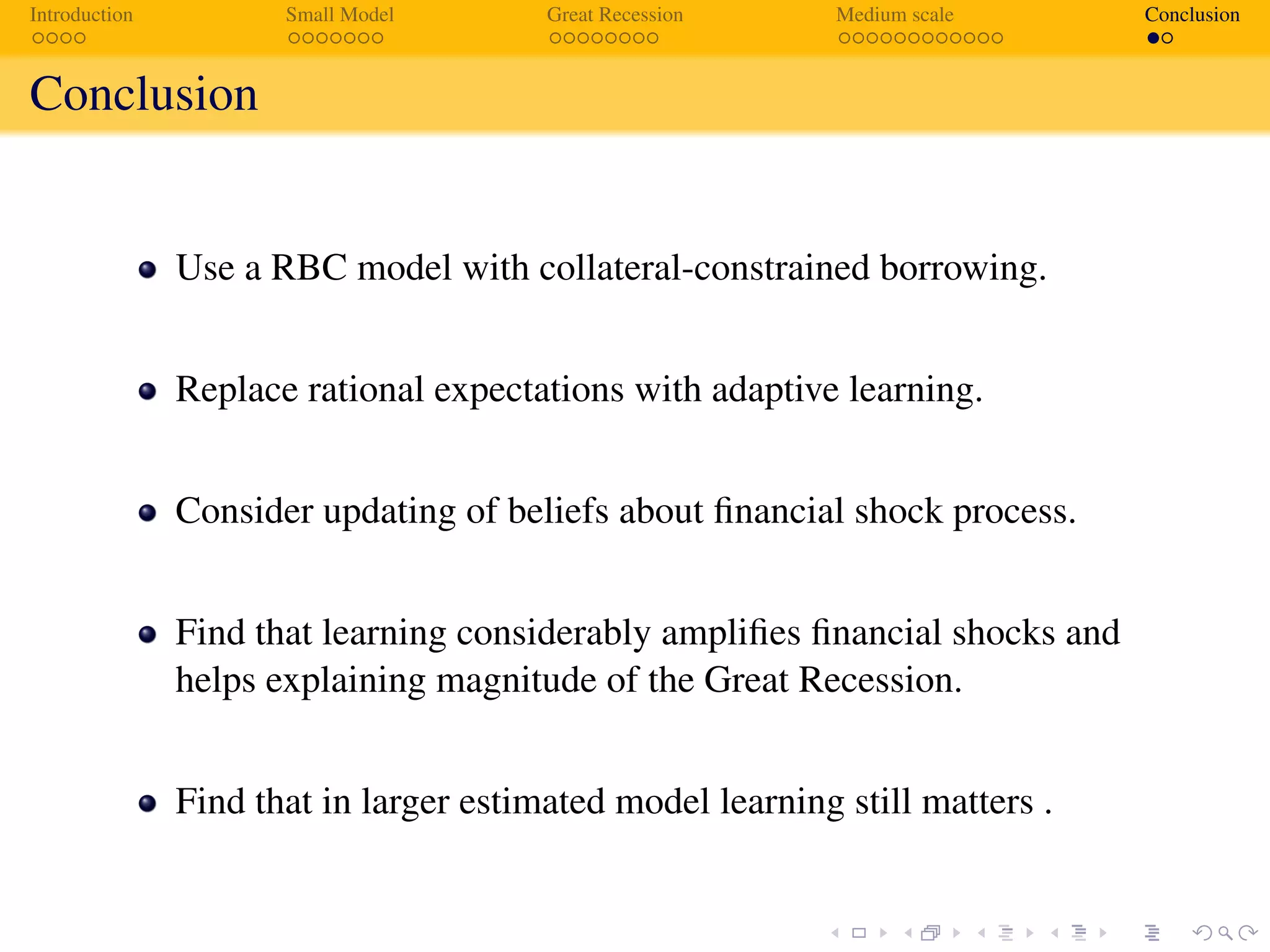

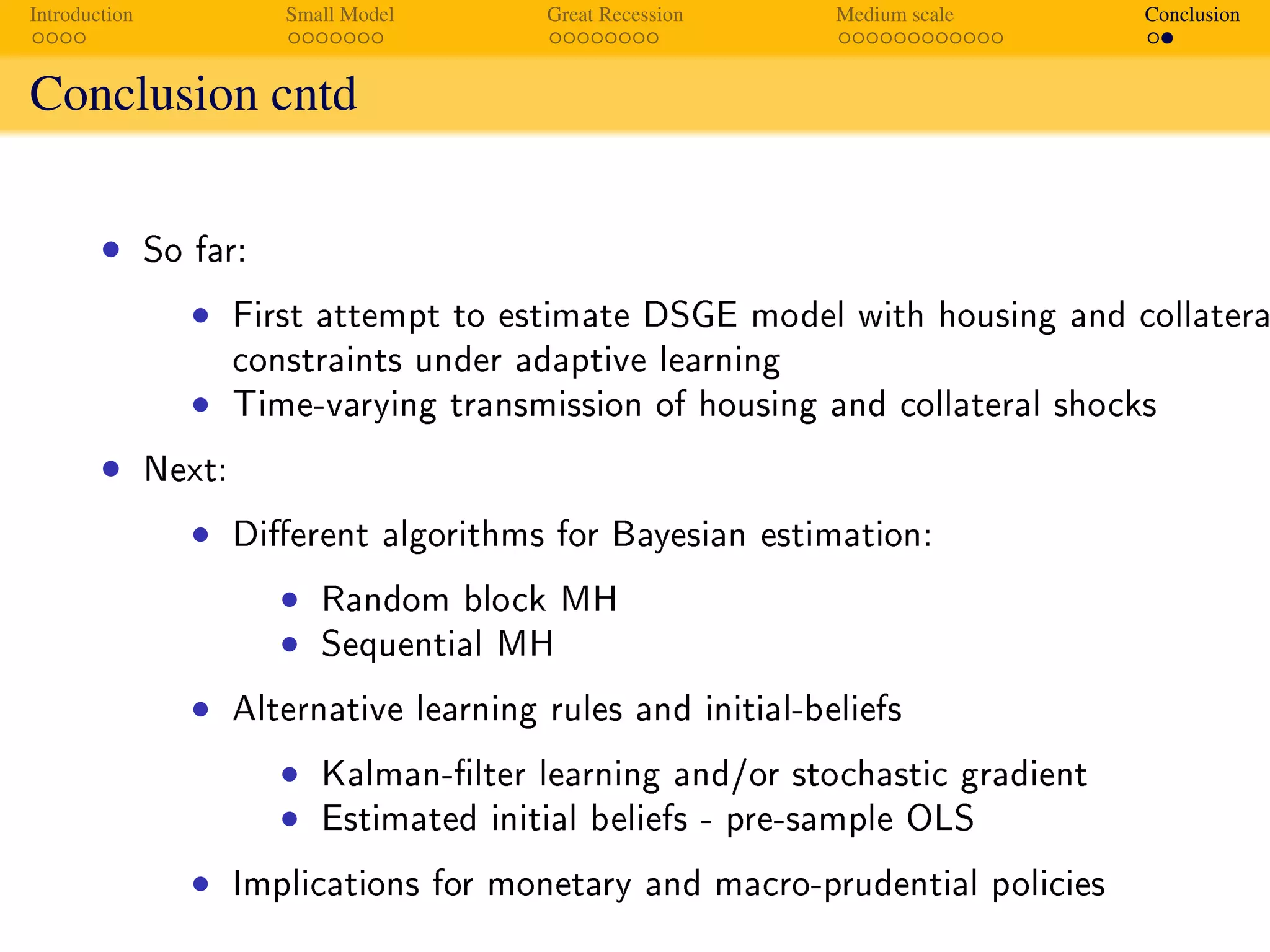

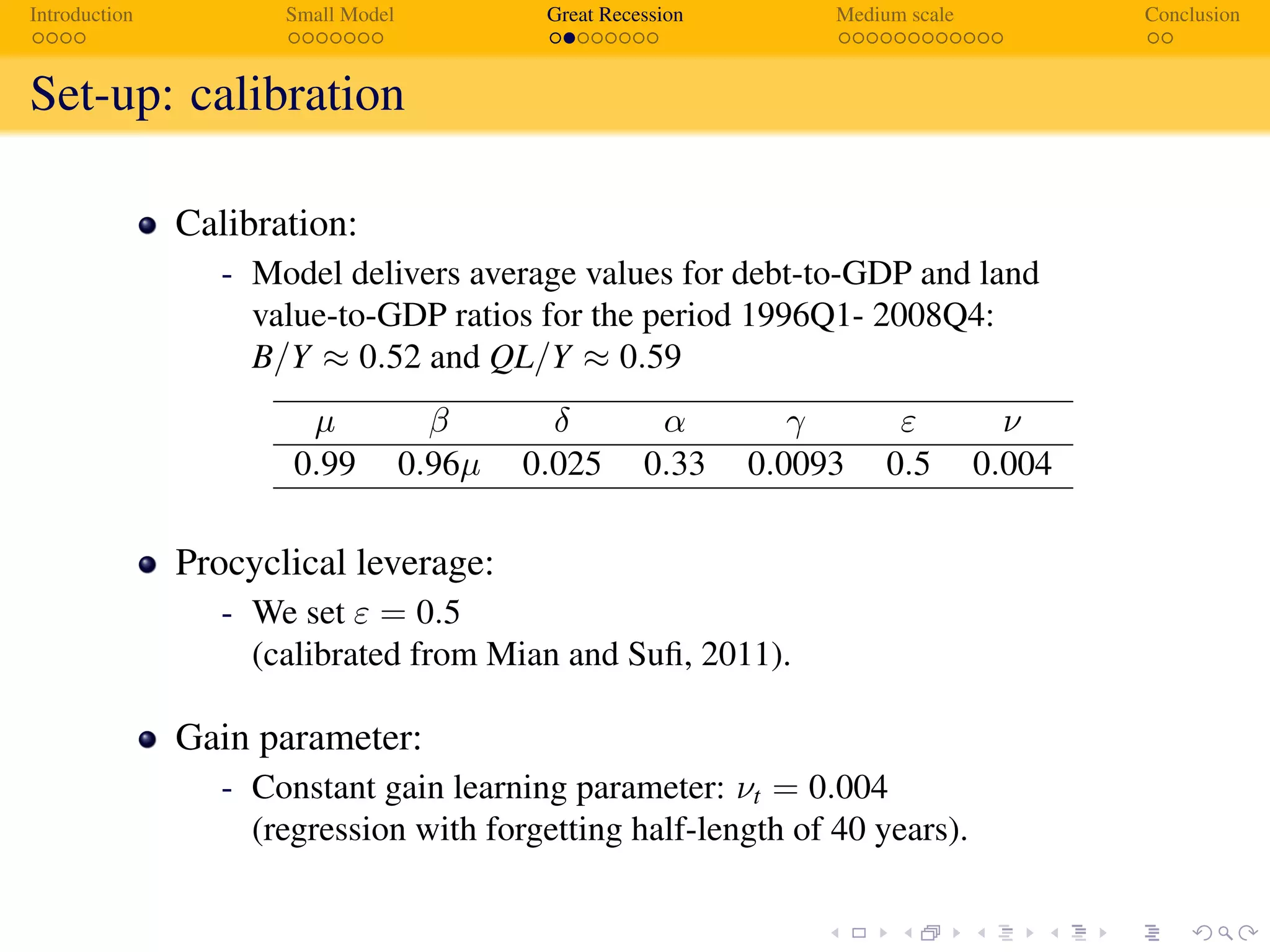

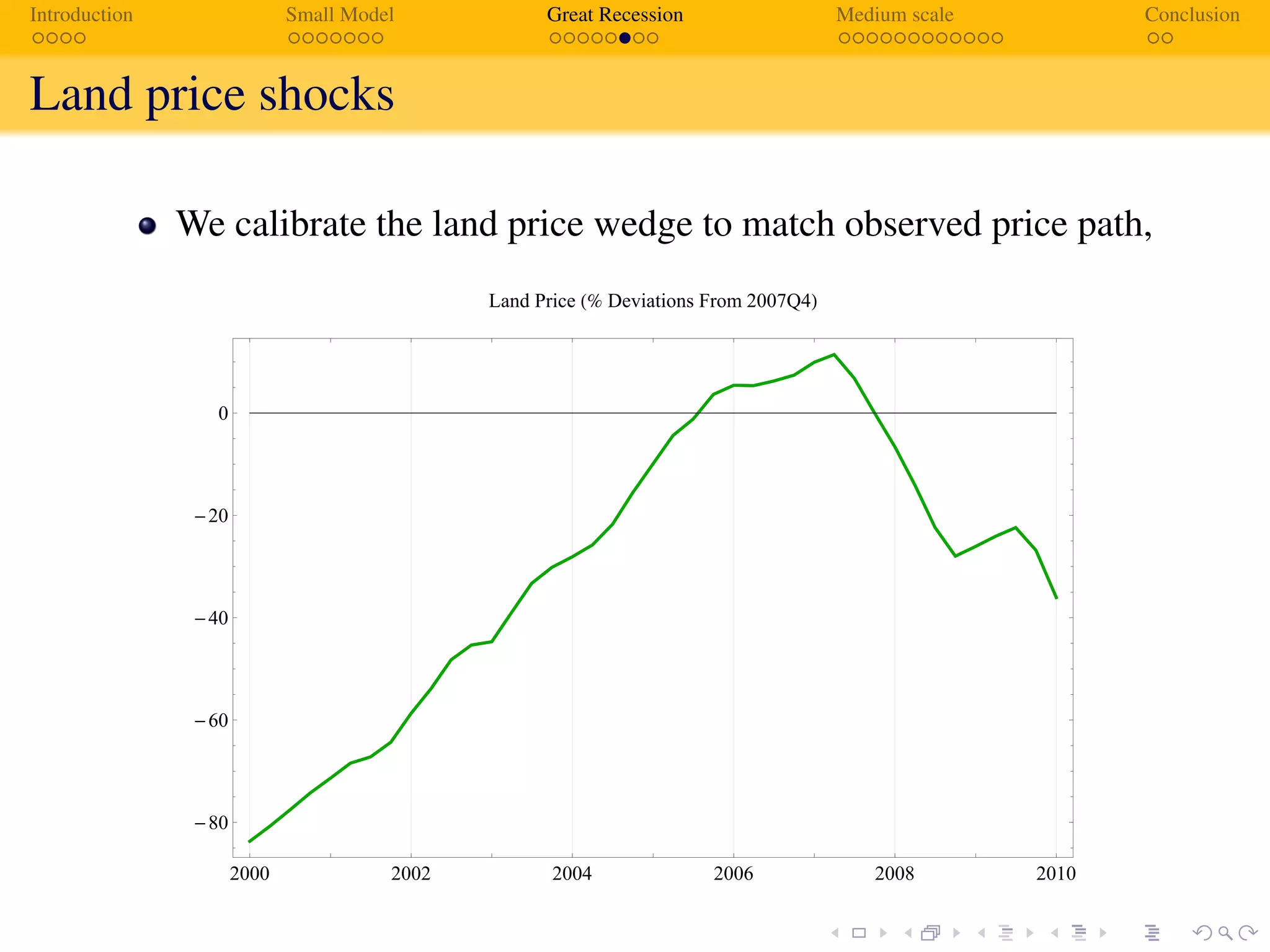

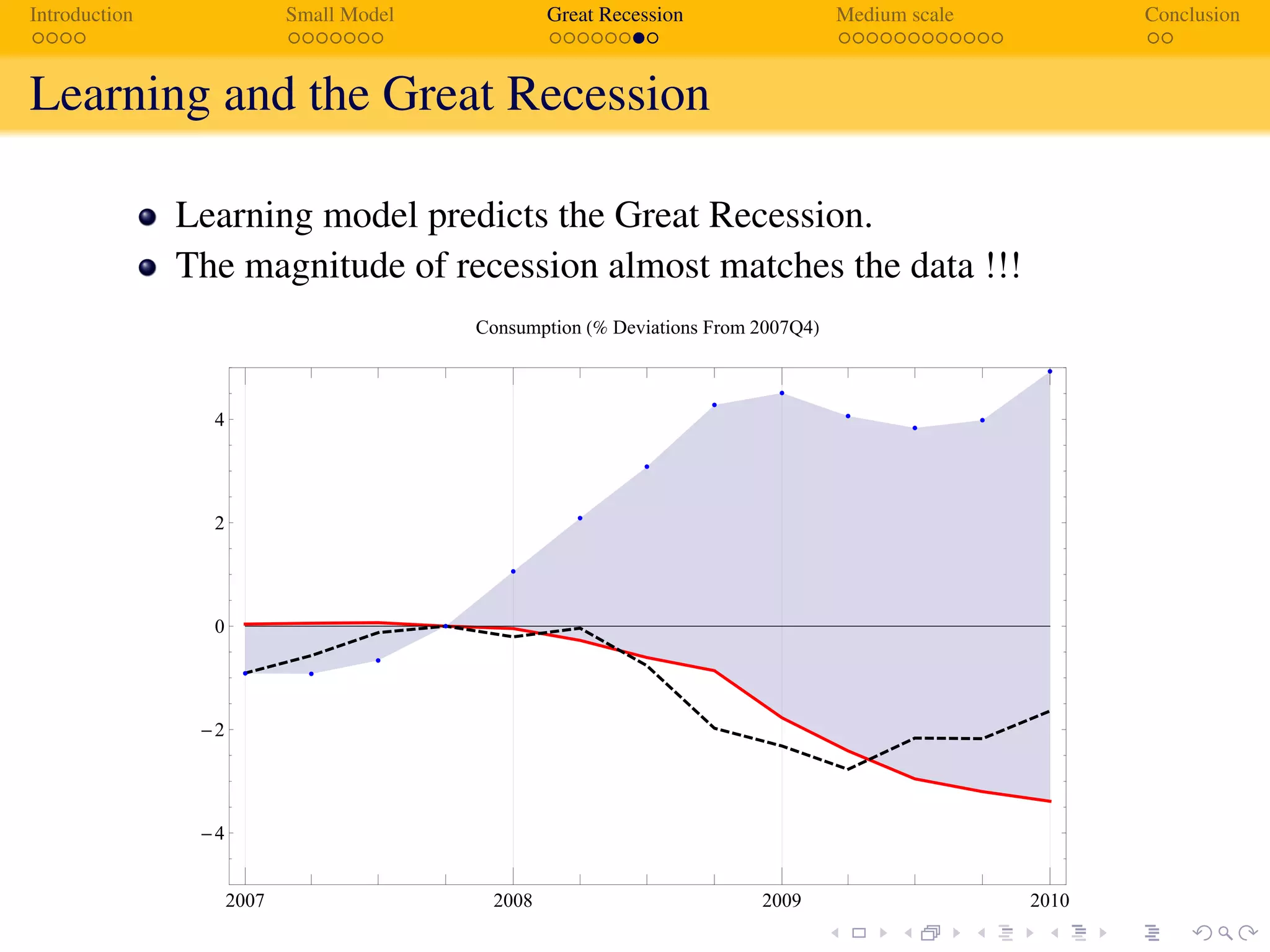

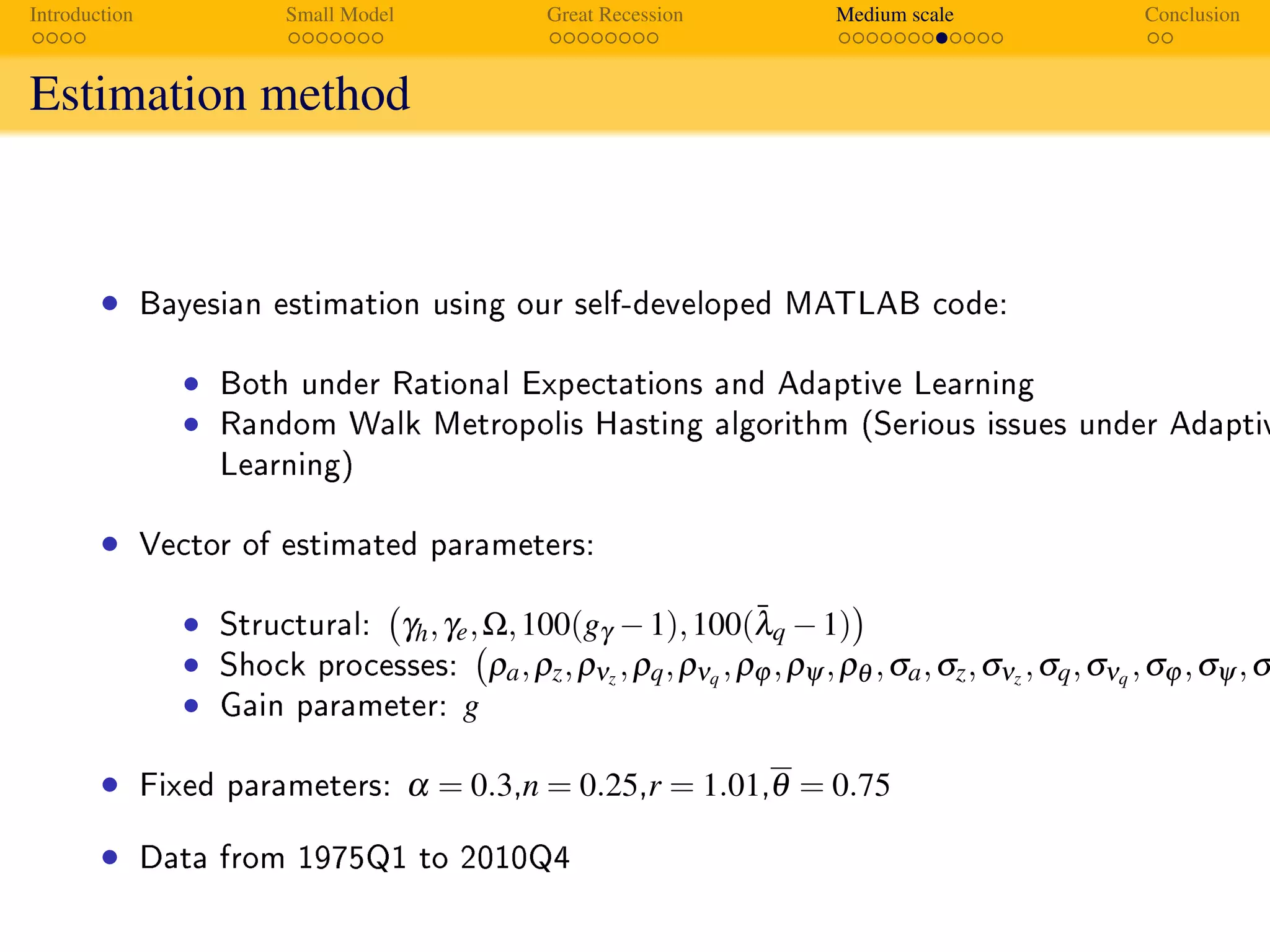

The document analyzes how adaptive learning may have contributed to the Great Recession, contrasting it with the rational expectations model. It presents a