2 HUMAN LIFE VALUE (HLV) Do youknowwhat yourHuman Life Value (HLV) is?PutyourInformation’stocalculate it. YOUR AGE (InYears) HLV Factor Up to 25 Years 20 Times 26 – 35 Years 15 Times 36 – 45 Years 12 Times 46 Years + 10 Times LIQUID ASSETS Those assetswhichcan be convertedtocash within7 days. E.g. FD, Shares,Bonds,Gold, Mutual Fundsetc. Annual GrossIncome LessExpense (Annual) (-) AmountAvailable (=) HLV Factor (as peryour age) (*) GrossHuman Life Value (=) LessLiquidAssets (-) LessExistingLife Cover(Sum Assure) (-) AddCurrentLiabilities (+) AddMonetary Value of Dreams (+) HUMAN LIFE VALUE (HLV) (=) NEEDS vs. WANTS Our “needs” must be met first before our “wants” Five Things I need What is the cost? 1. 2. 3. 4. 5. Five Things I want What is the cost? 1. 2. 3. 4. 5. What is your FinancialStatus Bank Account Life Insurance (Company/SA ) General Insurance Health Insurance Mutual Fund WithSIP Self Spouse Dependent1 Dependent2

- 3. WORK STATION Page 3 WELCOME LETTER We wholeheartedly welcome you to this Financial Entrepreneurial Development programme to enhance your skills through financial knowledge. We intend to provide quality training with continuous interaction during the training period, to enhance your financial awareness and skills required for the utilisation to acquire confidence to become future entrepreneurs. WORK STATION, wealth management consultancy firm started with a noble mission to offer consultancy and other allied services to our clients based on their needs and priorities. We are dedicated Team of Experts from Financial, Management and IT domains with special focus to render quality service to our clients. Through Master's Investment Skills Training Initiative (MISTI), WORK STATION wants to create financial awareness among various age groups starting from School students to Senior Citizen. As per our motto-Creating Systems for Creating Entrepreneur, we want to generate a force of efficient and specialised knowledge personnel for the financial sector domain, who can cater to the client’s needs with empathy and synergy. In our workshop we include the following topics. 1. Savings as a basic habit. 2. Different Instruments in financial domain & their specific needs including Banking, Health/Life/General Insurance,Mutual Funds etc. 3. Various Laws with the financial domain & their coverage. 4. Initiatives ofGovt ofIndia for the people. 5. Opportunities in the financial domain for employment & entrepreneurship. A nominal fee per participant towards a lifetime membership ofMISTI will be charged. We are looking forward for the growth of every individual, through which we can build a better society. Receipt of Lifetime Membership Fee WORK STATION Received the Lifetime Membership fee of Rs. ________with thanks & regards from Mr. / Mrs. /Miss.____________________________________________________ of ____________________ towards Master’s Investment Skills Training Initiative (MISTI). MISTI TEAM

- 4. WORK STATION Page 4 What is financial planning? It isan exercise of estimating our financial needs as also ways to meet them during the entire life cycle. E.g. birth of child, education, purchasing of house, marriage, purchasing of seeds etc. or to meetemergencysituationslike illness, accident, death, natural calamities like flood, drought etc. Why should we do financial planning? Financial planning enables us to plan in advance our likely expenses keeping in mind our level of income.Thus ithelpsintwoways,one- we can save regularly a portion of our income for meeting future needs and two- we can cut down expenses on non essential items with a view to save for future needs.Sowe shouldstartfinancial planning today so that we are in a better position to pay off our debt and build savings to buy a house or finance higher education with our own money. Attain your goals with financial planning. Why to maintain a Financial Diary? A Financial diaryhelpsustodofinancial planning.We wouldknow how muchmoneyisbeingspent on essential and non essential items during a given month. This helps us to identify the items on whichthe expensescanbe avoidedorreduced.Once we know it,we can regulate these expenses. We can save this money and break the cycle of poverty.

