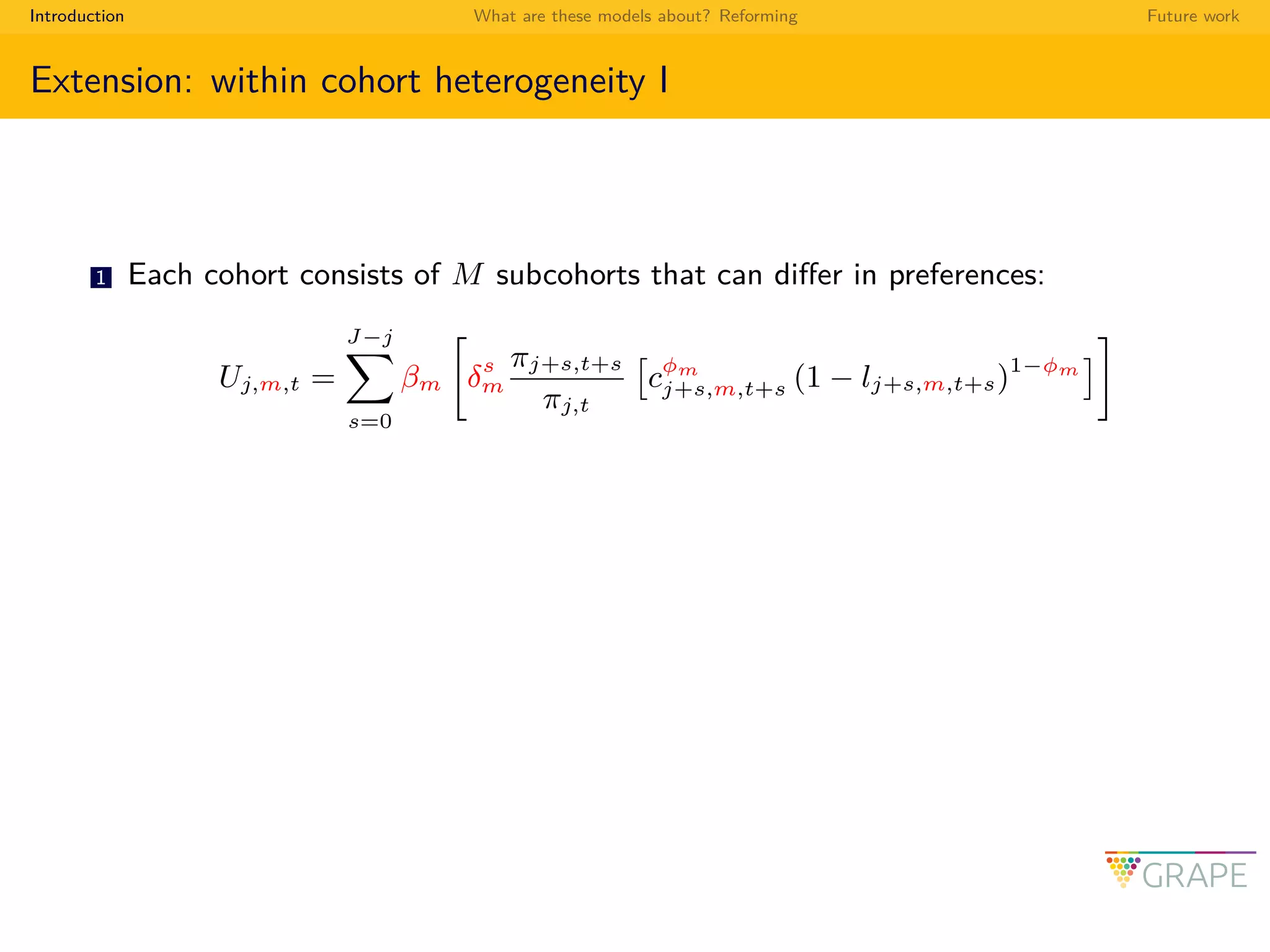

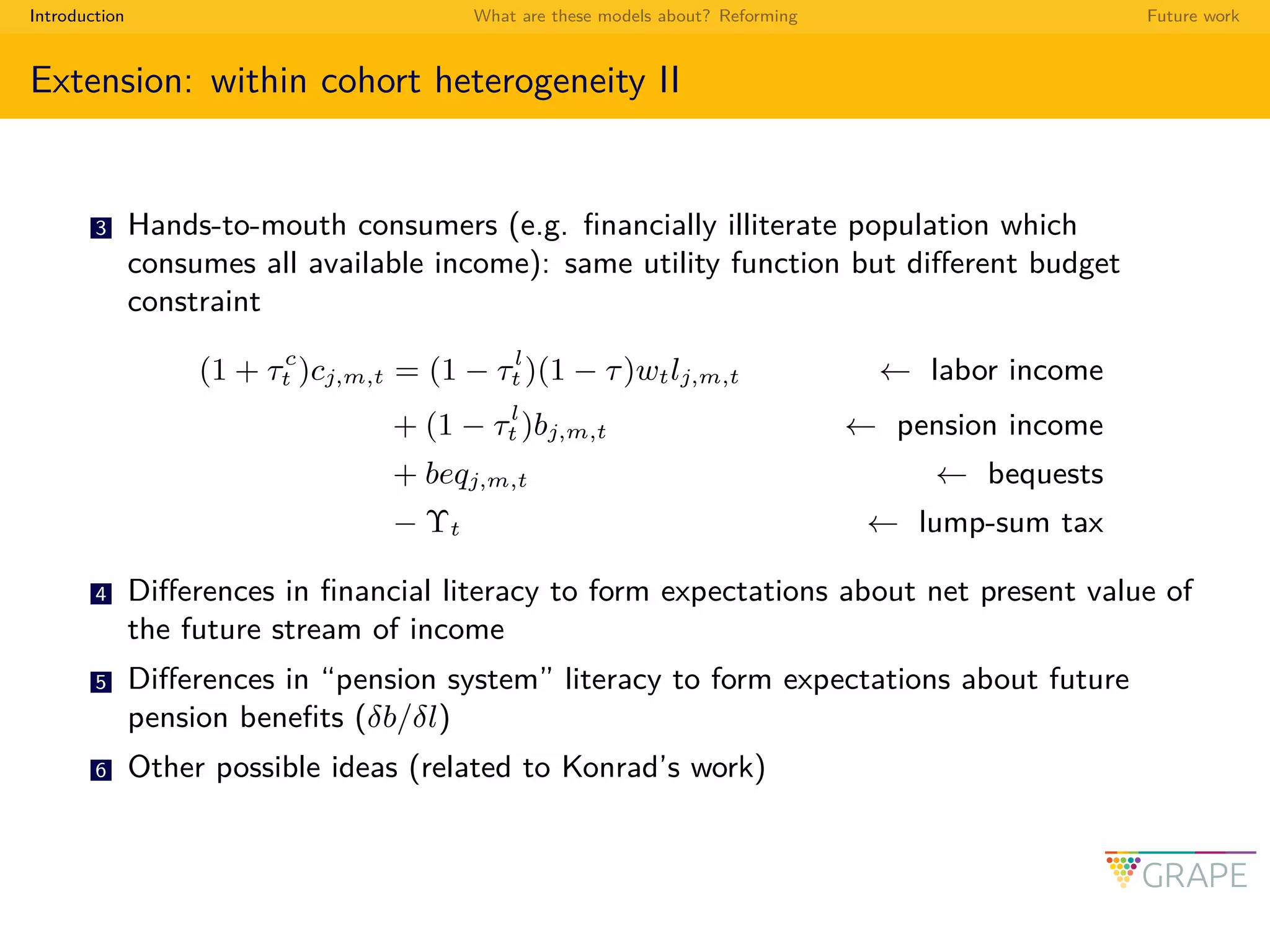

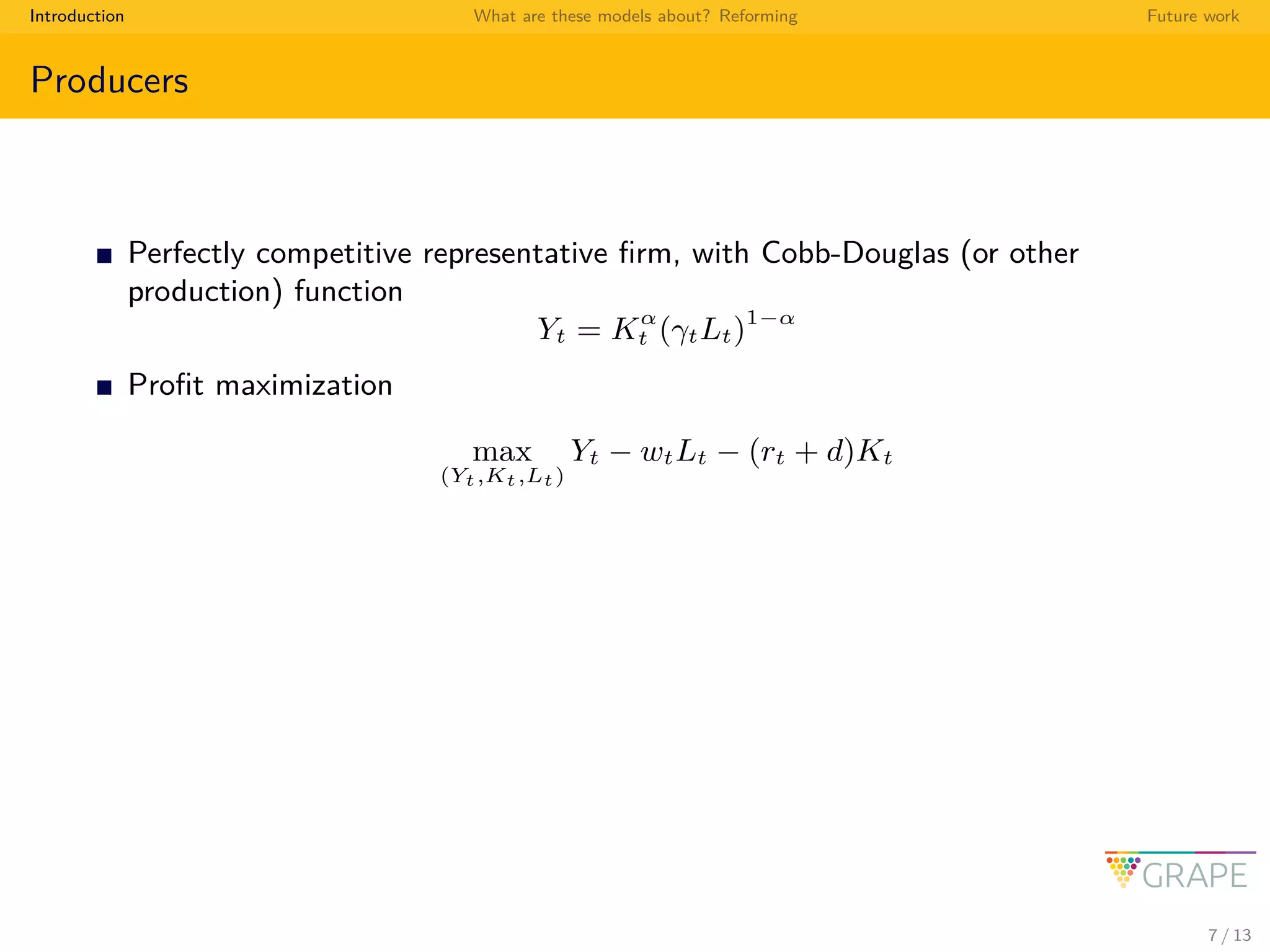

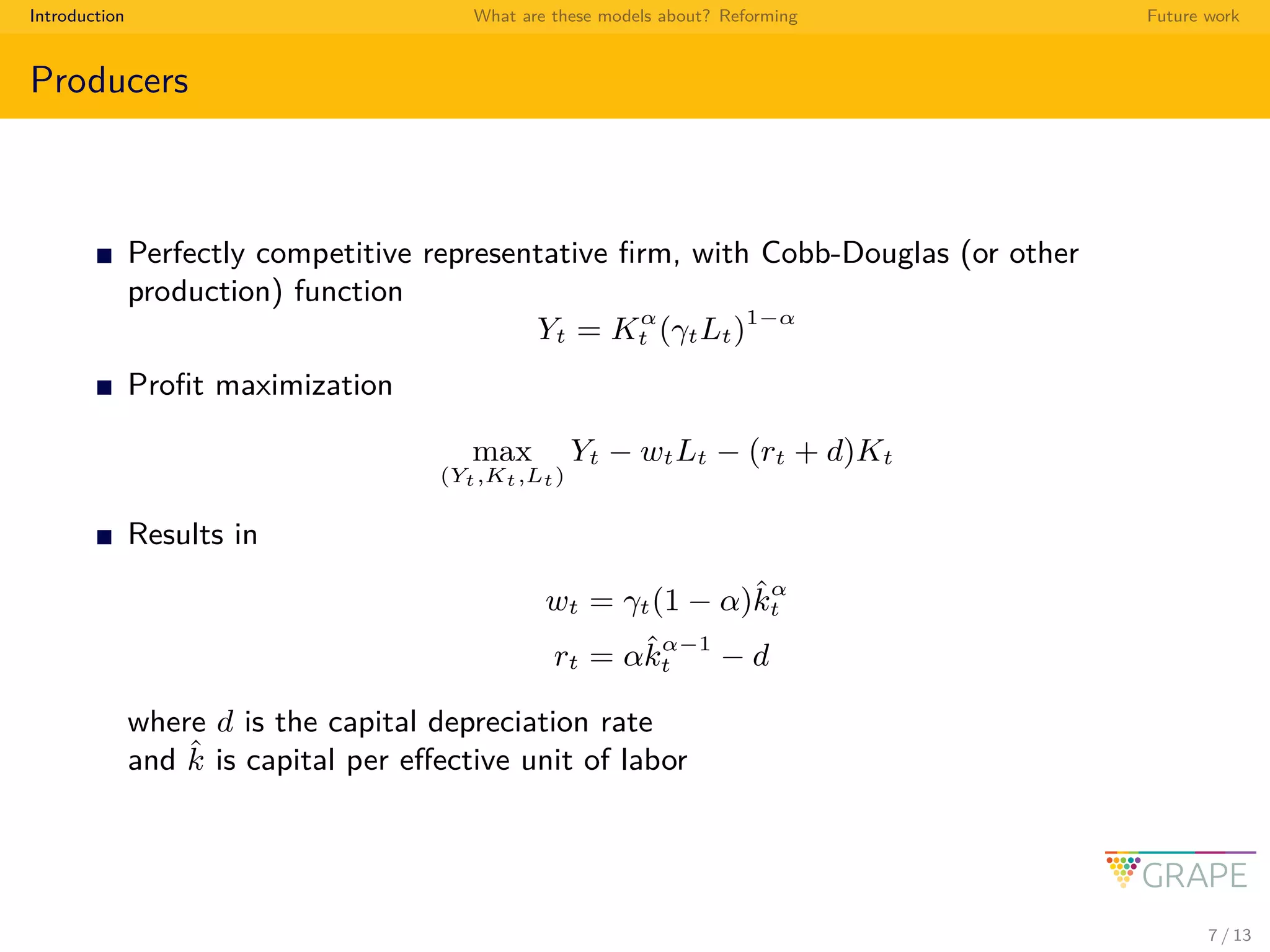