medium-scale model which demonstrates that agents' evolving perceptions of the economy can significantly influence financial behaviors and leverage, predicting a recession that aligns closely with observed data. The findings highlight time-varying impacts of shocks and the inadequacies of traditional rational expectations during financial crises.

![Introduction Small Model Great Recession Medium scale Conclusion

Borrowing constraint

Agents face borrowing constraint

˜ΘtE∗

t [Qt+1]Lt+1 ≥ (1 + R)Bt+1,

where

˜Θt ≡ Θt

E∗

t [Qt+1]

Q

ε

We allow leverage to respond to changes in the land price:

microfounded in simple moral hazard setting,

ε > 0 agrees with evidence in Mian and Sufi (2011) on US micro

data for the 2000s.](https://image.slidesharecdn.com/pintussudaturgutsndedallas28march2019-190329113926/75/Financial-Frictions-under-Learning-8-2048.jpg)

![Introduction Small Model Great Recession Medium scale Conclusion

FOCs

Borrowers ’ first-order conditions are

Ct : Λt = Ct − ψ

N1+χ

t

1 + χ

−σ

Nt : ψNχ+α+γ

t = (1 − α − γ)AKα

t Lγ

t

Lt+1 : TtQtΛt = βE∗

t [Tt+1Qt+1Λt+1] + βγE∗

t [Λt+1Yt+1/Lt+1]

+Φt

˜ΘtE∗

t [Qt+1],

Kt+1 : Λt = βE∗

t [Λt+1(αYt+1/Kt+1 + 1 − δ)]

Bt+1 : Λt = β(1 + R)E∗

t [Λt+1] + (1 + R)Φt](https://image.slidesharecdn.com/pintussudaturgutsndedallas28march2019-190329113926/75/Financial-Frictions-under-Learning-10-2048.jpg)

![Introduction Small Model Great Recession Medium scale Conclusion

REE

Linearized expectational system (in log levels):

Xt = AXt−1 + BE∗

t−1[Xt] + CE∗

t [Xt+1] + N + Dξt + Fψt,

Xt ≡ (ct, qt, λt, φt, bt, kt, θt, τt), ξt and ψt are innovations.