- 5. WORK STATION Page 5 Always think twice before spending. For example our monthly income is Rs.5000. By maintaining a Financial Diary we have come to know our expenses i.e. food, shelter and clothes (Rs.2000), education of children (Rs.1000), Rent (Rs.700) and sickness (Rs.300) and expenses on WANTS like festivals, pilgrimage (Rs.500) and expensesondrinks,gambling,etc,(Rs.500).We can reduce expenses on festivals, pilgrimage from Rs.500 to Rs.200 and avoid the expenses of Rs.500 on drinks, gambling. The excess of Rs.800 can nowbe saved.Thusbymaintainingafinancial diary, we have saved money. Without the diary, we will just spend all the money in our hand. How can we reduce expenses? We can reduce expenses on some of the extra items by spending judiciously. This saved money becomes our additional income for spending on essential items without earning more. It is very easyto understand.Forexample, if we are taking 4 cups of tea every day, then in the past 30 days (1 month) we have taken 120 cups of tea. Say each cup of tea costs us Rs.5 then the total cost is Rs.600. Justpause and thinkwhether we need to drink 4 cups of tea in a day. Had we taken 2 cups of tea every day then the expense would have been Rs.300 and we would have saved an equal amount of Rs.300. Here, 4 cups of tea is what we wanted but basically our need may be fulfilled with 2 cups of tea. In a way, our earning has increased by `300 in a month and in a year we have saved Rs.3600. Money saved is money earned Why should we save? We should save regularly so that it can be used in times when our expenditure is more than our income and we need more money. To meet higher expenses on birth, education, marriage, purchasing farm seeds, purchasing own house etc. To meet expenses on account of unexpected eventslike illness,accident,death,natural calamity. During the emergencies, savings can come to

- 6. WORK STATION Page 6 rescue.Moneyisneeded for lean periods i.e. when we are not able to earn. Money is needed for our old age. Money is needed to buy something which we cannot afford from regular income. In short, when we have to spend more money than we earn, we can meet these expenses from our own money if we have enough savings. How to save? We can save eitherbycuttingexpensesorbyincreasingourincome.Presumingincome issame,we spendmoneyforpurchasingeitheressential ornonessentialitems.Essential itemsare those things we really cannot do without, such as food, clothing, house repair, seeds and farming tools, children’s education and healthcare. We need these things every day for survival, whereas, non essential itemsare ‘extras’inlifewhichwe need because we enjoy them. Expenses on such items can be either avoided or reduced or postponed, e.g., spending money on drinks, drugs, gutka, gambling can be avoided whereas excessive expenses on marriage, festivals, pilgrimage can be reducedandexpenses on TV, scooter, car, jewellery, etc, can possibly be postponed. The less we spend on non essential items, the more we will be able to save for essential things. How can we save when we do not have enough money evento meet our regular expenses? The common refrain is that we do not earn enough so we cannot save. The truth is that everyone needssavingandcan save.We shouldkeepaside a portion of our earnings as saving from day one of ourearninglife.The importantthingisthatwe shouldstartsavingearly and regularly in our life, even if it is a small amount. And if we get some unexpected profit/earning, we should save all or most of it. This will reduce our worries of future financial needs and help us in dealing with unexpected expenses. If we earn Rs.100, we can save Rs.20 and if we earn Rs.10, we can save Rs.2. If we keep aside Rs.20 out of Rs.100 we earn, then in 5 earning days, we would have saved one day’s earning. In 100 earning days this would mean savings equivalent to 20 earning days plus interest. Is it not amazing!!!! For how long should we save? The longer we save, the more our savings will grow. The more we save, the more we will be preparedforemergencies and non working old age and not dependent on others for meeting our needs. As our savings grow, we will not have to borrow to meet our needs. When we save for longer periods, our savings will multiply many times as it earns interest. Where to Save? We mightbe keepingour savings under the pillow or in the Gullak. But what happens? We would always be worried about its safety. Sometimes rats or pest may also eat our hard earned money. Someone may steal it or we may be tempted to use the money or others may be tempted to borrow.Alsomoneysavedathome doesnotgrow. The bestwayto save is to depositthe money in a bank account. While small amounts can be kept in a Gullak, it is wiser to keep our savings in a bank. Do not lose your hard earned money; always save in a bank account. Why save in a bank? Moneykeptin a bankis safe as banksare regulatedandpool the savingsfor nation-building. Apart fromsafety,banksdonot charge fee fordepositing the money so far. On the other hand, they pay us interest on our deposits, so our money grows in bank. Putting our money in a bank means we

