Tax Saving Mutual Fund - Invest in Franklin India Taxshield Fund and save your Tax

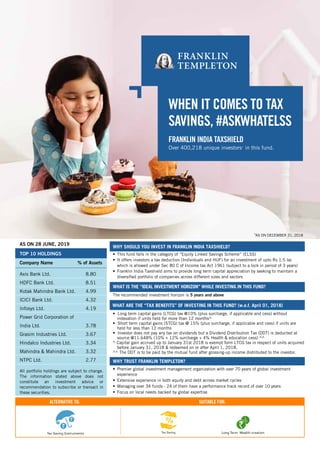

- 1. Company Name % of Assets Axis Bank Ltd. 8.80 HDFC Bank Ltd. 8.51 Kotak Mahindra Bank Ltd. 4.99 ICICI Bank Ltd. 4.32 Infosys Ltd. 4.19 Power Grid Corporation of India Ltd. 3.78 Grasim Industries Ltd. 3.67 Hindalco Industries Ltd. 3.34 Mahindra & Mahindra Ltd. 3.32 NTPC Ltd. 2.77 All portfolio holdings are subject to change. The information stated above does not constitute an investment advice or recommendation to subscribe or transact in these securities. TOP 10 HOLDINGS WHEN IT COMES TO TAX SAVINGS, #ASKWHATELSS WHY TRUST FRANKLIN TEMPLETON? • Premier global investment management organization with over 70 years of global investment experience • Extensive experience in both equity and debt across market cycles • Managing over 34 funds - 24 of them have a performance track record of over 10 years • Focus on local needs backed by global expertise WHAT IS THE “IDEAL INVESTMENT HORIZON” WHILE INVESTING IN THIS FUND? The recommended investment horizon is 5 years and above WHY SHOULD YOU INVEST IN FRANKLIN INDIA TAXSHIELD? • This fund falls in the category of “Equity Linked Savings Scheme” (ELSS) • It offers investors a tax deduction (Individuals and HUF) for an investment of upto Rs 1.5 lac which is allowed under Sec 80 C of Income tax Act 1961 (subject to a lock in period of 3 years) • Franklin India Taxshield aims to provide long term capital appreciation by seeking to maintain a diversified portfolio of companies across different sizes and sectors ALTERNATIVE TO: SUITABLE FOR: Long Term Wealth creationTax SavingTax Saving Instruments FRANKLIN INDIA TAXSHIELD Over 400,218 unique investors* in this fund. AS ON 28 JUNE, 2019 *AS ON DECEMBER 31, 2018 • Long term capital gains (LTCG) tax @10% (plus surcharge, if applicable and cess) without indexation if units held for more than 12 months^ • Short term capital gains (STCG) tax @ 15% (plus surcharge, if applicable and cess) if units are held for less than 12 months • Investor does not pay any tax on dividends but a Dividend Distribution Tax (DDT) is deducted at source @11.648% (10% + 12% surcharge + 4% Health & education cess) ^^ ^ Capital gain accrued up to January 31st 2018 is exempt form LTCG tax in respect of units acquired before January 31, 2018 & redeemed on or after April 1, 2018. ^^ The DDT is to be paid by the mutual fund after grossing-up income distributed to the investor. WHAT ARE THE “TAX BENEFITS” OF INVESTING IN THIS FUND? (w.e.f. April 01, 2018)

- 2. Copyright © 2018. Franklin Templeton Investments. All rights reserved. PRODUCT LABEL *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. This fund is suitable for investors who are seeking*: • Long term capital appreciation • An ELSS fund offering tax benefits under Section 80C of the Income Tax Act Past performance may or may not be sustained in future. Dividend on face value of `10 per unit. Pursuant to payment of dividend, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable). *Record date NAV. Please refer to www.franklintempletonindia.com for dividend track record of the Direct Plan. The Mutual Fund is not guaranteeing or assuring any dividend under any of the schemes and the same is subject to the availability and adequacy of distributable surplus. Record Date Rate Per Unit (₹) NAV* (₹) Jan 25, 2019 3.32 42.3086 Jan 25, 2018 4.50 49.8081 Jan 20, 2017 3.50 42.6699 Jan 22, 2016 3.50 40.6886 Jan 30, 2015 3.00 47.2441 Jan 24, 2014 3.00 31.1896 Jan 18, 2013 2.00 32.2527 Feb 03, 2012 3.00 30.3111 Jan 14, 2011 4.00 34.0334 Jan 15, 2010 3.00 33.0523 Dec 17, 2008 3.00 20.6681 Nov 14, 2007 8.00 46.8922 Jan 10, 2007 8.00 39.43 Feb 15, 2006 3.50 38.01 Mar 18, 2005 3.00 27.25 Feb 24, 2004 4.00 24.01 Mar 30, 2001 1.25 11.57 May 24, 2000 6.00 19.82 Mar 31, 2000 8.00 31.02 DIVIDEND HISTORY - DIVIDEND PLAN ASSET COMPOSITION SCHEME CATEGORY ELSS SCHEME CHARACTERISTICS Min 80% Equity with a statutory lock in of 3 years & tax benefit DATE OF ALLOTMENT April 10, 1999 FUND MANAGER(S) Lakshmikanth Reddy & R. Janakiraman BENCHMARK Nifty 500 FUND SIZE (AUM) Month End `4065.12 crores Monthly Average `4037.55 crores No. of Stocks 53 Top 10 Holdings 47.67% Top 5 Sectors 55.27% VOLATILITY MEASURES (3 YEARS) Standard Deviation 3.23% Beta 0.80 Sharpe Ratio* 0.28 * Annualised. Risk-free rate assumed to be 5.57% (FBIL OVERNIGHT MIBOR) MINIMUM INVESTMENT/ MULTIPLES FOR NEW INVESTORS ₹500/500 MINIMUM INVESTMENT FOR SIP ₹500/500 ADDITIONAL INVESTMENT/ MULTIPLES FOR EXISTING INVESTORS ₹500/500 LOAD STRUCTURE Entry Load: Nil Exit Load: (for each purchase of Units) Nil Different plans have a different expense structure FUND DETAILS For more information, please contact your distributor: Scheme specific risk factors: All investments in Franklin India Taxshield are subject to a lock-in-period of 3 years from the date of respective allotment and the unit holders cannot redeem, transfer, assign or pledge the units during this period. The Trustee, AMC, their directors or their employees shall not be liable for any of the tax consequences that may arise, in the event that the Equity Linked Savings Scheme is wound up before the completion of the lock-in period. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax and financial implications of the investment/participation in the scheme Mutual Fund investments are subject to market risks, read all scheme related documents carefully. 28.34% 7.42% 7.25% 6.27% 6.00% 5.30% 4.48% 3.94% 3.67% 3.34% 2.60% 2.26% 2.07% 1.79% 1.32% 1.19% 1.13% 0.98% 0.57% 0.51% 0.38% 0.00% 9.19% Banks Consumer Non Durables Power Software Auto Petroleum Products Gas Finance Cement Non - Ferrous Metals Telecom - Services Consumer Durables Pharmaceuticals Industrial Products Auto Ancillaries Ferrous Metals Hotels, Resorts And Other Recreational Activities Media & Entertainment Retailing Textile Products Transportation Unlisted Call,cash and other current asset