Under REE, E∗

t = Et and there exists a unique stationary

equilibrium

Xt = Mre

Xt−1 + Hre

+ Gre

ξt + Jre

ψt,

where Mre

and Hre

solve

M = [I8 − CM]

−1

[A + BM],

H = [I8 − CMre

]

−1

[BH + CH + N]](https://image.slidesharecdn.com/pintussudaturgutsndedallas28march2019-190329113926/75/Financial-Frictions-under-Learning-11-2048.jpg)

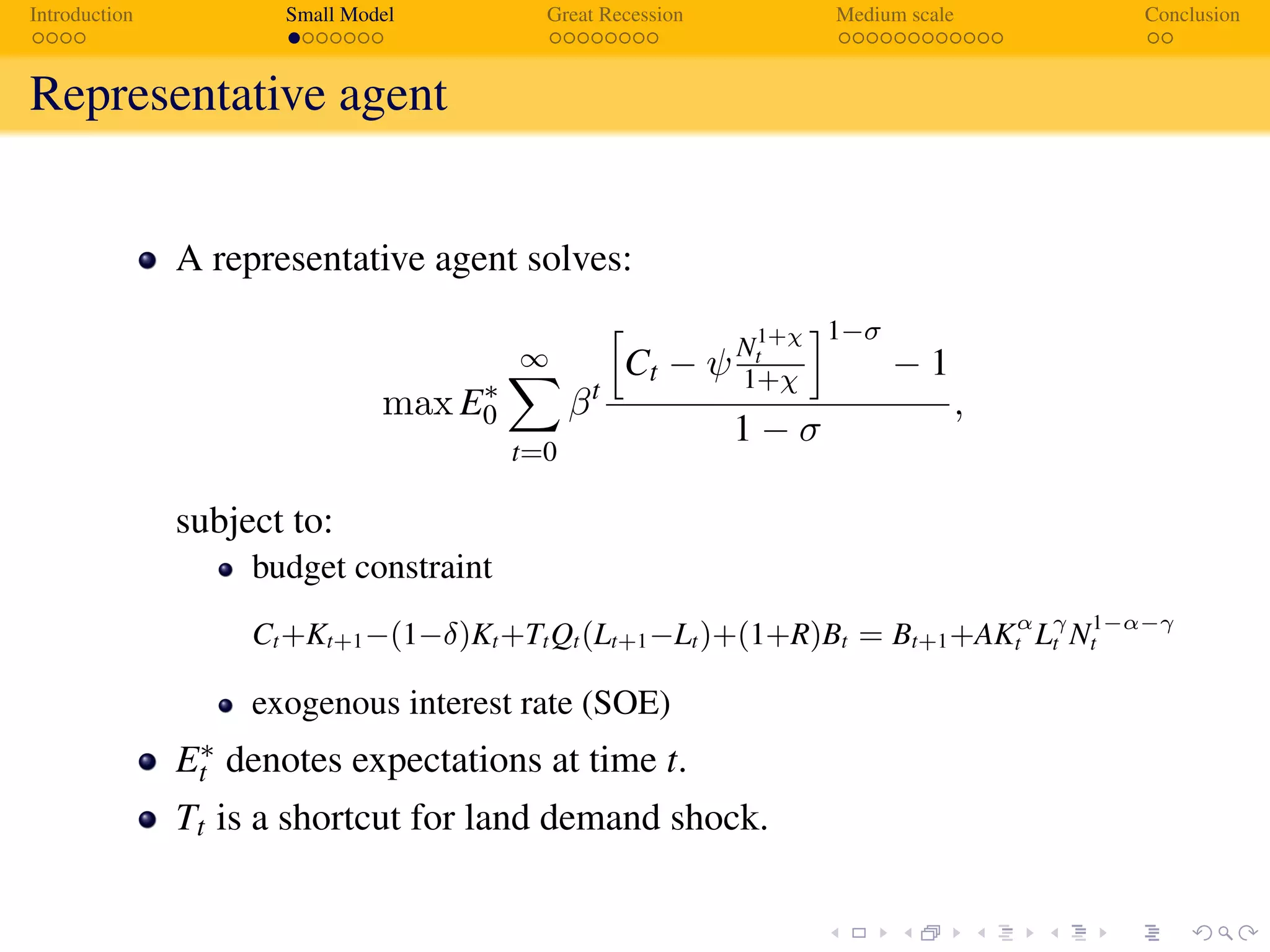

![Introduction Small Model Great Recession Medium scale Conclusion

Learning

Agents as econometricians:

Actual low of motion becomes

[I8 −CMt−1]Xt = [A+BMt−2]Xt−1 +[BHt−2 +CHt−1 +N]+Dξt +Fψt

Assume recursive updating of the perceived law of motion

Ωt = Ωt−1 + ν(Xt − Ωt−1Zt−1)Zt−1R−1

t

Rt = Rt−1 + ν(Zt−1Zt−1 − Rt−1),

where Zt = [1, Xt ] and Ω = [H M]

OLS/RLS if νt = 1/t,

constant gain if νt = ν.