- 7. WORK STATION Page 7 can alsouse itwheneverwe need it. The transactions with the banks are transparent. Banks offer lotsof otheruseful services.When we have a deposit account with banks, we can easily get many facilities like loans and remittance facilities at reasonable cost. We can even nominate a person who can claim the money after our death. What are the advantages of having a bank account? A Bank account gives us an identity which is recognised by other government agencies. Transactions are transparent in a bank account i.e. we know all the details of deposits, withdrawals, interest etc. Banksare non-discriminatoryi.e.rules are same in the bank for similar type of customers. Our money in a bank account is safe. Banks open savings, recurring and fixed deposit accounts according to our needs and pay interest on deposits. We can get our wages/salary directly credited to the bank account. We can getall social benefitslike MGNREGA wages,pensionsetc. directly credited to bank account through EBT. We can deposit or withdraw our money from the bank whenever we need. We can take loan from the bank in case of necessity. Banks give loans for productive purposes at reasonable interest rates. If we have a bank account, sanctioning of loans becomes easier. We can send remittance through the bank. Source: RBI Financial Diary,www.rbi.org.in

- 8. WORK STATION Page 8 Beginning of Accounting Systems Kautilya,in330 B.C.recognizedthe importance of accountingmethodsineconomicenterprises.He developedBook-keeping rules to record and classify economic data. He also linked the successful enforcement of rules and regulations to their clarity, consistency and completeness. He also emphasized the role of ethics in the economic activities. Current Banking Scenario Currently,Indiahas81 scheduledcommercial banks(SCBs):28(19 Nationalized banks+8 SBI Group + 1 IDBI), 29 Foreign banks and 24 Private Banks. They have a combined network of over 53,000 branches and 17,000 ATMs. At present 80% of the banking sector in India is under public sector, 15% underprivate and only 5% are foreign banks. The public sector banks hold over 75 percent of total assets of the banking industry, with the private and foreign banks holding 18% and 7% respectively. Insurance Insurance maythus be considered as a process by which the losses of a few, who are unfortunate to suffersuchlosses,are sharedamongstthose exposedtosimilaruncertainevents/situations. It is a meansof protectionfromfinancial loss. Itisa formof riskmanagementprimarilyused to remove the risk of uncertain loss. It provides compensation not profit. How insurance works? People exposed to the same perils come together, pool resources (money) and all of them share losses suffered by a few. Source: ExcidelifeInsurance Why do we need Insurance? To provide security and protection for the family in any unfortunate event. Old age pensions, Child educational and marriage expenses. Health care costs, Disability and Critical illness expenses etc. To safe guard the valuable possessions and assets.

- 9. WORK STATION Page 9 As a saving or investment mechanism. As a collateral for loan. For tax benefits. Need for insurance planning Insurance planningisconcerned with ensuring adequate coverage against insurable risks. Insurance enables us to live our lives to the fullest, without worrying about the financial impact of events that could hamper it. A majorreasonwhyyou needinsurance istoensure that you are not forced to close if you are exposed to a claim. Types of Insurance General Insurance General insurance ornon–life insurances policies, includingautomobile and homeowners policies, provide paymentsdependingonthe lossfrom a particular financial event. It is typically defined as any insurance that is not determined to be life insurance. Types of General Insurance Marine Insurance:Marine cargoinsurance,the oldestof all Insurance covers goods, freight, cargo and other interests against loss or damage during transit by sea, rail, road or air. Fire Insurance: Fire insurance means insurance against any loss caused by fire. Health Insurance:Commontypesof health insurance include individual health insurance, family floater health insurance, comprehensive health insurance and critical illness insurance. Motor insurance or auto insurance: Is insurance for cars, trucks, motorcycles, and other road vehicles.Itsprimaryuse istoprovide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise there from. The specific terms of vehicle insurance vary with legal regulations in each region. To a lesser degree vehicle insurance may additionally offer financial protection against theft of the vehicle and possibly