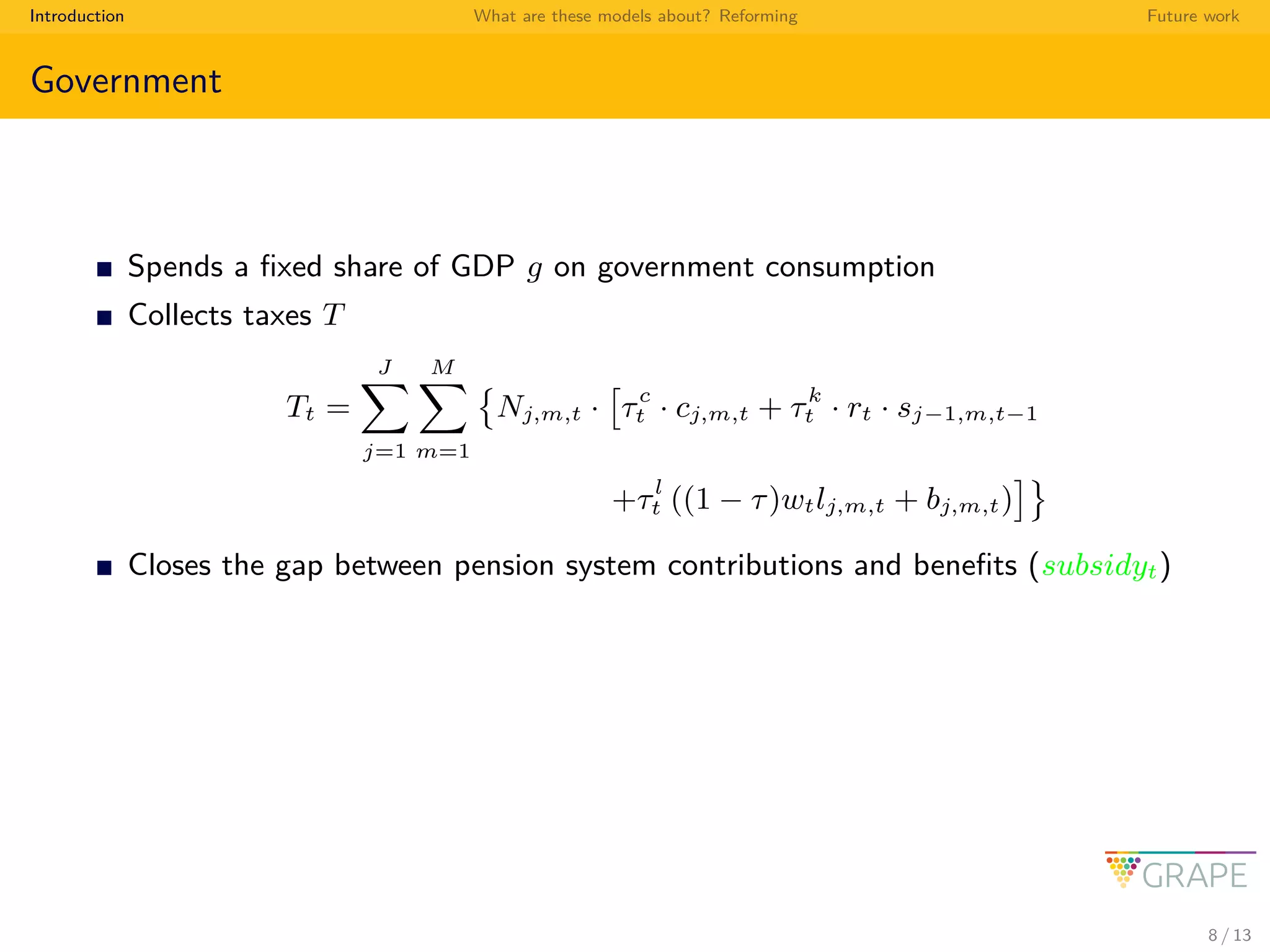

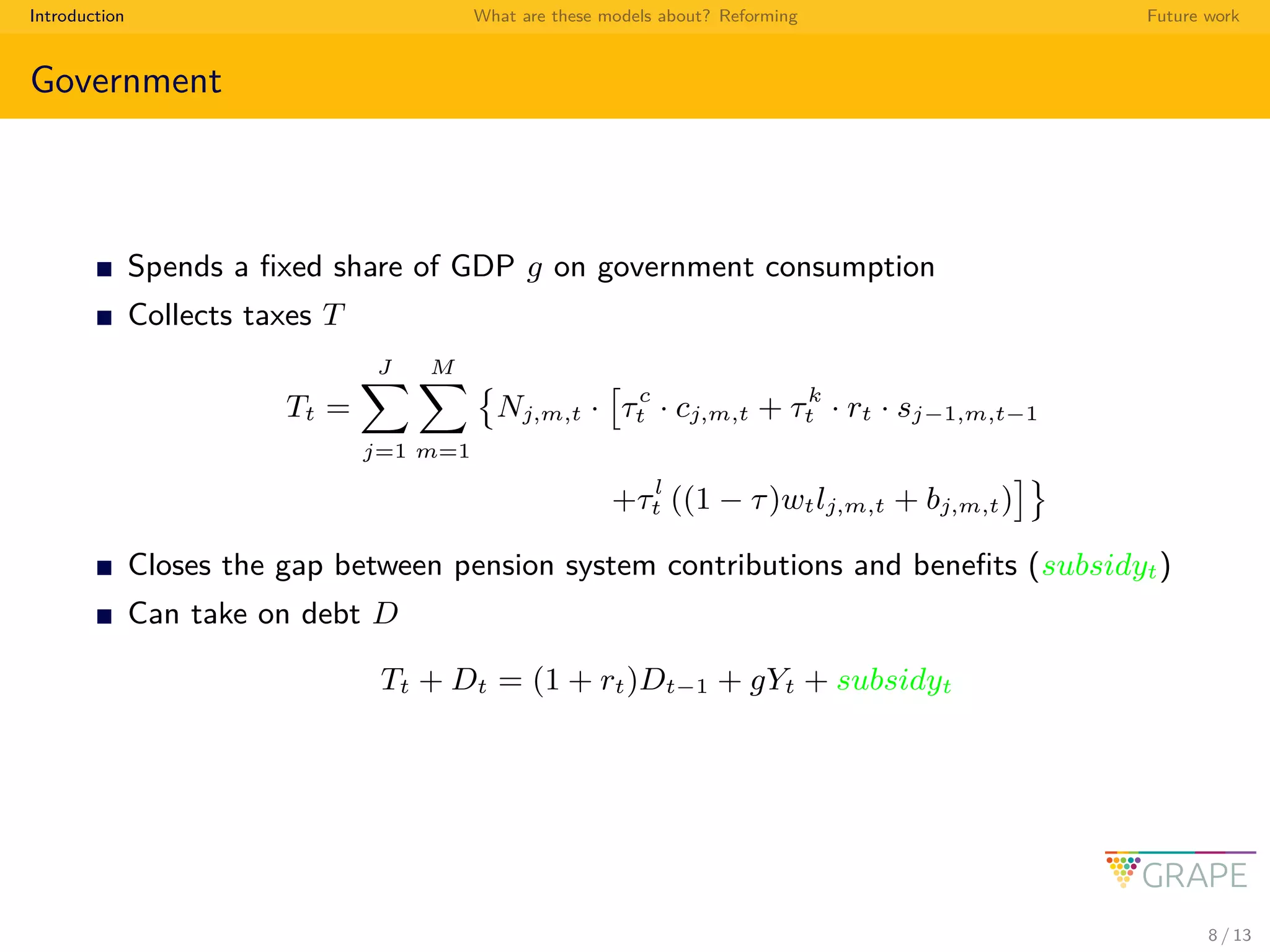

This document discusses overlapping generations models with heterogeneous agents. It introduces an overlapping generations model framework where cohorts live for multiple periods and differ in their preferences and decision rules. This allows for analysis of policy instruments aimed at voluntary pension savings. The model includes heterogeneous subcohorts within cohorts that differ in factors like preferences, financial literacy, and pension expectations. The document outlines the standard household problem and possible extensions, as well as the production sector, government policies, and different pension system components that could be analyzed using this type of model framework. The goal is to use this model to analyze potential reforms by first finding an initial stable solution and then examining the transition path after a policy change.