REE: perceived and actual laws of motions coincide.](https://image.slidesharecdn.com/pintussudaturgutsndedallas28march2019-190329113926/75/Financial-Frictions-under-Learning-13-2048.jpg)

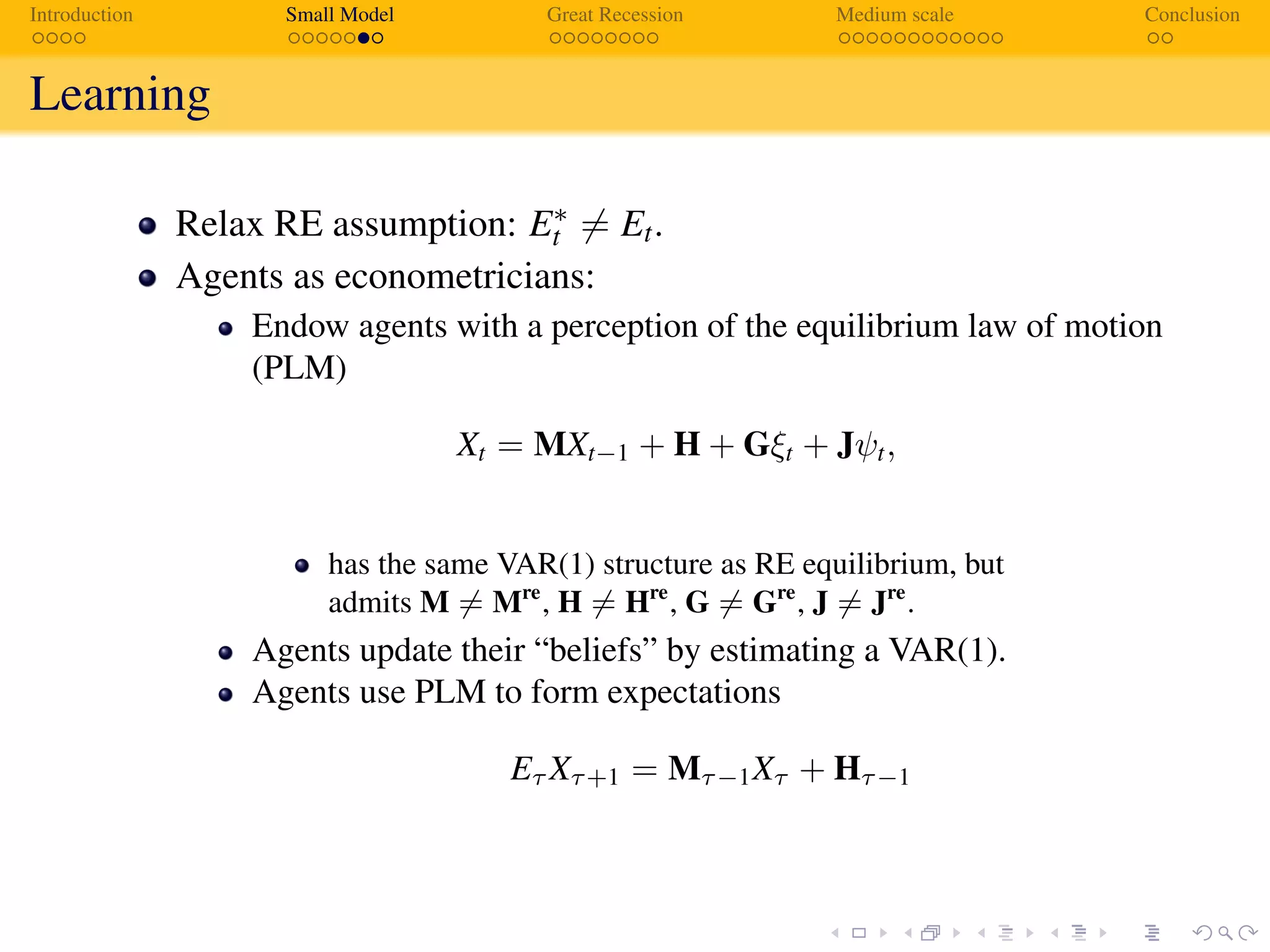

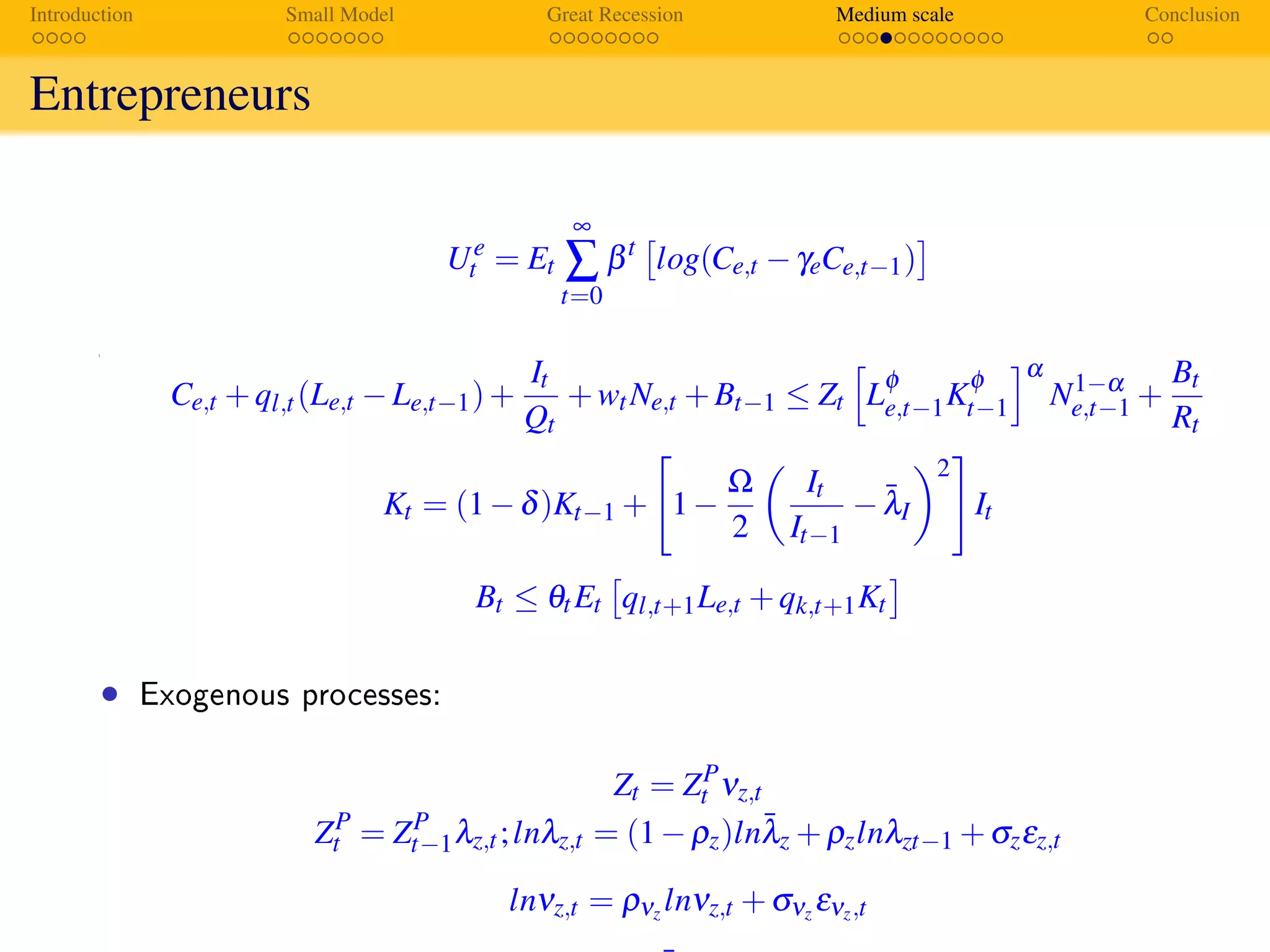

![Introduction Small Model Great Recession Medium scale Conclusion

Estimation results Estimation

Results - Estimation

RE AL

Description Parameter Prior Posterior Mean Posterior Mean

Household Habit Persistency γh Beta 0.5122 [0.42,0.57] 0.5619 [0.55,0.57]

Entrepreneur Habit Persistency γe Beta 0.7924 [0.64,0.91] 0.6153 [0.61,0.62]

Investment Adjustment Cost Ω Gamma 0.1784 [0.15,0.21] 0.1595 [0.15,0.17]

Exo. Growth Rate gγ Gamma 0.3386 [0.27,0.45] 0.3817 [0.36,0.41]

SS Investment Specic Tech ¯λq Gamma 1.2919 [1.20,1.42] 1.2377 [1.21,1.28]

AR Patience ρa Beta 0.9340 [0.92,0.95] 0.9113 [0.90,0.92]

AR Perm. Technology ρz Beta 0.5560 [0.43,0.65] 0.4249 [0.40,0.47]

AR Trans. Technology ρvz Beta 0.3747 [0.08,0.61] 0.3141 [0.28,0.35]

AR Perm. Investment Tech ρq Beta 0.4810 [0.35,0.64] 0.6422 [0.60,0.67]