- 10. WORK STATION Page 10 damage to the vehicle, sustained from things other than traffic collisions, such as keying and damage sustained by colliding with stationary objects. Other Types of General Insurance Crop Insurance: Is purchased by agriculture producers, including farmers, ranchers, and others to protect themselves against either the loss of their crops due to natural disasters, such as hail, drought, and floods, or the loss of revenue due to declines in the prices of agricultural commodities. The two general categories of crop insurance are called crop-yield insurance and crop-revenue insurance. The Pradhan Mantri Fasal Bima Yojana (Prime Minister's Crop Insurance Scheme) was launched by Prime Ministerof IndiaNarendraModi on 18 February 2016. It envisages a uniform premium of only2 percentto be paid by farmersforKharif crops,and 1.5 percent forRabi crops.The premium for annual commercial andhorticultural cropswill be 5 per cent. This scheme is dedicated to bring in more than 50% of the farmers under its wing within the next 2–3 years. Around 25% of the claimswill be senttothe farmer’sdirect account. Also, the scheme will remain as it is. This means that there will be nocap on coverage.Alsothere won’t be any cap on the reduction in the insured sum. Livestock Insurance Scheme: Under the scheme, the crossbreed and high yielding cattle and buffaloes are being insured at maximum of their current market price. The premium of the insurance is subsidized to the tune of 50%. The entire cost of the subsidy is being borne by the Central Government. The benefit of subsidy is being provided to a maximum of 2 animals per beneficiaryfora policyof maximumof three years. The scheme is proposed to be more species of livestock including indigenous cattle, yak & mithun.

- 11. WORK STATION Page 11 Life Insurance Life insurance is a protection against financial loss that would result from the premature death of an insured. The named beneficiary receives the proceeds and is thereby safeguarded from the financial impact of the death of the insured. The death benefit is paid by a life insurer in consideration of premium payments made by the insured. Types of Life Insurance Term Life: Term life insurance provides a death benefit for a fixed number of years. Usually 5 to 30 yearsthat you choose whenyoubuy the policy. You pay premiums for each year of the term. If you purchase level-premium insurance, which is common, you’ll pay the same rate each year. Whenthe term isup, youstoppayingpremiumsandyouno longerhave coverage.If you die at any pointduringthe term, your beneficiaries receive a death benefit. If you die after the terms ends, your beneficiaries get nothing. Term life insurance is generally the least expensive type of life insurance for the amount of coverage you get and it is the easiest type of life insurance to understand. For these reasons, it is also the best type of life insurance for most people. Whole Life: In addition to providing a death benefit, a whole life insurance policy also accumulates cash value that is guaranteed to grow by a certain amount each year. As a result, whole life premiumsare significantly higher than term life premiums for the same death benefit. Part of your premiums for the first few years of the policy will go toward administrative fees and the agent’s commission. The premiums are the same each year, and you can choose to pay premiums every year for as long as the policy is in effect or for a set number of years. Spreading your total premiumsoutoverjust10, 15 or 20 yearsinsteadof overa lifetimewill result in a higher annual premium during those years, but may be an appealing feature for someone who wants to

