Valuations Perspective August 2020

•

0 likes•264 views

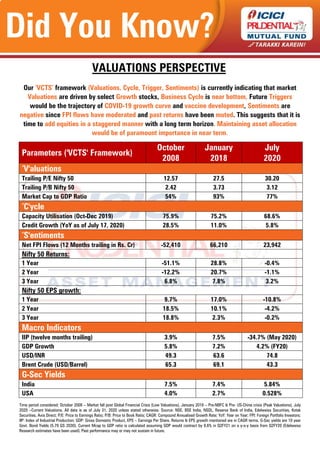

Business Cycle is near bottom, Future Triggers would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows have moderated and past returns have been muted.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

ICICI Prudential NASDAQ 100 Index Fund - One Pager

ICICI Prudential NASDAQ 100 Index Fund - One Pager

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

ICICI Prudential Mutual Fund- Valuations Perspective October 2020

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

ICICI Prudential Mutual Fund- Valuations Perspective November 2020

Impact Analysis, Monetary Policy Statement, 2020-21

Impact Analysis, Monetary Policy Statement, 2020-21

Fixed income update (Feb 2021) with ICICI Prudential Mutual Fund

Fixed income update (Feb 2021) with ICICI Prudential Mutual Fund

Impact analysis | Monetary Policy Statement, 2021-22

Impact analysis | Monetary Policy Statement, 2021-22

Valuation Perspective - ICICI Prudential Mutual Fund

Valuation Perspective - ICICI Prudential Mutual Fund

Similar to Valuations Perspective August 2020

Similar to Valuations Perspective August 2020 (20)

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

Valuations Perspective (October 2021) | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

Valuations Perspective | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Equity Valuations Perspective | ICICI Prudential Mutual Fund

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

Monthly Market Outlook July 2022 | ICICI Prudential Mutual Fund

More from iciciprumf

More from iciciprumf (20)

ICICI Prudential Equity Valuation Index | Nov 2023

ICICI Prudential Equity Valuation Index | Nov 2023

Recently uploaded

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

Bhubaneswar🌹Kalpana Mesuem ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswa...

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Famous No1 Amil Baba Love marriage Astrologer Specialist Expert In Pakistan a...

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Tilak Nagar (delhi) call me [🔝9953056974🔝] escort service 24X7

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

Female Russian Escorts Mumbai Call Girls-((ANdheri))9833754194-Jogeshawri Fre...

GIFT City Overview India's Gateway to Global Finance

GIFT City Overview India's Gateway to Global Finance

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

Kopar Khairane Cheapest Call Girls✔✔✔9833754194 Nerul Premium Call Girls-Navi...

Kopar Khairane Cheapest Call Girls✔✔✔9833754194 Nerul Premium Call Girls-Navi...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Valuations Perspective August 2020

- 1. Did You Know? Our ‘VCTS’ framework (Valuations, Cycle, Trigger, Sentiments) is currently indicating that market Valuations are driven by select Growth stocks, Business Cycle is near bottom, Future Triggers would be the trajectory of COVID-19 growth curve and vaccine development, Sentiments are negative since FPI flows have moderated and past returns have been muted. This suggests that it is time to add equities in a staggered manner with a long term horizon. Maintaining asset allocation would be of paramount importance in near term. Parameters ('VCTS' Framework) October January July 2008 2018 2020 ‘V'aluations Trailing P/E Nifty 50 12.57 27.5 30.20 Trailing P/B Nifty 50 2.42 3.73 3.12 Market Cap to GDP Ratio 54% 93% 77% ‘C'ycle Capacity Utilisation (Oct-Dec 2019) 75.9% 75.2% 68.6% Credit Growth (YoY as of July 17, 2020) 28.5% 11.0% 5.8% ‘S'entiments Net FPI Flows (12 Months trailing in Rs. Cr) -52,410 66,210 23,942 Nifty 50 Returns: 1 Year -51.1% 28.8% -0.4% 2 Year -12.2% 20.7% -1.1% 3 Year 6.8% 7.8% 3.2% Nifty 50 EPS growth: 1 Year 9.7% 17.0% -10.8% 2 Year 18.5% 10.1% -4.2% 3 Year 18.8% 2.3% -0.2% Macro Indicators IIP (twelve months trailing) 3.9% 7.5% -34.7% (May 2020) GDP Growth 5.8% 7.2% 4.2% (FY20) USD/INR 49.3 63.6 74.8 Brent Crude (USD/Barrel) 65.3 69.1 43.3 G-Sec Yields India 7.5% 7.4% 5.84% USA 4.0% 2.7% 0.528% Time period considered: October 2008 – Market fall post Global Financial Crisis (Low Valuations), January 2018 – Pre-NBFC & Pre- US-China crisis (Peak Valuations), July 2020 –Current Valuations. All data is as of July 31, 2020 unless stated otherwise. Source: NSE, BSE India, NSDL, Reserve Bank of India, Edelweiss Securities, Kotak Securities, Axis Direct; P/E: Price to Earnings Ratio; P/B: Price to Book Ratio; CAGR: Compound Annualised Growth Rate; YoY: Year on Year; FPI: Foreign Portfolio Investors; IIP: Index of Industrial Production; GDP: Gross Domestic Product, EPS – Earnings Per Share. Returns & EPS growth mentioned are in CAGR terms. G-Sec yields are 10 year Govt. Bond Yields (5.79 GS 2030). Current Mcap to GDP ratio is calculated assuming GDP would contract by 8.6% in Q2FY21 on a y-o-y basis from Q2FY20 (Edelweiss Research estimates have been used). Past performance may or may not sustain in future. VALUATIONS PERSPECTIVE

- 2. Did You Know? The „VCTS‟ (Valuations, Cycle, Trigger, Sentiments) framework is a market checklist which can be used to determine market valuations/conditions for investment at any given point in time. The framework can find application across asset classes. It aims to navigate markets efficiently by reflecting on various data points used in the framework. PE – Price-to-Earnings; PBV – Price to Book Value Ratio; COVID-19 is Coronavirus disease 2019. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America (“US”) and/or Canada or for the benefit of US persons (being persons falling within the definition of the term “US Person” under the US Securities Act, 1933, as amended) or persons residing in Canada. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. ABOUT OUR ‘VCTS’ FRAMEWORK