AR Trans. Investment Tech ρvq Beta 0.1523 [0.00,0.51] 0.2600 [0.23,0.29]

AR Land ρϕ Beta 1.0000 [1.00,1.00] 0.9997 [1.00,1.00]

AR Labor ρφ Beta 0.9987 [0.99,1.00] 0.9881 [0.99,0.99]

AR Collateral ρθ Beta 0.9879 [0.98,1.00] 0.9836 [0.98,0.98]

Std. Patience σa InvGamma 0.1404 [0.07,0.22] 0.1164 [0.08,0.14]

Std. Perm. Technology σz InvGamma 0.0038 [0.00,0.00] 0.0047 [0.00,0.00]

Std. Trans. Technology σvz InvGamma 0.0043 [0.00,0.00] 0.0037 [0.00,0.00]

Std. Perm. Investment Tech σq InvGamma 0.0042 [0.00,0.00] 0.0030 [0.00,0.00]

Std. Trans. Investment Tech σvq InvGamma 0.0022 [0.00,0.00] 0.0030 [0.00,0.00]

Std. Land σϕ InvGamma 0.0416 [0.04,0.05] 0.0451 [0.04,0.05]

Std. Labor σφ InvGamma 0.0069 [0.01,0.01] 0.0078 [0.01,0.01]

Std. Collateral σθ InvGamma 0.0109 [0.01,0.01] 0.0114 [0.01,0.01]

Gain g Gamma 0.0052 [0.01,0.01]

Log Marg. Likelihood 1940.3 1941.1

Pintus, Suda and Turgut (GRAPE) EXPECT 19.11.2018 15 / 25](https://image.slidesharecdn.com/pintussudaturgutsndedallas28march2019-190329113926/75/Financial-Frictions-under-Learning-35-2048.jpg)