- 12. WORK STATION Page 12 eliminate the ongoing expense of life insurance premiums before retirement. A variation called single-premium whole life insurance lets you pay the entire premium up front in a lump sum. Endowment: The endowmentpolicyisalife insurance contract designed to pay a lump sum after a specificterm(on its 'maturity') or on death. Typical maturities are 10/15/20 years up to a certain age limit. Some policies also pay out in the case of critical illness. Endowments can be cashed in early(orsurrendered) andthe holderthenreceivesthe surrendervalue whichisdeterminedbythe insurance company depending on how long the policy has been running and how much has been paid into it. Unit Linked Insurance Plans(ULIP): These are unique insurance plans which are basically a mutual fundandterm insurance planrolledintoone.The investordoesn'tparticipate in the profits of the plan per se, but gets returns based on the returns on the funds he or she had chosen. Some policies afford the policyholder a share of the profits of the insurance company – these are termed with-profits policies. Other policies provide no rights to a share of the profits of the company – these are non-profit policies. With-profitspoliciesare usedasa formof collective investmentscheme to achieve capital growth. Otherpoliciesoffer a guaranteed return not dependent on the company's underlying investment performance. Money Back: The money-back policy in India is a popular insurance policy. It provides life coverage duringthe termof the policyandthe maturity benefits are paid in instalments by way of survival benefitsinevery3/4/5years.The planisavailable with12to 25 yearsterm.In the event of deathwithinthe policyterm,the deathclaimismade upof full sumassuredwithoutdeducting any of the survival benefitamountsalreadypaid. The bonus is also calculated on the full sum assured. The premium paid is tax deductible under section 80C of Income Tax Act 1961. Annuity: A seriesof paymentsat fixed intervals, paid while the purchaser (or annuitant) is alive. Annuities may be sold in exchange for the immediate payment of a lump sum (single-payment annuity) or a series of regular payments (flexible payment annuity), prior to the onset of the annuity. The payment stream from the issuer to the annuitant has an unknown duration based principally upon the date of death of the annuitant. At this point the contract will terminate and the remainderof the fundaccumulatedisforfeitedunlessthereare otherannuitantsorbeneficiariesin

- 13. WORK STATION Page 13 the contract. Thus a life annuity is a form of longevity insurance, where the uncertainty of an individual's lifespan is transferred from the individual to the insurer, which reduces its own uncertainty by pooling many clients. Annuities can be purchased to provide an income during retirement, or originate from a structured settlement of a personal injury lawsuit. Government Indicatives towards the Citizens of India Source:Insurance Regulatory& Development Authorityof India, www.irda.gov.in Mutual Funds A mutual fundis a professionallymanaged investmentfund thatpoolsmoneyfrommanyinvestors to purchase securities.Mutual fundshave both advantages and disadvantages compared to direct investing in individual securities. They are generally the most common investment vehicle for retirement plans. The main advantage of mutual funds is they provide stock diversification and professionalinvestorsmanagingthe account.The maindisadvantage isthe fees/expenses charged.

