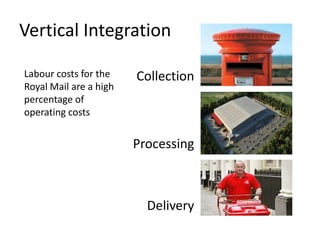

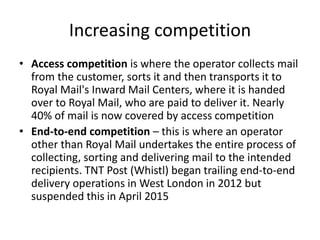

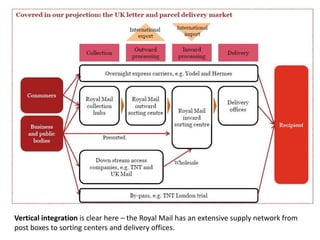

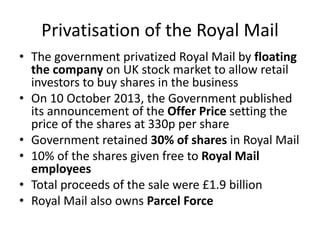

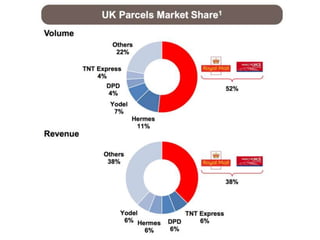

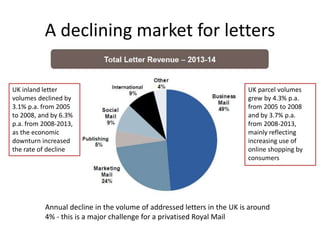

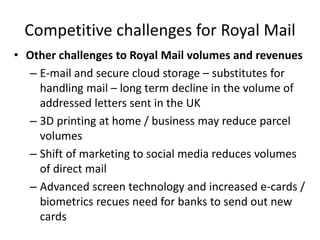

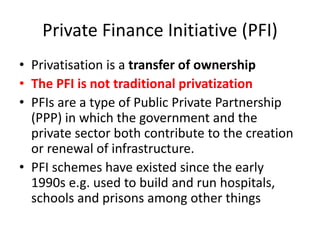

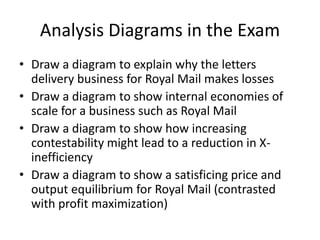

The document discusses the privatization of Royal Mail, detailing its implications for competition, labor costs, and efficiency. Key points include the introduction of access and end-to-end competition, the financial outcomes of the share flotation, and criticisms from trade unions regarding job losses and the necessity of public ownership. Additionally, challenges such as declining letter volumes and competition from new delivery services highlight the evolving landscape of the postal industry.