- 14. WORK STATION Page 14 Classification of funds by fund structure Open-end funds:Mostmutual fundsare open-endfunds. Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at the net asset value (NAV) computed that day based upon the prices of the securities owned by the fund. Most open-end funds also sell shares to the public every business day; these shares are also priced at NAV. A professional investment manager oversees the portfolio, buying and selling securities as deemed appropriate. The total amount of assets in the fund will vary based on share purchases, share redemptions and fluctuation in market valuation. There is no legal limit on the number of shares that can be issued. Closed-end funds: Closed-endfundsgenerallyissue sharestothe publiconlyonce,whentheyare created through an initial public offering (NFO). Their shares are then listed for trading on a stock exchange.Investorswhowantto sell their shares must sell their shares to another investor in the market; they cannot sell their shares back to the fund and the price they receive may be significantlydifferentfromNAV.Itmay be at a "premium" to NAV (i.e., higher than NAV) or, more commonly, at a "discount" to NAV (i.e., lower than NAV). A professional investment manager oversees the portfolio, buying and selling securities as deemed appropriate. Unit investment trusts: Unitinvestmenttrusts(UITs) canonlyissue tothe publiconce,whenthey are created.UITs generallyhave alimited life span, established at creation. Investors can redeem shares directly with the fund at any time (similar to an open-end fund) or wait to redeem them upon the trust's termination. Less commonly, they can sell their shares in the open market. Unit investment trusts do not have a professional investment manager; their portfolio of securities is established at the creation of the UIT and does not change. Exchange-traded funds: Exchange-traded funds (ETFs) are structured as open-end investment companies or UITs. ETFs combine characteristics of both closed-end funds and open-end funds. ETFs are traded throughout the day on a stock exchange. An arbitrage mechanism is used to keep the trading price close to net asset value of the ETF holdings. Classification of funds by types of underlying investments Mutual fundsare normallyclassifiedbytheirprincipal investments, as described in the prospectus and investment objective. Money market funds: Moneymarketfundsinvestin moneymarketinstruments,whichare fixedincomesecurities with a very short time to maturity and high credit quality. Investors often use money market funds as a substitute for bank savings accounts, though money market funds are not insured by the government, unlike bank savings accounts. Bond funds: Bond fundsinvestinfixedincome ordebtsecurities.Bondfundscanbe sub-classified according to the specific types of bonds owned (such as high-yield debt , investment- grade corporate bonds, government bonds or municipal bonds) and by the maturity of the bonds held (short-, intermediate- or long-term). Bond funds are classified based on the type of bond issuerof the bondsinwhichit invests,i.e.the country,creditlevel,ortax treatmentof the interest. Stock funds: Stock, or equity, funds invest in common stocks. Many stock funds focus on a particular area of the stock market, such as stocks from only a certain country or industry. Stock funds sometimes also specialize in a type of company such as a growth stock, a stock that the

- 15. WORK STATION Page 15 managers deem to be a good value, or stocks that pay high dividends and provide income. Funds may alsofocuson companiesof a certainmarketcapitalization,ortotal equityvalue,anindicatorof the size of the company. The market capitalizationof acompanyis calculatedasthe numberof sharesoutstandingtimesthe market price of the stock. They are typically divided into the following categories: Mega cap - companies worth $200 billion or more Big/large cap - companies worth between $10 billion and $200 billion Mid cap - companies worth between $2 billion and $10 billion Small cap - companies worth between $300 million and $2 billion Micro cap - companies worth between $50 million and $300 million Nano cap - companies worth less than $50 million Hybrid funds: Hybridfundsinvestinbothbondsandstocksor in convertible securities. Balanced funds,assetallocationfunds,target date or target risk funds and lifecycle or lifestyle funds are all types of hybrid funds. Hybrid funds may be structured as funds of funds, meaning that they invest by buying shares in othermutual fundsthatinvestinsecurities.Manyfundof fundsinvestinaffiliated funds (meaning mutual fundsmanagedbythe same fundsponsor),althoughsome investinunaffiliated funds (i.e., managed by other fund sponsors) or some combination of the two. Classification of funds by management style Index funds: Anindex fundorpassivelymanagedfundseekstomatchthe performance of a marketindex,suchasthe S&P500 index.These fundsare passivelymanagedandtypicallyhave verylowfeesandexpenses. Actively-managed fund: Anactivelymanagedfundseekstooutperformarelevantindexthrough superior security selection. Expenses are generally higher than index funds. Definitions of key terms Net asset value: A fund's net asset value (NAV) equals the current market value of a fund's holdingsminusthe fund'sliabilities(sometimesreferredto as "net assets"). It is usually expressed as a per-share amount,computedbydividingnetassetsbythe numberof fundsharesoutstanding. Funds must compute their net asset value according to the rules set forth in their prospectuses.

- 16. WORK STATION Page 16 Fundscompute theirNAV atthe endof each daythat the New York Stock Exchange isopen,though some funds compute NAVs more than once daily. Expense ratio: The expense ratio allows investors to compare expenses across funds. The expense ratio equals the distribution and services fee plus the management fee plus the other mutual fund fees and expenses divided by average daily net assets. The expense ratio is sometimes referred to as the total expense ratio (TER). Average annual total return: Mutual funds in the United States are required to report the average annual compoundedratesof returnforone, five and ten years period using the following formula: P (1+T) n = ERV Where: P = a hypothetical initialpaymentof Rs.1,000 T = average annual total return n = numberof years ERV = endingredeemable value of a hypothetical Rs.1,000 payment made at the beginning of the one,five orten year periods at the end of the one, five or ten-year periods (or fractional portion) Turnover: Turnoveris a measure of the volume of a fund's securities trading. It is expressed as a percentage of average marketvalue of the portfolio'slong-termsecurities.Turnoveristhe lesser of a fund'spurchasesor salesduringa givenyeardividedbyaverage long-termsecuritiesmarketvalue for the same period. If the period is less than a year, turnover is generally annualized. Mutual Funds in India The first introduction of a mutual fund in India occurred in 1963, when the Government of Indialaunched UnitTrust of India(UTI). UTI enjoyeda monopoly in the Indian mutual fund market until 1987, when a host of other government-controlled Indian financial companies established theirownfunds,including State Bankof India,Canara Bank,and PunjabNational Bank. This market was made open to private players in 1993. The first private sector fund to operate in India was Kothari Pioneer,whichlatermergedwith FranklinTempleton.In1996, SEBI, the regulatorof mutual funds in India, formulated the Mutual Fund Regulation which is a comprehensive regulatory framework. Mutual funds are an under tapped market in India Deposit being available in the market less than 10% of Indian households has invested in mutual funds. A recent report on Mutual Fund Investments in India published by research and analytics firm, Boston Analytics, suggests investors are holding back from putting their money into mutual fundsdue to their perceived high risk and a lack of information on how mutual funds work. There are 43 Mutual FundHousesor AssetManagementCompanies(AMC) are active in India as of March 2017 providing 900+ different fund options to the investors. The primary reason for not investing appears to be correlated with city size. Among respondents with a high savings rate, close to 40% of those who live in metros and Tier I cities considered such investments tobe veryrisky,where as33% of those in TierIIcitiessaidtheydidnot know how or where to invest in such assets.

- 17. WORK STATION Page 17 PROFESSIONAL CERTIFICATIONS RECOGNISED IN FINANCIAL INDUSTRY MISTI intends to impart training and guidance for the professional certifications recognized in financial sector with special emphasis of acceptability throughout India and which can be further upgradedforforeigncountriesafterpassingrelevantcertifications. We at MISTI, have experienced faculties whohave passedthesecertifications and have rich experience in the financial domain to trainthe participantsforsuccessful completion of the following professional courses , so that the participants can enter into the financial sector with required knowledge and skills. INSURANCECERTIFICATIONS offeredby prestigiousinstitute –THE INSURANCEINSTITUTEOF INDIA, MUMBAI, which was established in 1955 for the purpose of imparting insurance education to persons engaged or interested in insurance. LICENTIATE EXAMINATION Thisis essentiallyanintroductorycourse dealingwith the two compulsory papers i.e. Principles of Insurance and Practice of Insurance (Life and Non-Life) and one more paper as optional from professional exam curriculum. ASSOCIATESHIP EXAMINATION At thislevel,studentsmayhave optiontochoose subjectseitherLife orNon-Life orbothcombined. The scheme of studyprovidesknowledge of chosen subject. However, candidates will have to get familiar with the practical aspects related to these subjects. FELLOWSHIP EXAMINATION Thisis the highestlevelandinvolvesadvancedstudiesof specifiedareas. Below givenisthe brief of various specialized courses, for more details please refer to latest Examination Hand Book and Syllabus on website www.insuranceinstituteofindia.com. 1. Specialized Diploma on Marine Insurance thisdiplomadealswithPrinciples&Underwritingof Marine Cargo Insurance, Marine Insurance Claims & Marine Hull Insurance Underwriting and Claims. 2. Specialized Diploma on Fire Insurance thisdiplomadealswithFire Insurance Coverage’s, Fire Insurance rating & underwriting and Fire Insurance Claims. 3. Certificate Course in Foundations ofCasualty Actuarial Science This certificate course deals withthe basicfundamentalsof General Insurance Actuarial techniquesforscientific determination of premium rates. 4. Specialized Diploma in Casualty Actuarial Science This diploma deals Basic Ratemaking and EstimatingUnpaidClaimsUsingBasicTechniquesinadditiontosubjectsof above certificate course. 5. Certificate Programme in Advanced Insurance Marketing (CPAIM) this is an advanced comprehensive course to provide knowledge and understanding of insurance domain and the marketing functions applicable to insurance. The course is designed in 3 levels i.e. Basic, Intermediate & Advanced Level with Research Project. 6. Specialized Diploma on Health Insurance This diploma deals with Basics of Health Insurance, Health Insurance Claims and Health Insurance Operations. Belowgivenisthe brief of variousCertificate /DiplomaCoursesofferedjointly,formore details log on to https://www.insuranceinstituteofindia.com/web/guest/certificate-course

- 18. WORK STATION Page 18 1. Diploma & Advanced Diploma in Life Insurance Underwriting is being offered jointly with Association of Insurance Underwriters (AIU). A Diploma on Life Insurance Underwriting In addition to Life Assurance Underwriting subject, this diploma deals with Legal and Regulatory aspectsfor Life UnderwritersandFundamental of Medical Underwriting. b. Advanced Diploma on Life Insurance UnderwritingThisisadvanced diploma on Life Insurance Underwriting, which deals withIntermediate Medical & Nonmedical Life Insurance Underwriting & Advanced Life Insurance Underwriting. The textbooks for this course are being provided by Academy of Life Underwriting Inc. (ALU), U.S.A. 2. Certificate Course on Compliance,Governance and Risk Management in Insurance is being offered jointly with “The Institute of Company Secretaries of India (ICSI)” This course is divided in 2 parts i.e. 1) Online Examination & 2) Class room training of 3 days. This course deals with Fundamentals of Insurance, Insurance Regulations, Governance and Compliance and Risk Management in Insurance these examinations being conducted twice a year i.e. in the month of June & December every year. BANKING CERTIFICATIONS offeredbythe prestigiousBanking Institute , whichwas establishedin 1928 as a Company underSection 25 of the Indian CompaniesAct, 1913, Indian Institute of Banking & Finance (IIBF),formerlyknown as The Indian Institute of Bankers (IIB),is a professional body of banks, financial institutionsand theiremployeesinIndia. (www.iibf.org.in) Career in Banking-Positions for Entry Openingsare availableatvariouslevels:frombankclerkstoprobationary officers (PO), IT Officers. There is good scope for professionals like MBAs, CAs for Direct entry as Manager, Sr Manager. There is scope for Technical posts like Agriculture Officers, Industry Officers, Law Officers, Hindi Officers and Economic Officers. Qualifications for Banking Jobs For Clerical Jobs:Minimum Qualifications are 10+2 with marks 50% and above or Graduation. Age 18 yrs to 28 years. For Probationary Officers(PO):MinimumQualificationsare Graduationwithmarks55% and above. Age 21 yrs to 30 years. IT officer: Candidates with B.E/B.Tech or MCA (or equivalent) degree in computer science or any other stream. Law officer:Candidatesmust have abachelordegree (LLB) and post graduate degree in law (LLM). Subjects for Banking Exams Recruitments are on the basis of a written test, including General Awareness,Testof reasoning,Quantitative Aptitude,Englishlanguage,ITTerminology,Concepts of Marketing and/or a descriptive test. MUTUAL FUND CERTICIFICATIONS offered by the ASSOCIATION OF MUTUAL FUNDS IN INDIA. (https://www.amfiindia.com)

- 19. WORK STATION Page 19

- 20. WORK STATION Page 20 ONLY FOR AWARENESS GENERATION PREPARED BY JYOTIRMOY KASHYAP MASTER TRAINER (MISTI) & FREELANCE CORPORATE TRAINER